Underwriting has entered a new era. By 2026, the volume, complexity and global distribution of high-risk merchants have evolved far beyond the capacity of manual review teams. PSPs can no longer rely solely on document checks, website reviews and subjective assessments to evaluate merchant credibility. Regulators now expect data-backed, audit-ready decision-making, and fraud pressure continues to rise across every major MCC. At the same time, merchants increasingly operate cross-border, access multiple payment rails and scale faster than ever before.

In this environment, AI has shifted from a useful enhancement to a core underwriting requirement. Machine-learning models allow PSPs to detect hidden patterns, forecast chargeback probability, identify synthetic or misclassified merchants, and assess operational risk based on millions of historical signals. What once took days of manual analysis can now be completed in seconds, with far greater precision and consistency.

For high-risk sectors in particular such as coaching, supplements, ticketing, adult, forex/CFD, and high-velocity digital services, AI underwriting represents a fundamental upgrade in how PSPs measure stability, compliance readiness and long-term viability. Instead of penalising entire categories, AI allows underwriting teams to distinguish between merchants who are genuinely operationally sound and those who present structural or behavioural risks.

This blog explains how PSPs deploy AI to assess merchant risk profiles, chargeback probability, and business-model red flags. It also explores the regulatory guardrails shaping AI adoption, and the tangible benefits for merchants who prepare for model-driven underwriting.

- Why PSPs Need AI for High-Risk Underwriting in 2026

- AI Inputs for Merchant Risk Scoring (What Models Analyse)

- Predictive Chargeback Modelling

- Underwriting Scenarios AI Can Flag Before Approval

- How PSPs Deploy AI Underwriting Models in 2026

- Regulatory Guardrails for AI Underwriting

- Benefits for High-Risk Merchants Who Are Prepared for AI Underwriting

- Human + AI: The Hybrid Underwriting Model of 2026

- Conclusion

- FAQs

Why PSPs Need AI for High-Risk Underwriting in 2026

The underwriting challenges PSPs face in 2026 are fundamentally different from those of previous years. The combination of globalised merchant activity, increasingly aggressive fraud tactics and regulatory demands for defensible decisions means PSPs can no longer rely on human review alone. Manual underwriting, once sufficient for low-volume, domestic merchants, now struggles to interpret complex behavioural signals, cross-border fund flows and the subtle patterns that distinguish stable high-risk merchants from unstable ones. AI provides the scale, speed and analytical depth required to close this gap.

The Limitations of Traditional Underwriting

Traditional underwriting relies heavily on document checks, website reviews, KYB verification and historical statements. These steps are still important, but they only reveal surface-level information. Fraudulent operators now present polished documentation, professionally built websites and artificially inflated data that can easily pass a manual review.

More critically, manual underwriting cannot analyse behavioural signals such as device fingerprints, funnel structure, traffic consistency, user journey drop-offs or historical dispute patterns across millions of comparable merchants. Nor can it detect when a merchant’s claimed business model conflicts with the expected patterns for that MCC or industry vertical. In a world where bad actors adapt quickly and hide in plain sight, manual review simply does not provide a complete risk picture.

Regulatory Pressure for Data-Backed Decisions

Regulators in 2026 expect underwriting decisions to be reproducible, auditable and supported by objective evidence. PSD3 in the EU, FCA Consumer Duty in the UK and FATF recommendations globally require PSPs to demonstrate that merchant approval decisions are fair, logical and grounded in validated risk models. Subjective judgment or undocumented rationale is no longer enough.

This is why PSPs increasingly rely on AI-driven scoring. Model outputs provide measurable indicators of risk probabilities, behavioural anomalies, and predicted chargeback ratios that can be explained to regulators and incorporated into internal risk governance frameworks. AI effectively creates a defensible audit trail of each decision.

Fraud Complexity and High-Risk Vertical Expansion

High-risk industries continue to grow rapidly online, with more sophisticated onboarding tactics and increasingly complex business models. AI is uniquely suited to analysing the overlapping risk layers involved in unusual marketing patterns, compressed fulfilment timelines, unrealistic claims, emerging geographies, and corridor-specific dispute tendencies.

At the same time, cross-border merchants now dominate high-risk categories. This introduces multi-jurisdictional AML exposure, multiple payment-rail interactions and inconsistent regional behaviour none of which can be interpreted reliably by manual review.

AI allows PSPs to evaluate thousands of data points simultaneously, ensuring that risk assessments reflect the true scale and complexity of modern commerce.

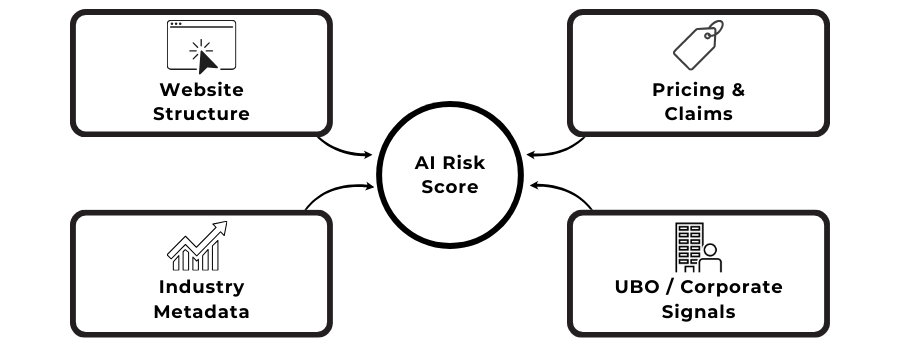

AI Inputs for Merchant Risk Scoring (What Models Analyse)

AI underwriting models evaluate far more than basic KYB documents. They examine a wide network of behavioural, operational, technical and historical signals that reveal how stable or risky a merchant is likely to be. By analysing thousands of data points simultaneously, models can detect patterns that human reviewers either overlook or cannot feasibly evaluate at scale. This shift allows PSPs to move from static document checks to dynamic behavioural analysis that reflects how the merchant truly operates.

Website Structure as a Behavioural Signal

To AI models, a merchant’s website is a rich source of insight. The structure, layout and content patterns can indicate risk even when documentation appears clean. Models analyse how information is presented, whether pricing and policies are clearly disclosed, how the sales funnel behaves, and whether the user journey contains tactics often linked to high-chargeback environments.

AI can identify inconsistencies such as hidden upsells, aggressive countdown timers, vague claims or non-standard checkout journeys that often correlate with customer dissatisfaction or future disputes. These patterns help underwriters understand whether the merchant’s digital presence is aligned with legitimate business practices or suggests engineered friction.

Pricing Transparency, Claims and Refund Logic

Pricing structures are another powerful signal. AI flags models with unrealistic promises (“guaranteed results”), vague refund conditions, heavily discounted funnels or recurring charges that are insufficiently disclosed. It also detects when refund terms contradict regulatory standards or appear designed to deter cancellations.

Because these factors directly correlate with chargeback behaviour, PSPs treat pricing and refund patterns as a core risk indicator. Good merchants with clear, consumer-friendly disclosures benefit from stronger scores, while those with ambiguous or aggressive pricing are flagged for additional review.

Industry Vertical Metadata and MCC Expectations

AI compares the merchant’s declared MCC and industry category to expected behavioural norms. If a merchant claiming to be “education” displays patterns typical of coaching leads, weight-loss funnels or financial services, the model detects the mismatch. Similarly, unrealistic conversion projections, geographically inconsistent traffic, or anomalous product claims may indicate undisclosed high-risk activities.

This comparative modelling allows PSPs to flag merchants that appear compliant on paper but whose behaviour reflects a different, often riskier, category.

Company Formation and UBO Intelligence

AI models evaluate corporate structure and ownership patterns not just for verification, but for risk prediction. By linking company registries, UBO records, prior business failures, and public domain data, models detect signs of synthetic businesses, recycled ownership structures or UBOs associated with previously terminated merchant accounts.

These insights help PSPs spot potential bad actors who attempt to re-enter the ecosystem under new entities. AI enables a level of ownership intelligence that surpasses manual searches and dramatically increases the accuracy of risk assessments.

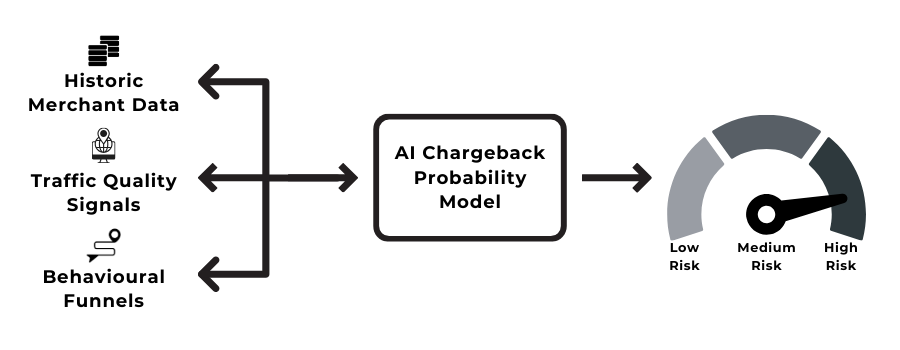

Predictive Chargeback Modelling

One of the most transformative applications of AI in underwriting is the ability to forecast chargeback probability before a merchant is approved. For high-risk verticals, chargebacks are often the single most influential driver of reserves, pricing and onboarding decisions. Traditional underwriting could only estimate risk using sector averages or historical performance data from the merchant themselves. AI replaces this guesswork with sophisticated modelling that analyses behavioural patterns, traffic sources, sales funnels and historical trends across thousands of similar merchants.

This results in a far more accurate understanding of how the merchant will behave once live long before a single transaction is processed.

Learning From Historic Merchant Data

AI models are trained on years of historical processing behaviour, covering a vast array of MCCs, geographies and merchant profiles. When a new merchant applies, the model compares its digital footprint, operating style, marketing behaviour and projected volumes against this enormous baseline. If the merchant resembles previously unstable operators whether in funnel structure, pricing, operational scaling or target geography the model flags this for additional scrutiny.

Instead of relying on subjective reviewer intuition, PSPs now have data-driven insights that reflect real outcomes from comparable merchants.

Traffic Quality Scoring and Behavioural Signals

Chargebacks rarely originate from a single cause. They emerge from patterns: low-quality traffic, misleading advertising, inconsistent conversion journeys, or customer expectations that do not match the product. AI analyses this at scale, scoring merchants based on signals such as referral sources, ad copy themes, device distribution, session patterns, bot indicators and sudden spikes in international visitors.

Models can detect whether the merchant’s traffic sources historically correlate with elevated dispute rates. Merchants with clean, organic or high-intent traffic benefit from stronger predictive scores, while those relying on aggressive affiliates or opaque traffic channels may face reserves or onboarding limits.

Chargeback Probability and Reserve Impact

The core output of predictive modelling is a numerical estimate of the merchant’s expected chargeback ratio. This projected value influences multiple underwriting decisions: whether to approve the merchant, what reserve structure to apply, which corridors to allow, how volumes should ramp, and whether additional disclosures or fulfilment evidence are required.

For high-risk merchants, predictive modelling is often the difference between approval and decline. A merchant with a strong model score may secure better terms than would have been possible under traditional underwriting, while a merchant with poor predicted performance receives clearer feedback about what must be addressed before onboarding can proceed.

Underwriting Scenarios AI Can Flag Before Approval

AI’s greatest value in underwriting is its ability to detect risk signals that appear legitimate on the surface but reveal deeper structural issues when analysed across thousands of data points. These scenarios often go unnoticed in manual reviews, yet they are precisely the cases that lead to disputes, fraud events or regulatory breaches once the merchant is live. In 2026, PSPs rely on AI to flag these behaviours early, preventing unstable merchants from entering the ecosystem while fast-tracking merchants who demonstrate genuine operational credibility.

Synthetic Merchants

One of the most difficult patterns for humans to detect yet one AI identifies reliably is the synthetic merchant. These merchants present high-quality documentation, polished websites and sophisticated narratives, but behavioural signals tell a different story. AI evaluates signals such as domain age, code similarity to previously terminated sites, template-based content reuse, unusual hosting histories and mismatched corporate metadata.

Even when every submitted document appears legitimate, AI recognises hidden inconsistencies that indicate the merchant may exist solely to process transactions before disappearing. This early detection dramatically reduces PSP fraud exposure.

Hidden MCCs and Disguised Activities

Some merchants declare themselves as low-risk categories while selling services or products associated with higher-risk MCCs. AI models detect these discrepancies by analysing website keywords, product claims, pricing behaviour, user journeys, and fulfilment promises.

For example, a merchant declaring an “education” MCC may in reality be selling high-ticket coaching programmes with aggressive marketing tactics. Similarly, a “supplements” brand may promote claims that push it into a regulated health category.

AI highlights these mismatches early, giving underwriters clear evidence that the business model may not align with declared operations.

Undisclosed or Grey-Area Business Activities

AI also identifies activities that merchants fail to disclose during onboarding.

This includes affiliate funnels, side products, bundled services, trial-to-subscription pathways, or secondary business lines not represented in the KYB file. Models examine domain linkages, tracking parameters, checkout logic, historical site iterations and behavioural anomalies to map out the full scope of the merchant’s operation.

In many cases, these undisclosed activities carry additional regulatory, operational or dispute risks. AI allows PSPs to surface them immediately, ensuring the underwriting decision reflects the true business model rather than the simplified version presented in the application.

How PSPs Deploy AI Underwriting Models in 2026

By 2026, AI will be embedded throughout the entire underwriting lifecycle not as a standalone tool, but as a continuous decisioning layer that shapes onboarding, monitoring and ongoing merchant evaluation. PSPs use AI to improve accuracy, accelerate approvals and ensure regulatory defensibility, while also reducing the number of false positives that previously slowed down legitimate high-risk merchants.

The result is a more efficient, transparent and data-driven underwriting environment in which both PSPs and compliant merchants can operate with greater confidence.

Pre-KYB Modelling for Faster Triage

Before human underwriters even examine documents, AI evaluates the merchant’s digital presence, traffic patterns, corporate footprint, expected volumes and likely chargeback behaviour. This pre-KYB model produces an initial risk score that determines whether the merchant enters a fast-track pathway, a standard review, or an enhanced due diligence process.

For merchants with clean behaviour, clear disclosures, predictable funnels, mature operational footprints this step significantly accelerates onboarding. For higher-risk cases, it ensures underwriters focus their expertise where it is most needed rather than processing large volumes of low-risk applications manually.

Real-Time Post-Onboarding Monitoring

Underwriting is no longer a one-time event. Once a merchant goes live, AI continuously analyses transaction data, refund behaviour, traffic changes, corridor shifts, fulfilment delays and operational anomalies. These signals allow PSPs to identify emerging risks early long before disputes escalate or regulators intervene.

If a merchant’s behaviour diverges from the model’s initial expectations for example, rapid volume spikes, declining traffic quality, or increased complaint patterns the PSP can intervene quickly through volume caps, reserve adjustments or targeted compliance reviews. This continuous monitoring protects PSPs while allowing legitimate merchants to scale safely.

Integration With Transaction-Level Fraud Engines

In 2026, underwriting systems and fraud engines are increasingly interconnected. AI models share data across onboarding, transaction monitoring and dispute systems, providing a holistic view of merchant behaviour.

For example, if the fraud engine detects a spike in risky BINs, synthetic identities or compromised cards targeting a particular merchant, this information feeds back into the underwriting model’s risk score. Likewise, if underwriting identifies inconsistent funnel behaviour, the fraud engine can adapt rules to prevent misuse.

This interconnected approach allows PSPs to detect systemic risk patterns that neither underwriting nor fraud systems could have identified alone.

Regulatory Guardrails for AI Underwriting

As PSPs adopt AI-driven underwriting, regulators worldwide are redefining the expectations that surround automated decision-making. While AI allows for faster, more consistent and more accurate assessments, it also introduces questions about fairness, transparency and consumer protection. In 2026, compliance teams must operate within a structured regulatory framework that governs how AI models score merchants, influence approval decisions and interact with traditional KYB/KYC controls.

For high-risk merchants, these guardrails provide clarity: PSPs must explain why decisions are made, ensure consistency across applicants, and avoid the opaque or subjective practices that previously created uncertainty.

Anti-Discrimination and Equality Obligations

Regulators in the UK, EU and other major markets have explicitly stated that AI underwriting cannot disadvantage applicants based on protected characteristics, nationality, region or indirect data correlations.

This means models must be trained on neutral signals, behavioural, operational and financial rather than proxies that could produce unequal outcomes.

For PSPs, this requires:

- Ongoing bias testing

- Removal of features that inadvertently target specific groups

- Governance processes ensuring model decisions are fair and explainable

For merchants, the benefit is a level playing field: high-risk categories are evaluated based on behaviour and stability, not subjective impressions.

Model Fairness and Explainability Requirements

Under PSD3, PSR and FCA Consumer Duty, PSPs must be able to justify AI-driven decisions.

This includes providing internal reviewers and, in some cases, merchants with a clear explanation of why the model flagged risk. Regulators expect:

- Interpretable model features

- Clear ranking of risk drivers

- Documentation proving the model is not a “black box”

- Structured internal sign-off for AI decisions

Explainability is particularly critical when the model leads to declines or enhanced due diligence requirements.

Documentation, Governance and Auditability

AI underwriting cannot operate without robust documentation. PSPs are expected to maintain full audit trails that show:

- When the model was trained

- What data sources are used

- Which signals influence scores

- How often the model is monitored or recalibrated

- Evidence that governance teams sign off on major changes

These requirements ensure PSPs remain accountable for automated decisions and provide regulators with a transparent view of the modelling process.

For merchants, strong governance reduces the risk of arbitrary declines and ensures underwriting decisions remain consistent over time.

Benefits for High-Risk Merchants Who Are Prepared for AI Underwriting

AI-driven underwriting does not exist to penalise high-risk sectors. In many cases, it provides responsible merchants with a clearer path to approval, better commercial terms and more predictable risk assessments. By replacing subjective human interpretation with structured, data-backed scoring, AI rewards merchants who operate transparently and maintain operational discipline. This levels the playing field in categories where legitimate businesses have historically been treated the same as unstable actors.

Faster and More Predictable Onboarding

Because AI can evaluate thousands of signals in seconds, PSPs increasingly use model-driven triage to accelerate onboarding for merchants who meet compliance expectations. Clear disclosures, stable business models, high-quality funnels and well-structured operational frameworks translate directly into stronger risk profiles.

For merchants, this reduces weeks of back-and-forth documentation requests and delivers a smoother, more transparent approval journey.

Lower Reserves Through Accurate Risk Calibration

Traditional underwriting often placed blanket reserves on entire verticals, treating all merchants within a high-risk MCC as equally risky. AI makes reserve structures more precise.

If a merchant demonstrates:

- Low predicted chargeback probability

- Clean behavioural and operational patterns

- Strong fulfilment logic

- Compliant marketing funnels

They can secure substantially lower reserve requirements even if their vertical historically attracts high dispute ratios. This modern, data-driven approach enables stable merchants to scale sustainably without unnecessary financial constraints.

More Transparent Feedback and Clear Improvement Signals

AI models identify which signals weaken a merchant’s risk profile and why.

This allows PSPs to provide merchants with actionable insights, such as:

- Improving refund disclosures

- Adjusting pricing transparency

- Modifying funnel friction points

- Clarifying product claims

- Tightening operational or UBO documentation

Instead of cryptic declines or generic explanations, merchants receive clear steps that increase the likelihood of approval, something nearly impossible under traditional underwriting frameworks.

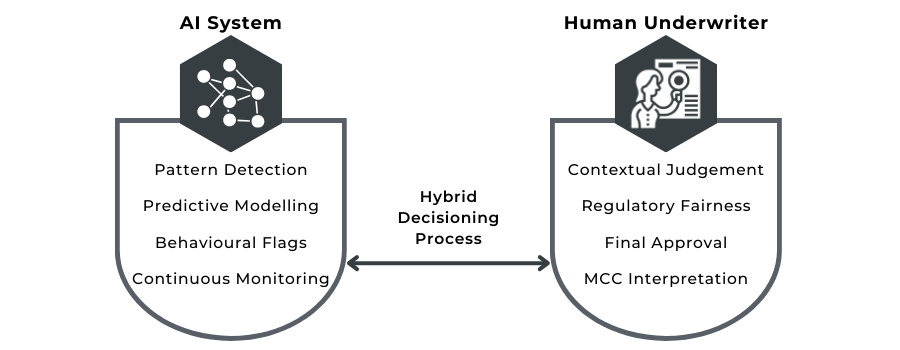

Human + AI: The Hybrid Underwriting Model of 2026

Despite rapid advances in automation, the future of underwriting is not fully algorithmic. Instead, PSPs are moving toward a hybrid model where AI handles large-scale pattern detection and risk prediction, while human underwriters provide contextual judgement, regulatory interpretation and fairness oversight. This balance ensures that underwriting decisions remain efficient without becoming opaque or overly dependent on opaque modelling.

In practice, the hybrid model addresses the two major weaknesses of historical underwriting: limited analytical capacity and inconsistent human decision-making. AI provides the speed and depth required to evaluate complex signals, while human reviewers ensure that decisions align with consumer protection standards, regulatory expectations and contextual nuances that models cannot fully interpret.

Where AI Excels: Scale, Pattern Detection and Consistency

AI is most effective in areas where high-scale pattern recognition is required. This includes:

- Analysing millions of historic merchant profiles

- Detecting behavioural anomalies

- Identifying disguised MCCs or undisclosed products

- Predicting dispute and refund behaviour

- Detecting correlations between funnel structure and risk

- Scoring cross-border behaviour and multi-rail exposure

These tasks cannot be handled reliably through human review alone. AI ensures decisions are consistent regardless of reviewer workload, experience level or subjective interpretation.

Where Humans Remain Essential: Context, Fairness and Regulatory Interpretation

Certain scenarios require a nuanced understanding that machine-learning models cannot yet replicate.

Human underwriters step in for:

- Interpreting borderline business models

- Assessing regulated products with complex legal requirements

- Identifying misleading but not explicitly fraudulent practices

- Performing enhanced due diligence on UBOs

- Applying fairness and anti-discrimination controls

- Making final decisions when model outputs conflict with contextual evidence

This dual approach ensures that automation does not override judgment, and that merchants are evaluated in a way that remains both efficient and proportionate.

The Outcome: Underwriting That Is Faster, Fairer and More Evidence-Driven

The hybrid model is ultimately designed to improve outcomes for both PSPs and merchants.

It creates:

- Faster decisions due to automated triage

- Fewer false flags for legitimate merchants

- Increased regulatory defensibility

- Greater transparency around risk evaluation

- A scalable underwriting framework that adapts to new products, regions and payment rails

In 2026, PSPs that adopt the hybrid model outperform those relying solely on manual review or fully automated systems. It is the most balanced, reliable and future-proof approach to assessing high-risk merchants.

Conclusion

By 2026, AI will have become one of the most important tools in high-risk underwriting. It has reshaped how PSPs evaluate merchant stability, predict chargeback behaviour and uncover business-model inconsistencies that previously went unnoticed. What once relied on manual interpretation and subjective judgement is now supported by data-driven analysis that operates at a global scale.

For PSPs, AI underwriting creates a more defensible, efficient and accurate framework for assessing risk. It enables continuous monitoring, early detection of problematic behaviour and transparent decision-making aligned with PSD3, FCA Consumer Duty and FATF expectations. For high-risk merchants, it offers a meaningful advantage: clean operational practices, clear disclosures and strong fulfilment models translate directly into stronger scores, faster approvals and more favourable reserve structures.

The future of underwriting is neither fully automated nor entirely human-led. Instead, the most resilient PSPs use a hybrid model where AI handles pattern recognition and prediction, while human underwriters apply context, fairness and regulatory oversight. This combination ensures that responsible merchants, not just those with sophisticated presentations receive the treatment they deserve.

As high-risk categories continue to expand globally, AI underwriting will become the primary differentiator between merchants who can scale sustainably and those who present structural or behavioural risk. The merchants who invest in transparency, operational discipline and compliance readiness will be the ones who benefit most from this new, model-driven era.

FAQs

1. Why are PSPs using AI for underwriting instead of relying on traditional reviews?

Because merchant behaviour, fraud patterns and cross-border dynamics have become too complex for manual review alone. AI allows PSPs to analyse thousands of signals instantly, detect hidden risks and provide data-backed decisions required under PSD3, FCA and FATF frameworks.

2. Does AI make underwriting stricter for high-risk merchants?

AI doesn’t make underwriting stricter, it makes it fairer. Stable high-risk merchants with transparent models often get faster approvals and lower reserves because AI distinguishes them from unstable or disguised operators.

3. What are the key data points AI models analyse during underwriting?

AI evaluates website structure, pricing transparency, refund logic, UBO intelligence, industry norms, traffic behaviour, cross-border patterns and signals associated with synthetic businesses or undisclosed activities.

4. How accurate is AI at predicting chargeback risk?

Modern models are highly accurate because they are trained on millions of historical dispute events across thousands of merchant profiles. This predictive capability often outperforms traditional risk scoring.

5. Can AI detect merchants who misclassify their MCC?

Yes. AI analyses content, funnel structure, claims, pricing and operational behaviour to detect when a merchant’s real activity does not match the declared MCC, a common source of underwriting failure.

6. What happens if AI flags my merchant application as high risk?

You may be placed into enhanced due diligence or provided with remediation guidance. PSPs must also apply human review, ensuring fairness, context and regulatory oversight before making final decisions.

7. Does AI remove human involvement in underwriting?

No. 2026 underwriting follows a hybrid model. AI handles pattern recognition and prediction, while human underwriters assess context, fairness, legal implications and final approvals.

8. How does AI support ongoing monitoring after onboarding?

AI tracks changes in transaction behaviour, refund patterns, traffic quality and fulfilment timelines. If risk profiles shift, PSPs can intervene early through reserves, volume caps or targeted reviews.

9. Are PSPs allowed to decline merchants based solely on AI models?

Regulators require fairness, explainability and human oversight. AI can inform decisions, but PSPs must document the rationale and ensure a human underwriter validates or interprets any model-driven decline.

10. What can merchants do to improve their AI underwriting score?

They can strengthen refund disclosures, clarify claims, align MCC with actual activity, improve operational readiness, ensure accurate KYB data, and avoid aggressive or misleading funnel structures.