If you’ve spent any time looking at expansion decks for Southeast Asia, the narrative is always the same: 680 million people, sky-high smartphone penetration, and an e-commerce appetite that’s off the charts. On paper, it looks like a single, unified prize waiting to be claimed.

But for the merchants we talk to every day, that “single market” narrative is a mirage that evaporates the moment a customer hits the checkout button.

The reality of 2026 is that while Southeast Asia is digitally connected, it remains operationally fractured. We’ve seen time and again how a checkout flow that’s “optimized” for Indonesia fails quietly in Singapore, or how a Thai consumer’s preferred payment method is treated as an edge case in the Philippines. These aren’t just technical glitches; they are fundamental differences in how local rails were built and how local trust is earned.

Treating this region as a monolith is one of the most expensive mistakes you can make right now. It leads to bloated launch timelines, hidden costs, and conversion gaps that are notoriously hard to diagnose. If you want predictable growth across the region, you have to stop trying to force Southeast Asia to behave like one market and start designing for the reality of many.

In this post, we’re going to break down why regional scaling fails and the architectural shifts you need to make to actually win at the local level.

- Why Regional Scaling Fails in Southeast Asia

- Domestic Payment Rails Are Strong and That’s the Constraint

- Wallet Ecosystems Are National, Not Regional

- Regulation Prevents a Unified Checkout Model

- Consumer Checkout Behaviour Diverges by Country

- What Breaks When Merchants Apply a “Regional” Checkout

- What Merchants Must Do Instead in 2026

- Designing Country-by-Country Payment Architecture

- Conclusion

- FAQs

Why Regional Scaling Fails in Southeast Asia

Regional scaling fails in Southeast Asia because the payments infrastructure was never designed with regional uniformity in mind. Each market prioritised domestic inclusion, cost reduction, and local control, building rails and rules that work exceptionally well at home but poorly when stretched across borders.

Unlike Europe, there is no shared regulatory backbone or scheme governance that standardises participation, settlement, or consumer protection. Instead, merchants face parallel systems: different access requirements, different risk thresholds, and different operational expectations in every country. Even when the user experience looks similar on the surface, the mechanics underneath are incompatible.

Another reason is that consumer behaviour tracks local rails, not regional brands. People trust what their bank, government, or daily merchants have normalised. That trust does not transfer automatically across borders.

A payment method that feels default in one country can feel unfamiliar or even risky in the next. As a result, regional checkouts that assume behavioural spillover underperform quietly.

Finally, PSP and gateway realities reinforce fragmentation. “Regional” PSPs still rely on local banking partners, licences, and schemes in each market. That means routing, settlement, refunds, and disputes are handled country by country, even if the merchant relationship appears centralised. The cost and complexity surface later during reconciliation, support, and scaling rather than at launch.

In short, Southeast Asia resists regional scaling because payments success is anchored locally: in regulation, rails, and consumer trust. Treating the region as a single market ignores these anchors and shifts complexity downstream, where it is more expensive and harder to fix.

Domestic Payment Rails Are Strong and That’s the Constraint

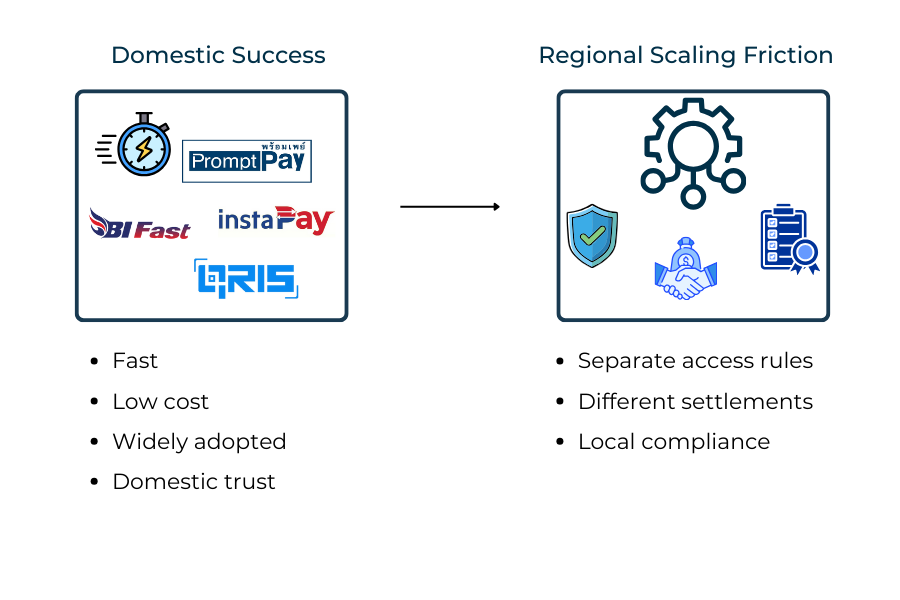

One of the biggest misconceptions about Southeast Asia is that payment fragmentation exists because infrastructure is weak. In reality, the opposite is true. Domestic payment rails across Southeast Asia are strong, widely adopted, and deeply embedded in local commerce and that strength is precisely what makes regional scaling so difficult.

Each major market has built real-time or near–real-time payment systems to solve local problems: reducing cash usage, lowering merchant costs, and improving financial inclusion. These systems work extremely well inside national borders, but they were never designed to support cross-border merchant standardisation.

From a merchant perspective, the friction does not appear at the point of consumer payment. It shows up later, in access rules, settlement logic, refunds, and compliance. What feels like “the same” type of bank transfer or QR payment behaves very differently once you move from one country to another.

The constraints merchants typically encounter include:

- Different participation and access requirements per rail

- Country-specific settlement cycles and reconciliation formats

- Inconsistent refund and dispute handling expectations

- PSP dependency on local banks and clearing systems

These are not surface-level differences. They shape how payments must be integrated, monitored, and supported in each market.

Singapore, for example, operates within a tightly regulated payments environment under the Monetary Authority of Singapore’s Payment Services Act, which defines licensing, safeguarding, and operational standards that do not automatically translate elsewhere in the region. Indonesia’s BI-FAST rail and Thailand’s PromptPay were built with domestic efficiency in mind, prioritising local participation and cost reduction over regional interoperability.

The result is a paradox. The more successful domestic rails become, the less incentive there is to compromise them for regional uniformity. For governments and central banks, that trade-off rarely makes sense. For merchants, it means accepting that strong local rails lock in local complexity.

By 2026, the implication is clear: scaling payments in Southeast Asia is not about finding a single rail that works everywhere. It is about designing acceptance, routing, and operations that respect the reality that each country’s strongest rails operate on their own terms.

Wallet Ecosystems Are National, Not Regional

If domestic payment rails make Southeast Asia hard to standardise, wallets make it impossible. Across the region, wallets are deeply national products, shaped by local regulation, funding models, and daily consumer habits. What converts exceptionally well in one country often has little relevance in the next.

This is because wallets in Southeast Asia are not simply front ends on top of cards or bank accounts. They are embedded into local financial and commercial ecosystems. Some are tightly bank-linked, others rely on stored value and cash-in networks, and many are integrated into super-apps that shape how consumers think about payments beyond checkout. Trust, once established locally, does not travel across borders.

For merchants, this creates a common but costly mistake: assuming that wallet success in one SEA market signals readiness in another. In practice, wallet placement, messaging, and refund logic that work in Indonesia may feel unfamiliar or unnecessary in Singapore, and irrelevant in Thailand or Vietnam. There is no regional learning curve; each market resets expectations.

Indonesia is a clear example of how national rules entrench this behaviour. QR-based wallet payments operate within the country’s QRIS framework, which standardises acceptance domestically while reinforcing local funding and compliance requirements. This has driven widespread wallet and QR adoption at home, but it does nothing to make those wallets portable or recognisable elsewhere in Southeast Asia.

The operational consequences for merchants show up quickly. Wallets require:

- Country-specific integration and certification

- Local refund handling aligned with wallet behaviour

- Market-specific customer support and reconciliation

Trying to unify these elements across borders increases support load and damages conversion, even when the same wallet brand appears in multiple countries.

By 2026, the lesson is well established. Wallets in Southeast Asia are local infrastructure, not regional tools. Merchants that accept this reality design country-level wallet strategies that convert reliably. Those that chase a regional wallet play end up managing complexity without seeing the expected performance gains.

Regulation Prevents a Unified Checkout Model

Even if payment rails and wallets could be standardised, regulation would still stop Southeast Asia from behaving like a single checkout market. Each country in the region operates under its own central bank, its own licensing regimes, and its own expectations around consumer protection, AML, and data handling. These rules are not cosmetic differences; they shape how payments must be built, monitored, and supported in practice.

For merchants, this means checkout logic cannot be abstracted away from compliance. Licensing requirements vary by country, influencing which PSPs can operate, which rails can be accessed, and how funds are safeguarded. AML and KYC thresholds differ, affecting onboarding flows, limits, and transaction monitoring.

Consumer protection rules define how refunds, reversals, and complaints must be handled often in ways that are incompatible across borders.

What makes this particularly challenging is that regulation is domestic by design. Central banks optimise for local stability, inclusion, and oversight, not regional merchant efficiency. Even where governments cooperate on payment initiatives, regulatory obligations remain anchored nationally. As a result, a checkout that complies cleanly in one market can introduce risk or friction in another without any visible change to the user interface.

The Philippines illustrates this dynamic clearly. Under the Bangko Sentral ng Pilipinas’ National Retail Payment System, payment schemes, access rules, and operational standards are defined locally to govern how transfers and wallets function within the country. Those standards support domestic adoption, but they do not align neatly with neighbouring markets’ requirements around settlement, dispute handling, or provider participation.

For PSPs, this fragmentation forces market-by-market operating models. For merchants, it means that “one checkout” strategies eventually surface hidden costs: additional compliance reviews, bespoke refund logic, and delayed market launches. The friction rarely appears at the design stage; it emerges later, when scale exposes regulatory mismatches.

By 2026, successful merchants treat regulation as a structural constraint, not a hurdle to be cleared once. Unified checkout models fail not because they are poorly designed, but because Southeast Asia’s regulatory reality makes uniformity impractical.

Consumer Checkout Behaviour Diverges by Country

One of the clearest reasons Southeast Asia cannot scale payments as a single market is that consumer checkout behaviour changes materially from country to country. These differences are not cosmetic. They affect which payment methods convert, how consumers react to friction, and where checkout design either reinforces trust or quietly breaks it.

This is where H3s genuinely matter, because each market operates with a distinct behavioural logic, not just a different payment mix.

Indonesia: Wallet-First, QR-Dominant Behaviour

Indonesia is one of the most wallet-centric markets in Southeast Asia. For a large share of consumers, especially on mobile, wallets and QR-based payments feel more natural than cards. Price sensitivity is high, and consumers are comfortable switching methods quickly if a flow feels slow or uncertain.

At checkout, Indonesian users expect:

- Prominent wallet and QR options

- Fast confirmation with minimal steps

- Clear visibility of final price and balance impact

Card-first designs often underperform here, not because cards are rejected, but because they feel heavier than necessary for everyday purchases. Merchants that push cards too aggressively see higher abandonment and lower retry rates than expected.

Singapore: Card-Heavy but Regulation-Led

Singapore looks very different. Card usage remains strong, particularly for online commerce, subscriptions, and higher-value transactions. Consumers are comfortable with card authentication flows and place significant trust in regulated financial institutions.

However, this is not a “cards everywhere” market. Behaviour is shaped by:

- Strong regulatory confidence

- Bank-linked expectations

- High standards for clarity and dispute handling

Wallets and bank-linked transfers coexist with cards, but checkout success depends on trust cues and regulatory familiarity, not novelty. Over-optimising for wallets at the expense of cards can harm conversion just as much as ignoring wallets entirely.

Thailand and the Philippines: Transfer- and Wallet-Led Hybrids

Thailand and the Philippines sit between these two extremes. In Thailand, PromptPay has normalised bank transfers for domestic payments, while wallets still play an important role for certain use cases. In the Philippines, uneven card penetration means consumers frequently rely on bank transfers and wallets, especially outside major urban centres.

In these markets, checkout behaviour is characterised by:

- Willingness to use non-card methods

- Sensitivity to fees and confirmation delays

- Strong expectations around successful completion messaging

A checkout that assumes card familiarity can feel exclusionary, while one that surfaces transfers and wallets clearly tends to perform more consistently.

Across all three cases, the lesson is the same. There is no Southeast Asian “average consumer”. Checkout design must respond to local behaviour, not regional assumptions. Merchants that try to force uniformity end up optimising for no one in particular.

What Breaks When Merchants Apply a “Regional” Checkout

Most payment failures in Southeast Asia do not show up as hard declines or obvious technical errors. Payments go through, rails are live, and dashboards look acceptable. Yet performance lags. Conversion is weaker than forecast. Support tickets rise. Launch timelines slip. This is what happens when merchants apply a regional checkout model to a market that only works locally.

The first thing that breaks is method hierarchy. A single regional ordering often card-first, followed by a generic wallet block rarely aligns with local intent. In wallet-first or transfer-led markets, this forces consumers to hunt for their preferred option or abandon early. In card-heavy markets, overcorrecting toward wallets creates unnecessary friction. The same checkout ends up underperforming everywhere, just in different ways.

The second failure point is retry and fallback logic. Regional designs often assume that users will retry the same method after a failure. In Southeast Asia, consumers are far more likely to switch rails immediately. When alternatives are hidden or surfaced late, that recovery opportunity disappears. What looks like low demand is often suppressed intent.

Refunds and post-payment handling are where problems compound. Applying a single regional refund policy across cards, wallets, and bank transfers ignores how consumers interpret outcomes. Some rails expect near-immediate balance updates, others tolerate delays. When refunds behave differently from expectations, trust erodes even if the funds eventually return.

Operational strain follows quickly. A regional checkout masks country-level complexity until scale exposes it:

- Disputes handled differently by rail and market

- Settlement and reconciliation formats that cannot be unified

- PSP escalations triggered by behaviour mismatches rather than fraud

None of these issues appear dramatic in isolation. Together, they create chronic underperformance that teams struggle to diagnose because nothing appears “broken” on paper.

By 2026, the pattern is consistent. Regional checkouts fail not because Southeast Asia lacks demand, but because uniform design collides with local behaviour. Merchants that continue to force regional models spend their time firefighting. Those that redesign around country-specific flows regain control over conversion, cost, and operational predictability.

What Merchants Must Do Instead in 2026

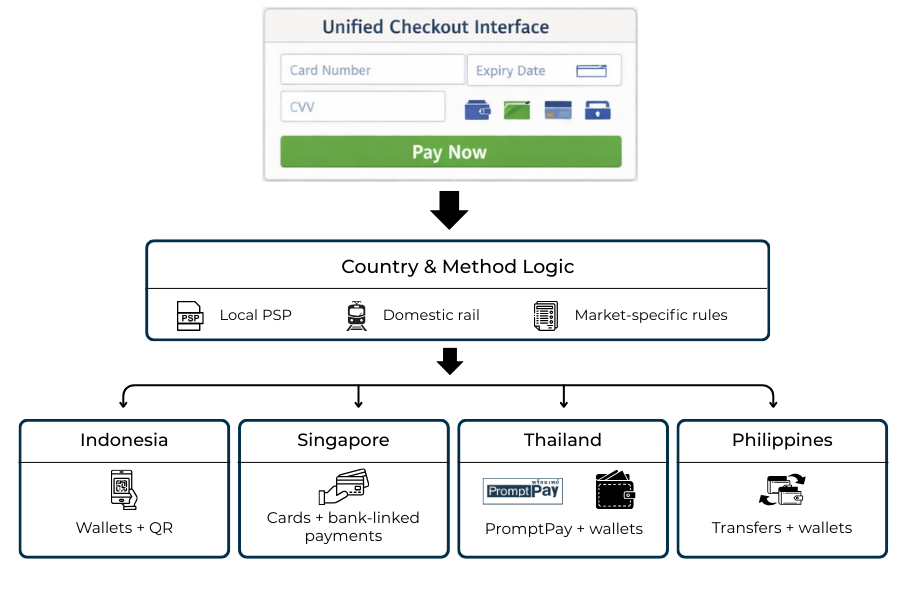

By 2026, the merchants that perform well in Southeast Asia are not trying to “solve” fragmentation. They accept it and design around it. The shift required is strategic rather than technical: moving from regional standardisation to country-level payment architecture.

The first change is organisational. Successful merchants stop treating Southeast Asia as a single launch and start treating it as a portfolio of markets, each with its own acceptance logic. That means planning payments alongside market entry, not after it. Checkout design, PSP selection, and operational workflows are defined per country from the outset.

The second change is architectural. Checkout becomes modular rather than fixed. Instead of one rigid payment stack, merchants deploy country-specific combinations of cards, wallets, transfers, and QR flows. The front end may look consistent, but the logic underneath adapts to local behaviour, rail availability, and regulatory constraints.

This approach also changes how performance is measured. Regional averages hide more than they reveal.

Merchants that succeed track conversion, retries, refunds, and support contact by country and by payment method. Problems surface earlier, and optimisation becomes targeted instead of reactive.

In practice, this shift means merchants must:

- Design acceptance stacks market by market, not regionally

- Choose PSPs for local depth, not just regional coverage

- Align payment ordering with local consumer intent

- Accept higher operational complexity in exchange for higher conversion

The trade-off is real. Country-specific design increases operational overhead. But in Southeast Asia, the alternative forcing uniformity costs more over time through lost conversion, delayed launches, and constant exception handling.

By 2026, the winning strategy is clear. Merchants that treat Southeast Asia as an architectural challenge rather than a geographic one build payment systems that scale predictably. Those that continue to chase a single regional checkout remain stuck optimising around a model that the region itself does not support.

Designing Country-by-Country Payment Architecture

Designing payments for Southeast Asia in 2026 is ultimately an architecture exercise, not a UI one. The merchants that scale reliably are those that separate what the customer sees from how payments are actually routed, settled, and managed underneath. Consistency on the surface is achieved by embracing differences below it.

At an architectural level, this means abandoning the idea of a single “SEA payment stack”. Instead, merchants build country-specific acceptance layers that plug into a shared core. Each market has its own mix of rails, wallets, PSP relationships, and operational rules, but they are orchestrated through a common decision layer rather than hard-coded into checkout.

Acceptance Stacks Are Defined Per Market

In practice, this starts with defining a clear acceptance stack for each country:

- Which methods are primary vs secondary

- Which rails are used for domestic vs cross-border flows

- How retries and fallbacks should behave locally

This prevents the most common SEA failure mode: carrying over payment assumptions from one market into another where they no longer apply.

Routing and PSP Strategy Becomes Local by Design

A country-by-country architecture also accepts that no single PSP performs best everywhere. High-performing merchants use different PSPs across markets, chosen for local access, settlement reliability, and regulatory alignment rather than regional branding.

Routing logic then sits above those PSPs, allowing transactions to be directed based on country, method, value, or risk profile without exposing that complexity to the user.

Operational Logic Must Match Local Expectations

Architecture decisions extend beyond acceptance. Refunds, reconciliation, and reporting must align with how each rail behaves locally. A unified dashboard is useful, but only if it reflects country-level realities rather than forcing everything into a single format.

Operationally, this approach changes four things immediately:

- Multiple PSP integrations are planned, not avoided

- Settlement and reconciliation are handled per market

- Refund logic is rail-aware, not generi

- Performance is analysed country by country

This architecture is undeniably more complex than a regional shortcut. But it scales cleanly. Issues surface where they belong, not weeks later in aggregated reporting.

By 2026, merchants that succeed in Southeast Asia are not the ones with the simplest payment stacks. They are the ones whose systems are designed to absorb fragmentation without leaking it into the customer experience.

Conclusion

Southeast Asia remains one of the most attractive regions for digital commerce, but it continues to resist being treated as a single payments market. The same forces that have accelerated local adoption, strong domestic rails, nationally trusted wallets, and country-specific regulation are the very forces that prevent regional standardisation at checkout.

By 2026, the gap between merchants who understand this and those who do not is easy to spot. Teams that persist with regional checkouts spend their time managing exceptions, explaining underperformance, and retrofitting fixes after launch. Those that design payments country by country see steadier conversion, clearer operational control, and faster learning cycles.The lesson is not that Southeast Asia is uniquely difficult. It is that precision matters more than uniformity. Payments scale in the region when architecture respects local behaviour, regulation, and infrastructure while keeping the customer experience coherent. Merchants that embrace this mindset build systems that grow with the region instead of fighting it.

FAQs

1. Why can’t Southeast Asia scale payments like Europe?

Because Southeast Asia lacks a shared regulatory framework and common payment schemes. Each country has built domestic rails and rules that work locally but do not align regionally.

2. Are cross-border QR initiatives solving the merchant scaling problem?

No. These initiatives help limited consumer use cases but do not remove the need for local compliance, settlement, and PSP integrations.

3. Why do wallets behave so differently across Southeast Asia?

Wallets are shaped by national regulation, funding models, and consumer habits. Trust in one country does not automatically transfer to another.

4. Can a single PSP cover all Southeast Asian markets effectively?

Not in practice. Even “regional” PSPs operate through local licences, banks, and rails, which creates market-by-market differences.

5. Is card-first checkout ever effective in Southeast Asia?

Yes, in card-heavy markets like Singapore. But applying card-first logic across the region leads to underperformance elsewhere.

6. What is the biggest checkout mistake merchants make in SEA?

Assuming that success in one country can be replicated in another without redesigning payment flows.

7. Does country-by-country payment design increase operational cost?

Yes, but it usually reduces total cost over time by improving conversion and lowering support and exception handling.

8. How should merchants measure payment performance in Southeast Asia?

By tracking conversion, retries, refunds, and disputes per country and per payment method, not just regional averages.

9. Are domestic payment rails in SEA getting more interoperable?

Interoperability is improving slowly, but it does not eliminate country-specific requirements for merchants.

10. What changes in 2026 compared to earlier years?

Consumer expectations are firmer, domestic rails are more entrenched, and the cost of forcing regional standardisation is higher.