Most merchants don’t get flagged because they’re doing something wrong. They get flagged because they describe themselves in ways that mean something very different to an acquirer than they do internally. In 2026, that gap matters more than it ever has.

Language has quietly become a risk signal. Not in a marketing sense, but in an underwriting one. Acquirers and PSPs now read merchant descriptions as clues about control, maturity, and potential exposure. Certain words trigger deeper review not because they’re forbidden, but because they imply obligations, liabilities, or behaviours that acquirers have been burned by before.

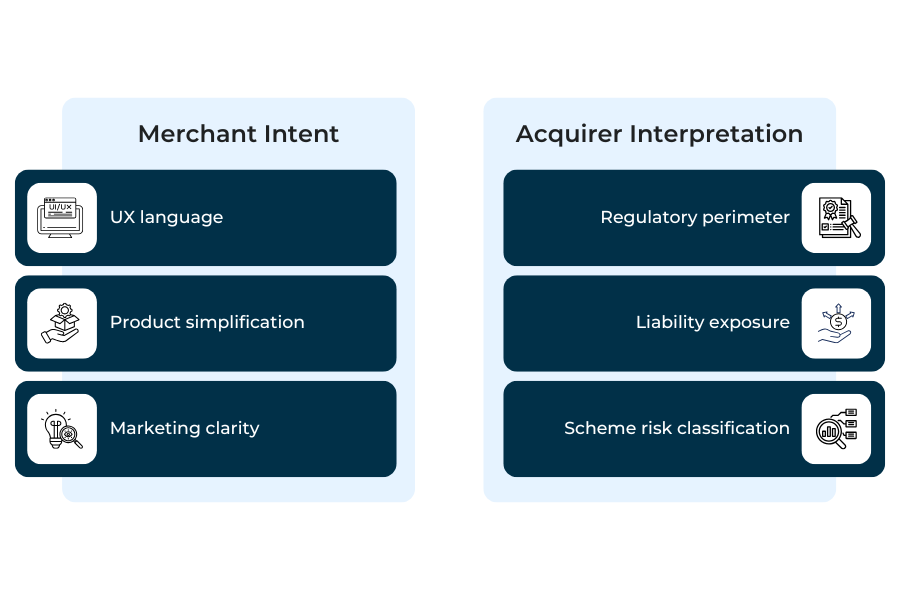

This is where frustration creeps in. Merchants think they’re being clear or modern. Acquirers think they’re spotting early warning signs. Nobody is lying, but both sides are speaking different dialects of the same language. The result is enhanced due diligence, stalled onboarding, or uncomfortable follow-up questions that feel disproportionate to the business being described.This blog exists to translate that gap. Not by telling merchants what they’re “allowed” to say, but by explaining what acquirers actually hear when certain payment terms appear. In 2026, precision in language isn’t about playing it safe. It’s about reducing unnecessary friction before it starts.

- How Acquirers Actually Read Merchant Language

- Terminology That Signals Uncontrolled Money Movement

- Terminology That Implies Facilitation or Aggregation

- Terminology That Suggests Synthetic or Convertible Value

- Borderline Vertical Language That Raises Adjacency Flags

- Where Merchants Usually Get Into Trouble

- How to Use Payment Terminology Safely (Without Self-Censoring)

- Conclusion

- FAQs

How Acquirers Actually Read Merchant Language

Merchants tend to assume that acquirers read descriptions the way customers do as explanations of what the business offers. In reality, acquirers read language as risk shorthand. Every word is quietly mapped to past incidents, regulatory obligations, and internal have we seen this go wrong before? playbooks.

This difference in perspective is critical. When an underwriter sees a term like wallet, platform, or stored value, they aren’t thinking about UX or branding. They’re thinking about safeguarding requirements, third-party exposure, AML controls, and whether this merchant could pull them into a regulatory perimeter they don’t want to be in. The word itself is less important than the assumptions it unlocks.

Acquirers also read language defensively. They are accountable not only for onboarding decisions, but for justifying those decisions later to schemes, auditors, and regulators. That makes them conservative by design. Ambiguity isn’t neutral; it’s risky. If a description can be interpreted in two ways, underwriters usually assume the more complex one until proven otherwise.

Another factor merchants underestimate is consistency. Acquirers compare wording across multiple touchpoints: onboarding forms, websites, pitch decks, FAQs, even support articles. When the language doesn’t line up, it raises questions about internal alignment. Are payments flows evolving faster than controls? Does the business fully understand its own model? Those questions surface long before any transaction risk appears.

Finally, experience matters. Acquirers don’t interpret terms in isolation; they interpret them through years of pattern recognition. Certain phrases have become associated with chargebacks, licensing disputes, or regulatory findings. Even if your use case is benign, the language can still trigger scrutiny simply because others used it badly before.

Understanding this mindset changes how merchants should think about wording. It’s not about avoiding “dangerous” terms. It’s about recognising that, in 2026, language is evaluated as evidence of how a business actually operates and acquirers read it with far more context than most merchants realise.

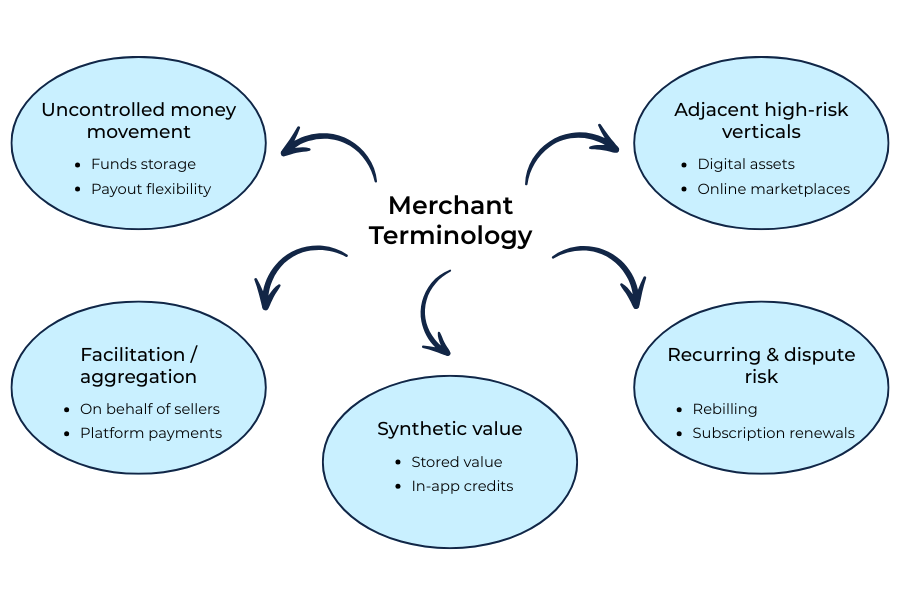

Terminology That Signals Uncontrolled Money Movement

This is one of the fastest ways merchants trigger enhanced review often without realising why. Certain payment terms immediately raise questions about where money sits, who controls it, and whether it’s being safeguarded properly. Even when the underlying product is simple, the language can suggest something far more complex.

What Merchants Usually Mean

Most merchants use these terms to describe internal mechanics, not financial products. They’re trying to make the user experience intuitive or modern.

Common intentions include:

- Showing a notional balance for convenience

- Issuing refunds or credits without re-running a card payment

- Using fintech-style language to feel familiar

From the merchant’s perspective, these are labels, not legal claims.

What Acquirers Actually Hear

Acquirers don’t hear labels. They hear regulatory implications.

Words that imply funds are held, stored, or reused immediately raise questions such as:

- Are customer funds being safeguarded?

- Is this e-money or something close to it?

- Does this activity fall inside a regulated perimeter?

Once those questions are on the table, the review scope expands. Licensing, segregation of funds, and consumer protection obligations all come into play even if the merchant never intended to offer anything resembling a financial product.

Common Trigger Terms

These words are frequently flagged during underwriting or re-review:

- Wallet

- Balance

- Stored funds

- Credits

- Prepaid

On their own, none of these terms are wrong. The issue is that they imply discretion over customer funds, which acquirers are trained to be cautious about. In Europe, for example, language that resembles e-money or stored value can immediately prompt questions about regulatory alignment under the payment services and electronic money framework European Banking Authority guidance.

The practical takeaway isn’t to strip all modern language out of your product. It’s to be precise. If funds aren’t actually stored, say so.

If credits can’t be transferred or withdrawn, explain that clearly. Precision collapses ambiguity and ambiguity is what turns innocent wording into a risk signal.

Terminology That Implies Facilitation or Aggregation

This is another category where merchants routinely get caught off guard. Certain words don’t just describe what you do, they imply how payments flow, who carries risk, and who is responsible for third parties. For acquirers, that distinction is non-negotiable.

How Merchants Commonly Frame Themselves

Many businesses use facilitation-style language because it sounds accurate at a high level or because it reflects how the product feels to users.

Typical phrases include:

- We’re a platform

- We connect buyers and sellers

- We facilitate payments

- We host vendors or creators

From a merchant’s point of view, this often just means we operate the product.

How Acquirers Interpret the Same Language

Acquirers don’t hear product positioning, they hear structural liability.

Facilitation language immediately raises questions such as:

- Are there sub-merchants involved?

- Who is the merchant of record?

- Who performs KYC on third parties?

- Who is responsible for disputes, refunds, and prohibited activity?

Once these questions are triggered, the merchant is no longer assessed as a simple direct seller. They are evaluated as a marketplace or payment facilitator, even if that was never the intention.

Why This Triggers Deeper Review

Facilitation models shift risk away from a single entity and spread it across participants. From an acquirer’s perspective, that means:

- Broader AML exposure

- More complex transaction monitoring

- Increased scheme and regulatory obligations

This is exactly why acquirers are conservative here. Under tighter monitoring frameworks, they need to justify that any merchant enabling third-party activity has clear controls and accountability in place. Programmes like Visa’s Acquirer Monitoring Program reinforce this pressure by making upstream risk harder to absorb quietly.

The practical risk for merchants is misclassification. A business that is actually the merchant of record can accidentally present itself as a facilitator through language alone. Once that happens, reversing the interpretation takes time, explanation, and often additional documentation.

The safer approach isn’t to avoid words like platform altogether. It’s to pair them with clarity. If you are a merchant of record, say so. If third parties never touch funds, make that explicit. Acquirers are not allergic to facilitation; they’re allergic to unclear responsibility.

Terminology That Suggests Synthetic or Convertible Value

This is one of the most subtle and misunderstood trigger zones. Merchants often use these terms to describe incentives, UX features, or internal mechanics. Acquirers, on the other hand, read them through an AML and misuse lens shaped by years of remediation work.

What Merchants Usually Mean

In most cases, the intent is harmless and practical. These terms are used to:

- Gamify engagement or loyalty

- Represent non-cash benefits

- Simplify pricing or redemption logic inside a product

From the merchant side, this is product language, not financial engineering.

What Acquirers Immediately Question

Acquirers don’t stop at intent. They ask what these constructs enable.

When merchants describe:

- Points

- Rewards

- In-app currency

- Conversion

- Tokens

The immediate concern is whether value can:

- Be accumulated over time,

- Be converted into something else,

- Move between users or contexts, or

- Be redeemed in ways that resemble money movement.

Even when the answer is no, the wording alone suggests a synthetic value layer that may need closer inspection.

Why This Raises AML and Scheme Concerns

Synthetic or convertible value creates ambiguity around:

- Source of funds,

- Value transfer mechanics,

- And auditability of flows.

From an AML perspective, these constructs can resemble closed-loop systems that are hard to monitor if poorly defined. From a scheme perspective, they raise questions about whether card payments are being transformed into something that behaves like money even if it technically isn’t.

This is why acquirers lean conservative. They’ve seen cases where just points quietly evolved into transferable credits, or where internal conversion masked FX-like behaviour. The wording becomes an early warning sign, not a verdict.

The fix here isn’t to strip all incentive language out of your product. It’s to define the boundaries clearly. If value can’t be transferred, say so. If it expires, explain that. If it never leaves the system or converts back to cash, make that explicit.

In 2026, acquirers aren’t allergic to innovation. They’re allergic to uncertain value mechanics. Clear language keeps your product innovative without dragging it into unnecessary risk conversations.

Borderline Vertical Language That Raises Adjacency Flags

Some of the hardest reviews merchants face don’t come from clearly high-risk activities, but from language that places them too close to sensitive verticals without clearly stating where the line is. Acquirers call this adjacency risk and in 2026, they’re far less tolerant of it than they used to be.

Words like gaming, entertainment, digital content, or education sound harmless on their own. Merchants use them to stay broad or avoid pigeonholing themselves. Acquirers, however, don’t read them broadly. They read them through exclusion lists and historical loss data.

When an underwriter sees vague vertical language, the immediate question is not what is this business? but what could this become?

Is gaming skill-based or chance-based?

Is digital content informational or adult?

Is education genuine training or investment signalling?

The problem is that ambiguity pushes the merchant closer to categories acquirers already treat with caution. Gambling-adjacent, adult-adjacent, investment-adjacent, and pseudo-financial services all sit behind words that look innocuous until context is missing. Once that proximity is established, the review scope expands quickly.

This is where merchants often underestimate how conservative acquirers must be. Under scheme and regulatory pressure, acquirers would rather over-classify risk than under-estimate it. If language leaves room for interpretation, the interpretation usually lands on the more restrictive side.

What works better is specificity, even when it feels less marketable. Saying subscription-based language learning content is far safer than a digital education platform. Saying skill-based games with no cash-out or wagering prevents a very different conversation than simply saying gaming experience.

The goal isn’t to sanitise your business description. It’s to remove unnecessary adjacency. In 2026, acquirers are less concerned with what you might do someday and far more concerned with what your language suggests you’re already doing. Clear boundaries in wording prevent your business from being pulled into risk categories it was never meant to sit in.

Where Merchants Usually Get Into Trouble

Most merchants don’t run into problems because of a single bad word. They get into trouble because their language drifts, and nobody notices until an acquirer does.

One common pattern is inconsistency across teams. Marketing uses aspirational language. Product teams describe features informally. Compliance fills out onboarding forms conservatively. Each version makes sense in isolation, but together they tell three different stories. To an acquirer, that looks like a business that hasn’t fully aligned its own understanding of how money moves.

Another frequent issue is copy-pasting language from competitors or fintech peers. Merchants borrow terms that sound credible “wallet”, “platform”, “credits” without realising those words come with baggage. What worked for a VC-backed fintech with licences and compliance teams may be completely inappropriate for a direct merchant using card payments.

Pitch decks are another quiet risk surface. Investor language often focuses on scale, flexibility, and future plans. When the same language shows up in onboarding or risk questionnaires, acquirers interpret it as current operational reality, not aspiration. That mismatch almost always triggers follow-up.

There’s also a tendency to oversimplify. Merchants try to stay broad to avoid scaring off partners, but vagueness rarely helps. Saying “we offer digital services” feels safe, but it forces the acquirer to guess what those services actually are and acquirers are paid to assume worst-case scenarios.

Finally, many businesses underestimate how long language persists. Old FAQs, deprecated product pages, or half-updated support articles still get read during reviews. Once a term exists publicly, it becomes part of the risk picture, even if the product has evolved.

The pattern is consistent: merchants don’t get flagged for being dishonest. They get flagged for being imprecise. In 2026, clarity isn’t just good communication. It’s part of staying off the wrong side of an underwriting conversation.

How to Use Payment Terminology Safely (Without Self-Censoring)

The goal here isn’t to tiptoe around language or strip your product of personality. It’s to reduce interpretation gaps. Merchants get into trouble when acquirers have to guess what a term means. They stay out of trouble when wording does that work upfront.

Be Precise, Not Vague

Precision beats safety-by-omission every time. Broad terms force acquirers to infer risk; specific ones collapse that uncertainty. Saying “users see a notional account balance that cannot be withdrawn or transferred” is far safer than simply saying “wallet”. It removes guesswork and short-circuits unnecessary reviews.

Precision doesn’t mean overloading descriptions with legal language. It means clearly stating what does and does not happen when money moves.

Describe Function, Not Aspiration

Many merchants describe what they plan to become, not what they are today. That’s fine for investors. It’s risky for underwriting.

If a feature is on the roadmap but not live, don’t blur the line. Acquirers read present tense as present reality. Describing future capabilities too early can pull your business into regulatory or facilitation conversations you’re not ready for.

A simple rule helps: if it doesn’t exist in production, it shouldn’t exist in onboarding language.

Align Language Across Teams

One of the easiest ways to trigger review is internal inconsistency. Sales decks, websites, onboarding forms, and support articles should all describe payments in roughly the same way. They don’t need to be identical but they shouldn’t contradict each other.

Acquirers compare sources. When they see alignment, confidence goes up. When they see drift, questions follow.

This isn’t about policing words. It’s about ensuring everyone in the business understands and communicates how money actually moves.

Used well, payment terminology doesn’t restrict you. It protects you. In 2026, the safest merchants aren’t the quietest ones. They’re the clearest.

Conclusion

In 2026, payment terminology is no longer a cosmetic choice. It’s part of how merchants are assessed, categorised, and trusted. The words used to describe products, flows, and value movement now sit alongside transaction data as inputs into underwriting and monitoring decisions.

What trips merchants up isn’t innovation or ambition. It’s a misalignment. Acquirers flag businesses when language creates ambiguity about control, responsibility, or regulatory perimeter. Once that ambiguity exists, scrutiny follows even if the underlying model is sound.

The merchants that navigate this well don’t censor themselves or flatten their products into bland descriptions. They do something far more effective: they describe reality precisely. They make it easy for acquirers to understand what happens to money, who is responsible at each step, and where the boundaries are.

That clarity pays off quietly. Fewer follow-up questions. Faster onboarding. Less friction during reviews. In a payments environment where acquirers are under pressure to justify every decision, clear language becomes a competitive advantage.

In 2026, managing payment risk isn’t just about systems and controls. It’s also about how well you explain what you do and how little room you leave for someone else to misinterpret it.

FAQs

1. Why does payment terminology matter more in 2026 than before?

Because acquirers are under greater regulatory and scheme pressure. Language is now treated as a proxy for how money moves, how controlled it is, and what risk it creates.

2. Can the wrong terminology really get a merchant flagged or delayed?

Yes. Certain words trigger deeper review even if the business model is legitimate. Flagging often happens due to ambiguity, not wrongdoing.

3. Is it safer to avoid words like “wallet” or “platform” entirely?

Not necessarily. The issue isn’t the word itself, but what it implies. If you use these terms, they must be clearly defined and limited in scope.

4. Why do acquirers assume the worst interpretation of vague language?

Because they are accountable to schemes and regulators. Ambiguity creates liability, so underwriters default to conservative assumptions.

5. What’s the difference between merchant intent and acquirer interpretation?

Merchants describe products from a UX or business perspective. Acquirers interpret language through historical risk, regulatory exposure, and past failures.

6. Can inconsistent language across my website and onboarding forms cause problems?

Yes. Acquirers compare sources. Inconsistencies suggest poor internal alignment or evolving payment flows without proper controls.

7. Why does “wallet” language often trigger licensing questions?

Because it can imply stored value, safeguarding, or e-money activity, which may fall within a regulated perimeter depending on jurisdiction.

8. Are subscription businesses automatically high risk?

No. But vague subscription language raises concerns around consent, cancellation, and chargebacks. Clarity reduces scrutiny.

9. How should startups describe features that are not live yet?

They shouldn’t be in compliance or onboarding contexts. Future plans should be clearly separated from current operational reality.

10. Is marketing language treated the same as compliance language?

Increasingly, yes. Acquirers review public-facing materials, not just forms. Marketing copy can influence risk perception.

11. What’s the safest general rule for payment terminology?

Describe function, boundaries, and responsibility clearly. Avoid aspirational or borrowed language that creates interpretation gaps.

12. Can precise language really reduce onboarding friction?

Yes. Clear descriptions often shorten reviews, reduce follow-up questions, and build trust with acquirers faster than silence or over-simplification.