Cross-border merchants face a level of underwriting scrutiny that is significantly higher than domestic businesses. By 2026, PSPs must evaluate far more than a merchant’s business model or financials they must understand the jurisdictions involved, the payment corridors used, the FX exposures created, and the AML risks arising from multi-country operations. Regulators globally have tightened expectations, and PSPs are now accountable for the risks created by merchants whose customers, settlement accounts, fulfilment processes, or fund flows extend across borders.

PSD3 in the EU, FCA Consumer Duty in the UK, MAS in Singapore, the FATF’s updated risk assessments, and the growing influence of domestic payment rails such as PIX, UPI and SEPA Instant have collectively reshaped how PSPs assess cross-border businesses. The challenge is no longer merely “Is this merchant legitimate?” but rather “Is every jurisdiction, currency path, and payment rail used by this merchant compliant, licensable, transparent and safe?”

Cross-border models often introduce mismatches between the merchant’s incorporation country and customer geographies, between pricing currency and settlement currency, or between local regulatory requirements and the merchant’s disclosures. These inconsistencies amplify underwriting risk and force PSPs to apply deeper KYB, multi-jurisdiction AML analysis, fund-flow mapping, and payment-rail compliance checks.

This blog explains how PSPs evaluate cross-border merchants under the 2026 framework, including the assessment of jurisdiction risk, FX exposure, AML alignment, domestic payment-rail rules and the documentation required to pass underwriting. It also highlights the trends shaping global underwriting, such as AI-driven geo-risk scoring and country-specific KYC uplifts.

How PSPs Score Jurisdiction Risk in 2026

For cross-border merchants, jurisdiction risk is the first and most decisive underwriting checkpoint. In 2026, PSPs must evaluate the regulatory posture, financial crime exposure and operational legitimacy of every country involved in the merchant’s business not just where the company is incorporated.

This includes:

- Source country (merchant entity)

- Target markets (customer geographies)

- Processing country (where transactions are routed)

- Settlement country (where funds ultimately land)

A mismatch or weak jurisdictional profile can result in higher reserves, ongoing monitoring, onboarding delays or outright decline. Regulators now expect PSPs to provide documented justification for every jurisdiction they allow merchants to operate.

Source Country (Merchant Location) Compliance Profile

PSPs begin by reviewing the merchant’s incorporation jurisdiction and assessing:

- FATF compliance rating (grey-listed or high-risk jurisdictions increase underwriting requirements)

- economic substance (offshore entities must prove real operational presence)

- UBO transparency laws (PSPs must confirm ownership is visible and verifiable)

- licensing obligations for regulated sectors (forex, travel, education, coaching in some markets)

Merchants incorporated in offshore or secrecy-friendly jurisdictions face enhanced due diligence (EDD), even if the business model itself is legitimate.

Target Markets (Customer Geography) Risk Levels

Next, PSPs evaluate all countries where the merchant sells or markets their product.

Key factors include:

- Chargeback rates associated with specific countries

- Dispute tendencies and consumer-protection strength

- Regulatory expectations (e.g., trial disclosures, refund rules)

- Payment-method reliance (local APMs or domestic schemes)

- Fraud prevalence (IP/device clustering, proxy usage)

Cross-border merchants with global customers must prove they can comply with each region’s consumer-protection and disclosure requirements, not just their home market.

Cross-Border Routing, Licensing & Scheme Rules

Underwriting becomes more complex when the merchant processes in one jurisdiction but delivers services in another. PSPs must validate:

- Whether cross-border acquiring is permitted under Visa/Mastercard rules

- When local acquisition is mandatory (e.g., India, Brazil, Turkey, Poland)

- Whether merchant activity requires local licences or registrations

- If settlement accounts are allowed to sit outside the operating geography

Routing risk is now a regulated issue: PSD3 and FCA guidance emphasise transparency of FX, charges, settlement flows and corridor-level compliance.

If a merchant’s routing structure appears designed to bypass local rules or reduce regulatory oversight, underwriting will be declined immediately.

FX & Settlement Risk Evaluation

Cross-border merchants introduce a unique layer of financial risk that domestic merchants do not: multi-currency pricing, FX spread exposure, and cross-border settlement volatility. PSPs in 2026 must evaluate whether the merchant’s FX flows are transparent, stable and compliant with regulatory expectations.

PSD3 (EU) and FCA Consumer Duty (UK) both prioritise clear, upfront FX disclosure, while acquirers increasingly require merchants to demonstrate that refunds, conversions and settlement processes are predictable and fair to customers.

If any part of the FX or settlement flow appears opaque, overly complex or operationally fragile, underwriting slows down or stops entirely.

FX Exposure & Transparency Requirements

PSPs assess whether a merchant handles FX in a compliant and customer-friendly manner. Key checks include:

- Are FX markups disclosed before the transaction?

- Does the checkout clearly state the billing currency?

- Does the customer see their final amount before paying?

- Are FX conversions handled at the merchant, PSP, or issuer level?

- Are refund amounts predictable and consistent?

Under PSD3 and FCA rules, unclear FX charges, undisclosed conversion timing and inconsistent refund calculations are considered consumer harm, making the merchant high risk.

Merchants offering billing in multiple currencies must prove they are not misleading customers or creating unpredictable post-transaction outcomes.

Multi-Currency Processing & Financial Stability

PSPs also examine how the merchant manages revenue across different currencies and settlement paths.

Factors include:

- Cash-flow resilience against FX volatility

- Reserve requirements for high-risk or unstable currency corridors

- Exposure to sudden currency devaluation

- Multi-currency refunds and dispute liabilities

- Whether settlement occurs in a stable or high-risk currency

If FX risk is significant, PSPs may impose rolling reserves or insist on settlement in a single stable currency.

Additionally, PSPs verify whether the merchant understands multi-currency accounting obligations and local tax considerations especially when settlement occurs outside the customer’s geography.

Chargeback Risk Amplified by Cross-Border FX

Cross-border FX exposure significantly increases dispute risk. PSPs model this during underwriting.

Common friction points include:

- Customers disputing charges due to FX differences

- Refund amounts not matching original charges

- Issuers declining unusual foreign-currency transactions

- Higher soft-decline rates for unfamiliar corridors

- Disputes triggered by exchange-rate fluctuations

Merchants with unclear pricing or multi-currency confusion often experience inflated chargeback ratios, making them difficult to onboard in 2026.

Cross-Border AML Requirements

Cross-border merchants automatically trigger a higher level of AML scrutiny because their businesses sit across multiple jurisdictions, currencies and regulatory environments. In 2026, PSPs are expected to show regulators that they understand not only who the merchant is, but also where they operate, how funds move, and where financial-crime exposure might arise. That means AML checks for cross-border models are deeper, wider and much more continuous than those performed on domestic-only merchants. Underwriting teams now treat cross-border onboarding as high risk by default, and it is up to the merchant to prove otherwise.

FATF alignment and handling high-risk third countries

The starting point for cross-border AML assessment is alignment with the FATF framework. Underwriters look carefully at how the merchant’s footprint overlaps with FATF grey-listed or black-listed countries, and how that affects risk. If the company is incorporated in a higher-risk jurisdiction, serves customers in countries with weak controls, or moves funds through territories known for secrecy or limited transparency, the PSP is obliged to treat the relationship as requiring enhanced due diligence.

Enhanced due diligence in this context is not a box-ticking exercise. It often means the PSP asking for additional corporate documents, more detailed explanations of business activity, evidence of where funds originate, multi-year financial accounts and a clearer picture of why the chosen corporate structure and jurisdictions make sense commercially. The PSP has to be able to defend, to its regulator, why a cross-border merchant operating around high-risk countries is still acceptable from a financial crime perspective.

Multi-jurisdiction UBO verification

Ultimate Beneficial Owner verification becomes significantly more complicated when a merchant’s structure spans several countries. Underwriters in 2026 are expected to trace ownership through holding companies, offshore entities and layered shareholdings until it is clear who ultimately controls and benefits from the business. That process must also check whether any owner is politically exposed, whether names appear on sanctions lists and whether there are historical links to failed or problematic ventures.

Under PSD3, FCA standards and FATF expectations, opaque ownership is no longer something a PSP can “monitor later”. If the structure is so complex that genuine control cannot be proven, or if owners sit in jurisdictions that raise serious AML concerns without good justification, the safest decision for the PSP is to decline. In other words, clean, traceable ownership is now a non-negotiable requirement for cross-border underwriting.

Transaction-flow mapping for cross-border models

A final core element of cross-border AML underwriting in 2026 is transaction-flow mapping. Regulators increasingly expect PSPs to be able to explain, step by step, how money moves through a merchant’s ecosystem. That means mapping the journey from the customer through the merchant, PSP, acquirer, banks and any intermediaries, right through to the settlement account, and then understanding how refunds or chargebacks reverse that journey.

For cross-border merchants, this mapping exercise must also capture which countries and currencies are involved at each stage, where FX conversions occur, which banks or payment rails are used and whether any part of the flow passes through high-risk corridors. If the map reveals unexplained routing choices, shell entities, unusual settlement locations or fund flows that do not match the declared business model, underwriting is likely to stop until the merchant restructures or provides a more credible explanation. In practical terms, a cross-border merchant that cannot clearly explain how money moves through its business will not be considered ready for onboarding under the 2026 AML expectations.

Multi-Rail Compliance Checks

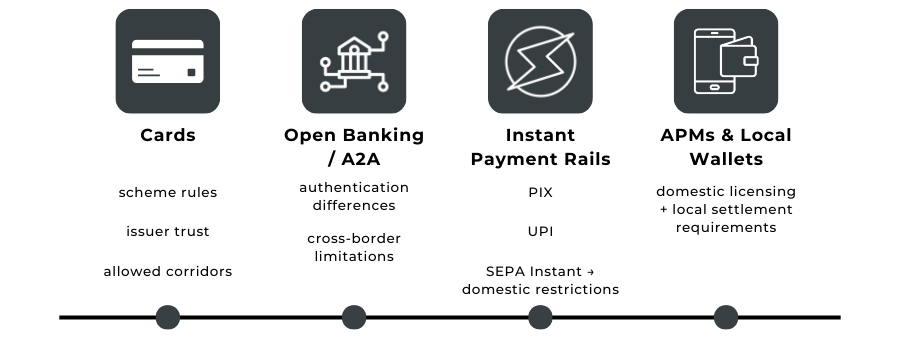

Cross-border merchants often rely on several payment rails simultaneously cards, open banking, instant payments and local APMs. In 2026, PSPs are required to evaluate whether the merchant’s use of each rail is legally permitted, operationally viable and compliant with local scheme rules. This is one of the most overlooked underwriting areas: many cross-border models fail because they attempt to use payment methods that require domestic licensing, local acquiring or jurisdiction-specific permissions.

A PSP must ensure that every rail the merchant intends to use aligns with regulatory expectations in the source country, the customer’s country and the processing country. Any inconsistency becomes a potential compliance breach and slows or halts onboarding.

Cards: Scheme Expectations for Cross-Border Processing

Card scheme rules play a defining role in how PSPs underwrite cross-border merchants. Visa and Mastercard have increased transparency expectations around routing, disclosure and corridor compliance. Issuers also treat cross-border card traffic with higher scepticism, which means PSPs must assess whether the merchant’s corridor is associated with elevated decline patterns, unusual MCC behaviour or increased soft fraud.

Underwriters examine whether the proposed routing model is allowed under scheme rules, whether domestic acquiring is required in certain markets, and whether the merchant’s pricing, descriptors and refund logic align with the customer’s currency and location. If the merchant attempts to process large volumes of domestic traffic through a foreign acquirer, underwriting usually pauses until a compliant structure is put in place.

Open Banking and Cross-Border A2A Limitations

Open banking and account-to-account (A2A) payments have grown rapidly within regions but remain highly fragmented across borders. In 2026, very few markets support true cross-border A2A transactions. PSPs must therefore determine whether the merchant’s payment flow is realistic. If the merchant assumes that customers in multiple countries can authenticate through A2A in the same way, the PSP must intervene and correct expectations.

Underwriting teams also check how the merchant plans to handle failed A2A payments, settlement timelines and authentication flows across regions with different consent frameworks. If these are misaligned or unclear, the PSP views the merchant as operationally unprepared for cross-border scaling.

Instant Payment Rails (PIX, UPI, SEPA Instant and Others)

Instant payment systems have become dominant in several major markets, but virtually all of them require local authorisation, local acquiring or domestic settlement. PSPs therefore assess whether the merchant can legally use the rail, whether the merchant has an appropriate local partner, and whether the proposed payment flow satisfies domestic obligations.

PIX in Brazil, UPI in India and SEPA Instant in the EU each have unique onboarding, data-handling and settlement rules. If the merchant attempts to offer these methods through a foreign setup or without the required permissions, underwriting cannot proceed. Instant rails are now a central reason why PSPs decline cross-border applications in high-growth regions.

APMs and Domestic Wallets

Alternative payment methods are deeply tied to local ecosystems. Many are inaccessible to cross-border PSP setups without domestic licences or residency requirements. Underwriters examine whether the merchant’s chosen APMs such as iDEAL, Bancontact, FPX, PromptPay, BLIK or GCC wallets are compatible with the merchant’s legal presence and customer geography.

If APM expectations do not match the merchant’s structure, the PSP must request restructuring or limit payment-method availability. Offering unsupported APMs is considered a misrepresentation risk under PSD3 and FCA Consumer Duty, creating grounds for underwriting rejection.

Cross-Border Website & Disclosure Requirements

A merchant’s website is one of the strongest indicators of cross-border readiness. In 2026, PSPs must verify that every disclosure from pricing and FX display to refund timelines and terms meets both the merchant’s home-market rules and the regulations of the countries where customers are located. Poor or inconsistent disclosures are one of the most common reasons cross-border applications are either delayed or declined. Regulators consider unclear pricing, missing FX information or contradictory terms to be direct consumer harm, which places the PSP at risk if the merchant is approved without correction.

FX Disclosure Transparency

Cross-border merchants frequently charge or settle in multiple currencies, which introduces risks around billing clarity, FX conversion timing and refund discrepancies. Under PSD3 and FCA Consumer Duty, merchants must present FX information in a way that is unambiguous, visible and consistent across their customer journey. Underwriters now examine how the website displays the billing currency, whether customers are told exactly what they will be charged and whether any markup or conversion is clearly explained before the transaction is submitted.

A merchant that fails to provide consistent FX explanations or relies on vague language around conversions is flagged immediately. PSPs are accountable for ensuring that customers in different jurisdictions receive clear information about currency calculations. If the merchant cannot demonstrate transparent FX disclosure, underwriting does not proceed.

Localised Terms, Refund Timelines and Consumer Protections

Cross-border merchants must adapt their website disclosures to the consumer-protection expectations of every market in which they sell. Underwriters review whether the merchant has incorporated country-specific refund rules, cancellation rights, delivery expectations, and complaint-handling processes into their customer-facing material. A single generic terms-of-service document is no longer sufficient for multi-country operations.

If a merchant offers a product to customers in the EU, for example, the website must reflect EU cooling-off periods and refund entitlements, even if the merchant operates from outside the region. Similarly, merchants selling into markets with strict recurring-billing rules must clearly explain renewal logic, trial periods and cancellation steps. When these obligations are missing or inadequate, PSPs treat the website as a regulatory liability.

Geo-Targeted Pricing and MCC Alignment

Underwriters also check whether the merchant’s pricing and product information match the regulatory requirements of the jurisdictions they target. If a merchant uses geo-targeted pricing, it must be clear, consistent and non-misleading. PSPs assess whether the MCC classification aligns with the products shown on the website and whether marketing claims create heightened risk particularly in sectors like supplements, coaching, forex/CFD or high-ticket digital programmes.

Misalignment between product presentation, target geography and licensing requirements triggers scrutiny. A merchant cannot advertise regulated services in a region without the proper authorisation, nor can they use marketing content that implies outcomes or guarantees that conflict with local advertising standards. Underwriters take these inconsistencies seriously because they directly influence chargeback risk, regulatory exposure and customer dissatisfaction.

Documentation PSPs Require for Cross-Border Models

Cross-border underwriting demands a deeper and more structured documentation package than domestic onboarding. PSPs must provide regulators with evidence that they understand how the merchant operates across multiple countries, how revenue is generated, how customers are supported, and how financial crime risks are mitigated. For this reason, cross-border merchants should expect additional documents, expanded explanations and multi-jurisdiction transparency requirements from the start. A PSP cannot approve a cross-border merchant unless the documentation clearly proves both operational readiness and regulatory compatibility.

Market-Entry and Operational Plan

Underwriters review the merchant’s expansion strategy to ensure the planned customer markets, payment methods and fulfilment processes are credible and compliant. This typically includes an overview of the target countries, the commercial logic for entering those regions, the expected transaction corridors, and operational details such as support coverage, delivery timelines, and refunds or dispute handling across borders.

A well-structured market-entry plan helps the PSP understand whether the merchant’s model can function without causing consumer harm or regulatory friction. Vague or inconsistent explanations often lead to follow-up requests or, in some cases, stalled underwriting, because the PSP cannot justify the cross-border risk without a clear operational blueprint.

Licensing and Legal Evidence

Many cross-border sectors require jurisdiction-specific permissions, even when the merchant is not physically located in that market. Underwriters therefore, request proof of licences or registrations that are necessary for the merchant’s products or services. This may include financial services authorisations, educational or coaching registrations, travel-industry licences or sector-specific permits for high-risk categories.

Additionally, PSPs expect clarity on corporate structure and legal domicile, especially when the merchant operates through subsidiaries or uses multiple group entities across borders. Any inconsistency between the merchant’s legal presence and its target markets must be explained and justified. PSPs cannot approve a merchant that appears to be operating without the appropriate legal basis in one or more jurisdictions.

Cross-Border AML and Compliance Controls

Underwriters also require documents demonstrating that the merchant has adequate AML, operational, and customer-protection controls for a multi-country environment. This includes AML and KYC policies that remain valid across jurisdictions, risk assessments that reflect the merchant’s corridors, compliance training evidence, dispute-handling procedures, and data-processing documents where GDPR or local equivalents apply.

For cross-border merchants, this is an area where PSPs frequently identify gaps. Policies written for a single jurisdiction rarely satisfy global operations, and many merchants must update their documentation to address foreign rules, higher-risk corridors, or multi-currency transaction flows. Underwriters use this material to evaluate whether the merchant is capable of operating responsibly in a fragmented regulatory landscape.

2026 Underwriting Trends for Global Merchants

Underwriting for cross-border merchants is evolving rapidly, driven by heightened regulatory expectations, stricter scheme rules, and more advanced risk-scoring technologies. By 2026, PSPs must justify every onboarding decision with data, jurisdiction-level analysis and documented evidence of how cross-border risks are mitigated. As a result, global merchants face a different underwriting environment, one in which automated decisioning, geo-specific controls and increased transparency obligations have become standard.

These trends reshape not only how PSPs assess risk, but also how merchants must prepare their operational and compliance frameworks before entering new markets.

AI-Driven Geo-Risk Scoring

One of the most significant changes in 2026 is the widespread adoption of AI-driven geo-risk scoring. PSPs increasingly rely on machine models that analyse thousands of jurisdictional and behavioural indicators, including settlement corridors, customer IP patterns, historical dispute data, device fingerprints and local economic stability. AI allows underwriters to identify cross-border risk anomalies long before traditional manual reviews would detect them.

For merchants, this means inconsistencies or opaque operational details are exposed quickly. If the model flags a corridor as high risk, underwriters must apply stricter evidence requirements or deny the onboarding request until the merchant demonstrates a credible operating plan. AI has effectively removed the grey areas that once allowed cross-border inconsistencies to go unnoticed.

Country-Based KYC Uplift Requirements

Another trend shaping 2026 underwriting is the introduction of jurisdiction-specific onboarding thresholds. PSPs must now adjust their KYC and KYB requirements based on the customer geographies a merchant targets. Countries associated with elevated financial crime exposure, high dispute rates or weak regulatory oversight require additional verification, higher-quality documentation or enhanced due diligence.

For global merchants, this often means different onboarding requirements depending on the expansion strategy. A business entering Europe, Southeast Asia and LATAM at the same time may face three distinct KYC profiles, even though the business model remains consistent. PSPs apply these uplifts to protect themselves from regulatory scrutiny and to ensure each market’s risk environment is properly addressed.

Cross-Border Payment Rail Restrictions Increasing

Domestic payment rails continue to reshape global underwriting expectations. Countries such as India, Brazil, Turkey, Poland, Malaysia and Singapore increasingly require local authorisation, domestic acquiring or residency to access their instant payment systems or national APMs. As these restrictions tighten, PSPs must evaluate whether cross-border merchants are structurally capable of using the payment rails they intend to offer.

This trend has major implications for merchants entering high-growth regions. A cross-border PSP setup may work for initial entry, but full performance often requires domestic licensing or partner integrations. Underwriters therefore assess whether the merchant’s payment-rail plan reflects the realities of each region, and whether reliance on unsupported APMs may create regulatory or operational risk. This is now a determining factor in global underwriting decisions.

Conclusion

Cross-border merchants face a far more complex underwriting journey than domestic operators, and by 2026, that gap is wider than ever. Regulators expect PSPs to justify every risk decision with evidence, jurisdiction-level analysis, and a clear understanding of how funds move across borders. As a result, merchants that operate internationally must demonstrate a higher degree of operational transparency, clearer disclosures, and stronger AML frameworks than they may have needed in previous years.

Merchants that prepare for this shift with accurate jurisdiction mapping, transparent FX handling, multi-rail compliance, and documentation tailored to multi-country requirements will experience faster onboarding, fewer follow-up requests and more favourable reserve conditions. Those who enter new markets with unclear fund flows, ambiguous pricing, unsupported APMs or complex ownership structures will face prolonged reviews or rejection.In a regulatory environment where PSPs bear increasing responsibility for cross-border risk, readiness is no longer optional. The merchants who succeed in 2026 will be those who treat underwriting not as a gateway hurdle, but as a strategic compliance discipline that enables sustainable, scalable international growth.

FAQs

1. Why are cross-border merchants subject to stricter underwriting in 2026?

Cross-border merchants introduce additional regulatory, financial and AML exposure because their transactions and fund flows pass through multiple jurisdictions. PSPs must validate compliance with each country’s rules, assess FX transparency, and ensure the merchant has appropriate licences or permissions. This multi-layered exposure makes the underwriting process more detailed than domestic onboarding.

2. How does my business’s incorporation country affect underwriting outcomes?

Underwriters evaluate whether the merchant’s home jurisdiction aligns with FATF recommendations, offers transparency over beneficial ownership and maintains credible AML oversight. Entities incorporated in high-risk or secrecy jurisdictions require enhanced due diligence and often face slower onboarding or higher reserve requirements.

3. Do PSPs look at customer geography during underwriting?

Yes, customer geography determines chargeback expectations, consumer-protection obligations, fraud patterns and payment-method requirements. If the merchant targets markets with elevated dispute risk or strict local payment rules, PSPs need stronger evidence of operational readiness.

4. How do FX fees and multi-currency pricing impact underwriting?

PSPs must ensure FX markups, conversions and refund calculations are transparent and compliant with PSD3 and FCA Consumer Duty. If a merchant cannot clearly explain how FX is handled or displayed, underwriters treat the model as a consumer harm risk.

5. What documentation is required for a cross-border underwriting application?

Merchants must provide a market-entry plan, operational structure, KYC/KYB documents, licensing evidence (where applicable), AML policies tailored to multi-country operations and detailed explanations of fund-flow routing. PSPs expect more comprehensive documentation for cross-border models than for domestic merchants.

6. Why do PSPs request a transaction-flow map?

A transaction-flow map allows underwriters to understand how funds move across borders, which countries and rails are involved, where FX occurs, and whether any part of the flow passes through high-risk jurisdictions. PSPs cannot approve merchants whose fund flows are unclear or inconsistent with their stated model.

7. Can cross-border merchants use local APMs like PIX, UPI, iDEAL or FPX?

Not always. Many APMs and instant payment rails require local acquiring, domestic licensing or settlement within the country. Underwriters must confirm that the merchant meets these requirements before allowing APM access.

8. How does my ownership structure affect cross-border underwriting?

Complex or opaque ownership raises AML concerns, especially if UBOs are located in high-risk jurisdictions. PSPs must be able to verify ownership fully, and any unclear or layered structures often result in enhanced due diligence or a decline.

9. Why do PSPs review website content during underwriting?

For cross-border merchants, website disclosures must meet the consumer-protection requirements of every target market. PSPs check for FX transparency, country-specific refund rules, compliant marketing claims and accurate product descriptions. Poor or inconsistent disclosures indicate operational risk.

10. How do card network rules affect cross-border approval?

Visa and Mastercard require merchants to route transactions in accordance with local scheme rules, and they penalise routing structures designed to circumvent domestic acquiring. Underwriters assess whether the merchant’s planned processing corridors comply with these rules.

11. Are reserves more likely for cross-border merchants?

Yes. FX volatility, higher dispute risk and jurisdictional exposure often lead PSPs to impose rolling reserves or holdback structures. Merchants with strong documentation, clear fund flows and compliant payment-rail usage tend to receive more favourable reserve terms.

12. How can cross-border merchants improve their chance of approval?

Merchants who prepare a clear operational plan, provide jurisdiction-specific compliance evidence, ensure FX transparency, redesign unclear website disclosures and simplify ownership structures are far more likely to receive fast approval with minimal remediation. Cross-border readiness is now a key indicator of a merchant’s long-term viability.