The Middle East is entering 2026 as one of the fastest-growing payments corridors in the world and one of the most closely scrutinised. PSPs operating in or connected to the region are facing a compliance environment that is materially stricter than even a few years ago, not because of a single new rule, but because of how sanctions risk, cross-border flows, and real-time payments now intersect.

This shift is structural. The region sits at the crossroads of global trade, remittances, marketplaces, and FX-linked activity, while also being exposed to rapidly changing sanctions regimes and heightened geopolitical sensitivity. For regulators and correspondent partners, that combination elevates payments risk from a background consideration to a frontline concern.

What has changed most is where compliance is expected to operate. Sanctions screening is no longer viewed as something that can be contained at onboarding. As instant payments, wallets, and high-velocity payouts scale across Middle East-linked corridors, regulators increasingly expect controls to function inside payment flows themselves, at speed and with clear auditability.

This blog explains why PSP compliance expectations in the Middle East are tightening in 2026, how sanctions and screening obligations are evolving from static checks into operational disciplines, and what this means in practice for PSPs and high-risk merchants navigating the region’s payment rails.

- Why the Middle East Has Become a High-Scrutiny Payments Corridor

- Why the Middle East Has Become a High-Scrutiny Payments Corridor

- How Sanctions Compliance Is Shifting from KYC to Payments

- Real-Time Payments and the Shrinking Compliance Window

- Why Middle East-Linked Corridors Trigger Enhanced Due Diligence

- What Regional Regulators Are Signalling Through Enforcement

- Common Sanctions & Screening Failure Points in PSP Models

- What “Stricter Compliance” Looks Like for PSPs in 2026

- What This Means for High-Risk Merchants and Platforms

- Conclusion

- FAQs

Why the Middle East Has Become a High-Scrutiny Payments Corridor

The Middle East’s compliance profile has changed because the risk has moved into the flow, not because the region suddenly became riskier. By 2026, PSPs will be assessed less on where they are licensed and more on how money moves through their systems, who pays whom, through which intermediaries, and at what speed.

Three dynamics converge here. First, transaction growth is genuinely high: marketplaces, FX-linked services, travel, and payout-heavy platforms have expanded rapidly. Second, these flows are inherently cross-border, touching multiple banks, jurisdictions, and correspondent networks. Third, sanctions regimes are more active and more targeted, which means exposure can arise from counterparties, intermediaries, or narratives, not just named customers.

Crucially, scrutiny is now corridor-based. A PSP licensed in a well-regulated jurisdiction can still attract heightened attention if it services routes that intersect with sanctioned programmes, monitored jurisdictions, or complex trade patterns. That’s why compliance expectations “travel” with the payments, regardless of where the PSP sits.

What regulators and partners are responding to is the combination of scale, complexity, and speed:

- High-velocity flows (instant payments, wallets, automated payouts) compress decision windows.

- Layered payment chains (aggregators, marketplaces, nested payouts) blur the true beneficiary.

- FX and trade adjacency increase exposure through intermediaries and payment narratives.

- Ownership complexity makes static KYB insufficient without ongoing monitoring.

The result is a recalibration of trust. PSPs connected to Middle East corridors are expected to demonstrate explainability, the ability to articulate, evidence, and defend how controls operate across the full lifecycle of a payment. Those that can do this move faster. Those that can’t encounter friction that feels sudden but is, in fact, predictable.

Why the Middle East Has Become a High-Scrutiny Payments Corridor

The Middle East’s compliance profile has changed because the risk has moved into the flow, not because the region suddenly became riskier. By 2026, PSPs will be assessed less on where they are licensed and more on how money moves through their systems, who pays them, through which intermediaries, and at what speed.

Three dynamics converge here. First, transaction growth is genuinely high: marketplaces, FX-linked services, travel, and payout-heavy platforms have expanded rapidly. Second, these flows are inherently cross-border, touching multiple banks, jurisdictions, and correspondent networks. Third, sanctions regimes are more active and more targeted, which means exposure can arise from counterparties, intermediaries, or narratives, not just named customers.

Crucially, scrutiny is now corridor-based. A PSP licensed in a well-regulated jurisdiction can still attract heightened attention if it services routes that intersect with sanctioned programmes, monitored jurisdictions, or complex trade patterns. That’s why compliance expectations “travel” with the payments, regardless of where the PSP sits.

What regulators and partners are responding to is the combination of scale, complexity, and speed:

- High-velocity flows (instant payments, wallets, automated payouts) compress decision windows.

- Layered payment chains (aggregators, marketplaces, nested payouts) blur the true beneficiary.

- FX and trade adjacency increase exposure through intermediaries and payment narratives.

- Ownership complexity makes static KYB insufficient without ongoing monitoring.

The result is a recalibration of trust. PSPs connected to Middle East corridors are expected to demonstrate explainability, the ability to articulate, evidence, and defend how controls operate across the full lifecycle of a payment. Those that can do this move faster. Those that can’t encounter friction that feels sudden but is, in fact, predictable.

How Sanctions Compliance Is Shifting from KYC to Payments

For a long time, sanctions compliance at PSPs was treated as a front-door control. Screen the customer at onboarding, refresh periodically, and rely on alerts if something changes. By 2026, that model is no longer considered sufficient for the Middle East–linked payment flows.

The reason is simple: sanctions risk increasingly sits inside transactions, not just inside customer profiles. A customer may screen clean at onboarding, but exposure can arise later through who they pay, who ultimately benefits, which intermediaries are involved, or how funds are routed and described.

Regulators have been clear that sanctions obligations are dynamic. Designations change, ownership structures evolve, and exposure can emerge without the customer themselves being sanctioned. This is why guidance from the U.S. Treasury’s Office of Foreign Assets Control emphasises the need for ongoing, risk-based sanctions controls rather than static checks at entry.

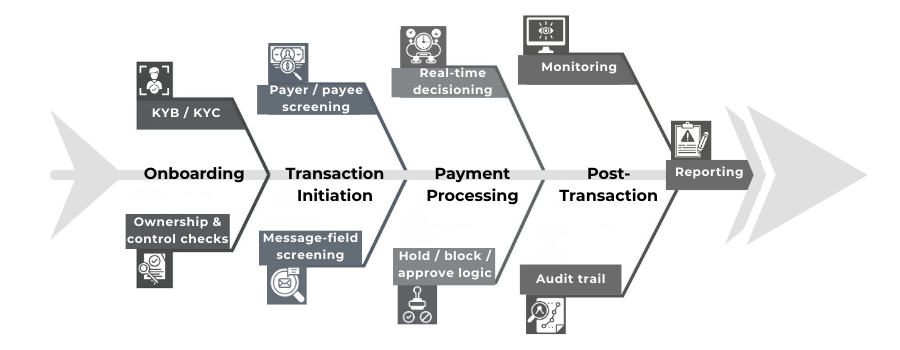

In practice, this shifts sanctions compliance from a KYC exercise to a payments discipline. PSPs are expected to apply screening across the full lifecycle:

- At onboarding, through deeper KYB, ownership and control checks

- At transaction time, screening payers, payees, intermediaries, and relevant message fields

- Through ongoing monitoring, capturing changes in behaviour, counterparties, or exposure

- With clear escalation paths, covering holds, rejections, reporting, and record-keeping

What makes this transition challenging is speed. As instant payments, wallets, and automated payouts become normal across the Middle East, the time available to detect and act on sanctions risk shrinks. Controls must operate reliably at transaction speed, with rules that are well-defined and defensible.

This is also where PSPs feel pressure from multiple directions. Regulators expect effective sanctions controls. Correspondent banks and settlement partners expect explainability. And merchants expect payments to move without unpredictable disruption. Balancing those demands requires sanctions screening to be embedded into payment flows themselves, not bolted on as an afterthought.

By 2026, PSPs that still treat sanctions as a one-off onboarding hurdle will struggle. Those that design controls around how money actually moves are better positioned to operate confidently in high-scrutiny Middle East corridors.

Real-Time Payments and the Shrinking Compliance Window

Real-time payments change the compliance problem in one fundamental way: they remove time. In slower card or bank-transfer environments, PSPs could afford manual review in a small subset of cases without materially harming user experience. In an instant payment world, delays quickly become customer-facing incidents, and “we’ll look at it later” becomes operationally risky.

This is why screening expectations are tightening. If value can move in seconds, sanctions controls must make decisions in seconds too consistently, explainably, and with a clear audit trail. OFAC has directly addressed this challenge in guidance focused on instant payment systems, emphasising risk-based compliance approaches and the importance of designing controls that function in high-speed environments.

What changes in practice is not that PSPs review everything manually. It is that they formalise automated decisioning, backed by governance and evidence. That typically means investing in stronger data hygiene and clearer escalation rules before transactions hit the rails.

Operationally, the 2026 “real-time” compliance stack tends to include:

- Pre-validation and normalisation of names (including transliterations and aliases)

- Automated screening and scoring with tuned thresholds

- Defined outcomes (approve, hold, reject) tied to clear policy logic

- Case management discipline so exceptions are handled consistently

- Audit-ready logs that show what was screened, what matched, and why decisions were made

This is also where PSPs feel the trade-off between false positives and false negatives. In high-speed systems, too many false positives create friction, support tickets, and merchant churn. Too many false negatives create regulatory exposure. The answer is not simply “tighten thresholds”. It is to improve data quality, tune models, and align screening logic with corridor-specific risk.

For the Middle East–linked corridors, the shrinking compliance window is one of the strongest drivers of stricter enforcement.

When payments move instantly, controls must be engineered to keep up. In 2026, the PSPs that succeed are those that treat real-time compliance as an operational capability, not a policy statement.

Why Middle East-Linked Corridors Trigger Enhanced Due Diligence

Enhanced due diligence is no longer reserved for a short list of “obviously high-risk” customers. In 2026, it is increasingly corridor-driven: PSPs are expected to apply deeper checks when payment flows touch jurisdictions or counterparties that raise monitoring expectations, even if the PSP itself operates from a strong regulatory base.

A key reason is that global AML and sanctions risk frameworks are updated continuously. Payment exposure can change as jurisdictions move into or out of increased monitoring, or as typologies evolve. FATF’s list of jurisdictions under increased monitoring is one of the clearest public signals used across the financial system to calibrate due diligence expectations. For PSPs serving Middle East-linked flows, this matters because cross-border commerce and remittance corridors frequently intersect with jurisdictions that counterparties, banks, or regulators treat as higher scrutiny.

In practice, this shifts the compliance question from “Is my customer high-risk?” to “Does this flow create heightened exposure?” That distinction is crucial for platforms, marketplaces, and payout-heavy models, where the end beneficiary may change frequently and where funds can pass through multiple hands quickly.

Where PSPs most often feel this pressure is in three types of activity:

- Remittance and FX-adjacent flows, where counterparties and beneficiaries span multiple jurisdictions

- Marketplace and platform payouts, where nested relationships make the true beneficiary harder to capture cleanly

- B2B trade-linked payments, where intermediaries and narrative fields can introduce exposure outside simple payer/payee screening

This is why EDD in 2026 increasingly focuses on explainability and ownership clarity. PSPs and their banking partners want to understand the customer’s business model, counterparties, beneficiary structure, and how funds are used and returned. The stronger the corridor risk, the less tolerance there is for vague descriptions or incomplete KYB.

For PSPs operating in the Middle East, the practical takeaway is not that every transaction becomes a compliance event. It is that corridor-linked scrutiny makes the baseline deeper: better KYB, clearer controls over beneficiaries, and monitoring designed around how cross-border money movement actually behaves.

What Regional Regulators Are Signalling Through Enforcement

For PSPs, one of the clearest signs that compliance expectations are tightening in 2026 is that regional regulators are not only issuing guidance they are publishing enforcement outcomes. This matters because enforcement is where expectations become measurable. It tells the market what supervisors consider “non-negotiable”, and it shows that weaknesses in controls can carry financial and operational consequences.

The key signal is that regulators are increasingly evaluating effectiveness, not intent. It is no longer enough to show a sanctions policy, a transaction monitoring manual, or an organisational chart with a compliance officer at the top. Supervisors want to see whether controls actually work under volume, whether escalation happens consistently, and whether risk is identified and documented in a way that can withstand review.

This enforcement direction also affects PSPs indirectly. Even if a PSP is not the subject of an action, its partners may tighten requirements in response. Banks, processors, and settlement partners frequently “push down” controls across their networks when regulators demonstrate a higher bar. That’s why PSP compliance tightening often arrives as new onboarding questions, revised thresholds, or changed settlement conditions.

A practical example of this signal is the Central Bank of the UAE’s publication of administrative sanctions and enforcement actions under the UAE’s AML framework [Central Bank of the UAE enforcement actions]. The details vary case by case, but the broader message is consistent: regulators expect firms to detect risk in practice, not just describe controls on paper.

What enforcement is effectively telling PSPs to prioritise in 2026:

- Controls must be documented and operational, not theoretical

- Screening and monitoring must be consistent, with clear decision rules

- Escalations must be traceable, including rationale and outcomes

- Reporting and governance must demonstrate ongoing oversight

In other words, enforcement is reducing the space for “compliance by policy binder”. For PSPs operating across Middle East corridors, the safest interpretation is that the baseline has moved: supervisors want evidence that sanctions and screening controls can function at speed, at scale, and under pressure.

Common Sanctions & Screening Failure Points in PSP Models

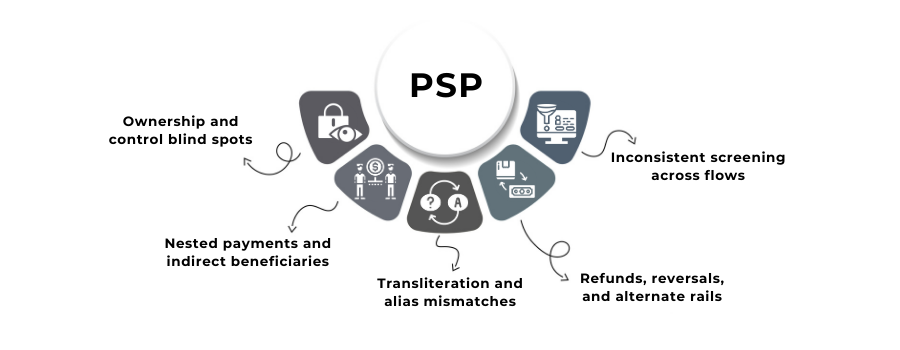

Most sanctions and screening failures in PSPs are not the result of ignoring the rules. They happen because controls were designed for simpler payment journeys than the ones PSPs now operate in 2026. As flows become faster, more layered, and more automated, gaps appear in predictable places.

One recurring weakness is ownership and control visibility. A customer entity may screen clean, but exposure sits with a UBO, a controlling person, or a related entity that is insufficiently mapped. When ownership changes or group structures evolve, static KYB quickly becomes outdated. Without ongoing refresh and linkage, screening loses relevance.

Another common failure point sits in nested and indirect payments. Marketplaces, platforms, and payout aggregators often process payments on behalf of multiple third parties. If the PSP’s model focuses only on the primary merchant, the true beneficiary may never be screened properly. In high-scrutiny corridors, this is one of the fastest ways to attract regulator or bank attention.

Language and data quality issues also create material risk. Transliteration and alias handling are particularly challenging in Middle East–linked flows, where names may appear in multiple scripts and spellings. Poor normalisation leads to two dangerous outcomes at once: false negatives that miss exposure, and false positives that disrupt legitimate payments and erode trust.

Operational blind spots often emerge later in the lifecycle. Refunds, reversals, and rerouting can move funds through different rails or partners than the original payment. If screening logic is applied only at initiation, these secondary movements may escape proper review, creating gaps that are difficult to explain during audits.

Across PSP models, these failure points tend to cluster around a few themes:

- Static controls applied to dynamic payment behaviour

- Incomplete beneficiary identification in multi-party models

- Inconsistent screening logic across different rails and flows

- Weak documentation of why decisions were made at transaction speed

What makes these issues costly is not just regulatory exposure, but the disruption they cause when discovered late. Retrofitting controls under pressure is far harder than designing them upfront. In 2026, PSPs that proactively address these failure points reduce both enforcement risk and day-to-day operational friction.

What “Stricter Compliance” Looks Like for PSPs in 2026

In 2026, “stricter compliance” does not simply mean more alerts or more manual reviews. It means PSPs are expected to run sanctions and screening as an engineered operational capability measurable, repeatable, and defensible under audit.

The direction of travel is towards controls that work across the full payment lifecycle: onboarding, transaction screening, monitoring, and escalation. Regulators and banking partners increasingly want to see that a PSP can make consistent decisions at speed, explain those decisions, and prove that the programme is being tuned and governed over time.

This is also being formalised through supervisory guidance. For example, the European Banking Authority has published guidelines on internal policies, procedures, and controls for compliance with restrictive measures, reinforcing expectations around governance, risk assessment, and effective implementation. While the Middle East is not the EU, these frameworks influence global partner expectations particularly where PSPs touch EU/UK banking corridors.

In practical terms, the 2026 baseline looks like a set of capabilities rather than a set of documents:

- Transaction-level sanctions screening, not just onboarding checks

- Name-matching governance (tuning, thresholds, QA, and audit evidence)

- Clear decision logic for block, reject, or hold scenarios

- Consistent case management with documented rationale and outcomes

- Ongoing KYB refresh and ownership mapping, especially for higher-risk merchants

- Effectiveness metrics, so the programme can be tested and improved

What changes most for PSP leadership is accountability. Compliance can no longer sit as a parallel function that “approves” product direction after the fact. It must be integrated into product design and operations, because real-time payments and high-velocity flows force decisions to be made automatically and continuously.

For PSPs operating across Middle East-linked corridors, stricter compliance in 2026 is best understood as an upgrade in maturity. The winners will be those that can demonstrate two things at once: low-friction payments for legitimate users, and high-confidence controls for corridors where sanctions exposure and regulatory scrutiny are unavoidable.

What This Means for High-Risk Merchants and Platforms

For high-risk merchants and platforms operating in Middle East-linked corridors, stricter PSP compliance in 2026 will feel less like a policy change and more like a change in day-to-day friction. Onboarding questions get deeper. Settlement partners ask for more evidence. Reviews happen earlier and more often. The underlying reason is that PSPs are being pushed to prove they understand and control how money moves, not just who their customers claim to be.

The most immediate impact is on boarding and underwriting. High-risk categories already face tighter acceptance criteria, but in 2026 the focus shifts further towards beneficiary clarity, ownership structure, and transaction explainability. Merchants that cannot clearly map their customer journey, payment flows, and refund logic are more likely to face delays, conditional approvals, or limited corridors.

Platforms and marketplaces feel this even more because they introduce multi-party risk. PSPs increasingly want to know who ultimately receives funds, how sellers or sub-merchants are vetted, and whether payouts can be traced cleanly through the chain. If a platform cannot provide that transparency, it becomes a compliance risk regardless of its headline legitimacy.

Refund handling is another pressure point. In higher-scrutiny environments, PSPs look closely at how refunds, reversals, and cancellations work across rails, especially when money moves quickly. Merchants that treat refunds as an operational afterthought often create the very gaps that trigger PSP escalation: unclear references, inconsistent timelines, and mismatched customer messaging.

The practical preparation for merchants is not complicated, but it is specific. Merchants and platforms that are “easy to onboard” in 2026 typically have:

- Clear KYB and ownership documentation that stays current

- A simple explanation of who pays, who gets paid, and why

- Rail-aware refund rules and customer communication

- Evidence of monitoring and controls proportional to their risk profile

The key message is that stricter compliance does not automatically mean lower acceptance. It means PSPs will favour merchants that are operationally mature and transparent. In Middle East corridors where sanctions and screening pressure is rising, credibility is built through clarity and clarity reduces friction.

Conclusion

By 2026, sanctions and screening in the Middle East are no longer peripheral compliance checks. They sit at the core of how payments are designed, routed, and settled. The tightening of PSP compliance is not driven by a single new regulation, but by the reality that risk now lives inside high-speed, cross-border payment flows rather than at static onboarding points.

For PSPs, this means that effective compliance is measured by how well controls operate in practice: at transaction speed, across complex corridors, and under regulatory scrutiny. Sanctions screening, monitoring, escalation, and documentation must function as an integrated system, not as disconnected policy layers. Firms that invest in this maturity gain operational resilience and credibility with regulators and banking partners alike.

For merchants and platforms, the message is equally clear. Stricter compliance does not automatically reduce access to payment services, but it does raise the bar for transparency and preparedness. Businesses that can clearly explain their flows, beneficiaries, and controls move faster and face fewer disruptions.

In the Middle East, payments growth and compliance intensity are rising together. Treating sanctions compliance as a payment discipline rather than a one-time hurdle is what allows PSPs and merchants to operate confidently in 2026 and beyond.

FAQs

1. Why is sanctions compliance becoming stricter for PSPs in the Middle East?

Because the region combines high transaction growth, cross-border corridors, and elevated sanctions exposure. Regulators and banking partners now expect sanctions controls to operate inside payment flows, not only at onboarding.

2. Is sanctions screening required on every transaction in 2026?

In practice, yes for higher-risk corridors. PSPs are expected to apply transaction-level screening proportionate to risk, especially where instant payments or cross-border flows are involved.

3. How do real-time payments change sanctions and screening expectations?

They reduce the time available for manual intervention. Compliance controls must make automated, defensible decisions at payment speed, with clear audit trails.

4. What role does FATF monitoring play in PSP risk decisions?

FATF’s jurisdictions under increased monitoring influence how PSPs calibrate due diligence. Corridor exposure to monitored jurisdictions often triggers enhanced controls, even if the PSP itself is well licensed.

5. Why are refunds and reversals a sanctions risk?

Because funds may move through different rails or intermediaries than the original payment. If screening is applied only at initiation, secondary movements can create compliance gaps.

6. How do transliteration issues affect sanctions screening in the Middle East?

Names may appear in multiple scripts and spellings. Weak normalisation increases both false negatives and false positives, undermining screening effectiveness.

7. What evidence do regulators expect from PSPs during audits?

They expect proof of effectiveness: documented decision logic, transaction-level screening records, escalation rationale, and evidence that controls are tuned and governed over time.

8. How can high-risk merchants prepare for stricter PSP onboarding in 2026?

By maintaining clear KYB documentation, mapping beneficiaries and payment flows accurately, and aligning refund and payout logic with the rails they use.

9. Does stricter compliance mean higher decline rates for legitimate merchants?

Not necessarily. PSPs with mature, well-designed controls can reduce friction for legitimate activity while maintaining strong sanctions protection.

10. Is sanctions compliance now a product issue as well as a compliance issue?

Yes. In 2026, sanctions controls must be embedded into payment design and operations, making compliance a shared responsibility across product, risk, and engineering teams.