For high-risk merchants, securing the right payment service provider has never been more difficult than it will be in 2026. Regulatory pressure is rising across every major market, from the EU’s PSD3 and PSR reforms to tightening fraud obligations in the UK and real-time monitoring expectations across APAC. With jurisdictions taking different approaches to payment security, risk scoring and consumer protection, merchants who operate internationally are facing a more fragmented environment than ever before.

At the same time, PSPs are becoming more selective. Acquirers are narrowing their risk appetites, banks are applying more stringent onboarding controls, and many providers are de-risking entire sectors. For merchants in gaming, travel, digital entertainment, remittance, crypto-adjacent services or subscription billing, this can mean sudden contract changes, unexpected freezes, or the loss of banking access entirely.

Against this backdrop, staying “bankable” is no longer a passive outcome it must be an intentional strategy. Merchants now need a structured approach to choosing PSPs that can support them across multiple jurisdictions, withstand regulatory scrutiny, and continue processing reliably even as rules evolve. This 2026 framework sets out how high-risk businesses can evaluate providers, reduce exposure and build long-term payments resilience.

- Why PSP Selection Is More Complex in 2026

- What “Bankability” Means for High-Risk Merchants

- The 2026 PSP Selection Framework: Five Core Pillars

- Jurisdictional Risk Mapping for High-Risk Merchants

- Regulatory Alignment as a PSP Selection Criterion

- PSP Risk Appetite & PSP Risk Tiers

- Evaluating Multi-Rail Capability (Cards, A2A, Wallets, Instant Payments)

- Acquirer & Banking Relationship Strength

- Technical Architecture & Orchestration Readiness

- Geographic Expansion Fit

- Data Transparency, Risk Reporting & Monitoring KPIs

- PSP Due Diligence Checklist (KYC, Chargebacks, Fraud Tools)

- Fees, FX & Settlement Operations

- Contract Clauses Merchants Must Review (Reserves, T+ Cycles, Terminations)

- PSP Red Flags to Avoid

- Case Studies: How PSP Choice Shapes Merchant Outcomes

- Case Study 1: European Gaming Merchant Needing Multi-Jurisdiction Stability

- Case Study 2: Cross-Border Travel Merchant Facing Settlement Disruptions

- Case Study 3: Subscription Platform Seeking Better Dispute Handling

- Case Study 4: Digital Goods Merchant Expanding Into LATAM

- Case Study 5: Remittance and Wallet Operator with Complex Compliance Requirements

- KPI Checklist for PSP Evaluation

- Practical PSP Selection Roadmap

- Future View: AI-Driven Underwriting & Global Risk Scoring

- Conclusion

Why PSP Selection Is More Complex in 2026

Choosing a PSP has always been important, but the decision carries far more weight in 2026. The payments landscape is shifting quickly, with new regulations, fraud patterns and technology standards shaping how providers operate. For high-risk merchants, these changes translate into tighter onboarding, more selective underwriting, and providers that are increasingly cautious about who they support.

One of the biggest drivers of this complexity is regulatory divergence. The EU is preparing for PSD3 and the new Payment Services Regulation, while the UK maintains its own fraud and consumer-protection agenda through the FCA. In parallel, APAC jurisdictions have expanded real-time payment oversight, and several LATAM regulators have introduced stricter controls around high-risk activity. Merchants operating across borders must now deal with a patchwork of requirements rather than a unified global standard.

Technology expectations are also rising. Multi-rail payments, real-time fraud scoring and token-based security models are now essential capabilities, not optional value-adds. PSPs without this infrastructure often struggle to serve merchants operating in multiple regions, especially when issuers and banks expect advanced authentication and monitoring systems as part of the baseline. For merchants, the challenge is no longer simply selecting a provider that can process payments it’s choosing one with the regulatory readiness, technical resilience and global reach to keep them bankable as the environment evolves.

What “Bankability” Means for High-Risk Merchants

“Bankability” has become one of the most important words in high-risk payments. In 2026, it no longer refers simply to whether a merchant can secure an account or process payments. Instead, it reflects a deeper measure of how stable, compliant and future-proof a business appears to banks, acquirers and PSPs.

For merchants operating across borders, this determines whether they can continue selling uninterrupted or whether a provider may unexpectedly tighten terms, freeze settlements or exit the relationship entirely.

A new definition shaped by regulation and risk

Historically, bankability was about the merchant’s operational strength and financial standing. Today, it is driven by regulatory confidence. PSPs assess whether a merchant can meet evolving standards from transaction monitoring and SCA requirements to AML controls and sector-specific risk rules. They also look at corridor-level behaviour, chargeback patterns, and whether the business is exposed to emerging fraud vectors that might trigger enhanced screening.

For high-risk sectors, this means bankability is an ongoing state, not a milestone achieved at onboarding. Providers continuously re-evaluate merchants, adjusting risk levels as regulations change or as new markets open. Staying bankable in 2026 requires a combination of transparent reporting, strong data governance, robust fraud tools and PSPs that can support the merchant’s risk profile across multiple jurisdictions without sudden shifts in appetite.

The 2026 PSP Selection Framework: Five Core Pillars

PSP selection in 2026 demands more than comparing fees or approval rates. High-risk merchants must assess providers against a structured set of criteria that reflect both regulatory expectations and operational realities. These five pillars form the foundation of a bankable, multi-jurisdiction PSP strategy.

- Regulatory Fit

A PSP’s regulatory alignment determines whether it can support merchants through tightening oversight. This includes PSD3 and PSR readiness in the EU, FCA expectations in the UK, and card-scheme monitoring requirements for high-risk MCCs. Providers with stronger compliance frameworks are better positioned to maintain long-term relationships without sudden derisking or restrictive contract changes.

- Risk Appetite Alignment

Every PSP has a defined risk threshold. High-risk merchants must choose providers whose appetite matches their activity, geography and transaction profiles. This affects onboarding difficulty, monitoring strictness, and the likelihood of corridor-level restrictions. Selecting a PSP that overestimates a merchant’s risk often leads to future instability.

- Multi-Rail Capability

In 2026, merchants operating across borders require support for cards, A2A payments, instant payments and wallets. A PSP with multi-rail capability can route transactions more efficiently, reduce reliance on single-rail networks, and adapt quickly when a region favours a new rail.

- Cross-Border Stability

Merchants expanding across Europe, LATAM, APAC or MENA need PSPs that offer consistent approval behaviour and reliable settlement windows in multiple corridors. Providers with diverse acquiring relationships and local presence tend to offer better stability in markets with strict regulations or higher fraud rates.

- Data Transparency and Reporting

PSPs must provide merchants with access to key performance data, dispute trends and risk signals. Transparent reporting allows businesses to understand corridor volatility, track approval performance and identify areas needing intervention. Providers that hide or limit data often create blind spots that impact merchant bankability.

Jurisdictional Risk Mapping for High-Risk Merchants

Operating across multiple jurisdictions introduces a level of complexity that goes far beyond simple licensing or payment acceptance. In 2026, regulators across Europe, the UK, LATAM, MENA and APAC are tightening expectations around fraud controls, settlement transparency, AML procedures and merchant due diligence. For high-risk merchants, understanding this regulatory patchwork is essential when choosing PSPs that can support consistent, uninterrupted processing.

Different regions apply pressure in different ways. Some markets prioritise consumer protection and authentication, while others focus on AML strength or real-time monitoring. A PSP that performs well in one region may struggle in another, especially when risk scoring, dispute handling or local payment rails differ substantially. Mapping these regional dynamics is now a critical step in assessing PSP suitability.

- EU: PSD3, PSR and high-risk oversight

The European Union is preparing its next wave of payments reform under PSD3 and the Payment Services Regulation, which emphasise stricter fraud monitoring, risk-based SCA and greater transparency in dispute reporting. PSPs serving high-risk sectors must be prepared for deeper supervisory expectations and more rigorous cross-border scrutiny.

- UK: FCA standards and APP scam obligations

The UK continues to diverge from EU rules, with the FCA expecting stronger real-time fraud controls, clearer data reporting and better authentication flows for high-risk merchants. APP scam liability frameworks and SCA expectations place additional pressure on PSPs to monitor risk continuously, not only at onboarding.

- MGA Malta, CBUAE and other licensing-heavy regions

Certain sectors especially iGaming, digital entertainment and forex often operate from regulatory hubs such as Malta. Here, providers must meet Malta Gaming Authority (MGA) requirements for risk, AML and customer due diligence. In the Middle East, the CBUAE mandates rigorous transaction monitoring and settlement controls for PSPs serving cross-border merchants, requiring strong fraud frameworks and predictable operating models.

- LATAM: PIX, instant payments and evolving oversight

Countries like Brazil and Mexico rely heavily on instant-payment rails such as PIX. These systems require PSPs to monitor alias-based fraud behaviour and velocity abnormalities minute by minute. Local regulators have also strengthened rules around onboarding and AML for high-risk merchants, making local PSP expertise essential for stable processing.

- APAC: UPI, PayNow and strict central-bank supervision

Markets like India and Singapore apply stringent oversight on real-time payments, data flows and authentication. India’s RBI mandates strong security for UPI transactions, including device integrity checks, tokenisation requirements and fraud-monitoring systems. Singapore’s MAS maintains similar expectations, requiring PSPs to implement behavioural monitoring and structured reporting for scam-prevention efforts.

Across all these regions, the commonality is clear: regulators now expect PSPs to demonstrate proactive, data-driven risk management and transparent reporting. Merchants who understand these jurisdictional pressures can select providers that are genuinely capable of supporting their risk profile across borders not just offering surface-level coverage.

Regulatory Alignment as a PSP Selection Criterion

One of the strongest predictors of long-term PSP stability is how well a provider aligns with current and upcoming regulatory frameworks. In 2026, high-risk merchants cannot afford to work with PSPs that are slow to adopt compliance updates or rely on outdated risk controls. Regulatory alignment now influences everything from onboarding difficulty to dispute handling, data transparency and whether a provider may unexpectedly restrict or terminate services.

Key regulatory checkpoints merchants should evaluate in a PSP:

- EU PSD3/PSR readiness: Including enhanced monitoring, structured fraud reporting, and updated SCA requirements.

- UK FCA compliance expectations: Particularly around APP scam liability, high-risk monitoring and authentication standards.

- AML and licensing depth: Especially for sectors regulated by bodies such as the MGA (Malta) or central banks in MENA and APAC.

- Ongoing audit responsiveness: Which indicates whether a PSP can adapt to evolving rules without operational friction.

- Local expertise: Especially in regions like Brazil, India or Singapore, where real-time payment systems impose strict and unique fraud controls.

A PSP that consistently tracks and responds to regulatory change demonstrates the operational maturity required to support high-risk merchants. Providers that lag or take a narrow interpretation of compliance obligations introduce a far greater risk of disruptions, penalties, or sudden derisking. Selecting the right PSP means choosing one that treats regulatory readiness as a core capability, not an afterthought.

PSP Risk Appetite & PSP Risk Tiers

Every PSP operates with its own interpretation of what “high-risk” means. In 2026, this interpretation becomes even more important because acquirers and payment institutions are tightening their underwriting criteria in response to regulatory changes. Understanding a PSP’s appetite is not simply about knowing whether they accept your sector it’s about evaluating how they assess ongoing exposure, how they respond to corridor-level risk, and how stable their appetite is likely to be over time. A mismatch here is one of the most common reasons merchants face unexpected freezes, sudden termination notices, or requests for additional documentation months after onboarding.

Understanding PSP Risk Tiers

PSPs generally fall into recognisable tiers: regulated providers, global acquirers, aggregators, and offshore processors. Regulated PSPs and direct acquirers tend to apply the strictest onboarding standards but offer the most stable long-term relationships. Aggregators can onboard faster but often rely on upstream partners, meaning their risk appetite is partially determined by another institution. Offshore processors may support sectors and markets others avoid, but their contracts often come with higher scrutiny, less predictable settlement cycles, and a greater risk of banking changes.

For high-risk merchants, the objective is not to choose the least restrictive tier it is to select the tier that aligns with their long-term risk profile and regional footprint. A merchant expanding across Europe, APAC and LATAM may need a combination of regulated PSPs for core markets and specialised providers for challenging corridors. By understanding where each PSP sits in the risk landscape, merchants can build a payments stack that supports growth without creating future instability.

Evaluating Multi-Rail Capability (Cards, A2A, Wallets, Instant Payments)

In 2026, merchants can no longer rely on a single payment rail to serve all markets. Consumers now expect to move fluidly between cards, bank transfers, digital wallets and instant-payment systems and regulators increasingly promote alternatives to traditional card rails. For high-risk merchants expanding across multiple jurisdictions, choosing a PSP with limited rail coverage creates bottlenecks, exposes them to higher decline risks and reduces their ability to adapt when a particular market shifts its preferred payment method.

The most resilient PSPs are those that approach payments as an orchestrated ecosystem rather than a fixed card-only pipeline. They combine acquiring, open banking, real-time rails and tokenised wallet payments into one consistent processing layer. This matters because issuer behaviour, fraud patterns and regulatory requirements differ drastically between rails. A PSP that cannot support these differences will inevitably limit a merchant’s approval potential in certain corridors.

How multi-rail support shapes merchant performance

Multi-rail capability offers more than convenience it directly influences performance. In markets like Brazil, India and Singapore, high adoption of instant-payment systems means card-only PSPs cannot deliver competitive approval rates. In Europe, open banking continues to expand through regulated A2A flows, while digital wallets maintain strong customer loyalty in sectors like gaming, travel and online entertainment.

A PSP capable of intelligently routing between rail types gives merchants access to wider audiences and reduces dependency on any single network’s risk appetite.

For high-risk merchants, this flexibility is especially valuable. It allows them to diversify exposure, maintain continuity when issuers tighten card-based controls, and adopt rails that inherently reduce disputes or authentication friction. Multi-rail readiness is now a defining trait of PSPs able to support cross-border, high-growth business models in 2026 and beyond.

Acquirer & Banking Relationship Strength

A PSP’s ability to support high-risk merchants across multiple jurisdictions depends heavily on the strength of its acquiring and banking relationships. In 2026, acquirers are applying closer scrutiny to sectors such as gaming, travel, subscription billing, remittance and digital goods. This means PSPs with shallow or unstable banking connections often struggle to maintain consistent approval rates, predictable settlements or uninterrupted corridor access. For merchants operating internationally, the depth of these relationships has become a core selection criterion.

What defines strong acquiring and banking relationships?

- Diverse acquiring partners: Including Tier-1 banks capable of underwriting cross-border traffic.

- Local acquiring coverage: Particularly in Europe, LATAM and APAC, where regional issuers favour domestic routing.

- Stable settlement arrangements: With predictable payout timelines and minimal reliance on upstream aggregators.

- Direct scheme connectivity: Giving PSPs more control over authentication, risk and decline recovery.

- Consistent risk governance: Ensuring acquirer changes do not immediately lead to account freezes or contract revisions.

When a PSP relies on a single acquirer or an offshore banking partner with limited tolerance for high-risk sectors, merchants inherit that instability. Conversely, PSPs with strong, multi-jurisdiction banking networks can shield merchants from regulatory volatility and scheme-driven adjustments. For businesses operating across borders, these relationships often make the difference between seamless international expansion and recurring processing interruptions.

Technical Architecture & Orchestration Readiness

A PSP’s technical design has become one of the strongest indicators of whether it can support high-risk merchants at scale. As payments move toward multi-rail environments and regulators demand more structured data reporting, merchants now depend on providers capable of routing intelligently, enriching transaction metadata and responding to issuer behaviour dynamically. A PSP without orchestration depth may appear functional during onboarding, but its limitations surface quickly when traffic diversifies across corridors or regulatory requirements tighten.

Core infrastructure requirements

At the heart of orchestration readiness is the PSP’s ability to manage different payment rails, authentication flows and issuer responses through a unified system. This includes dynamic routing across multiple acquirers, automated failover mechanisms and real-time analysis of transaction-level signals. Merchants relying on PSPs without this capability often experience unexplained declines, inconsistent SCA flows or delays in dispute reporting because the provider lacks the infrastructure to manage payments holistically.

Scalability across jurisdictions

Equally important is how well the PSP’s architecture scales across regions. High-risk merchants frequently expand into markets with vastly different authentication protocols, risk controls and consumer payment preferences. A PSP built on fragmented or legacy systems will struggle to adapt, particularly when required to support card tokenisation, A2A flows or local payment methods. By contrast, providers with modular, API-driven platforms can incorporate new acquirers or rails quickly, maintaining stability as merchants enter new geographies.

Geographic Expansion Fit

For high-risk merchants operating across borders, a PSP’s geographic fit is just as important as its technical and regulatory capabilities. Each region presents its own combination of fraud patterns, authentication expectations and preferred payment methods. A PSP that performs strongly in one corridor may prove ineffective in another, especially when issuer behaviour, local risk scoring or card-acceptance maturity varies.

In Europe, merchants face increasingly rigorous authentication requirements under PSD2 and the upcoming PSD3 transition, making SCA performance a core differentiator. In LATAM, domestic schemes and instant-payment systems dominate, with issuers often favouring local acquirers over international routes. APAC markets, meanwhile, rely heavily on domestic real-time rails and wallet ecosystems, requiring PSPs to support a broader set of payment options and more detailed monitoring signals.

A good PSP for global expansion understands these regional nuances and can adapt transaction flows accordingly. Merchants benefit from providers that combine local acquiring in key markets with strong card-network connectivity, reliable routing logic and support for domestic payment rails. Without this regional adaptability, high-risk businesses may experience inconsistent approval rates, settlement delays or sudden shifts in acquirer policy that interrupt growth. The right PSP brings regional fluency, enabling expansion without operational friction.

Data Transparency, Risk Reporting & Monitoring KPIs

Visibility is one of the most important and most overlooked elements of PSP selection in 2026. High-risk merchants rely on timely, transparent data to understand approval behaviour, fraud patterns, chargeback trends and corridor performance. Without access to granular insights, merchants operate blind, making it difficult to manage risk or identify early warning signs that a PSP may be tightening its appetite.

Data points that should be accessible from any PSP

- SCA challenge rates, exemptions applied and authentication outcomes.

- Chargeback ratios broken down by corridor, BIN and payment method.

- Fraud alerts and monitoring signals based on real-time behaviour.

- Settlement reports that align with corridor-level payout cycles.

- Transparent dispute timelines and case ageing data.

When a PSP limits access to these metrics, merchants are left dependent on the provider’s interpretation of performance. Conversely, PSPs that supply structured reporting give merchants the tools to anticipate risk shifts, manage disputes proactively and maintain compliance across jurisdictions. In 2026’s more heavily supervised environment, this level of transparency is no longer optional; it is a critical part of staying bankable.

PSP Due Diligence Checklist (KYC, Chargebacks, Fraud Tools)

Selecting a PSP in 2026 requires a far deeper level of due diligence than in previous years. High-risk merchants must validate not only whether a provider can support their sector but also whether the PSP’s internal controls, onboarding processes and fraud stack are strong enough to maintain long-term stability. Weak due diligence creates blind spots that often lead to sudden freezes, extended reserves or account termination. This section outlines the essential checks merchants should apply before signing with any provider.

KYC and onboarding robustness

A PSP’s onboarding standards are one of the clearest indicators of its operational quality. Merchants should expect thorough KYC reviews, documentation requests and business-model verification. Providers that onboard too quickly or ask for minimal detail often rely on upstream aggregators, meaning their risk tolerance is unstable. Strong PSPs perform structured KYC checks, corridor-specific assessments and ongoing monitoring all of which support a more predictable payments relationship.

Chargeback thresholds and fraud stack evaluation

Understanding how a PSP manages disputes and fraud is equally important. Chargeback thresholds vary widely by provider and may be stricter for high-risk sectors. Merchants need clarity on how these thresholds are calculated, how warning levels are communicated and how disputes are escalated. The PSP’s fraud tools whether rules-based, behavioural, machine-learning driven or integrated with orchestration platforms should also be evaluated carefully. A limited or outdated fraud stack can quickly lead to elevated dispute levels, which then trigger additional scrutiny from acquirers.

By assessing these areas before onboarding, merchants reduce the likelihood of entering agreements with providers that cannot support their long-term risk profile. Strong due diligence ensures that both the PSP and the merchant are aligned from the outset, establishing a more resilient partnership as the regulatory environment evolves.

Fees, FX & Settlement Operations

Understanding how a PSP manages fees, FX conversion and settlement cycles is essential for any high-risk merchant evaluating long-term bankability. These operational components have a direct impact on cash flow, profitability and the predictability of international expansion. In 2026, fee structures have become more complex, often influenced by corridor-level risk, issuer behaviour and the PSP’s own banking relationships. Merchants must now assess not only the headline rates but the underlying commercial mechanics that drive those costs.

FX handling is another area where PSPs differ significantly. Providers with local acquiring in key regions can often offer more favourable FX spreads and reduced cross-border charges, while those relying on offshore or single-rail processing may pass on higher costs. The method of conversion whether dynamic, pre-funded or settlement-based also affects net revenue. High-risk merchants processing across LATAM, APAC and the Middle East feel these differences most sharply, particularly when large portions of volume settle in non-deliverable or volatile currencies.

Settlement operations are equally important. Predictable payout cycles, clear reconciliation files and stable reserve requirements determine whether a merchant can maintain operational continuity. Inconsistent settlement timing or rolling reserves imposed without clear justification are common issues when working with PSPs that lack strong acquiring relationships. Providers with well-structured settlement operations give merchants visibility and confidence, ensuring that growth in new corridors does not introduce unnecessary cash-flow risk.

In 2026’s more regulated environment, fees, FX and settlements are no longer administrative details; they are strategic factors that determine whether a PSP can support a high-risk merchant reliably across jurisdictions.

Contract Clauses Merchants Must Review (Reserves, T+ Cycles, Terminations)

Even the strongest PSP relationship can become unstable if the commercial terms are misaligned with the merchant’s risk profile. In 2026, contracts in high-risk sectors are far more detailed, often shaped by acquirer expectations, regulatory obligations and real-time monitoring requirements. Merchants who overlook key clauses may find themselves dealing with sudden reserve increases, extended settlement delays or termination events that were embedded in the agreement from the outset. Understanding these terms is now essential for long-term stability.

Key contract elements every high-risk merchant must examine

- Rolling reserves: How they are calculated, when they can be increased and what conditions trigger early release or extension.

- T+ settlement cycles: Corridor-specific payout timelines, cut-off windows and whether delays may occur due to upstream acquirer rules.

- Termination rights: Conditions under which the PSP can exit the relationship, including risk reclassification, excessive disputes or regulatory pressure.

- Early termination fees: Whether the merchant is liable and under what circumstances fees apply.

- Risk reviews & audits: PSP rights to request additional KYC, data or business-model updates at any point.

- Suspension clauses: What triggers temporary freezes, how long suspensions last and how funds are handled during interruption.

These clauses shape the operational relationship far more than pricing alone. A PSP with strong risk governance and transparent policies will clearly define when actions may be taken and how merchants will be notified. Providers with vague or overly broad clauses often create uncertainty, leaving merchants exposed to unexpected interruptions. Clear commercial terms provide the foundation for a stable, multi-jurisdictional payments strategy.

PSP Red Flags to Avoid

Selecting the wrong PSP can introduce risks that only become visible once processing begins. For high-risk merchants, these risks often appear as sudden settlement holds, unexplained approval drops, or unexpected changes in fee structures. Many of these issues can be avoided by recognising warning signs early in the evaluation process. PSPs that lack transparency, stability or clear operational controls may not be able to support a global, multi-jurisdiction merchant in 2026’s evolving regulatory environment.

Warning signs during evaluation

One of the biggest red flags is inconsistent information during onboarding whether in documentation requests, product explanations or projected approval rates. PSPs that promise unusually high acceptance without performing detailed due diligence often rely on unstable acquiring pathways. Another warning sign is limited access to performance data. Providers who cannot offer granular reporting on declines, disputes or corridor-level risk create blind spots that leave merchants unable to manage compliance obligations effectively.

Finally, merchants should be cautious of PSPs with narrow acquiring relationships or those that outsource most of their risk controls to upstream partners. These dependencies can lead to abrupt contract changes, increased reserves or even full service termination when the upstream provider adjusts its appetite. A stable PSP demonstrates consistent policies, transparent communication and the technical depth to manage risk independently.

Case Studies: How PSP Choice Shapes Merchant Outcomes

Real-world examples are one of the clearest ways to illustrate how PSP selection decisions impact long-term stability. The scenarios below are drawn from common patterns seen across high-risk sectors operating internationally. Each highlights the practical challenges merchants face and how the right provider can transform payment performance, compliance resilience and customer experience.

Case Study 1: European Gaming Merchant Needing Multi-Jurisdiction Stability

A gaming operator licensed in Malta and serving players across the EU struggled with inconsistent approval rates on weekends and peak hours. Their PSP relied on a single acquiring bank, which throttled volumes in certain corridors, resulting in fluctuating authorisation levels. After migrating to a PSP with multiple EU acquiring partners and better routing intelligence, the merchant experienced smoother authorisation behaviour across Germany, France and the Nordic regions. The biggest improvement wasn’t speed it was stability. With predictable approvals, the merchant could safely scale marketing spend without fearing corridor-level interruptions.

Case Study 2: Cross-Border Travel Merchant Facing Settlement Disruptions

A mid-sized travel booking platform serving Europe, LATAM and APAC saw growing delays in settlement cycles. Their PSP’s upstream banking partner enhanced its monitoring rules, triggering repeated payout holds until manual reviews were completed. These delays caused working-capital strain during seasonal peaks. The merchant switched to a PSP with strong local acquiring in Europe and a diversified settlement framework. Settlement timing became predictable, enabling the company to rebuild stable inventory relationships with airlines and hotels and avoid unnecessary reserve escalations.

Case Study 3: Subscription Platform Seeking Better Dispute Handling

A subscription SaaS platform operating in Europe and Southeast Asia consistently struggled with chargeback recovery and unclear dispute timelines. Their PSP provided minimal dispute-level data and offered no structured reporting on ageing cases. After transitioning to a provider with more transparent dispute workflows, the merchant gained clarity into issuer-level trends, enabling them to proactively address retention issues and improve churn communication. While disputes remained a natural part of their model, the improved visibility prevented thresholds from creeping into risk review territory.

Case Study 4: Digital Goods Merchant Expanding Into LATAM

A digital content merchant entering Brazil and Mexico faced high cross-border declines due to issuer preference for domestic routing. Their PSP processed all traffic through international acquiring lanes, resulting in inconsistent authorisations despite strong customer demand. After onboarding with a PSP offering local acquiring and instant-payment support (such as PIX), the merchant saw a smoother entry into the region. Local presence rather than a different fraud strategy proved to be the decisive factor.

Case Study 5: Remittance and Wallet Operator with Complex Compliance Requirements

A cross-border wallet and remittance provider operating in the Middle East and Southeast Asia faced recurring requests for additional documentation from their previous PSP. The provider lacked the compliance infrastructure to handle cross-border flows under multiple regulators. By moving to a PSP with deeper licensing coverage and more established AML procedures, the merchant secured long-term banking stability and avoided repeated onboarding resets that previously disrupted user payouts.

These scenarios highlight a consistent theme: The right PSP is not the one offering the fastest onboarding or the lowest fees. It is the one with the regulatory depth, acquiring strength, data transparency and technical capability to keep the merchant bankable across diverse markets.

KPI Checklist for PSP Evaluation

As PSP selection becomes more complex in 2026, merchants need objective criteria to compare providers beyond pricing or onboarding speed. A strong PSP relationship is built on measurable performance, not assumptions particularly for high-risk merchants who rely on stable, predictable processing in multiple jurisdictions. The KPIs below represent the most reliable indicators of whether a provider can deliver sustained bankability, consistent approval rates and transparent risk management across different corridors.

The KPIs that matter most when evaluating a PSP

- SCA Efficiency: Challenge rates, exemption usage and authentication success across Europe and the UK.

- Chargeback Ratio Trends: Dispute rates by market and category, including how quickly ageing cases are escalated.

- Fraud Detection Signals: Accuracy of behavioural scoring, false-positive trends and real-time monitoring indicators.

- Settlement Timelines: Average T+ payout cycles and corridor-specific settlement behaviour.

- Reserve Stability: Frequency of reserve reviews, triggers for increases and transparency of release criteria.

- Acquirer Distribution: Volume balance across acquiring partners, showing reliance or diversification.

- Rail Adoption Rates: Uptake of A2A, instant payments and wallets versus cards in each geography.

- Decline Reason Quality: Clarity and granularity of issuer reason codes.

- Operational Responsiveness: Support ticket response times, compliance communication speed and dispute-handling consistency.

These indicators reveal whether a PSP can maintain performance under regulatory pressure, adapt to new markets and provide the level of transparency expected by acquirers in 2026. Merchants who monitor these KPIs regularly build a far clearer understanding of their provider’s capabilities and can make confident decisions when expanding across borders or evaluating new PSP relationships.

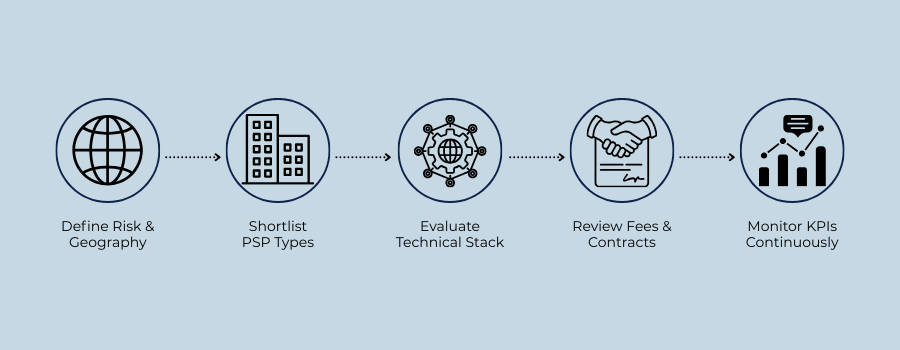

Practical PSP Selection Roadmap

Choosing a PSP in 2026 is no longer a simple procurement exercise it is a strategic decision that determines whether a merchant can expand safely, meet regulatory expectations and maintain uninterrupted processing. High-risk merchants must approach PSP selection with the same rigour they would apply to licensing, operational planning or market entry. A structured roadmap helps avoid the common pitfalls that lead to unstable partnerships or unexpected account restrictions.

Step 1: Define business model risk and geographic intent

Before approaching providers, merchants must understand how their sector, transaction patterns and future expansion plans will be perceived by PSPs. A gaming or travel merchant entering new geographies faces a different risk profile from a subscription platform or digital goods operator. Clarity on intended markets allows merchants to shortlist PSPs whose licensing coverage, risk appetite and acquiring relationships match their geographic strategy. Without this step, merchants often engage providers that cannot support all required corridors, leading to gaps and later disruptions.

Step 2: Evaluate technical readiness and long-term resilience

Once potential PSPs are shortlisted, merchants should assess whether each provider’s technology, routing intelligence and risk stack align with their needs. This includes understanding the PSP’s orchestration capability, resilience across payment rails and visibility into data and reporting. Providers with outdated systems or limited routing flexibility may perform well initially but struggle as volumes grow or authentication rules change.

High-risk merchants benefit from PSPs that demonstrate adaptability both technologically and operationally to support long-term expansion.

A well-structured roadmap ensures merchants choose PSPs capable of supporting sustainable growth, offering clarity on regulatory expectations, and providing the stability needed to operate across multiple jurisdictions. With the right process, PSP selection becomes a strategic advantage rather than a recurring operational challenge.

Future View: AI-Driven Underwriting & Global Risk Scoring

By 2026, PSP underwriting is evolving from manual assessments into continuous, AI-supported evaluation models. Instead of reviewing merchants only at onboarding or during scheduled audits, providers are increasingly adopting real-time risk scoring that monitors behaviour across all transactions, corridors and payment methods. This shift reflects a broader industry trend: regulators and acquirers expect PSPs to identify emerging risks quickly and demonstrate that their monitoring systems adjust as patterns evolve. For high-risk merchants, this means the stability of their PSP relationship will depend more on behavioural consistency than on initial documentation alone.

The next stage of this evolution is the emergence of federated risk models. Instead of relying solely on a single PSP’s dataset, these models draw insights from anonymised, multi-institution networks, enabling providers to compare merchant behaviour against broader baselines. This approach strengthens fraud detection, improves underwriting accuracy and reduces false positives particularly useful for merchants operating internationally, where corridor-specific risk patterns may vary dramatically. Such models are already influencing acquirer decision-making and are expected to play a greater role in how banks evaluate their PSP partners.

AI integration also enables PSPs to respond more quickly to regulatory expectations. As real-time payment rails expand and oversight increases across Europe, the UK, APAC and LATAM, PSPs must demonstrate that their monitoring systems can adapt without creating friction for legitimate merchants. AI-driven underwriting offers a path to maintain compliance while supporting merchant growth, reducing the likelihood of sudden freezes or unexplained contract changes. For high-risk businesses, PSPs adopting these models will provide a more stable foundation not because they are lenient, but because they understand risk more precisely and act with greater consistency.

Conclusion

The PSP landscape is undergoing one of its most significant transformations in years, driven by regulatory reform, advances in fraud technology and the growing complexity of cross-border payments. For high-risk merchants, remaining bankable in 2026 depends on choosing providers with the right blend of regulatory strength, technical capability and geographic adaptability. A PSP is no longer just a processing partner — it is a core component of a merchant’s risk posture, compliance strategy and international growth plan.

This framework highlights the factors that matter most: robust acquiring relationships, strong oversight alignment, multi-rail readiness and transparent reporting. Merchants who assess providers through these lenses can build resilient payment stacks that withstand regulatory shifts and support expansion into new markets. As PSPs continue adopting AI-enabled underwriting and real-time monitoring, the relationship between merchants and their providers will become even more data-driven. With thoughtful selection and ongoing evaluation, high-risk businesses can secure the stability they need to thrive across multiple jurisdictions in an increasingly demanding payments environment.

1. What does “bankability” mean for high-risk merchants in 2026?

Bankability refers to a merchant’s ability to maintain stable, uninterrupted payment processing across regions without facing sudden freezes, reserve changes or account termination. In 2026, it is shaped by regulatory confidence, fraud controls, data transparency and how well the business fits within a PSP’s risk appetite. High-risk merchants must demonstrate consistent behaviour, strong dispute management and clear operational controls. A bankable merchant is one that PSPs are confident supporting across borders, even as rules evolve. It is no longer a one-time assessment but an ongoing measure of regulatory and operational resilience.

2. Why is choosing the right PSP more complex for high-risk sectors?

The complexity comes from rising global regulations, deeper fraud monitoring requirements and differences in how regions classify high-risk activities. PSPs now face tougher oversight and must evaluate merchants more closely, especially in gaming, travel, remittance and digital goods. At the same time, issuers and acquirers apply stricter authentication and dispute controls. This means providers have narrower appetites and greater sensitivity to corridor-level risk. High-risk merchants must consider not just cost or onboarding speed but regulatory alignment, acquiring coverage and a provider’s ability to support long-term stability.

3. What should merchants look for when assessing PSP risk appetite?

A PSP’s risk appetite reflects how comfortable it is underwriting certain sectors, corridors and transaction patterns. Merchants should look for signs of consistency: structured onboarding, transparent reviews, clear dispute policies and stable reserve rules. If a PSP promises unusually high approval rates or performs minimal checks, it may rely heavily on unstable upstream partners. A strong PSP clearly explains its acceptable risk parameters, provides predictable monitoring and supports merchants across multiple geographies without sudden shifts in tolerance.

4. How do regional regulations affect PSP selection?

Each region now enforces its own blend of fraud, AML and authentication requirements. The EU is moving toward PSD3 and the new PSR, while the UK has separate FCA obligations and APP scam liabilities. APAC and the Middle East apply strict real-time monitoring standards, and LATAM markets prioritise domestic acquiring rules. A PSP that excels in one jurisdiction may struggle in another. High-risk merchants must choose providers whose compliance framework, licensing and risk controls match the regions where they operate or plan to expand.

5. What role does multi-rail capability play in improving approval rates?

Multi-rail capability enables a PSP to process payments across cards, A2A, instant payments and digital wallets depending on the region and customer preference. This flexibility can significantly improve approval rates, particularly in markets where domestic rails outperform card networks, such as Brazil (PIX) or India (UPI). Merchants benefit from routing options that reduce friction, bypass issuer restrictions and adapt to evolving customer behaviour. In 2026, a PSP without multi-rail support can limit growth simply because it cannot respond to rail-level differences.

6. Why do PSP banking relationships matter so much for high-risk merchants?

A PSP is only as stable as the banks and acquirers behind it. Strong banking relationships mean predictable settlements, consistent approval behaviour and more flexible handling of disputes or reserves. PSPs with limited or unstable partners may face upstream pressure that results in delayed settlements, sudden freezes or changes to contract terms. For high-risk merchants, providers with broad acquiring networks and region-specific banking strength offer a far more reliable foundation for cross-border operations.

7. How can merchants evaluate a PSP’s technical architecture?

Merchants should focus on whether the PSP supports modern routing, orchestration and real-time data visibility. A strong technical architecture includes modular APIs, dynamic routing between acquirers, transparent authentication flows and rich decline data. PSPs built on fragmented or legacy systems often struggle with SCA changes, issuer preference shifts or region-specific authentication differences. Evaluating technical depth is not about complexity it’s about confirming that the PSP can adapt to regulatory, rail and behavioural changes without disruption.

8. What due diligence should merchants perform before onboarding with a PSP?

Due diligence should include reviewing KYC expectations, understanding how the PSP handles chargebacks, verifying the fraud stack and checking whether the provider uses stable acquiring partners. Merchants should also assess reporting quality, dispute timelines and authentication behaviour. A PSP that cannot explain its risk processes, contract terms or review triggers tends to create operational uncertainty. High-risk merchants benefit significantly from providers that demonstrate clarity, structure and consistent communication during onboarding.

9. How important are contract clauses like rolling reserves and T+ cycles?

Extremely important. Contract clauses determine how your funds are handled, when settlements occur and under what conditions reserves can be increased. Rolling reserves, termination rights, audit triggers and suspension rules all shape the merchant–PSP relationship. In 2026, high-risk sectors frequently see reserve or settlement changes tied to acquirer monitoring. Merchants should not sign contracts without understanding the triggers for these clauses. A PSP with transparent, well-defined terms offers far greater long-term stability.

10. How do KPIs help merchants compare PSPs?

KPIs provide objective, measurable indicators of performance something critical in an environment where PSP behaviour varies by corridor, issuer and rail. Metrics such as authorisation rates, SCA success, chargeback ratios, reserve reviews, settlement timing and acquirer distribution reveal how a PSP behaves in practice, not just what it promises. Monitoring these KPIs helps merchants avoid underperforming providers and ensures that PSPs remain accountable across different jurisdictions.

11. What is the biggest mistake merchants make when selecting a PSP?

The most common mistake is choosing a PSP based on price or onboarding speed alone. High-risk merchants need providers with strong compliance depth, multi-region acquiring, consistent fraud controls and transparent data reporting. PSPs that appear “easy” during onboarding often rely on unstable or restrictive upstream partners, which later leads to payout disruptions or termination. A balanced evaluation that considers risk appetite, routing capability and regulatory strength is far more effective.

12. How will AI-driven underwriting change PSP selection in the future?

AI-driven underwriting will make PSP decisions more behaviour-based and less reliant on manual assessments. This means PSPs will evaluate live transaction patterns, corridor-level risk and authentication outcomes continuously. Merchants with predictable, compliant behaviour will benefit from fewer checks and more stable relationships. Those with inconsistent patterns may face earlier interventions. For high-risk sectors, this shift rewards transparency, clear data flows and strong internal controls. PSPs adopting AI-driven underwriting will increasingly become the most reliable partners for global merchants.