The Verification of Payee (VoP) scheme has formally moved from preparation to enforcement. The European Payments Council confirmed that its VoP scheme rulebook entered into force on 5 October 2025, just days ahead of the EU’s Instant Payments Regulation (IPR) deadline for eurozone payment service providers (PSPs). From this point, VoP is no longer an optional control or pilot feature. It is a mandatory payment step that European PSPs must support as part of compliant euro credit transfer processing.This timing matters. VoP’s activation is tightly aligned with the IPR’s push for safer, real-time euro payments, signalling a clear policy direction: payment accuracy and fraud prevention must occur before execution, not after settlement.

What Happened: The VoP Rulebook Entered into Force

On 5 October 2025, the EPC’s VoP scheme rulebook became effective across participating communities. The rulebook outlines the procedures for PSPs to perform a payee verification check when a payer initiates a euro credit transfer. The confirmation removes any ambiguity about readiness periods or voluntary adoption. From this date, VoP sits within the EPC’s scheme framework as an enforceable requirement.

Operationally, this shifts VoP from “recommended capability” to scheme obligation. PSPs that initiate or receive euro credit transfers are expected to support VoP outcomes and integrate them into customer-facing payment journeys and backend processing.

What Verification of Payee (VoP) Actually Means

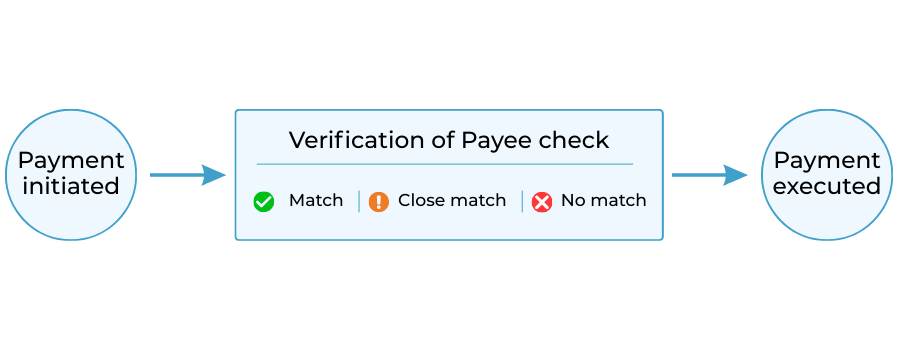

VoP introduces a pre-execution verification step that checks whether the payee name provided by the payer aligns with the name held by the receiving PSP for the destination IBAN. The outcome is returned to the payer before the payment is released, using one of three standard responses:

- Match – the payee name matches the IBAN records

- Close game – the name is similar but not identical

- No game – the name does not correspond to the IBAN

The intent is straightforward. By surfacing mismatches before execution, VoP reduces the risk of misdirected payments and authorised push payment (APP) fraud, where payers are tricked into sending funds to the wrong beneficiary.

Crucially, VoP does not block payments by default. It provides information and warning signals at the decision point. Responsibility then shifts to PSPs to design flows that present outcomes clearly and handle exceptions consistently.

Why This Matters Now: Alignment With the Instant Payments Regulation

VoP’s enforcement is not an isolated scheme update. It is directly aligned with the Instant Payments Regulation, which makes instant euro credit transfers mandatory and sets expectations around availability, pricing parity, and safety.

From 9 October 2025, VoP becomes mandatory for euro credit transfers covered by the IPR. In practical terms, instant payments without a robust pre-execution verification step are no longer acceptable. Real-time settlement removes the possibility of post-payment recall in most cases, so error prevention must happen upfront.

For PSPs, this alignment means VoP is no longer a “nice-to-have” fraud feature. It is part of the regulatory baseline for instant payments across the euro area.

Impact on PSP and Merchant Payment Operations

VoP changes how payments are initiated, processed, and reconciled. For PSPs, the most immediate impact is on payment initiation flows. Name checks must be triggered, outcomes returned quickly, and customer decisions captured without degrading user experience or breaching instant payment timing requirements.

Downstream, VoP affects reconciliation and exception handling. Close matches and no matches introduce new states that must be logged, monitored, and, in some cases, reported. Over time, these outcomes are likely to become inputs into fraud monitoring and risk scoring models.

Merchants are indirectly affected as well. Where beneficiary data is inaccurate or inconsistently formatted, VoP outcomes may surface issues that were previously hidden.

This is particularly relevant for businesses that receive high volumes of inbound payments from consumers or partners.

Sector-Specific Implications

Travel

Travel businesses often operate with multiple legal entities, trading names, and settlement accounts. VoP increases the importance of ensuring that beneficiary names presented to customers align with bank records. Mismatches can introduce friction at checkout or during refund flows.

Marketplaces

Marketplaces depend on accurate seller onboarding data. VoP outcomes will expose weaknesses in beneficiary master data, particularly where sellers use personal accounts, brand names, or abbreviations that do not align with bank-held names.

B2B Payouts

Automated B2B payout models rely on scale and speed. VoP introduces an additional validation step that must be handled programmatically. Close-match handling and exception workflows become critical to avoid operational bottlenecks.

Operational Reality: What PSPs Must Have in Place

With the rulebook in force, PSPs are expected to have end-to-end VoP capability in production.

This includes:

- VoP logic integration within payment initiation flows

- Clear handling of outcomes, including customer messaging for close and no matches

- Consistent decisioning rules to avoid ad-hoc overrides

- Logging and reporting are aligned with scheme expectations

Partial or inconsistent implementation is unlikely to be sustainable. As VoP outcomes become part of scheme monitoring and supervisory discussions, gaps in coverage will be visible.

From an operational risk perspective, VoP also requires coordination across teams. Product, compliance, fraud, and customer support functions all need to understand how outcomes are generated and how disputes or complaints should be handled.

Conclusion: A Structural Shift in Euro Credit Transfers

The entry into force of the VoP rulebook marks a structural change in how euro credit transfers are executed. Accuracy and fraud prevention are now embedded at the point of payment initiation, reflecting the realities of instant settlement and limited recall options.

For European PSPs, the message is clear. VoP is no longer a future requirement or a competitive differentiator. It is a mandatory safety control that underpins trust in real-time payments. In 2026 operations, compliance will be judged not on intent, but on whether VoP works reliably at scale, across sectors, and under real-world conditions.

As instant payments become the norm, controls like VoP set the standard for what “safe by design” means in modern European payment systems.

FAQs

1. When did the Verification of Payee (VoP) scheme become effective?

The VoP scheme rulebook entered into force on 5 October 2025, as confirmed by the European Payments Council.

2. Is VoP now mandatory or still optional for PSPs?

VoP is now mandatory under the EPC scheme framework. It is no longer a pilot, recommendation, or optional feature.

3. Which payments are affected by VoP?

VoP applies to euro credit transfers, particularly those covered by the EU Instant Payments Regulation.

4. How does VoP work in simple terms?

VoP checks whether the payee name provided by the payer matches the IBAN holder’s name before the payment is executed and returns a match, close match, or no match result.

5. Does VoP automatically block payments?

No. VoP provides pre-execution information, not automatic rejection. PSPs must decide how outcomes are presented and handled within their payment flows.

6. Why is VoP especially important for instant payments?

Instant payments are typically irreversible once executed. VoP helps prevent errors and fraud before funds are sent, when correction is still possible.

7. From when does VoP become mandatory under the Instant Payments Regulation?

VoP becomes mandatory for relevant euro credit transfers from 9 October 2025, in line with the IPR timeline.

8. Are merchants directly responsible for implementing VoP?

No. PSPs are responsible for implementing VoP. However, merchants may be indirectly affected if beneficiary data is inaccurate or inconsistent.

9. Which sectors are most likely to notice VoP-related changes?

Sectors with high payment volumes or complex beneficiary structures, such as travel, marketplaces, and B2B payout platforms, are likely to see the most operational impact.

10. Does VoP eliminate authorised push payment fraud?

No. VoP is a preventive control, not a complete fraud solution. It reduces certain risks but does not remove the need for broader fraud and monitoring controls.

11. What happens if a “close match” result is returned?

A close match indicates a partial or similar name match. PSPs must decide how to present this information and whether to allow the payer to proceed.

12. Will VoP outcomes need to be logged or reported?

Yes. PSPs are expected to log and manage VoP outcomes as part of scheme compliance and operational oversight.

13. Is further EPC guidance expected after this announcement?

Currently, the EPC announcement confirms the enforcement of the rulebook. Any additional technical or reporting guidance would be communicated separately.