In 2026, one of the most persistent failures in fraud prevention is not a lack of data or sophistication, but a fundamental misunderstanding of risk itself. Too many scoring frameworks still treat every risky transaction as evidence of a risky customer. The result is a system that punishes legitimate users for momentary anomalies, while missing the more nuanced signals that indicate genuine fraud.

This problem is especially visible in high-frequency digital payments. A long-standing customer may trigger a high-risk score simply because they act outside their usual routine making a larger-than-normal purchase, switching devices, or transacting at an unusual time. In legacy systems, these signals are often collapsed into a single decision: decline the transaction and downgrade the customer’s risk profile. Over time, this approach erodes trust, increases false positives and damages customer lifetime value.

Modern risk frameworks are moving away from this conflation. Instead, they recognise a critical distinction: customer risk and transaction risk are not the same thing. A customer’s identity trust is built gradually, based on historical behaviour, authentication strength and account tenure. Transaction intent, by contrast, is situational. It reflects what is happening right now in a specific moment, through a specific channel, under specific conditions.

Treating these two dimensions as interchangeable leads to blunt outcomes. Treating them separately enables precision. A risky transaction can be challenged without permanently downgrading a trusted customer. Likewise, a low-risk transaction should not automatically absolve an untrusted identity.

This separation aligns with broader shifts in how identity, trust and financial risk are being understood at a systemic level. Global policy discussions on digital identity increasingly emphasise that trust is cumulative and contextual, not binary, a perspective reflected in work published by organisations such as the World Economic Forum, which explores how identity assurance and risk assessment evolve independently over time.

- Identity Trust Scoring: Who Is This Customer, Really?

- Transaction Intent Scoring: What Is Happening Right Now?

- Framework Design: Dual-Score Architecture and Interaction Logic

- Where Separation Matters Most (Subscriptions, Wallets, Instant Payments)

- Risk Decay and Trust Accumulation Over Time

- Operational Benefits: Fewer Step-Ups, Better Retry Logic

- KPIs: Customer False-Positive Rate and Repeat-User Approval Lift

- Conclusion

- FAQs

Identity Trust Scoring: Who Is This Customer, Really?

Identity trust scoring is concerned with a fundamentally different question than transaction risk: how confident are we that this customer is who they claim to be, and how reliable has their behaviour been over time? In 2026, advanced scoring frameworks treat identity trust as a long-lived signal that evolves gradually, rather than fluctuating with every transaction.

Identity trust is cumulative, not reactive

Unlike transaction risk, which can spike in seconds, identity trust is built slowly. It reflects consistency, longevity and successful interaction history rather than momentary behaviour. This distinction is crucial, because it prevents systems from overreacting to short-term anomalies.

Signals that typically contribute to identity trust include:

- Account age and tenure

- History of successful authentication events

- Device and network familiarity over time

- Stability of personal and behavioural attributes

- Prior dispute, fraud or abuse outcomes

Individually, none of these signals proves legitimacy. Together, they form a confidence profile that answers whether the customer has demonstrated reliability across repeated interactions.

Why identity trust should not reset

One of the most common failures in legacy fraud systems is trust reset. A single flagged transaction can instantly downgrade a customer who has months or years of positive history. In modern frameworks, this is recognised as a design flaw.

Identity trust should decay slowly and deliberately. It may be temporarily overridden during high-risk moments, but it should not be erased unless there is clear evidence of account compromise or malicious intent. This approach ensures that good customers are not permanently penalised for edge-case behaviour.

Identity trust and regulatory alignment

Separating identity trust from transaction intent also aligns more closely with risk-based regulatory thinking. Global financial crime standards increasingly emphasise proportionality, the idea that controls should reflect both historical confidence and present risk.

Guidance published by international standard-setting bodies such as the Financial Action Task Force reinforces this principle by distinguishing between customer risk profiles and transaction-specific risk assessments within a broader risk-based approach.

Transaction Intent Scoring: What Is Happening Right Now?

If identity trust answers who the customer is over time, transaction intent scoring answers a very different question: what is happening in this specific moment? In 2026, modern fraud frameworks treat transaction intent as volatile, situational and highly sensitive to context.

Transaction intent does not care whether a customer has been trustworthy historically. It focuses on whether the current action makes sense given timing, channel, velocity and surrounding behaviour. This separation is critical, because even highly trusted customers can become victims of coercion, malware or account takeover.

Intent is moment-based, not cumulative

Unlike identity trust, transaction intent can change within seconds. A single session may move from low risk to high risk rapidly, especially in environments with instant funding and payouts.

Common intent signals include:

- Sudden changes in transaction amount or frequency

- Rapid escalation from low-impact actions to high-impact ones

- Channel switching immediately before payment or payout

- Unusual timing relative to recent behaviour

- Atypical sequences that suggest automation or pressure

Individually, these signals are often explainable. What elevates intent risk is how they cluster within a short time window.

Why intent must override trust temporarily

A key design principle in modern frameworks is that transaction intent can override identity trust without destroying it. A long-standing customer initiating a suspicious payout should be challenged at that moment, but their underlying trust score should remain intact unless there is evidence of compromise.

This distinction allows systems to:

- Intervene decisively when intent looks wrong

- Avoid permanently downgrading valuable customers

- Recover quickly once the risk event passes

In other words, intent drives controls, not judgement.

Intent scoring aligns with real-time payments

As settlement speeds increase, the margin for error shrinks. Real-time and near-instant payment environments require intent decisions to be made immediately, without relying on retrospective analysis.

International guidance on payment system risk consistently highlights that transaction-level controls must operate independently of long-term customer assessments to remain effective in fast-moving systems. This principle underpins much of the policy work published by the Bank for International Settlements, which examines how risk manifests differently at the transaction layer versus the customer layer in modern payment infrastructures.

Key takeaway

Transaction intent scoring answers what is happening right now. It must be fast, situational and decisive but it should never be allowed to redefine who the customer is over time. Separating intent from identity is what enables precise intervention without collateral damage.

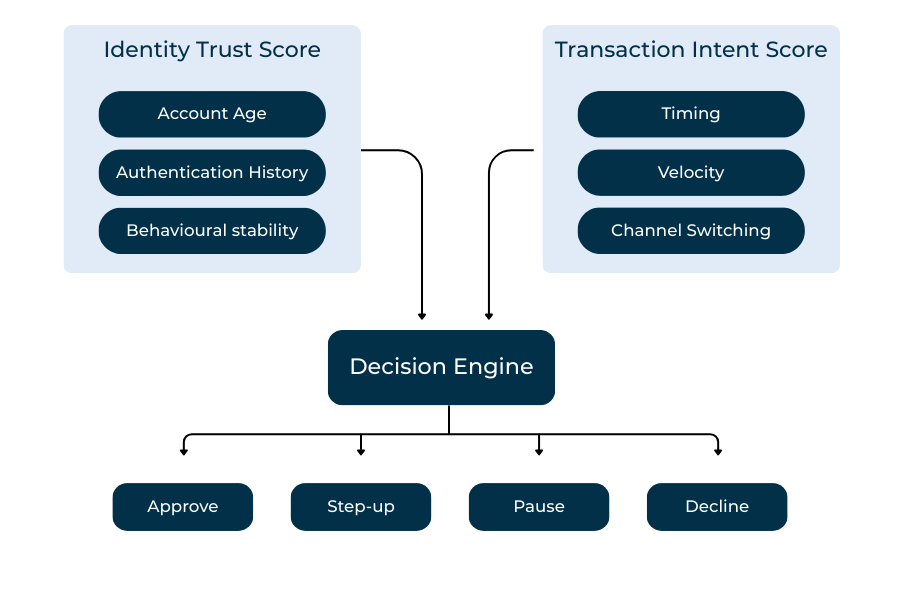

Framework Design: Dual-Score Architecture and Interaction Logic

Separating customer risk from transaction risk only works if the scoring architecture itself is designed to keep those assessments independent. In 2026, leading payment and fraud platforms increasingly rely on dual-score architectures, where identity trust and transaction intent are evaluated in parallel rather than collapsed into a single composite score.

Two scores, two purposes

A dual-score framework typically produces:

- An identity trust score, representing long-term confidence in the customer

- A transaction intent score, representing situational risk in the current moment

These scores answer different questions and operate on different timescales. Identity trust evolves slowly and decays deliberately. Transaction intent fluctuates rapidly and resets once the event passes.

The mistake legacy systems make is forcing these dimensions into one number. When that happens, a risky transaction permanently damages customer trust, and a trusted customer unintentionally masks high-risk activity.

How interaction logic works

The value of a dual-score model lies in how the two scores interact not in merging them, but in letting one temporarily influence decisions without overwriting the other.

Common interaction patterns include:

- Intent overrides trust for control decisions (e.g. step-ups, blocks)

- Trust constrains intent responses, preventing unnecessary friction

- Controls escalate based on intent, not customer reputation

- Trust remains stable unless compromise is confirmed

This allows a trusted customer to be challenged safely during a suspicious moment and returned to a low-friction experience once the risk subsides.

Decisioning without identity damage

A well-designed framework avoids “trust contamination.” That means:

- A declined transaction does not automatically downgrade the customer

- Step-up authentication does not reset trust history

- Temporary controls do not create permanent penalties

Instead, the system records the event, evaluates outcomes, and adjusts only if evidence supports a change in identity confidence.

Design principles that matter

From a governance and engineering perspective, dual-score systems benefit from:

- Clear separation of data inputs

- Independent model tuning and validation

- Transparent decision logic between scores

- Auditability of why one score influenced a decision

International standards bodies that focus on risk management and system design increasingly emphasise this kind of modularity and explainability. High-level guidance from organisations such as the International Organization for Standardization (ISO) reinforces the importance of separating long-lived risk attributes from real-time operational risk in complex systems.

Key takeaway

Dual-score architectures do not reduce risk by being stricter. They reduce risk by being more precise. Separating identity trust from transaction intent allows systems to intervene exactly where needed without destroying the customer relationship in the process.

Where Separation Matters Most (Subscriptions, Wallets, Instant Payments)

The practical value of separating identity trust from transaction intent becomes most visible in payment models where users transact frequently, funds move quickly, or value accumulates over time. In these environments, collapsing all risk into a single score creates unnecessary friction and, in some cases, actively increases fraud exposure.

Subscriptions and recurring billing

Subscription businesses depend on continuity. Customers may change devices, locations, or payment methods over the life of a subscription, but their underlying identity trust remains strong. When transaction risk is incorrectly merged with customer risk, these routine changes trigger step-ups or failed renewals that frustrate legitimate users.

With separation in place:

- Identity trust remains stable across billing cycles

- Transaction intent is assessed per renewal or payment event

- Temporary anomalies trigger proportionate checks, not account downgrades

This approach improves retention while still protecting against takeover or abuse during high-risk moments.

Wallets and stored-value accounts

Digital wallets are especially sensitive to risk conflation. Users build trust over time through repeated low-risk behaviour, yet a single high-risk action such as adding a new payout method can prompt aggressive controls if intent and identity are not decoupled.

This is critical in wallet ecosystems, where overblocking often drives users to abandon balances altogether.

Instant payments and real-time payouts

Instant payment environments leave little room for correction. Decisions must be made immediately, and reversibility is limited. In these cases, transaction intent must take priority without rewriting the customer’s trust profile.

This design aligns with broader policy thinking around real-time payments, where risk controls must be precise rather than punitive. Public-sector analysis on payment system resilience and consumer protection, reflected in work published by organisations such as the Organisation for Economic Co-operation and Development, consistently highlights the need to balance speed, safety and user confidence in modern payment infrastructures.

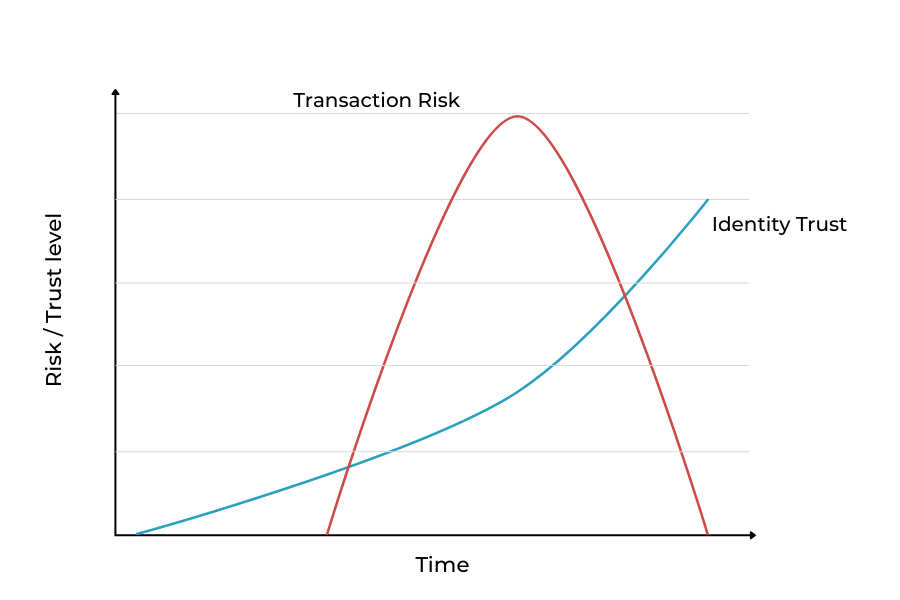

Risk Decay and Trust Accumulation Over Time

One of the most important benefits of separating transaction risk from customer risk is the ability to model time correctly. In modern scoring frameworks, risk is no longer a permanent label. It is something that should rise, decay, and reset depending on evidence. Trust, by contrast, should accumulate slowly and erode only when justified.

Why risk should decay

Transaction intent risk is, by nature, temporary. A suspicious event reflects uncertainty in a specific moment, not a lasting judgement about the customer. When systems fail to model decay properly, short-lived anomalies leave long shadows customers continue to experience friction long after the risk has passed.

In a well-designed framework, transaction risk should diminish once the triggering conditions no longer apply.

Trust accumulates through evidence

Identity trust behaves differently. It grows through repeated confirmation that a customer behaves consistently and successfully navigates controls. This includes:

- Completing authentication without issue

- Transacting regularly without disputes or abuse

- Maintaining stable behavioural patterns over time

- Recovering cleanly from challenged events

Trust accumulation creates resilience. It allows systems to tolerate small deviations without escalating unnecessarily.

The danger of slow decay and fast penalties

Legacy models often penalise quickly and forgive slowly. This imbalance disproportionately affects good customers, especially in high-frequency environments. Modern frameworks reverse this logic:

- Transaction risk spikes fast but decays quickly

- Trust increases slowly but decays deliberately

This asymmetry reflects reality: intent can change instantly, identity rarely does.

Designing decay correctly

Effective decay mechanisms are:

- Time-based, not event-based

- Sensitive to resolution outcomes

- Isolated to transaction-level risk

- Transparent and auditable

Public policy discussions on responsible risk management increasingly recognise the importance of proportionality over time. Broader government guidance on risk-based decision-making and fair treatment of users supports the idea that controls should adapt as conditions change, rather than locking customers into permanent risk states.

Operational Benefits: Fewer Step-Ups, Better Retry Logic

Separating identity trust from transaction intent does more than improve theoretical risk accuracy. It delivers tangible operational benefits that affect conversion, customer experience and support costs. For high-risk merchants operating at scale, these benefits often justify the architectural shift on their own.

Reducing unnecessary step-up authentication

One of the most immediate gains is a reduction in redundant challenges. When transaction risk is incorrectly merged with customer risk, systems tend to escalate controls repeatedly even after a customer has already proven themselves.

This leads to smoother journeys for trusted users while still preserving strong controls when intent genuinely changes.

Smarter retry logic after failed attempts

Legacy systems often treat failed transactions as evidence of customer risk. In reality, many failures are technical or situational network issues, bank-side timeouts, or user errors. When identity trust is preserved, retry logic becomes far more intelligent.

Effective separation enables platforms to:

- Allow retries without forcing re-authentication

- Adjust transaction-level controls without escalating customer risk

- Distinguish between suspicious retries and benign repetition

This is particularly valuable in instant-payment environments, where a failed attempt does not necessarily indicate malicious intent.

Consistency across channels

When identity trust is stable, users experience consistent treatment across devices and channels. They are not penalised for switching from mobile to desktop or reattempting a payment after interruption. This consistency builds confidence and reduces abandonment.

Public-sector analysis on consumer trust in digital services consistently highlights that predictability and proportionality are key drivers of user confidence. Broader guidance published through UK government digital and consumer policy resources reinforces the idea that risk controls should be firm but fair, particularly in automated systems that directly affect access to services.

Key takeaway

Separating identity and intent allows systems to intervene once, not repeatedly. The result is fewer step-ups, more intelligent retries and a measurable reduction in operational friction without compromising security.

KPIs: Customer False-Positive Rate and Repeat-User Approval Lift

Separating identity trust from transaction intent only delivers value if it improves measurable outcomes. In 2026, leading merchants and PSPs evaluate scoring frameworks not by how much risk they block, but by how precisely they differentiate between genuine customers and genuinely risky activity. The most telling indicators sit at the intersection of fraud control and customer experience.

Customer false-positive rate

False positives occur when legitimate customers are incorrectly challenged, blocked or downgraded. When identity and transaction risk are conflated, this rate tends to climb steadily, particularly in high-frequency environments.

Repeat-user approval lift

Repeat-user approval lift measures how frequently returning customers are approved compared with baseline models. This KPI is especially important for subscriptions, wallets and platforms with habitual usage.

When identity trust is preserved:

- Returning users face fewer friction points

- Approval rates improve without increasing fraud losses

- Conversion becomes more predictable over time

Approval lift is a strong signal that the system recognises customer history without allowing it to mask genuine transaction-level risk.

Balancing performance with accountability

As scoring frameworks become more sophisticated, performance measurement must remain transparent. KPIs should support explainable decisions rather than incentivising complexity for its own sake. International policy discussions on responsible analytics and automated decision-making consistently emphasise that performance gains must be balanced with fairness and clarity.

Work published by global policy bodies such as the Organisation for Economic Co-operation and Development reflects this view, highlighting the importance of measuring not only outcomes, but also the quality and impact of automated decisions on users.

Conclusion

By 2026, one of the most important evolutions in fraud and risk management is not the addition of more signals, but the correct separation of what those signals are meant to represent. Customer identity trust and transaction intent answer fundamentally different questions, operate on different timelines, and demand different responses. Treating them as interchangeable continues to be one of the main drivers of false positives, customer frustration and avoidable revenue loss.

Identity trust is earned over time. It reflects consistency, successful authentication and long-term behavioural reliability. Transaction intent, by contrast, is fleeting. It captures uncertainty in the present moment and should trigger proportionate, temporary controls without redefining who the customer is. When these two dimensions are collapsed into a single score, systems become both overly punitive and dangerously imprecise.

Modern scoring frameworks demonstrate that separating identity and intent leads to better outcomes on both sides of the equation. Fraud controls become sharper, because intent risk can escalate decisively when needed. Customer experience improves, because trust is preserved once the moment of risk has passed. Operationally, this separation reduces repeated step-ups, improves retry logic and allows teams to focus on genuine threats rather than managing fallout from blunt decisions.

As payment environments become faster and more automated, precision matters more than severity. In that landscape, scoring identity and intent independently is no longer a design preference; it is a structural requirement for building systems that are secure, fair and resilient at scale.

FAQs

1. Why do traditional fraud systems confuse transaction risk with customer risk?

Legacy systems were designed around single composite scores, largely for simplicity. This approach assumes that a risky transaction reflects a risky customer, which breaks down in modern digital payments where legitimate users frequently behave outside historical norms due to device changes, urgency, or channel switching.

2. Can a trusted customer still perform a high-risk transaction?

Yes. Trusted customers can be compromised, coerced, or act under unusual circumstances. That is why modern frameworks allow transaction intent to override identity trust temporarily, without permanently downgrading the customer’s reputation.

3. How does identity trust scoring improve customer experience?

By preserving long-term trust, systems avoid repeatedly challenging the same customer for routine changes. This reduces friction for returning users, improves approval rates, and prevents customers from being penalised for isolated anomalies.

4. What types of payments benefit most from separating identity and intent?

High-frequency and fast-moving payment models benefit the most, including subscriptions, wallets, instant payments, gaming deposits, and real-time payouts. These environments amplify the cost of false positives when trust and intent are conflated.

5. Does separating scores weaken fraud controls?

No. In fact, it strengthens them. Transaction intent scoring becomes sharper because it is no longer diluted by historical trust signals. Controls can escalate decisively when intent looks wrong, without collateral damage to the customer profile.

6. How does risk decay work in a dual-score framework?

Transaction risk decays quickly once the triggering conditions disappear. Identity trust decays slowly and only when evidence supports it. This prevents one-off events from creating long-term friction.

7. What operational teams gain from this separation?

Support teams see fewer repeat complaints, risk teams handle fewer false positives, and operations benefit from smarter retry logic. Overall, the system becomes easier to manage and explain internally.

8. Are regulators aligned with separating customer and transaction risk?

Yes. Risk-based regulatory thinking increasingly supports proportional controls and differentiated risk treatment. Separating identity trust from transaction intent aligns well with expectations around fairness, explainability, and proportional intervention.

9. How should success be measured after implementing a dual-score model?

Key metrics include customer false-positive rate, repeat-user approval lift, reduction in step-up frequency, and faster return to low-friction journeys after challenges.

10. Is this approach only relevant for large platforms?

No. While large platforms benefit significantly, mid-sized and high-growth merchants often see the biggest gains because false positives disproportionately affect their conversion and customer retention.