From January 1, 2026, cash stopped being a neutral operating choice for Nigerian merchants. The Central Bank of Nigeria’s revised cash-related policies do more than cap withdrawals or add fees, they fundamentally change how value is expected to move through the economy. For businesses that still rely heavily on cash for collections, payouts, or agent liquidity, this is not a compliance footnote. It is a structural reset.

Nigeria has always been a cash-intensive market, especially outside major urban centres and in sectors with large offline footprints. But high-risk and high-volume merchants feel policy shifts earlier than most. Gambling, digital services, FX-related platforms, marketplaces, and agent-led models all depend on predictable liquidity. When cash access tightens, the friction shows up immediately in treasury operations, customer experience, and PSP relationships.

The practical effect of the clampdown is not “less spending,” but different rails. As cash becomes more expensive and more scrutinised, merchants are pushed toward instant bank transfers, USSD-initiated payments, and structured digital collections. At the same time, regulators and PSPs expect stronger audit trails, clearer source-of-funds narratives, and tighter transaction monitoring to match the increased visibility of digital flows.

This blog breaks down what actually changes in 2026, how reduced cash availability reshapes merchant behaviour, which payment rails absorb the displaced volume, and why fraud and AML expectations tighten rather than relax. The goal is simple: help merchants and PSPs redesign their payment and compliance models early, instead of reacting under pressure once the rules are already live.

- What Changed in the CBN Cash-Related Policies and Why

- How Reduced Cash Availability Changes Merchant Behaviour

- Likely Winners: Transfers, USSD, Agent Networks, Instant Rails

- What Changes in Fraud and Compliance When Cash Is Constrained

- AML Controls PSPs Will Demand in 2026 (High-Risk Lens)

- What Merchants Must Update in Practice

- Merchant Checklist – How to Be Ready for January 1, 2026

- Conclusion

- FAQs

What Changed in the CBN Cash-Related Policies and Why

The Central Bank of Nigeria’s revised cash-related policies coming into force on January 1, 2026 are often reduced to “cash withdrawal limits,” but that description misses the deeper shift. What really changes is the assumption that large-scale cash usage can continue without friction, cost, or scrutiny. From 2026 onward, cash becomes a constrained operating channel, not a neutral one.

At the core of the policy are weekly cumulative withdrawal thresholds that apply across channels. This is a deliberate design choice. Merchants can no longer manage cash exposure by spreading withdrawals across ATMs, branches, or multiple days. Once thresholds are exceeded, additional fees apply and bank processes become more restrictive.

What the policy concretely introduces for merchants:

- Cumulative weekly limits on cash withdrawals, not per-channel caps

- Additional fees once thresholds are exceeded, increasing operating cost

- Stricter bank-side controls, including recordkeeping and scrutiny for frequent withdrawals

- Reduced flexibility for cash-heavy treasury and payout models

Beyond mechanics, the policy signals a shift in regulatory intent. Cash handling is expensive, difficult to audit, and closely associated with informal activity and AML blind spots. By tightening access rather than banning cash outright, the CBN is using economic pressure to move activity onto traceable, monitorable payment rails.

For merchants, the practical implication is clear. Cash is no longer the easiest way to scale operations. Models that depend on frequent, high-volume withdrawals now face higher costs, slower execution, and more questions from banks.

Why this matters operationally in 2026:

- Liquidity planning becomes harder for cash-reliant businesses

- Treasury operations face new friction and unpredictability

- Customer-facing delays increase if cash remains the primary rail

- PSPs and banks gain earlier visibility into merchant behaviour

This is why the cash clampdown should be understood as a behavioural reset, not a temporary compliance hurdle. Merchants that treat it as a minor inconvenience will struggle later. Merchants that redesign their flows early can transition away from cash before the constraints become painful.

How Reduced Cash Availability Changes Merchant Behaviour

Reduced cash availability does not simply push merchants to “go digital.” It changes how businesses are organised, how customers are handled, and how risk is managed day to day. The biggest shift is psychological: cash stops being the fallback option when systems fail or volumes spike. Once that safety valve is restricted, merchants are forced to redesign behaviour rather than patch processes.

For many Nigerian merchants, especially those operating at scale, cash has historically absorbed inefficiencies. Delays, reconciliation gaps, failed digital payments, or agent shortages could all be smoothed over with physical cash. The 2026 clampdown removes that buffer.

From cash-first operations to rail-first decision-making

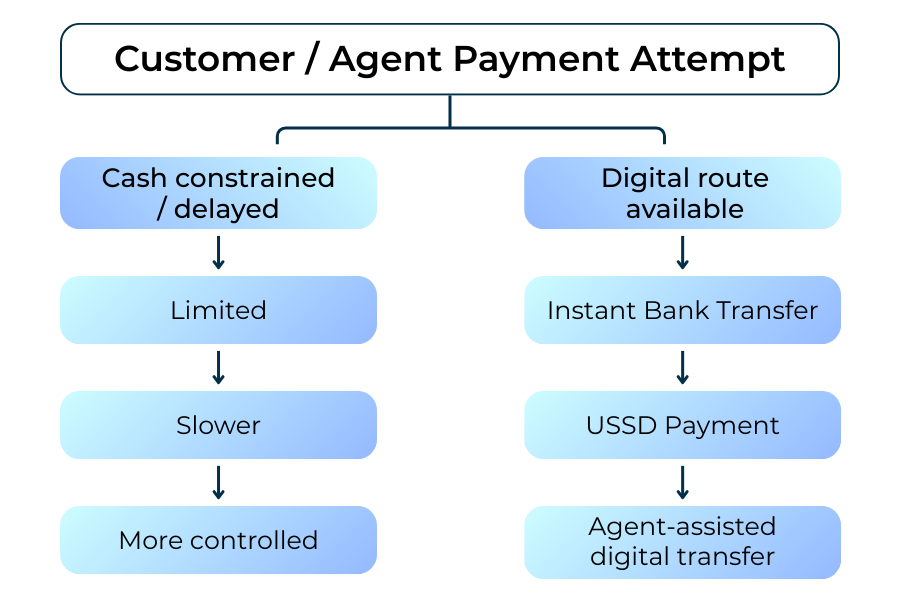

As cash access tightens, merchants begin making explicit choices about payment rails instead of defaulting to cash for convenience. This shows up most clearly in how collections and payouts are structured.

Merchants that adapt successfully stop asking “How do we get cash out?” and start asking “Which rail is appropriate for this transaction?” That shift sounds subtle, but operationally it is profound.

You start to see:

- Domestic collections redesigned around instant transfers or USSD, not physical handoff

- Payouts and refunds executed digitally to avoid withdrawal bottlenecks

- Agent networks reoriented around digital settlement with controlled cash float, rather than unlimited cash liquidity

This is less about technology adoption and more about behavioural discipline.

Where friction appears first

The transition is not smooth for everyone. Reduced cash availability exposes weak points that were previously hidden.

The most common friction points include:

- Customer confusion when cash is no longer accepted or delayed

- Treasury stress when liquidity planning assumed unrestricted withdrawals

- Agent tension when cash float becomes constrained or monitored

Merchants that fail to anticipate these issues often see a short-term spike in disputes and customer dissatisfaction, even if their long-term costs eventually fall.

Offline to digital is not binary

One mistake merchants make is assuming the shift is purely “offline to app.” In reality, Nigeria’s transition is hybrid.

USSD, agent-assisted transfers, and instant bank payments become the practical bridge between cash-heavy behaviour and fully digital flows. This is why merchants that ignore USSD or agent-supported digital rails often struggle more than those that treat them as core channels.

The behaviour change is not customers abandoning cash overnight, it is customers accepting digital equivalents when friction is managed correctly.

What separates early adapters from reactive merchants

By late 2026, a clear divide emerged between merchants who redesigned behaviour early and those who reacted late.

Early adapters tend to:

- Communicate limits and payment options proactively

- Guide customers toward digital rails before cash fails

- Design payout and refund flows that do not depend on withdrawals

- Train agents and staff to handle digital-first interactions

Reactive merchants, by contrast, often experience:

- Payment bottlenecks during peak periods

- Increased scrutiny from banks and PSPs

- Higher complaint and escalation rates

- Emergency changes under regulatory pressure

The key insight is that reduced cash availability reshapes behaviour whether merchants plan for it or not. The only choice is whether that change is controlled or chaotic.

Likely Winners: Transfers, USSD, Agent Networks, Instant Rails

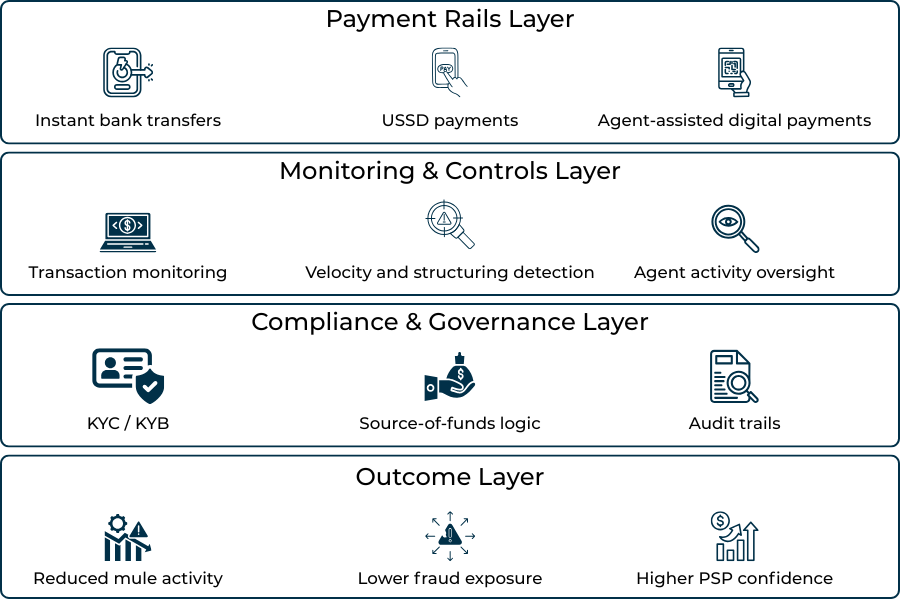

When cash becomes constrained, payment volume does not migrate evenly across all channels. It flows toward rails that can absorb scale without breaking trust, liquidity, or regulatory expectations. In Nigeria’s case, the shift is not about replacing cash with a single method, but about rebalancing behaviour across a small set of practical rails.

Instant bank transfers naturally sit at the centre of this shift. They already operate at national scale and are deeply embedded in consumer behaviour, which allows them to absorb displaced cash volume with relatively low friction. For merchants, the benefit is not just speed, but predictability. Funds arrive quickly, reconciliation is cleaner than cash, and transaction trails support tightening AML expectations.

That said, instant rails are unforgiving. Weak reconciliation logic, unclear payment references, or poor customer messaging surface immediately when transfers fail or are misdirected. Merchants that previously relied on cash to absorb operational messiness feel this pressure first.

USSD plays a different but equally important role. It acts as a bridge rail, keeping transactions digital when apps or cards are impractical. In many parts of Nigeria, USSD remains the most reliable way to complete a payment under real-world conditions, especially for assisted or semi-offline commerce. As cash access tightens, USSD prevents digital exclusion from turning into revenue loss.

Agent networks also remain relevant, but their function changes. They are no longer sustainable as unrestricted cash distribution points. Instead, agents increasingly operate as facilitators of digital payments, helping customers initiate transfers or USSD payments while operating within tighter cash float constraints.

At a high level, the rails that benefit most from the cash clampdown share a few characteristics:

- They support instant or near-instant settlement, reducing reliance on physical liquidity

- They are widely accessible, even outside major urban centres

- They create traceable transaction records, aligning with regulatory expectations

Cards, by contrast, are not the primary domestic winner. While they remain important for international and online-only use cases, they are less suited to replacing cash for frequent, low-value, domestic transactions.

The real advantage, therefore, does not sit with any single rail. It sits with merchants that can blend rails intentionally, defaulting to transfers where possible, using USSD to protect reach, and redesigning agent activity around digital settlement rather than cash dependency. In Nigeria’s 2026 environment, flexibility and clarity outperform loyalty to any one payment method.

What Changes in Fraud and Compliance When Cash Is Constrained

Constraining cash does not remove risk from the system, it moves it. In Nigeria’s case, reducing cash availability shifts fraud away from opaque, physical leakage and toward faster, more structured digital abuse. For merchants, this transition often feels sudden because the risks surface earlier, at higher velocity, and with clearer audit trails.

When cash was widely available, many forms of fraud stayed hidden inside informal handling, agent float manipulation, or manual reconciliation gaps. As value moves onto instant rails and USSD, those blind spots close. The trade-off is visibility: regulators, banks, and PSPs can see more and therefore expect more from merchants operating at scale.

One of the most visible changes is the rise in structuring behaviour. Instead of large cash withdrawals, bad actors split activity into smaller, repeated digital transactions designed to stay below thresholds. This is not new behaviour, but instant payments make it easier to execute quickly if monitoring is weak.

At the same time, mule activity and social engineering increase as customers and agents adapt to digital flows. Fraudsters target assisted payments, exploit trust in agents, or manipulate customers into initiating transfers themselves. Because instant payments settle immediately, the window to intervene is short.

The risk patterns merchants and PSPs see most often after cash constraints tighten include:

- High-velocity small-value transfers replacing single large cash movements

- Agent-assisted abuse, where digital payments are initiated under false guidance

- Increased complaint volumes driven by unclear limits, fees, or payment instructions

These shifts directly affect compliance expectations. Even after Nigeria’s removal from FATF increased monitoring, banks and PSPs remain focused on proving that reforms are durable. That means higher expectations around transaction monitoring, auditability, and source-of-funds explanations, especially for high-risk merchants.

What changes in practice is not just the tooling, but the standard of explanation. Merchants are increasingly expected to explain:

- Why certain transaction patterns occur

- How limits are enforced and communicated

- How unusual behaviour is detected and escalated

- How refunds or reversals are handled when instant payments go wrong

Merchants that rely on manual reviews or post-event clean-up struggle in this environment. Instant rails reward preventive controls, clear customer messaging, and early intervention. This does not mean over-blocking or adding friction everywhere. It means understanding where risk concentrates once cash is no longer the release valve.

The core insight is simple but uncomfortable: as cash retreats, ambiguity disappears. Digital rails force behaviour into the open. Merchants that treat this as an opportunity to professionalise risk and compliance tend to stabilise quickly. Those that underestimate the shift often experience rising disputes, PSP pressure, and avoidable regulatory attention.

AML Controls PSPs Will Demand in 2026 (High-Risk Lens)

As cash usage tightens and more value moves onto instant rails, AML scrutiny does not ease it sharpens. For PSPs and gateways operating in Nigeria, 2026 is less about meeting minimum regulatory checklists and more about defending portfolio risk. High-risk merchants are assessed on whether their controls can hold up under speed, scale, and visibility.

What changes most is not the existence of AML controls, but the standard of proof. PSPs are no longer satisfied with policy documents or generic risk statements. They expect merchants to demonstrate that controls actually function in an instant-payment environment, where transactions complete in seconds and patterns emerge quickly.

What “boardability” looks like in Nigeria in 2026

From an underwriter’s perspective, a high-risk merchant is judged on coherence. Payments, customer behaviour, and compliance narratives must line up. When they don’t, questions escalate fast.

In practice, PSPs expect merchants to clearly explain:

- How customers fund accounts or make payments

- Why transaction sizes and frequencies look the way they do

- How agents or assisted channels are supervised

- What happens when behaviour deviates from the norm

Merchants that cannot articulate this logic even if they are technically compliant are increasingly viewed as unstable.

The controls PSPs actively test for

Rather than adding layers of friction everywhere, PSPs focus on a small set of controls that signal maturity. These are not theoretical; they are operational expectations.

The controls most often scrutinised include:

- KYC/KYB depth that matches transaction risk, not just onboarding speed

- Transaction monitoring tuned for structuring, not only large anomalies

- Agent and assisted-payment oversight, where applicable

- Clear audit trails linking payments, customers, and outcomes

These controls matter because instant payments remove the buffer time that once allowed manual intervention. Weak monitoring is no longer a back-office problem it becomes a live risk.

FATF delisting: what changed, and what didn’t

Nigeria’s removal from FATF increased monitoring in 2025 is often misunderstood. For PSPs, it does not signal relaxation. It signals expectation. The emphasis shifts from remediation to durability proving that controls work consistently, not occasionally.

For high-risk merchants, this means scrutiny remains high around:

- Source-of-funds explanations

- Repeat transaction behaviour

- Cross-channel consistency (cash, transfers, USSD, agents)

PSPs are especially cautious of merchants whose digital growth appears to replace cash opacity with digital opacity. Faster rails with the same blind spots are not acceptable.

Where merchants typically fall short

Many high-risk merchants underestimate how quickly AML expectations evolve once cash constraints bite. Common failure points include reactive monitoring, unclear ownership of compliance decisions, and poor coordination between payments and risk teams.

The merchants that perform better tend to:

- Design AML controls alongside payment flows, not after

- Treat monitoring alerts as operational signals, not compliance noise

- Align customer communication with internal risk rules

In 2026, PSPs are not looking for perfection. They are looking for intentional design. Merchants that can show they understand where their risk sits and how it changes as cash recedes are far more likely to remain boardable as scrutiny increases.

What Merchants Must Update in Practice

The cash clampdown does not require merchants to reinvent their business overnight, but it does force practical adjustments across payments, operations, and customer communication. The merchants that struggle most are not those with limited resources, but those that delay decisions and try to patch old cash workflows onto new constraints.

The first area that needs attention is payment option design. When cash becomes unreliable, customers do not automatically migrate to digital rails on their own. Merchants must guide that transition deliberately. This means presenting instant transfers and USSD not as secondary options, but as default paths, with clear instructions and predictable outcomes. Ambiguity at the payment stage is one of the fastest ways to increase failed transactions and support volume.

Limits and fees messaging becomes equally important. Cash constraints introduce friction that customers notice immediately. If merchants do not explain why certain payment paths are restricted or delayed, frustration often turns into complaints or chargebacks framed as “payment errors.” Clear, upfront communication reduces disputes far more effectively than post-transaction explanations.

From an operational standpoint, reconciliation and refunds require a rethink. Instant payments move faster than many internal finance processes were designed to handle. Merchants that rely on end-of-day or manual reconciliation quickly fall behind, creating mismatches that look suspicious to PSPs and regulators. Refunds, in particular, must be designed as structured digital flows rather than ad-hoc cash resolutions.

In practice, merchants updating successfully tend to focus on a small set of concrete changes:

- Defaulting collections and payouts to instant rails or USSD, with cash as an exception

- Aligning internal limits with external constraints, so customer promises match reality

- Tightening reconciliation cycles, ideally moving closer to near-real-time visibility

- Standardising refund handling, especially for failed or misdirected transfers

Another often overlooked adjustment is customer and agent education. Reduced cash access changes behaviour at the edges of the business first field staff, agents, and customer support teams. Merchants that invest early in training and clear escalation paths see fewer operational shocks when limits are hit.

Ultimately, what merchants must update is not just tooling, but expectation management. Nigeria’s 2026 environment rewards businesses that are explicit about how money moves, what customers can expect, and where constraints apply. Those that rely on informal workarounds or silent assumptions find themselves under pressure from customers, PSPs, and banks at the same time.

Merchant Checklist – How to Be Ready for January 1, 2026

By the time Nigeria’s revised cash rules take effect, most of the heavy lifting should already be done. The merchants that struggle are rarely those that misunderstood the policy; they are the ones that postponed operational decisions and tried to absorb the impact reactively. This checklist is not about perfection, it’s about avoiding obvious failure points.

Start with rail readiness. Merchants should already know which transactions will move away from cash and where they will land instead. If instant transfers or USSD are positioned as “backup options,” customers will continue to default to cash until friction hits. By January 2026, digital rails must feel like the normal path, not the alternative.

From there, alignment matters more than expansion. Adding payment methods without internal coordination creates more problems than it solves.

At a minimum, merchants should be able to answer “yes” to the following:

- Collections and payouts can run without relying on large cash withdrawals

- Instant transfers and/or USSD are clearly presented and supported in customer journeys

- Internal transaction limits mirror external bank and regulatory constraints

- Reconciliation processes can keep up with same-day or near-real-time settlement

Compliance readiness is the next pressure point. As cash recedes, PSPs expect clearer explanations, not just cleaner data. Merchants should already have internal clarity on where funds originate, how agents or assisted channels are supervised, and how unusual behaviour is escalated.

Operationally, this means:

- Monitoring rules are tuned for frequency and structuring, not just size

- Agent activity, where applicable, is digitally visible and auditable

- Refunds and error handling follow documented digital processes, not ad-hoc fixes

Finally, there is a human element that often gets missed. Reduced cash access changes frontline behaviour first. Customer support teams, agents, and operations staff must understand the new constraints well enough to explain them calmly and consistently. Confusion at the edges of the business is one of the fastest ways to trigger complaints, PSP friction, and reputational risk.

Being “ready” for January 1, 2026 does not mean eliminating cash entirely. It means ensuring that when cash becomes constrained, the business does not stall. Merchants that treat this checklist as a final validation step rather than a to-do list are the ones that enter 2026 with stability instead of stress.

Conclusion

Nigeria’s 2026 cash-withdrawal clampdown is not an isolated regulatory intervention. It is part of a broader, deliberate shift toward a payments ecosystem where value moves through channels that are faster, more transparent, and easier to supervise. For merchants, especially those operating at scale or in higher-risk segments, this marks a clear end to cash as a dependable operational backbone.

The immediate impact is practical rather than theoretical. Cash constraints force decisions about how collections are made, how payouts are executed, and how customer expectations are managed. Instant transfers, USSD, and digitally settled agent flows are not emerging trends in this context; they are becoming the default rails through which business continuity is maintained. Merchants that delay this transition find themselves reacting under pressure, often with higher costs and greater scrutiny.

At the same time, reduced cash availability reshapes risk and compliance dynamics. Fraud does not disappear; it becomes faster and more visible. AML expectations rise alongside digital adoption, and PSPs place greater weight on whether controls work in real time, not just on paper. Nigeria’s removal from increased FATF monitoring reinforces this focus on durability rather than signalling a relaxation of standards.Looking ahead, Nigeria offers a preview of how other cash-heavy markets may evolve. The trajectory is not toward a cashless society in absolute terms, but toward controlled cash supported by robust digital alternatives. Merchants that approach this shift with intent designing payment flows, controls, and communication together enter 2026 with stability and credibility. Those that treat the clampdown as a temporary inconvenience risk being overtaken by a system that has already moved on.

FAQs

1. What are Nigeria’s new cash withdrawal limits from January 1, 2026?

The CBN’s revised policy introduces weekly cumulative cash withdrawal limits across channels, with additional fees applied once thresholds are exceeded. The intent is to make large-scale cash usage more costly and more controlled.

2. Do the cash limits apply across ATMs, branches, and agent channels?

Yes. The limits are cumulative across channels, which means switching between ATMs, branches, or other access points does not avoid the thresholds.

3. Which merchants are most affected by the cash clampdown?

Cash-intensive and high-volume businesses are impacted first. This includes agent-led models, offline-heavy merchants, gaming and betting operators, digital platforms with frequent payouts, and any business relying on regular cash liquidity.

4. What replaces cash for collections in Nigeria in 2026?

Instant bank transfers and USSD become the primary replacements for cash in most domestic use cases, supported by agent-assisted digital payments where needed.

5. Is USSD still relevant despite growing mobile app adoption?

Yes. USSD remains critical in areas with limited data connectivity or smartphone access and continues to protect conversion for assisted and semi-offline transactions.

6. How does reduced cash availability change fraud risk?

Risk shifts from opaque cash leakage to digital patterns such as structuring, mule activity, and social engineering. Fraud becomes faster and more visible, increasing the importance of real-time monitoring.

7. Will AML checks increase for high-risk merchants after the FATF delisting?

Yes. While Nigeria has been removed from increased monitoring, PSPs and banks focus on proving the durability of reforms. Expectations around audit trails, source-of-funds clarity, and monitoring remain high.

8. What do PSPs expect from merchants after January 1, 2026?

PSPs expect merchants to demonstrate intentional payment design, reduced dependence on cash, effective transaction monitoring, and clear operational explanations for payment behaviour.

9. Does this mean Nigeria is going fully cashless?

No. The shift is toward controlled cash usage supported by digital rails, not the elimination of cash entirely.

10. What is the biggest mistake merchants can make ahead of 2026?

Treating the cash clampdown as a short-term inconvenience rather than redesigning payment flows, controls, and customer communication in advance.