Chargeback management has traditionally been reactive. A dispute is raised, evidence is gathered, representation is submitted, and the outcome is accepted. For years, this model was considered unavoidable disputes were simply part of doing business online. In 2026, that assumption no longer holds.

Pre-dispute alerts have changed where chargeback prevention actually happens. Instead of reacting after a cardholder files a dispute, early-warning workflows allow merchants to intervene during the narrow window before a dispute formally enters the scheme process. This shift is subtle but powerful: once a dispute is filed, ratios are already affected, operational cost is locked in, and recovery becomes uncertain. Preventing the filing entirely delivers far greater value than winning after the fact.

This matters more than ever as monitoring improves and scheme pressure increases. Card networks and issuers are now far better at detecting dispute-prone behaviour, and merchants operating in high-risk or high-volume environments face tighter thresholds and faster consequences when ratios drift. In this context, optimising representation alone is no longer enough. Prevention must move upstream.

Ethoca- and Verifi-style alerting frameworks illustrate how this upstream shift works. When a potential dispute is detected early, merchants are given a limited opportunity to act typically by refunding, resolving a service issue, or supplying information that prevents escalation. The goal is not to “win” a case, but to ensure it never exists.

Importantly, these workflows are not informal or ad-hoc. They sit squarely within scheme-defined processes, with clear expectations around response timing, evidence handling, and customer treatment. Visa’s own dispute management guidance frames early resolution as a core mechanism for controlling dispute volumes, not a secondary optimisation tactic.

- Why Pre-Dispute Matters More in 2026 (Monitoring and Ratio Pressure)

- Alert Workflow Design: Triage, Refund Thresholds, Evidence Capture, and SLA Clocks

- When to Refund vs Fight: Decision Rules by Reason Code Family

- Automation Opportunities: CRM Integration, Order Lookups, Instant Refunds, Customer Messaging

- High-Risk Vertical Adaptations: Gaming, Adult, Subscriptions, Travel

- Operational KPIs: Measuring Whether Pre-Dispute Workflows Actually Work

- Governance: Preventing Refund Abuse While Lowering Disputes

- Conclusion

- FAQs

Why Pre-Dispute Matters More in 2026 (Monitoring and Ratio Pressure)

In 2026, chargebacks are no longer viewed solely as a post-transaction failure. They are increasingly treated as a leading indicator of merchant risk. Monitoring systems, scheme programmes, and issuer behaviour now converge much earlier in the lifecycle, which is why pre-dispute resolution has become strategically important rather than operationally optional.

One driver is the sophistication of transaction monitoring. Issuers are better at identifying transactions that are likely to turn into disputes, often before cardholders formally raise a complaint. When those early signals appear, alerts are generated upstream and merchants are judged not just on how they respond to filed disputes, but on whether they act early enough to prevent them.

Ratio pressure amplifies this effect. Dispute ratios are still calculated on filed chargebacks, not on alerts. This means a dispute prevented at the pre-dispute stage delivers a double benefit: it avoids scheme fees and operational cost, and it keeps ratio metrics stable. By contrast, even a successfully represented dispute still counts toward monitoring thresholds while it is open, and in some programmes, regardless of outcome.

The economics make the case clear. As volumes scale, even small improvements in prevention rates have an outsized impact on risk posture.

A merchant that resolves disputes before filing can tolerate growth without triggering remediation programmes, whereas one that relies on post-filing recovery often sees ratios drift upward despite strong representation performance.

There is also a timing dimension that did not exist a decade ago. Scheme and issuer expectations around responsiveness have tightened. Alerts come with defined SLA clocks, and delayed action often defaults into formal disputes. Pre-dispute workflows force operational discipline: either the issue is resolved quickly, or the opportunity is lost.

Visa’s public rules and dispute processes reinforce this reality. They make clear that early resolution mechanisms are part of the scheme’s intended operating model, designed to reduce downstream dispute volume and system friction rather than merely adjudicate after escalation.

Alert Workflow Design: Triage, Refund Thresholds, Evidence Capture, and SLA Clocks

Pre-dispute alerts only reduce chargebacks when they are handled through a disciplined, time-aware workflow. Unlike traditional disputes, these alerts operate under compressed timelines, limited context, and strict scheme expectations. Poorly designed workflows turn early warnings into missed opportunities.

Triage comes before decisioning

The first step is not refunding or fighting it is classification. Effective triage distinguishes alerts that require immediate action from those that can be safely deprioritised. This assessment is usually driven by a combination of reason code family, transaction value, customer history, and fulfilment status.

At this stage, the goal is speed without guesswork. The faster an alert is routed to the correct decision path, the more likely it is to prevent escalation.

Refund thresholds define when speed beats recovery

Refund thresholds are the economic backbone of pre-dispute workflows. They establish when it makes more sense to refund immediately rather than risk a formal dispute. These thresholds are rarely static; they flex by value, vertical, and dispute type.

Common considerations include:

- Transaction amount versus scheme fee exposure

- Likelihood of winning representment

- Ratio sensitivity in the current monitoring period

Clear thresholds prevent emotional or inconsistent decision-making under SLA pressure.

Evidence capture happens early or not at all

One of the biggest workflow mistakes is treating evidence capture as a post-escalation activity. In pre-dispute environments, evidence must be gathered before a decision is finalised. If a merchant chooses to fight, supporting documentation must already be available, accurate, and retrievable within minutes, not days.

This is why tight integration with order systems, delivery records, and customer communication logs is essential. Evidence that cannot be accessed quickly is effectively unusable.

SLA clocks drive operational urgency

Pre-dispute alerts operate on scheme-defined response windows. Miss the clock, and the alert converts into a formal dispute automatically. This makes SLA tracking a core workflow component, not an administrative detail.

Well-run teams design workflows around SLA visibility, ensuring that alerts are either resolved or consciously escalated before time expires.

Visa’s dispute management documentation explicitly frames early resolution as a time-bound process, with expectations around responsiveness and documentation quality. These guidelines make clear that pre-dispute handling is intended to reduce downstream disputes, not delay them.

When to Refund vs Fight: Decision Rules by Reason Code Family

Pre-dispute alerts force merchants to confront a decision that traditional chargeback workflows often postponed: whether resolving the issue early is economically smarter than attempting recovery later. In 2026, this decision is increasingly driven by dispute category, not confidence or precedent.

Different dispute types behave very differently once they escalate. Some are rooted in customer confusion or dissatisfaction, others in genuine unauthorised use, and many sit somewhere in between. Grouping alerts by reason code family allows merchants to apply consistent, defensible decision logic before a dispute formally exists.

Categories where early refunds usually outperform recovery

Certain dispute families are structurally resistant to resolution through evidence alone. They often reflect perception-based issues rather than provable error, which makes escalation both costly and unpredictable.

Early refunds are typically the rational option when alerts relate to:

- Cancellation or “no-show” misunderstandings in travel and hospitality

- Subscription recognition, renewal, or cancellation disputes

- Service quality or “not as described” complaints where evidence is subjective

In these cases, even well-documented fulfilment may not prevent escalation, and the cost of defending often exceeds the value recovered.

Categories where contesting can still be justified

Other dispute families lend themselves to resolution if merchants can act quickly and accurately during the alert window. These typically involve transactional clarity rather than subjective dissatisfaction.

Merchants may choose to withhold immediate refunds when:

- Delivery or access can be reliably demonstrated

- Duplicate processing or technical error is identifiable

- The customer has a prior history of resolved alerts

Speed matters here. If evidence cannot be surfaced within the alert SLA, the opportunity to contest meaningfully disappears.

Consistency matters more than optimism

The biggest risk in pre-dispute workflows is inconsistency. When refund decisions vary by analyst or shift, merchants unintentionally train cardholders to escalate. Decision rules tied to dispute categories remove subjectivity and ensure predictable outcomes, regardless of who handles the alert.

From a governance perspective, category-based decisioning also supports proportionality and auditability key expectations in modern payments operations. Merchants can demonstrate that early refunds are not arbitrary, but part of a structured risk-control strategy.

Automation Opportunities: CRM Integration, Order Lookups, Instant Refunds, Customer Messaging

Pre-dispute alerts are time-bound by design. Their value depends less on analytical sophistication and more on how quickly a merchant can act. Automation is what turns early warning into early resolution. Without it, alerts arrive faster than teams can respond, and the prevention window closes before a decision is made.

CRM and case-system integration

The first automation layer is integration with customer and case-management systems. Pre-dispute alerts should land directly where customer issues are already handled, rather than creating a parallel workflow that teams must monitor manually.

Well-integrated systems allow:

- Immediate visibility of customer history and prior interactions

- Faster triage without switching tools

- Consistent decisioning across support and payments teams

This reduces handoffs and ensures alerts are treated as part of the customer lifecycle, not an isolated payments problem.

Real-time order and fulfilment lookups

Automation also determines whether evidence is usable within the alert window. When order data, delivery status, access logs, or service timestamps are retrievable in real time, teams can make confident decisions quickly.

This capability matters because:

- Delayed evidence often forces refunds by default

- Partial visibility increases inconsistent outcomes

- Speed is more valuable than completeness at the pre-dispute stage

The goal is not perfect reconstruction, but enough certainty to decide before escalation.

Instant refund execution

In pre-dispute workflows, refunds are preventative tools, not concessions. Automation enables refunds to be issued immediately when thresholds are met, eliminating delays that would otherwise allow a dispute to be filed.

Instant execution:

- Maximises dispute prevention rates

- Reduces customer frustration during the alert window

- Removes reliance on manual approval chains

This is particularly important in high-volume environments where minutes, not hours, determine outcomes.

Customer-facing messaging

Automation extends beyond internal systems. Proactive, well-timed customer communication can often prevent escalation entirely. When customers receive clear confirmation that an issue is being resolved, the incentive to file a dispute drops sharply.

Effective messaging focuses on:

- Acknowledging the issue quickly

- Confirming the resolution path (refund, clarification, or support follow-up)

- Setting realistic expectations on timing

This aligns closely with broader consumer protection principles around transparency and responsiveness. UK government guidance on consumer rights consistently emphasises timely resolution and clear communication as key factors in preventing disputes.

High-Risk Vertical Adaptations: Gaming, Adult, Subscriptions, Travel

Pre-dispute workflows are not universally portable. While the mechanics of alerts may be similar, the reasons disputes arise and the way customers escalate vary sharply by vertical. High-risk merchants that apply a single refund or response model across sectors often reduce efficiency rather than improve prevention.

Gaming and betting

Gaming environments combine instant value delivery with high dispute sensitivity. Deposits are often consumed immediately, and disputes are frequently triggered by confusion around outcomes, bonus terms, or account restrictions rather than unauthorised use.

Pre-dispute handling here prioritises speed and clarity:

- Alerts must be assessed alongside recent gameplay and account actions

- Refunds are weighed carefully against abuse risk and bonus exploitation

- Customer messaging focuses on explaining outcomes rather than conceding error

Because disputes in this sector are closely monitored by regulators, consistency in early-resolution decisions is critical. UK oversight bodies emphasise transparency and fair treatment, reinforcing the need for well-documented, proportionate responses.

Adult and digital content

Adult and other digital-content platforms see disputes driven by recognition issues: forgotten purchases, shared devices, or misunderstandings about access duration. Evidence exists, but its interpretation is often subjective.

Here, the goal is not to prove entitlement, but to prevent disputes that are unlikely to be resolved convincingly once filed.

Subscriptions and recurring billing

Subscription disputes are rarely about fraud. They typically stem from cancellation friction, renewal timing, or unclear billing descriptors. Pre-dispute alerts offer a chance to resolve confusion before it becomes formal conflict.

Successful approaches are largely narrative-driven:

- Reviewing cancellation attempts or support contact history

- Refunding selectively when process ambiguity exists

- Reinforcing clear, documented cancellation paths going forward

Merchants that use pre-dispute alerts as feedback loops often reduce future dispute volume by addressing root causes, not just individual cases.

Key takeaway

Pre-dispute workflows only work when they reflect how disputes actually arise in each vertical. High-risk merchants that adapt decisioning by sector prevent more disputes, issue fewer unnecessary refunds, and maintain stronger operational control.

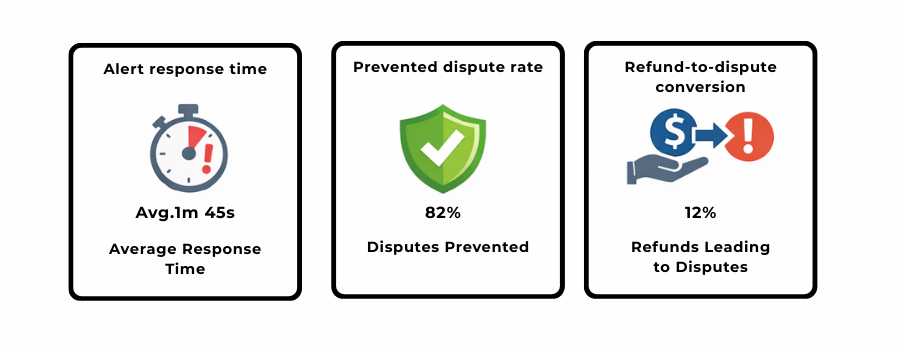

Operational KPIs: Measuring Whether Pre-Dispute Workflows Actually Work

Pre-dispute alerts only deliver value if they change outcomes. Traditional chargeback KPIs focus on what happens after escalation; they are too slow and too blunt to measure early-warning effectiveness. In 2026, merchants running pre-dispute workflows need metrics that reflect speed, prevention quality, and economic discipline.

Alert response time

Alert response time measures how quickly a merchant acts once an early warning is received. At the pre-dispute stage, time is not a convenience metric it is the defining constraint.

Why it matters:

- Alert windows are short and non-negotiable

- Delayed action often results in automatic dispute filing

- Faster response consistently correlates with higher prevention rates

Teams that monitor this KPI closely tend to design workflows around minutes, not hours, and treat alerts as operational priorities rather than queue items.

Prevented dispute rate

This metric captures the percentage of alerts that are resolved without converting into formal disputes. It is the clearest indicator of whether pre-dispute workflows are achieving their primary goal.

Refund-to-dispute conversion

Refund-to-dispute conversion tracks how often refunded alerts still become disputes. This KPI acts as a guardrail against over-refunding and refund abuse.

What it reveals:

- High conversion suggests refunds are too slow or poorly communicated

- Persistent increases may indicate customer behaviour exploiting refund policies

- Stable, low conversion confirms refunds are being issued decisively and clearly

This metric is particularly important in high-risk verticals where refund abuse can escalate quickly.

How these KPIs work together

| KPI | What It Signals | What to Watch For |

| Alert response time | Operational readiness | SLA breaches, manual bottlenecks |

| Prevented dispute rate | True prevention effectiveness | Trend direction, not absolute value |

| Refund-to-dispute conversion | Refund discipline | Early signs of abuse or miscommunication |

Together, these KPIs move performance measurement upstream from dispute outcomes to dispute avoidance.

From a governance perspective, regulators increasingly expect firms to demonstrate that controls are effective and proportionate, not just present. UK supervisory guidance consistently emphasises timely intervention, operational effectiveness, and evidence of risk mitigation all of which these metrics support when used correctly.

Governance: Preventing Refund Abuse While Lowering Disputes

As pre-dispute workflows mature, governance becomes the differentiator between sustainable prevention and uncontrolled leakage. Issuing refunds earlier and faster reduces disputes, but without guardrails it can also invite abuse. In 2026, effective governance is about balancing customer fairness with merchant protection and proving that balance consistently.

Why pre-dispute governance is different

Unlike post-dispute handling, pre-dispute decisions are made under time pressure and with incomplete information. This increases the risk of:

- Over-refunding to avoid escalation

- Inconsistent outcomes across teams or shifts

- Customers learning to exploit early-resolution paths

Governance frameworks must therefore be designed specifically for early-warning environments, not copied from traditional chargeback processes.

Customer fairness and regulatory alignment

Early refunds must also align with consumer protection expectations. Transparency, timeliness, and clarity of communication matter as much as the refund itself. When customers understand what is happening and why, escalation drops sharply.

UK regulatory guidance consistently emphasises fair treatment and proportionate responses to consumer issues, especially where automated decisioning is involved. Governance frameworks that embed these principles reduce both disputes and regulatory exposure.

Key takeaway

Pre-dispute governance is not about slowing refunds down, it is about issuing them intentionally. With the right controls, documentation, and oversight, merchants can reduce disputes without creating new abuse risks.

Conclusion

By 2026, pre-dispute alerts are no longer a niche optimisation layered onto chargeback teams. They have become a core component of payments operations, sitting at the intersection of risk management, customer experience, and financial control. The ability to intervene before a dispute exists changes not just outcomes, but how merchants think about disputes altogether.

What makes pre-dispute workflows powerful is not the alert itself, but the discipline around how alerts are handled. Merchants that succeed in this space design clear triage logic, define when refunds make economic sense, automate execution where speed matters, and adapt decisioning to the realities of different verticals. Prevention becomes intentional rather than reactive.

Just as importantly, governance ensures that early resolution remains sustainable. Without controls, documentation, and performance measurement, refund-driven prevention can quickly erode margins or invite abuse. When governance is embedded from the start, pre-dispute handling strengthens both risk posture and customer trust.

The broader implication is that dispute management has shifted upstream. Winning representation cases still matters, but it no longer delivers the greatest impact. The biggest gains now come from disputes that never enter the system at all.

For high-risk and high-volume merchants, this shift is decisive. Pre-dispute alerts are no longer an optional add-on or a cost-saving experiment. They are the foundation of modern chargeback control and an essential capability for operating at scale in 2026 and beyond

FAQs

1. What are pre-dispute alerts in card payments?

Pre-dispute alerts are early warning notifications generated before a cardholder formally files a chargeback. They give merchants a short window to resolve the issue-often through refunds or clarification-so the dispute never enters the scheme process.

2. How are pre-dispute alerts different from traditional chargebacks?

Traditional chargebacks occur after escalation and already affect dispute ratios. Pre-dispute alerts operate upstream, allowing merchants to intervene before ratios, fees, and operational cost are triggered.

3. Why are pre-dispute workflows more important in 2026?

In 2026, dispute monitoring is tighter and thresholds are less forgiving. Preventing disputes before filing protects ratios more effectively than post-dispute recovery, especially for high-risk or fast-growing merchants.

4. Should merchants always refund when a pre-dispute alert is received?

No. The decision depends on dispute category, transaction value, evidence availability, and abuse risk. Structured decision rules help merchants refund strategically rather than reflexively.

5. How does automation improve pre-dispute success rates?

Automation enables faster triage, instant data access, immediate refunds, and proactive customer communication. Without automation, alert windows often close before meaningful action can be taken.

6. Can pre-dispute refunds increase refund abuse?

They can if poorly governed. Velocity controls, behavioural monitoring, and refund-to-dispute conversion tracking are essential to ensure refunds remain a prevention tool, not an abuse vector.

7. Which industries benefit most from pre-dispute alerts?

High-risk and high-volume sectors such as gaming, adult content, subscriptions, and travel benefit most, as they face higher dispute sensitivity and tighter monitoring thresholds.

8. Are pre-dispute alerts part of compliance, or just operations?

They are both. While operational in execution, pre-dispute workflows support compliance by reducing dispute ratios, demonstrating proportional controls, and aligning with fair-treatment expectations.