For years, merchants optimised their payment performance using static rules: fixed routing preferences, monthly acquirer reviews, and after-the-fact reporting. That approach worked when payment ecosystems were slower, issuer behaviour was predictable, and acquirer performance varied only marginally over time. But in 2026, the payments environment has shifted into something far more dynamic. Issuers adjust fraud thresholds in real time, acquirers experience fluctuating load and latency, networks propagate token updates instantly, and risk engines re-score transactions at the moment of authentication.

In this environment, static optimisation doesn’t just underperform, it fails. Merchants who rely on retrospective reporting or monthly adjustments often lose millions in approvals simply because they cannot see what is happening inside the payment stack the moment a customer transacts. The rise of real-time diagnostics changes this entirely. Instead of waiting for declines to accumulate, merchants can now detect issuer tightening, acquirer degradation, network throttling, or risk-model shifts as they happen.

This evolution turns payments from a black box into an observable system. Real-time issuer signals, acquirer health indicators and dynamic risk scores allow merchants to make intelligent decisions instantly: switching acquirers, modifying authentication, reformatting transactions or retrying through a healthier route. The result is a step change in performance, especially for high-risk and cross-border merchants who operate in volatile corridors where acceptance can shift hour to hour.

Real-time diagnostics are not a convenience; they are now a competitive requirement. Merchants who embrace them see higher authorisation rates, reduced false declines and a more resilient payments strategy built for a world where risk, trust and infrastructure conditions evolve continuously.

- What Real-Time Diagnostics Look Like in 2026

- Issuer Health Signals: Understanding How Banks Behave in Real Time

- Acquirer Health Signals: What PSPs Reveal About Performance

- Risk Engine Signals: The New Behavioural Layer in Diagnostics

- How Real-Time Diagnostics Feed Smart Routing in 2026

- Why High-Risk Verticals Benefit the Most

- Operational Setup: How Merchants Implement Real-Time Diagnostics

- Conclusion

- FAQs

What Real-Time Diagnostics Look Like in 2026

Real-time payment diagnostics mark a clear break from the reporting-heavy approaches merchants once relied upon. In previous years, operational teams waited for settlement reports, dispute summaries or acquirer dashboards to understand why authorisation rates dipped. By the time insights surfaced, the damage was already done. In 2026, diagnostics bring an entirely different model: merchants see what issuers, acquirers, networks and risk engines are doing as transactions are happening.

This shift is driven by improved scheme transparency, PSP architecture upgrades, AI-driven risk scoring and the universal push toward more interpretable payment data under PSD3 and similar regulations. Instead of relying on lagging indicators, merchants now have access to first-party signals that reveal the real-time state of their acceptance stack.

These diagnostics typically arrive through high-frequency data feeds, webhooks and streaming events that update within milliseconds. They capture issuer decisions as they happen, surface acquirer health fluctuations, and provide contextual risk scores that help determine whether a transaction should be retried, rerouted or handled differently. Payment optimisation becomes a live activity instead of a retrospective one.

First-Party Issuer Signal Access

Banks are no longer black boxes. In 2026, issuer-side decisioning is significantly more transparent due to scheme requirements and regulatory pressure for clearer decline reason codes. Merchants can now see real-time indicators such as whether an issuer is applying additional fraud controls, temporarily tightening BIN-level thresholds, or returning decline codes due to authentication mismatches. This transparency allows merchants to react instantly modifying transaction formatting, sending additional data elements or shifting traffic to another acquirer before declines escalate.

PSP Latency Feeds and Infrastructure Visibility

PSPs now expose their own infrastructure health in real time, giving merchants insight into message delivery latency, gateway congestion or API delays that may be affecting approval rates. Where traditional dashboards presented averaged data, real-time diagnostics reveal moment-to-moment conditions that directly impact transaction success. Merely knowing that latency is elevated allows merchants to switch routing pathways or throttle specific corridors until the PSP stabilises.

Network Token Lifecycle and Authentication Insights

Tokenization ecosystems have matured to the point where token lifecycle health influences acceptance nearly as much as issuer behaviour. Real-time diagnostics show whether a token is fresh, whether a cryptogram is valid, whether lifecycle updates have propagated and whether authentication flows align with issuer expectations. When token status becomes a problem, merchants can regenerate tokens, refresh credentials or bypass token routing temporarily to avoid unnecessary declines.

Issuer Health Signals: Understanding How Banks Behave in Real Time

For years, merchants treated issuers as unpredictable forces. Approval rates would rise or fall without warning, and no one could explain why. In 2026, that changes entirely. Issuers now generate live health signals that reveal how their fraud engines, authentication logic, network connectivity and corridor preferences evolve minute by minute. These signals give merchants unprecedented visibility into one of the most influential parts of the payment chain the issuing bank’s real-time decisioning posture.

The behaviour of issuers is no longer static. Fraud models tighten and relax dynamically, SCA requirements shift based on perceived risk, and BIN-level throttling can activate temporarily during fraud spikes or system stress. Without real-time visibility into these fluctuations, merchants experience sudden performance drops that appear random when in reality, they are part of predictable behavioural patterns. Diagnostics bridge this gap, turning the issuer environment into something observable rather than mysterious.

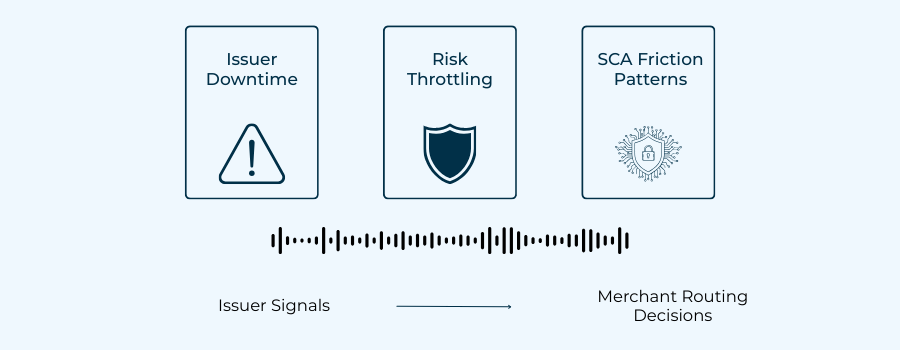

Downtime, Degradation and SCA Friction Patterns

Banks encounter performance degradation just like any other technology-driven organisation. When authentication servers slow down, fraud models misfire or SCA endpoints fail, issuers begin returning declines that have nothing to do with merchant risk. Real-time diagnostics allow merchants to see these patterns as they unfold, not after thousands of failed attempts.

These insights make a critical difference. If an issuer’s authentication service is struggling, merchants can temporarily reduce SCA burden where exemptions are permitted or reroute traffic to acquirers with more resilient issuer connections. Instead of letting a degradation event ruin acceptance for an entire hour or region, merchants can adapt in real time and preserve conversions that would otherwise be lost.

Risk Throttling and BIN-Level Tightening

Issuer fraud engines are now highly dynamic. They adjust thresholds, velocity rules and corridor-level risk scores automatically in response to perceived anomalies. This means an issuer might suddenly tighten approvals for a specific MCC, geography or card range not because the merchant is problematic, but because the issuer’s system detected wider ecosystem risk.

Real-time signals reveal when these throttles activate. If a certain BIN range begins soft declining disproportionately, merchants can immediately route transactions through alternative acquirers that the issuer trusts more in that moment, or soften authentication flows to reduce issuer suspicion. What used to be invisible friction becomes a manageable optimisation opportunity.

Geo-Prioritisation and Corridor-Level Sensitivity

Issuers evaluate transactions differently depending on the region in which the cardholder is located, the merchant’s location and the corridor used. Cross-border payments, in particular, are heavily influenced by geopolitical risk, local fraud trends and regional issuer preferences. In 2026, diagnostics will expose this corridor sensitivity in real time.

Merchants can now see when issuers are favouring domestic traffic, tightening certain cross-border corridors, or adjusting risk weightings for specific countries. This enables merchants to dynamically shift cross-border routing, rebalance traffic across acquirers or add supplementary data elements to strengthen issuer trust. Instead of accepting corridor volatility as inevitable, merchants can actively stabilise performance with real-time visibility.

Acquirer Health Signals: What PSPs Reveal About Performance

While issuers are often blamed for declines, an equally important component of transaction success is the behaviour and stability of the acquirer. In 2026, merchants finally gain real-time clarity into acquirer performance, something traditionally hidden behind generic decline codes or delayed operational reports. Modern PSPs now expose acquirer health metrics as streaming signals, allowing merchants to understand instantly when an acquirer is struggling, overloaded or applying heightened fraud controls.

This visibility is transformative. Instead of relying on instinct or waiting for customer complaints, merchants can monitor acquirer behaviour as precisely as they monitor their own systems. Essential signals latency, timeouts, regional loads, fraud firewall activation, and scheme connectivity become operational inputs that inform routing decisions in real time. The acquirer is no longer a static endpoint; it becomes a dynamic, measurable component of the payments stack.

Timeouts, Latency Spikes and Queue Congestion

Acquirer processing capacity varies throughout the day. During peak periods or system degradation, acquirers may introduce queuing delays or fail to respond within the expected time window. Historically, this would lead to undiagnosed declines or vague “issuer unavailable” messages. In 2026, real-time diagnostics expose these delays as they happen.

When latency spikes, merchants can reroute transactions instantly, avoiding the cascading failures that occur when acquirers become congested. Instead of waiting for general outages to resolve, merchants can bypass bottlenecks proactively preserving approvals and protecting customer experience. This level of control fundamentally alters how merchants manage payment resilience.

Fraud Trigger Spillover and Aggressive Risk Firewalls

Acquirers operate their own fraud engines, separate from issuers and networks. These systems can become overly aggressive, especially when detecting sudden velocity changes or unusual cluster behaviour across multiple merchants. When acquirer firewalls activate, they may begin dropping or flagging transactions that are otherwise legitimate.

Real-time health signals reveal when these triggers are active. If an acquirer’s fraud engine tightens unexpectedly, merchants can adjust their routing strategy, shift affected traffic or introduce additional risk metadata to satisfy automated checks. Instead of losing approvals to unseen acquirer filters, merchants gain the ability to respond with precision.

Regional Acceptance Patterns and Corridor Asymmetry

Acquirer performance varies significantly by region. One acquirer may excel in Western Europe but underperform in Southeast Asia; another may have strong relationships with LATAM issuers but struggle with North American BINs. Before real-time diagnostics, merchants would discover these patterns only after weeks of underperformance.

In 2026, PSPs surface regional acceptance data in real time. Merchants can immediately see which acquirer is performing better for a specific geography, issuer cluster or card range. This data empowers merchants to make informed routing decisions, shifting traffic toward the healthiest acquirer in each corridor and unlocking acceptance uplift that would otherwise be impossible.

Risk Engine Signals: The New Behavioural Layer in Diagnostics

Modern payment flows are no longer shaped only by issuers and acquirers. Risk engines both merchant-side and PSP-side now control a significant portion of transaction outcomes. In 2026, these engines generate behavioural insights that become part of the real-time diagnostics layer, allowing merchants to understand how risk scoring influences acceptance at the very moment a transaction is processed.

Risk scoring was once a static exercise, producing broad classifications such as “high,” “medium” or “low risk.” Today, models operate continuously, recalibrating after every interaction. They evaluate device fingerprints, traffic patterns, behavioural anomalies and cross-session activity, all within milliseconds. For merchants trying to optimise acceptance, these insights are invaluable. They reveal whether a transaction failed because of genuine issuer suspicion or because the merchant’s own risk engine introduced friction.

The diagnostic layer helps merchants fine-tune authentication strategies, adjust fraud thresholds in real time and segment traffic more intelligently. In high-risk verticals, where the margin between approval and decline is razor thin, this visibility becomes an operational advantage with direct revenue impact.

ML Score Bands and Dynamic Thresholds

Machine-learning models now drive risk scoring for most PSPs and large merchants. These models group transactions into score bands that update in real time based on consumer behaviour, historical fraud patterns and corridor risk. When diagnostics reveal that an unusually high percentage of transactions are falling into elevated risk bands, merchants can respond instantly by modifying authentication flows, applying 3DS selectively, or relaxing certain internal checks to prevent unnecessary friction.

Instead of waiting for fraud or approval reports at the end of the day, merchants now see risk model behaviour the moment it shifts.

Device Anomalies, Behavioural Fingerprints and Bot Spikes

Device intelligence is one of the most powerful indicators in the modern diagnostics stack. Risk engines monitor how users navigate, the speed of their interactions, device configurations and subtle behavioural patterns that distinguish genuine customers from automated or compromised actors. When anomalies appear such as unusually uniform device fingerprints or sudden bot-like behaviour risk engines raise signals that merchants can act on immediately.

These real-time insights help merchants calibrate their defences without blocking legitimate customers. They can strengthen risk checks when bot activity surges, and relax them when the environment stabilises.

Velocity Indicators and Synthetic Spike Detection

Velocity-based flags remain essential in underwriting and fraud detection, but in 2026 they are more sophisticated and dynamic. Rather than rigid limits, modern systems use contextual velocity: how quickly a specific user, device or IP changes behaviour relative to normal patterns. Real-time diagnostics expose these shifts, helping merchants decide when to throttle traffic, adjust fraud scoring or verify sudden volume surges.

These signals are especially valuable for businesses affected by seasonal peaks, influencer-driven traffic spikes or corridor-based fluctuations. Instead of treating all volume spikes as suspicious, merchants interpret them through real-time behavioural context.

How Real-Time Diagnostics Feed Smart Routing in 2026

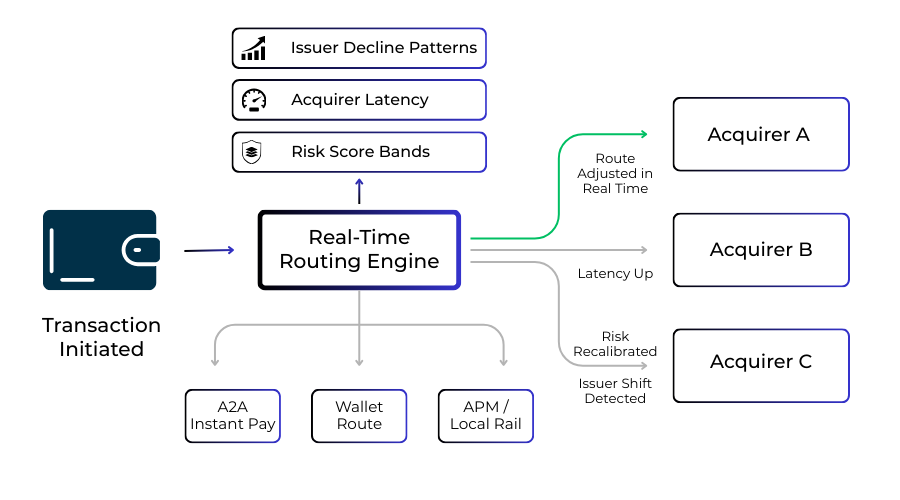

Smart routing has evolved dramatically. What was once a rules-based system “send Region A to Acquirer X” or “retry once after a soft decline” has transformed into a dynamic intelligence layer powered entirely by real-time diagnostics. In 2026, routing engines no longer wait for aggregated data or monthly performance reviews. They respond instantly to issuer feedback, acquirer degradation, latency patterns, corridor-specific shifts, and risk engine behaviour.

This means payments are optimised not in hindsight, but in the moment. When diagnostics reveal a sudden drop in issuer approvals for a specific BIN range, the routing layer can pivot traffic to an acquirer with stronger issuer connectivity. When acquirer latency spikes, transactions can be rerouted before timeouts accumulate. When risk engines detect elevated risk for a subset of users, merchants can automatically adjust authentication flows to preserve approvals.

The result is an orchestration environment where routing decisions reflect real-time ecosystem conditions, not static assumptions. For high-risk sectors, subscription models, and cross-border merchants operating across volatile corridors, this shift produces meaningful gains in approval rate, stability and predictable revenue.

Switching Routes Based on Issuer Decline Patterns

Issuer decline behaviour fluctuates constantly, often without warning. In the past, merchants had no way to detect these patterns in real time; they only recognised problems after hours of failed transactions. Diagnostics now reveal when issuers tighten fraud rules, adjust SCA requirements, or introduce regional throttles.

Routing engines respond instantly. If an issuer begins soft-declining through one acquirer but maintains strong performance through another, routing can shift traffic automatically, preserving conversions during sensitive periods. This is particularly valuable in corridors where issuer trust varies greatly across acquirers.

Retry Logic Powered by Real-Time Risk Recalibration

The retry logic of 2026 is far smarter than the “retry after decline” rules of previous years. Today’s systems incorporate real-time risk scoring, issuer feedback and device-level insights to tailor retries for each transaction.

If diagnostics indicate a temporary issuer outage, a retry may be delayed by a few seconds rather than attempted immediately. If the issue is a token mismatch, the retry may be reformatted or token-regenerated. If the risk engine identifies behavioural friction, the retry may bypass certain internal checks to create a smoother path for the issuer.

Instead of retrying blindly, merchants retry strategically informed by real-time data.

Multi-Rail Optimisation Across Cards, A2A and Wallets

Routing is no longer limited to acquirer switching. In 2026, merchants increasingly operate across multiple rails: card networks, instant payment systems, open banking rails, regional APMs and mobile wallets. Real-time diagnostics make it possible to move transactions across these rails based on moment-to-moment performance.

If card approvals drop due to issuer tightening, the routing engine may promote A2A or wallet options. If instant payment rails slow down or experience downtime, the system can push traffic back to card schemes. The ability to optimise rail selection, not just acquirer selection, gives merchants a multidimensional strategy for protecting conversions.

This rail-level flexibility is especially powerful in regions like LATAM, India, Southeast Asia and the Middle East, where payment ecosystems evolve rapidly and issuer preferences shift frequently.

Why High-Risk Verticals Benefit the Most

High-risk merchants operate in environments where approval rates can shift dramatically in minutes. Unlike low-risk ecommerce merchants with stable domestic traffic and predictable customer behaviour, high-risk sectors experience rapid swings in issuer trust, acquirer interpretation and fraud-model sensitivity. This is exactly why real-time diagnostics have become transformative for these industries in 2026. They provide the visibility needed to stabilise revenue streams that have historically been volatile and difficult to control.

For these merchants, even a small decline in acceptance of 5% or 10% can translate into substantial revenue loss. Real-time diagnostics give them the ability to identify sudden shifts, understand the root cause and make immediate routing or authentication changes that preserve conversions. Instead of waiting to discover problems after the fact, they operate with the same live intelligence that issuers, acquirers and networks are using internally.

Travel, Gaming, Adult and Subscription-Intensive Models

These sectors experience some of the most unpredictable payment patterns. Travel merchants often deal with fluctuating cross-border demand and high average transaction values, both of which increase issuer scrutiny. Gaming and adult merchants face aggressive risk controls and corridor-specific restrictions that can tighten without warning. Subscription models are particularly sensitive to SCA friction and token lifecycle issues, which can trigger recurring payment failures unexpectedly.

Real-time diagnostics allow these merchants to monitor approval patterns as they shift, identify when specific issuers tighten authentication or fraud thresholds, and reroute traffic accordingly. In industries where customer intent is strong but issuer trust can be fragile, immediate visibility into decisioning behaviour becomes essential for revenue stability.

Cross-Border Corridors with Volatile Issuer Trust

Trust is not uniform across borders. Issuers in emerging markets may treat foreign merchants more cautiously, especially in high-risk MCCs. A route performing well in the morning may deteriorate by the afternoon due to fraud alerts, local regulatory actions or issuer-specific tightening. Without real-time signals, merchants cannot detect or respond to these shifts quickly enough to maintain strong approval rates.

Diagnostics expose corridor-level performance minute by minute. Merchants can see when a specific region begins to underperform, understand which issuer clusters are affected and determine whether the issue lies with authentication, routing or risk scoring. This allows them to adjust their strategy immediately and preserve approval performance across diverse geographies.

Operational Setup: How Merchants Implement Real-Time Diagnostics

Gaining access to real-time diagnostics is only the first step; merchants must also build an operational environment capable of acting on these signals instantly. In 2026, the merchants who outperform their peers are not simply those who collect more data, they are the ones who integrate diagnostics into their decision-making infrastructure. This shift requires a combination of technical readiness, organisational alignment and disciplined data governance.

Real-time optimization depends on systems that can consume signals as they happen, routing engines that can adapt dynamically, and internal teams that understand how to interpret ongoing fluctuations in issuer, acquirer and risk behaviour. When implemented properly, diagnostics evolve from passive monitoring tools into active levers for acceptance improvement, transforming payment operations from reactive to predictive.

Webhooks and Event-Streaming for Instant Signal Delivery

Webhooks and streaming architectures such as Kafka or Pub/Sub now form the backbone of real-time payment intelligence. Instead of polling dashboards or querying APIs, merchants receive continuous updates the moment an issuer tightens controls, an acquirer slows down or a risk engine shifts a score band.

This immediacy allows routing, authentication and retry strategies to adapt with almost no latency. Merchants that rely on batch reporting or periodic API queries can miss the narrow windows where rapid adjustments would have produced meaningful approval gains. Event-streaming ensures that diagnostics become operational signals, not background noise.

Data Governance, Observability and Alerting

Real-time diagnostics only create value when the data is accurate, structured and governed properly. Merchants must implement observability frameworks that validate incoming signals, track anomalies and avoid false positives. This includes monitoring latency across their own systems, ensuring correct mapping of issuer reason codes, and establishing thresholds that trigger alerts when performance shifts.

Effective governance prevents misinterpretation. For example, an isolated decline spike may not warrant routing changes, but sustained patterns across multiple issuers or regions do. Clear data stewardship avoids reactionary decisions and ensures that optimisation remains grounded in reliable insights.

Cross-Functional Integration Between Payments, Risk and Product Teams

Real-time diagnostics reshape internal collaboration. Payments teams must work closely with risk, product and engineering teams to interpret signals and implement changes quickly. Risk teams use diagnostics to tune fraud models and authentication logic; product teams adjust user experience flows when specific issuers exhibit sensitivity; engineering teams support orchestration changes at scale.

This multidisciplinary approach ensures that real-time optimisation becomes a shared responsibility rather than a siloed operational function. Merchants that adopt this model achieve faster response times, better acceptance performance and more resilient payment infrastructure.

Conclusion

The days when merchants could rely on static routing rules, monthly performance reports or isolated decline analysis are long gone. Payments in 2026 are shaped by constantly shifting issuer rules, acquirer stability, network health and real-time risk evaluations. Merchants who continue operating in a retrospective model will always be reacting too late discovering missed approvals only after the customer has abandoned the checkout.

Real-time diagnostics change this dynamic entirely. By exposing live issuer feedback, acquirer performance fluctuations, token lifecycle health and risk engine behaviour, merchants gain the ability to respond instantly to shifts in the payment ecosystem. This agility translates directly into higher authorisation rates, fewer false declines and more resilient payment operations across all markets.

For high-risk and cross-border merchants, the benefits are even more pronounced. These sectors depend on maintaining trust with issuers, navigating volatile corridors and adapting to rapid changes in risk thresholds. Real-time diagnostics allow them to stabilise acceptance in a previously impossible way, ensuring that sudden shifts no longer translate into sudden revenue losses.

Ultimately, real-time diagnostics are not just a technical upgrade, they are a competitive differentiator. Merchants who embrace this intelligence layer build payment systems that are responsive, predictive and optimised for a world where every transaction is shaped by live signals. Those who adopt this approach now will outperform their peers, reduce operational risk and unlock acceptance gains that would be out of reach without this level of visibility.

FAQs

1. What are real-time payment diagnostics?

They are live data signals from issuers, acquirers, networks and risk engines that show how each part of the payment chain behaves at the moment a transaction is processed.

2. Why do merchants need real-time diagnostics in 2026?

Because issuer behaviour, acquirer performance and risk thresholds now change dynamically. Without live visibility, merchants lose approvals before they know a problem exists.

3. Do real-time diagnostics replace traditional reporting?

No. They complement reporting by providing actionable insights instantly, whereas legacy reports explain trends after the damage is done.

4. Which merchants benefit the most from diagnostics?

High-risk and cross-border merchants benefit significantly because they experience the largest swings in issuer trust, corridor performance and fraud-model sensitivity.

5. Are issuers required to share clearer decline information now?

Yes. PSD3/PSR and network rule updates push issuers toward greater transparency, which enables more granular diagnostic signals.

6. Can real-time diagnostics really improve authorisation rates?

Absolutely. Merchants who act on these signals using dynamic routing, improved authentication and intelligent retries often see meaningful acceptance uplift.

7. How does real-time routing differ from traditional routing?

Traditional routing uses static rules. Real-time routing adapts instantly to issuer, acquirer or risk-engine changes to select the route with the highest approval likelihood.

8. Do merchants need specialised infrastructure to use diagnostics?

Yes. Event-streaming, webhook delivery, data validation and observability tools are required to process signals in real time.

9. Are diagnostics useful only for card payments?

No. They inform optimisation across cards, A2A payments, instant payment rails, open banking and regional wallets.

10. Is machine learning necessary for diagnostics to work?

Not required, but ML dramatically enhances predictive ability, especially for detecting behavioural anomalies and shaping smarter retry or authentication decisions.

11. Can real-time diagnostics reduce fraud?

Yes. Risk engines surface anomalies as they happen, allowing merchants to adjust controls before losses occur.

12. What happens if a merchant ignores real-time signals?

They experience avoidable declines, unstable approval rates and higher operational costs, particularly in volatile cross-border corridors.

13. Do PSPs provide diagnostics by default?

Some do, but others offer them only through premium optimisation products or specialised orchestration layers.

14. Can real-time diagnostics help with SCA compliance?

Yes. They reveal when issuers are struggling with authentication flows, allowing merchants to adjust SCA strategy to reduce friction.

15. Are diagnostics relevant for small or mid-sized merchants?

Increasingly yes, especially those with international traffic or recurring billing, where performance fluctuations directly impact revenue.