For high-risk merchants, the payment challenge in 2026 is no longer authorisation or routing efficiency, it is the unpredictability of settlement. Corridors that previously behaved reliably now experience intermittent outages, regional banking delays, and unplanned extensions in T+ cycles. Even short disruptions can prevent merchants from issuing refunds, honouring withdrawals, or maintaining regulated liquidity thresholds. As volumes grow and payout timing becomes more central to customer trust, inconsistent settlement behaviour introduces operational, compliance, and reputational risk.

This is why the industry is shifting towards settlement risk intelligence: a data-driven approach that monitors corridor health in real time, forecasts delays before they happen, and highlights where liquidity gaps may form. For UK merchants exposed to multi-rail, multi-region settlement routes, predictive insight is becoming essential rather than optional.

What Is Settlement Risk Intelligence?

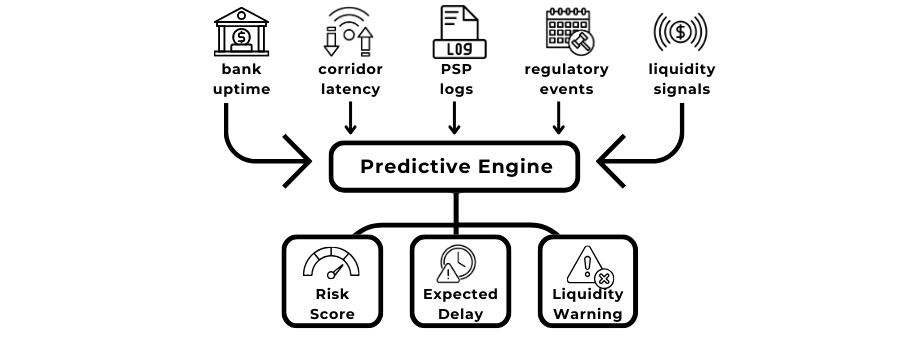

Settlement risk intelligence refers to a predictive framework that monitors the health of settlement corridors, detects unusual behaviour in payout routes, and identifies where delays or liquidity gaps are likely to emerge. Unlike traditional settlement reporting which only reflects completed events risk intelligence surfaces destabilising patterns before they impact merchant operations.

At its core, the model combines historical settlement behaviour, live corridor signals, and provider-level performance data to generate a continuously updated risk score. This allows UK merchants to understand not just when funds will arrive, but how settlement may deviate from expected timing due to systemic or region-specific pressures.

Data-Driven Corridor Scoring

Risk intelligence systems assign each corridor a dynamic score based on variables such as bank uptime, historical latency, FX availability, dispute ratios, and compliance-triggered interruptions. These scores reflect the probability of a delay within a given settlement window and can shift throughout the day as new data arrives.

Real-Time Settlement Health Signals

Where legacy PSP dashboards only show whether a settlement is pending or complete, intelligence layers monitor the components surrounding each event, bank queue times, provider slowdowns, regulatory alerts, liquidity movements, and risk flags. This provides a more granular view of settlement health across the full payout chain.

For merchants operating in high-risk verticals, where even minor interruptions can cascade into customer complaints or regulatory attention, this intelligence transforms settlement from a reactive function into a proactive risk-managed capability.

Data Inputs Used in Predictive Models

Predictive settlement models rely on a wide dataset that reflects both structural behaviour in the banking system and real-time volatility across payout corridors. Rather than waiting for settlement reports to indicate a delay, intelligence systems capture upstream signals that historically precede outages, liquidity gaps, or elongated T+ cycles. These inputs allow UK merchants to form an accurate expectation of settlement timing, even when operating across multiple rails and jurisdictions.

Bank Uptime & Operational Reliability

A corridor’s stability depends heavily on the operational continuity of the receiving bank. Predictive systems monitor uptime patterns, maintenance windows, and queue congestion to estimate when inflows may slow. This matters particularly in regions where domestic clearing houses publish performance summaries only at end-of-day.

Corridor Latency Patterns

Historical latency is one of the strongest indicators of future settlement drift. Predictive models compare expected movement times against real-time timestamping to flag emerging slowdowns. This is especially important for cross-border bank transfers where intermediary banks introduce variability.

Liquidity Flow Patterns

Merchants often experience delays when the receiving corridor faces temporary liquidity shortages or increased demand during peak periods. Intelligence systems analyse FX availability, intra-day liquidity trends, and settlement batching behaviour to anticipate these gaps before they impact payouts.

Regulatory & Compliance Triggers

Events such as enhanced due-diligence reviews, geopolitical restrictions, or AML alerts can slow settlement flows unexpectedly. Predictive models incorporate regulators’ public advisories and historic enforcement patterns to adjust corridor risk scores dynamically. For example, the FATF’s cross-border payments guidance emphasises the impact of supervisory interventions on international fund movement, FATF Digital Payments & Cross-Border Risk

PSP Performance Logs

PSPs occasionally experience internal queue backlogs, reporting delays, or slowed reconciliation cycles. By ingesting provider-level performance drift such as increased error rates or irregular batch releases predictive systems gain visibility long before these issues appear in merchant settlement files.

Key Predictive Scenarios

Predictive settlement systems are designed to identify the early signals that precede payout delays, liquidity pressure, or complete corridor disruption. In high-risk verticals, where payouts and withdrawals are time-sensitive these scenarios determine whether merchants maintain customer trust or face operational bottlenecks.

A risk-intelligence layer looks across thousands of data points to surface the patterns that historically correlate with settlement instability.

1. Corridor Outages

A corridor may enter partial or full outage when domestic clearing systems slow, intermediary banks introduce friction, or regional liquidity becomes constrained. Predictive models identify this through

- Rising end-to-end latency

- Delayed ledger timestamp propagation

- Decreasing bank uptime scores

- Unusual queue accumulation at the PSP level

These indicators allow merchants to switch payout routes or adjust customer timing expectations before a backlog forms.

2. AML-Triggered Holds

Regulators across Europe and the UK are tightening real-time AML review on cross-border flows. When a hold is triggered, settlements can pause for hours or even days. Predictive systems monitor patterns such as corridor-specific false-positive surges, regional enforcement actions, or PSP-level case escalations.

This aligns with supervisory direction from the FATF, which emphasises early detection of compliance-related interruptions in cross-border funds movement.

3. Bank Queue Backlogs

Even well-established corridors experience temporary slowdowns. Predictive engines look at micro-indicators queue growth rates, clearing-house processing windows, or deviations in expected batch cycles.

4. FX Liquidity Warnings

Cross-border settlements frequently depend on intraday FX availability. Sudden liquidity shortages can delay settlement finality or redirect flows through slower fallback routes.

Predictive models use historical FX depth, regional trading behaviour, and treasury-level liquidity movements to warn merchants when:

- FX spreads widen

- Liquidity pockets thin

- Volatility spikes around predictable events

These predictive scenarios help merchants transition from reactive troubleshooting to proactive liquidity and corridor management. They also support the industry’s broader move toward settlement transparency outlined in research from the BIS Cross-Border Payments Programme, which highlights the operational fragility of many international settlement chains.

PSP Adoption Models

Settlement risk intelligence has moved from an experimental capability to an operational requirement for PSPs serving multi-region merchants. By 2026, providers are embedding predictive models directly into their payout infrastructure to reduce settlement failures, protect liquidity positions, and meet emerging regulatory expectations around transparency. The adoption models vary, but most fall into three practical categories.

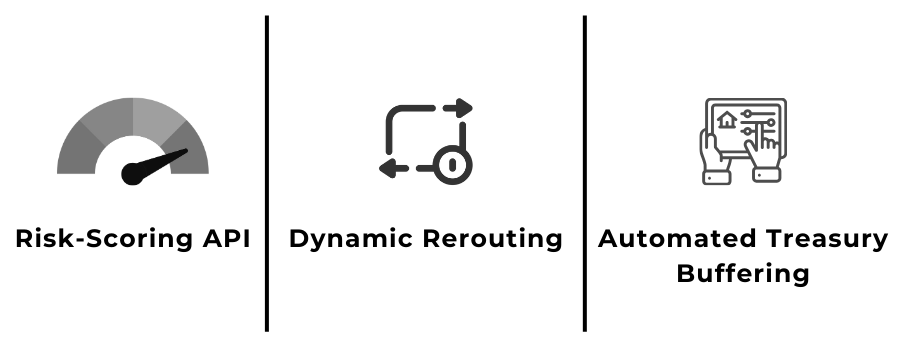

Embedded Risk-Scoring API

Many PSPs now expose a risk-scoring API that merchants or internal payout engines can query before initiating a settlement. The API returns a corridor-level risk score incorporating expected latency, bank uptime, regulatory friction, and liquidity behaviour.

Common use cases include:

- Checking corridor health before releasing high-value payouts

- Selecting between multiple available settlement rails

- Forecasting whether a payout may fall outside its expected T+ window

This aligns with the broader push for real-time data transparency reflected in the BIS Cross-Border Payments Programme, which encourages institutions to adopt predictive tools to identify corridor-level instability.

Dynamic Payout Rerouting

Instead of relying on static routing rules, PSPs increasingly shift payouts automatically when models detect potential degradation in corridor performance. Dynamic rerouting considers:

- Fallback rails with higher reliability

- Regional banking schedules or maintenance windows

- FX liquidity depth across available payout paths

- thresholds configured by the merchant

This approach reduces manual intervention and dramatically lowers the number of merchant-reported settlement disputes.

Automated Treasury Buffering

Settlement holds, corridor slowdowns, and AML pauses create liquidity pressure, especially for high-risk sectors with frequent withdrawals. To avoid payout failures, PSPs now pre-position liquidity in strategic corridors based on predictive signals. Automated buffering typically involves:

- Reserving intra-day liquidity in markets with volatile settlement timing

- Increasing buffer levels ahead of forecasted delays

- Smoothing payout cycles when inflows temporarily underperform

Treasury teams gain more control because the orchestration engine signals which corridors may require additional liquidity hours or sometimes days in advance.

Key Takeaway

Merchant Advantages

For UK merchants operating across high-risk or high-velocity verticals, the value of settlement risk intelligence becomes visible almost immediately. Unpredictable settlement behaviour whether caused by corridor congestion, bank delays, or liquidity mismatches creates downstream pressure on refunds, withdrawals, compliance duties, and customer satisfaction. Predictive intelligence stabilises these weak points by giving merchants clearer visibility into when funds will arrive and which corridors may require intervention.

Cash Flow Stability

Predictive settlement models provide merchants with an anticipated settlement window rather than a static T+ expectation. This allows treasury teams to prepare liquidity, schedule payouts, and plan for intraday cash requirements. The ability to forecast deviations is particularly important for merchants offering withdrawals or time-sensitive payouts, where even a small delay affects user trust.

Key improvements include:

- More accurate intra-day liquidity planning

- Reduced dependency on manual reconciliation timetables

- Quicker identification of underperforming corridors or PSPs

Reduced Settlement Disputes

Many merchant disputes stem not from failed transactions, but from unclear settlement timelines. When payouts drift unexpectedly, support teams are forced into reactive communication with customers or partners. Risk intelligence reduces disputes by generating early signals when timelines may extend and by enabling proactive adjustments.

Merchants typically see a drop in:

- Customer payout complaints

- Misaligned reporting between PSPs and internal finance teams

- Manual investigations triggered by missing or late settlements

Consistency in Payout Cycles

Markets with uneven settlement behaviour LATAM, Southeast Asia, parts of Eastern Europe often produce volatility in payout cycles. Predictive intelligence smooths this by recommending alternative routes, adjusting liquidity buffers, or flagging slow corridors before cut-off times.

For UK-regulated firms, this also supports readiness under the FCA’s expectations on safeguarding and operational resilience, which emphasise the importance of predictable fund handling and strong oversight of outsourced payment partners.

FCA Operational Resilience & Safeguarding Guidance

Regulatory Considerations (2026)

By 2026, regulatory expectations around settlement have grown substantially, driven by a global push for transparency across cross-border payment routes. Regulators are no longer satisfied with oversight at the transaction level; they now expect firms to evidence how funds settle, why delays occur, and whether internal controls can identify anomalies early. Predictive settlement intelligence aligns closely with this shift, giving UK merchants and PSPs the visibility required to meet evolving standards.

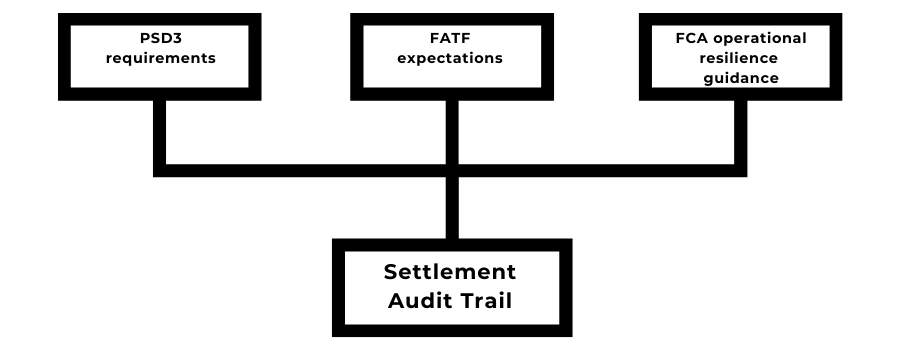

PSD3 and the Demand for Settlement-Level Reporting

PSD3 places renewed emphasis on how payment institutions supervise outsourced partners, monitor post-transaction flows, and maintain accurate audit trails. Settlement drift, corridor instability and unexplained delays must be traceable in a way that allows firms to demonstrate they acted with appropriate oversight. Predictive intelligence supports this by creating a timestamped record of settlement behaviour, supported by real-time alerts that highlight any deviation from expected patterns.

FATF Expectations on Cross-Border Transparency

The FATF has reinforced that cross-border transactions must demonstrate traceability throughout the entire payment chain, not just at initiation. This includes understanding intermediary banks, liquidity constraints, regulatory checks and settlement-routing decisions. Predictive models help firms meet these expectations by surfacing early signs of operational or compliance friction, allowing institutions to react before a delay escalates into a reportable event.

FATF – Cross-Border Payments Survey Results

Audit-Trail Readiness for UK Merchants

Audit teams increasingly request structured evidence of settlement processes: how long funds took to settle, which corridor was used, why alternative rails were selected, and whether any delays were anticipated. Risk intelligence tools produce a chronological ledger that simplifies these requirements. Instead of gathering disparate reports from PSP dashboards, merchants gain a consolidated audit surface that aligns with the FCA’s expectations on operational resilience.

Several data points that auditors now expect to see consistently include:

- Clear identification of settlement batches and timestamp drift

- Corridor-specific explanations for delayed inflows

- Records of liquidity rebalancing decisions

- Evidence that predictive warnings were acted upon

These requirements reflect a broader shift: settlement is no longer viewed as an operational black box but as a regulated activity that demands structured monitoring and proactive oversight.

Key Takeaway

- Predictive settlement intelligence now plays a central role in meeting PSD3, FATF and FCA requirements

- Firms that maintain real-time oversight of corridors and liquidity movements are better prepared for audits and regulatory inquiries

- The regulatory direction is clear: settlement transparency is becoming as important as transaction transparency

Implementation Blueprint

Implementing settlement risk intelligence isn’t a technical “switch-on” exercise; it requires merchants to build the right data foundations, configure corridor-level rules, and establish governance processes that ensure the insights actually influence payout and treasury decisions. The blueprint below reflects the way UK merchants are adopting these models in 2026: phased, controlled, and aligned with operational realities.

API Activation and Data Ingestion

The first step is enabling the risk-intelligence API and connecting it to existing PSPs, banks and treasury systems. The API needs enough historical and real-time data to generate meaningful corridor signals. For most merchants, the onboarding phase focuses on:

- Mapping settlement files and bank reconciliation records into a unified format

- Connecting PSP performance logs, including latency patterns and exception queues

- Ensuring time-series accuracy so predictive models don’t misinterpret normal batching as settlement drift

This process also supports broader expectations under the FCA’s operational resilience framework, which emphasises maintaining visibility over outsourced payment functions and ensuring firms can demonstrate continuity even when partners experience delays.

FCA Operational Resilience Guidance

Corridor Monitoring and Threshold Configuration

Once the system is live, merchants configure the thresholds that determine when an alert or rerouting decision should be triggered. These thresholds vary widely across corridors, industries and payout frequencies. High-risk merchants typically configure

- Upper latency limits for different settlement windows

- Rules that trigger alternative payout rails when corridor scores worsen

- Liquidity buffer levels that increase automatically before a predicted delay

- Event-based alerts (regulatory updates, bank maintenance windows)

This stage ensures the intelligence layer behaves in line with the merchant’s actual operating model not as a generic risk engine.

Data Governance and Internal Ownership

Predictive systems only remain reliable when the underlying data is clean and consistently updated. Merchants benefit from assigning joint ownership across operations, treasury and compliance, each responsible for a part of the settlement lifecycle. Effective governance often includes:

- Routine validation of corridor risk scores

- Quarterly review of API performance and threshold tuning

- Internal audit trails documenting how alerts were handled

- Clear decision rights for rerouting payouts or adjusting liquidity

This governance framework is increasingly expected by regulators, especially under PSD3’s emphasis on strengthened oversight of outsourced and cross-border payment functions.

Key Takeaway

- Implementation succeeds when merchants treat risk intelligence as an operational capability not just a data feed

- Corridor thresholds, liquidity rules and audit processes must reflect real-world payout behaviour

- Strong governance ensures predictive insights translate into measurable improvements in settlement performance

Conclusion

By 2026, global settlement flows are too complex, too fragmented and too time-sensitive for merchants to operate without predictive oversight. High-risk and high-volume businesses in particular have learned that the cost of settlement unpredictability is not just operational—it carries financial, regulatory and reputational consequences. As corridor volatility, regulatory interventions and FX-linked liquidity gaps become more common, the ability to anticipate delays is now a competitive necessity.

Settlement risk intelligence provides this capability. By combining corridor scoring, performance drift analysis, and real-time payout health monitoring, it gives merchants and PSPs a clear picture of when and where settlement issues will arise. Instead of reacting to missing funds, withdrawn payouts or unexplained T+ elongation, firms gain the foresight required to optimise liquidity, respond to regulatory expectations and maintain a stable customer experience.

For UK merchants expanding across multiple regions, the direction is clear: predictive models are no longer an enhancement to settlement—they are becoming part of the core settlement infrastructure itself.

FAQs

1. How does settlement risk intelligence differ from standard settlement reporting?

Traditional settlement reports show what already happened. Risk intelligence predicts what is likely to happen next, identifying corridor delays, liquidity pressures and compliance triggers before they affect payouts.

2. Which merchants benefit most from predictive settlement models?

High-risk sectors such as gaming, trading, FX, travel and subscription platforms benefit first because their payout cycles are highly time-sensitive and operate across multiple regions.

3. Can predictive models fully prevent settlement delays?

No model can eliminate delays entirely, but they significantly reduce unexpected disruptions by warning merchants early and enabling rerouting or liquidity adjustments.

4. What data is most important for predicting corridor slowdowns?

Bank uptime, historical latency patterns, PSP performance drift, FX liquidity depth and regulatory event signals are the strongest predictors.

5. Does predictive intelligence help with regulatory compliance?

Yes, it strengthens audit trails, supports PSD3 requirements for settlement oversight and aligns with FATF expectations around cross-border transparency.

6. Do merchants need engineering resources to implement risk intelligence?

Most implementations require light engineering work to activate APIs and unify settlement data feeds across PSPs and payout partners.

7. How does risk intelligence improve treasury planning?

By forecasting settlement timing, merchants can position liquidity earlier, maintain payout continuity and reduce reliance on emergency funding.

8. Does settlement risk intelligence work with multi-rail payout systems?

Yes. It performs best when merchants use several corridors or rails, as it can compare performance and recommend optimal routes.

9. How often are corridor risk scores updated?

Most systems refresh continuously, often every few minutes using real-time signals from banks, PSPs and clearing networks.

10. Can predictive signals be automated to trigger operational actions?

Yes, many PSPs and merchants now automate rerouting, buffer creation and corridor deprioritisation when risk scores deteriorate.