Expanding into a new market used to be as simple as adding another acquirer or switching on cross-border processing. By 2026, that model will no longer be enough. Payment systems are becoming more localised, domestic rails are strengthening, and regulators are placing greater scrutiny on how merchants route and settle transactions. For high-risk and cross-border merchants especially, choosing the wrong acquiring model can lead to lower approval rates, higher costs and avoidable regulatory exposure.

The core decision merchants now face is whether to enter a country using local acquiring integrating with an acquirer based in that jurisdiction or cross-border acquiring, where processing is handled from another market. Each path has its strengths, limitations and hidden operational implications. Local acquiring generally delivers trust and higher approvals, while cross-border acquiring offers speed and easier onboarding. But neither approach is universally correct.

This blog breaks down the real-world trade-offs between the two models and offers a clear framework for selecting the right strategy for your 2026 expansion plans.

- What Local and Cross-Border Acquiring Actually Mean

- The 2026 Market Reality: Why “One Acquirer for All Regions” No Longer Works

- Approval Rates: Why Local Acquiring Outperforms Cross-Border (Issuer Behaviour Breakdown)

- Cost Structure Comparison: Interchange, FX, Scheme Fees & Operational Overheads

- Compliance Requirements: When Local Acquiring Is Mandatory

- Local APM Access: Why Cross-Border Acquirers Can’t Deliver Regional Methods

- Speed vs Sustainability: When Cross-Border Acquiring Is Still the Better Entry Model

- The Hybrid Strategy: How Successful Merchants Blend Both Models in 2026

- Operational Checklist: What Merchants Need Before Choosing Their Entry Model

- Market-by-Market Snapshot (Short Capsules)

- Case Scenarios: Choosing the Right Model Based on Merchant Type

- 2026 Decision Framework: When to Choose Local vs Cross-Border

- Conclusion

- FAQs

What Local and Cross-Border Acquiring Actually Mean

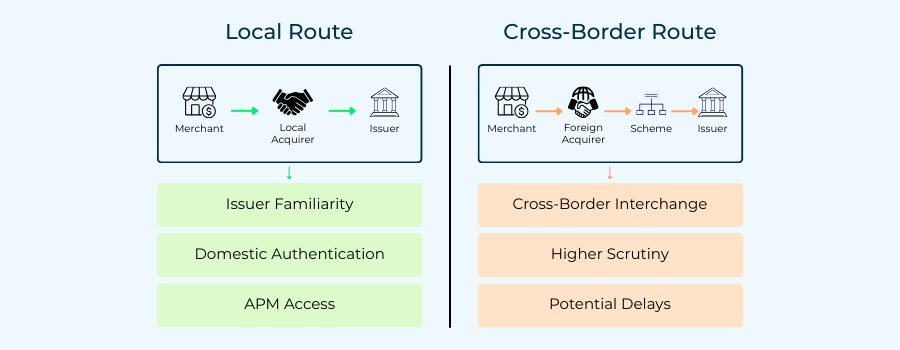

Understanding the difference between local and cross-border acquiring is essential before evaluating a strategy. Although both routes process card payments, issuers interpret them very differently, which directly affects approval rates, fees and customer experience.

Local acquiring means the merchant uses an acquirer based in the same country as the customer’s payment instrument. The transaction is treated as domestic, using local clearing, domestic scheme rules and familiar risk indicators. This typically results in higher approval rates, clearer SCA handling and access to local payment methods that cross-border acquirers cannot support.

Cross-border acquiring routes the transaction through an acquirer in a different jurisdiction. This offers faster onboarding and lower operational burden, especially for early-stage market entry. However, issuers often view cross-border traffic as unfamiliar or higher risk, which can lead to more soft declines, additional authentication and increased FX-related fees.

For merchants expanding internationally, these definitions are not academic they influence performance, compliance exposure and whether the local market will treat the merchant as a trusted participant or a foreign outsider.

The 2026 Market Reality: Why “One Acquirer for All Regions” No Longer Works

For years, merchants could rely on a single cross-border acquirer to serve multiple regions. That model is becoming increasingly outdated. In 2026, payment ecosystems are shifting toward regionalisation, driven by regulatory reforms, domestic scheme growth and the rise of country-specific instant payment systems.

Across the EU, PSD3 and PSR are reshaping how issuers evaluate transactions, making domestic routing and transparent authentication more important. In LATAM, payment behaviour is dominated by instant systems like PIX and SPEI, with domestic acquirers holding a structural advantage. India’s UPI, supported by regulatory mandates, requires local integrations, while Southeast Asia continues to rely heavily on local wallets and national payment rails.

These shifts mean global acquirers can no longer offer universal performance across markets. Domestic schemes, local risk scoring models and market-specific compliance rules increasingly require local acquiring relationships. Merchants who depend solely on cross-border acquiring risk higher decline rates, missing access to key payment methods, and slower alignment with domestic regulatory expectations.

The global expansion landscape is no longer one-size-fits-all each new market demands a tailored acquisition approach.

Approval Rates: Why Local Acquiring Outperforms Cross-Border (Issuer Behaviour Breakdown)

Approval rates are often the deciding factor when merchants evaluate acquiring models. The gap between local and cross-border performance is rarely accidental it stems from how issuers assess the risk and familiarity of each transaction.

When a payment is processed through a local acquirer, issuers recognise domestic BIN ranges, local regulatory signals and familiar routing patterns. The transaction travels through domestic clearing systems, presenting fewer unknowns. This alignment gives issuers greater confidence, leading to fewer soft declines and smoother authentication flows. For many merchants, especially in high-risk verticals, this familiarity can be the difference between sustainable volume and persistent approval challenges.

Cross-border acquiring introduces additional layers: foreign acquirer codes, cross-border interchange, varied authentication paths and inconsistent metadata. Issuers may classify these signals as higher risk, even when the underlying customer is legitimate. This results in more issuer-initiated declines, additional SCA frictions and unpredictable performance, especially in markets with strict domestic rules.

Merchants expanding into new markets quickly learn that issuers reward transactions that look and behave like local payments. That inherent trust absent in most cross-border flows is a central reason why local acquiring consistently outperforms in approval rates.

Cost Structure Comparison: Interchange, FX, Scheme Fees & Operational Overheads

Choosing between local and cross-border acquiring isn’t only about approval rates—the cost structure behind each model can materially change a merchant’s profitability. Local acquiring is often associated with lower fees, but it also comes with onboarding demands and operational considerations. Cross-border routes offer simplicity but introduce additional charges that can accumulate quickly.

Local acquiring usually benefits from domestic interchange rates, no cross-border markups and reduced FX exposure. For merchants processing high volumes or operating in heavily regulated regions, these savings can be significant. However, local acquiring may require separate contracts, local compliance checks and settlement accounts in each jurisdiction.

Cross-border acquiring simplifies setup by allowing merchants to operate through a single acquirer across regions. Yet the added cost of cross-border fees, FX margins and higher scheme charges can make this model more expensive over time—especially in markets where domestic rails dominate.

Cost Snapshot: Local vs Cross-Border

| Cost Element | Local Acquiring | Cross-Border Acquiring |

| Interchange | Domestic rates | Cross-border uplift |

| FX Costs | Low or none | Higher FX margin exposure |

| Scheme Fees | Domestic programs | International scheme fees |

| Operational Effort | Higher onboarding | Simplified setup |

| Long-Term Cost Efficiency | Usually stronger | Depends on volume + market |

A clear understanding of these cost layers helps merchants choose the model that aligns with both their immediate priorities and long-term strategy.

Compliance Requirements: When Local Acquiring Is Mandatory

Compliance can often determine whether a merchant must use local acquiring rather than treat it as a strategic choice. Several regions now impose rules that restrict or discourage cross-border processing, particularly for high-risk sectors or for transactions involving domestic payment schemes.

India is one of the clearest examples. Under the Reserve Bank of India’s regulatory framework, UPI transactions operate entirely within the domestic ecosystem, and card transactions increasingly follow localisation requirements. Merchants entering India need domestic acquiring relationships to access the most widely used payment methods and to comply with data-residency expectations.

Brazil has taken a similar direction through the growth of PIX. Although not formally restricting cross-border acquiring, the practical reality is that major payment volume flows through domestic rails, and issuers expect local acquiring signals. Foreign acquirers struggle to match the performance of domestic institutions due to local clearing rules and fraud-monitoring expectations.

In the UAE, domestic schemes and local bank preferences lead many sectors especially high-risk or high-value to rely on local acquiring for predictable approval rates and compliance alignment. Markets like Turkey (with the TROY scheme) and Mexico (SPEI) follow the same pattern, where access to core payment options effectively requires local acquisition.

For merchants entering these regions, compliance isn’t simply another consideration it becomes the defining factor in how transactions must be routed.

Local acquiring isn’t just a way to improve performance; in many markets, it is the only way to participate properly in the payments ecosystem.

Local APM Access: Why Cross-Border Acquirers Can’t Deliver Regional Methods

As consumer preferences shift away from cards, access to local Alternative Payment Methods (APMs) has become a defining factor in successful market entry. These methods ranging from instant payment systems to national wallets are deeply embedded in regional behaviour. The challenge for merchants is that most APMs require local acquiring or local PSP infrastructure to function correctly.

Examples are increasingly visible across key growth markets. In Brazil, PIX dominates daily payments and is only accessible through domestic connections. In the Netherlands, iDEAL remains the preferred method for online purchases, and its routing depends on local bank integrations. India’s UPI, one of the fastest-growing payment systems globally, operates exclusively within domestic networks. Other examples include Bancontact in Belgium, BLIK in Poland, PayNow in Singapore and PromptPay in Thailand all of which rely on country-specific settlement systems.

Cross-border acquirers generally cannot support these methods because they lack access to domestic clearing rails or the regulatory licensing needed to route funds locally. Even when a cross-border provider claims to offer support, the experience is often indirect or reliant on intermediaries, which weakens performance and adds operational costs.

For merchants expanding into new markets, APM access is no longer optional. Without local acquiring or domestic PSP partnerships, they risk missing the payment options most trusted by local consumers undermining both conversion and long-term market viability.

Speed vs Sustainability: When Cross-Border Acquiring Is Still the Better Entry Model

Despite its limitations, cross-border acquiring remains a practical and often necessary starting point for merchants entering new markets. It offers a level of speed and simplicity that local acquiring cannot always match. For businesses that want to test early demand, validate product-market fit or move quickly ahead of competitors, cross-border onboarding provides a fast route to market without the administrative overhead of local licensing, tax registration or contract negotiation.

Cross-border acquiring is especially useful for low-risk digital merchants, where issuers are more tolerant of foreign acquirer signals and where payment behaviour is already globalised. In markets with strong international card adoption parts of Western Europe, North America and certain GCC corridors, cross-border acquiring can deliver acceptable performance while keeping operational complexity low.

However, this model is best viewed as a temporary bridge rather than a long-term solution. Approval rates may be sufficient during the initial phase, but they typically plateau as volume grows, and cross-border fees can erode margins. Regulatory expectations may also tighten over time, particularly in regions where domestic schemes and local APMs dominate.

Cross-border acquiring works when the priority is speed. It becomes less effective when the priority becomes sustainability, optimisation and deep market penetration.

The Hybrid Strategy: How Successful Merchants Blend Both Models in 2026

Most global merchants no longer treat local and cross-border acquiring as an either–or decision. In 2026, the most effective expansion strategies combine both models, using each where it delivers the greatest advantage. This hybrid approach recognises that cross-border acquiring offers speed, while local acquiring delivers depth and resilience.

A typical strategy begins with cross-border onboarding to launch quickly and test early performance. This allows merchants to assess demand, evaluate corridor behaviour and identify the payment methods most important to local customers. Once volume stabilises and regulatory expectations become clearer, merchants add one or more local acquirers to improve approval rates, reduce FX exposure and access domestic payment rails.

The real advantage emerges when these routes are combined through an orchestration layer. With intelligent routing, transactions can be sent to the acquirer most likely to approve based on customer location, issuer behaviour, risk signals and payment method. Local acquirers handle domestic traffic, while cross-border routes serve as fallbacks or support regions where local acquiring is not yet in place.

This staged, blended model reduces operational risk and ensures merchants can adapt as regulations, payment habits and domestic schemes continue to evolve. It allows businesses to enter markets quickly without sacrificing long-term performance and regulatory alignment.

Operational Checklist: What Merchants Need Before Choosing Their Entry Model

Choosing between local and cross-border acquiring is not only a commercial decision it is an operational one. Before committing to either model, merchants need clarity on the regulatory, technical and financial implications of entering a new market. A well-prepared operational foundation helps prevent unexpected delays, onboarding failures or compliance issues once payment volumes begin to scale.

Key considerations before selecting your acquiring model

Merchants should begin by assessing MCC restrictions and sector rules in the target market. Some jurisdictions impose specific licensing or local partnership requirements for industries such as gaming, digital wallets, financial services or subscription products. Understanding these constraints early helps determine whether local acquiring is mandatory or simply advantageous.

Settlement and banking requirements also play a role. Local acquiring may require domestic settlement accounts, tax registration or foreign entity formation, while cross-border routes typically settle funds centrally.

Merchants must decide whether these operational steps align with their expansion timeline and resources.

Payment method availability is another essential factor. If the market relies heavily on domestic APMs or national instant payment systems, local acquiring becomes considerably more valuable. PSP capability is equally important; not all providers support both models, and fewer still offer seamless orchestration between them.

By reviewing these operational elements in advance, merchants can enter new markets with a strategy that supports approvals, compliance and long-term scalability not just rapid deployment.

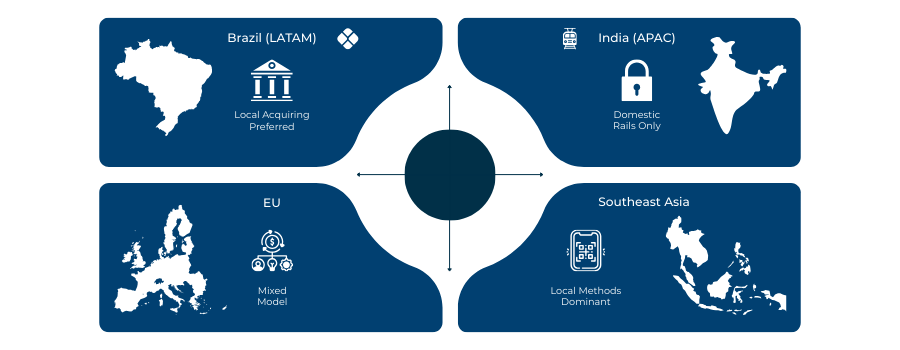

Market-by-Market Snapshot (Short Capsules)

Understanding how acquiring models behave in different regions helps merchants choose the right entry strategy. Each market has its own regulatory culture, payment preferences and issuer expectations. These short profiles highlight the practical realities merchants face when expanding internationally.

Brazil

Brazil’s payment landscape is anchored by PIX, the instant-payments network that has rapidly become the country’s dominant method. While card payments remain strong, issuers favour domestic routing, and many merchants see materially better approval rates with local acquiring. Cross-border setups often struggle with issuer suspicion, FX costs and inconsistent authentication. For long-term expansion, domestic connections are the practical standard.

India

India’s payments ecosystem is shaped by UPI and strict regulatory oversight. Local acquiring is effectively required for merchants who want to access the full suite of domestic methods and comply with data-handling and tokenisation rules. Cross-border acquiring can work for limited testing, but it cannot deliver the performance or compliance alignment needed for sustained growth.

European Union

PSD3 and PSR are reshaping the European acquiring environment, increasing transparency expectations around routing, SCA and FX. While cross-border acquiring remains functional within the Single Market, local acquirers often outperform due to issuer familiarity and access to domestic schemes such as Bancontact, Girocard and Cartes Bancaires. Merchants should prepare for corridor-specific performance differences.

Southeast Asia (SEA)

SEA markets are highly fragmented, with countries favouring their own domestic wallets and instant systems. Singapore’s PayNow, Thailand’s PromptPay and Malaysia’s FPX dominate online payments, and each requires domestic integrations for best performance. Cross-border acquiring is useful for early entry but cannot deliver the full payment mix without local support.

Case Scenarios: Choosing the Right Model Based on Merchant Type

Every merchant faces a different set of demands when entering a new market. Sector, risk level, transaction profile and customer expectations all shape whether local or cross-border acquiring is the better choice. These scenarios illustrate how businesses in different verticals might approach their 2026 expansion strategy.

Digital Subscription Merchant Entering the EU

A low-risk subscription merchant selling software or media can often begin with cross-border acquiring. Issuers in the EU are accustomed to international digital services, and approval rates for these categories are generally stable. As subscription volumes grow or churn optimisation becomes important, adding a local acquirer improves recurring billing performance and reduces SCA friction.

Gaming Operator Entering Brazil

For gaming and entertainment merchants, cross-border acquiring is rarely sufficient. Issuers monitor these sectors closely, and domestic behaviour heavily favours PIX and local routing. Local acquiring is the practical entry point, ensuring predictable approvals and compliance alignment. Cross-border routes may support initial testing but cannot sustain long-term performance.

EdTech Platform Expanding into India

India’s regulatory landscape and domestic rails make local acquiring the default choice. UPI integration is essential, and foreign acquirers cannot deliver the compliance or payment coverage required. Merchants may test demand using international card rails, but meaningful scale requires domestic connections and alignment with local onboarding rules.

Marketplace Entering the UAE

Marketplaces face complex settlement, KYC and risk-management requirements. Cross-border acquiring can speed up early entry, but local acquiring becomes necessary once payouts, domestic wallets and sector oversight come into play. A hybrid approach is common: cross-border to launch, local acquiring added as volume and regulatory obligations deepen.

2026 Decision Framework: When to Choose Local vs Cross-Border

Choosing the right acquisition model for a new market is no longer a simple technical decision. It depends on how approval rates, compliance obligations, payment behaviour and operational readiness intersect. This framework provides a structured way for merchants to decide which model aligns with their 2026 expansion goals.

When Local Acquiring Is the Right Choice

Local acquiring makes sense when issuers rely heavily on domestic signals or when the market’s preferred payment methods are tied to national rails. Merchants who operate in high-risk categories, depend on recurring billing or require access to local APMs generally perform better with domestic acquiring. It also becomes the default choice in countries where regulatory rules or sector licensing limit cross-border processing.

When Cross-Border Acquiring Works Best

Cross-border acquiring is suitable when the priority is fast entry with minimal administrative overhead. Low-risk digital categories can often launch effectively with international routing, especially in markets where card behaviour is already globalised. This model is also useful for testing new geographies before committing to local onboarding and infrastructure.

When a Hybrid Strategy Delivers the Most Value

Most merchants find the best results by blending both approaches. Cross-border acquiring supports rapid deployment, while local acquiring improves long-term approval rates, reduces FX costs and enables access to domestic methods. With orchestration, transactions can be routed dynamically to whichever path offers the highest likelihood of success.

This framework helps merchants move beyond a one-size-fits-all approach and choose the acquiring model that supports both immediate entry and long-term scalability.

Conclusion

Expanding into a new market in 2026 requires more than switching on another payment route. As domestic schemes grow stronger and regulators tighten expectations, merchants must choose acquiring models that fit the local environment rather than relying on a single global solution. Local acquiring delivers trust, approvals and access to regional payment methods, while cross-border acquiring offers the speed and simplicity needed for early testing and rapid deployment.

In practice, most merchants benefit from a staged strategy launching quickly with cross-border connections and adding local acquiring as demand, compliance requirements and payment preferences become clearer. With the support of orchestration, this blend becomes even more powerful, allowing traffic to be routed intelligently across corridors and acquirers.

The right acquiring model is ultimately the one that aligns with your market’s behaviour, your regulatory obligations and your long-term goals. In a world where payments are becoming more local, flexibility and localisation are no longer optional; they are essential to sustainable global growth.

FAQs

1. What is the main difference between local acquiring and cross-border acquiring?

Local acquiring uses an acquirer in the same country as the customer, allowing transactions to be processed domestically with familiar issuer signals. This often leads to higher approval rates and access to local payment methods. Cross-border acquiring routes transactions through foreign acquirers, offering faster onboarding but typically resulting in higher fees and more issuer friction. The choice depends on the merchant’s market entry strategy, risk profile and payment method requirements.

2. Why do approval rates improve with local acquiring?

Issuers trust transactions more when they originate from domestic routes because they recognise the acquirer, BIN ranges and regional authentication patterns. Local acquiring reduces uncertainty and supports domestic schemes and real-time payment systems. This alignment improves SCA performance and reduces soft declines. Cross-border acquiring lacks these familiar signals, so issuers may treat the traffic as higher risk, resulting in more declines or additional authentication.

3. When should a merchant choose cross-border acquiring first?

Cross-border acquiring is useful when speed is the priority. It allows merchants to launch quickly without setting up local entities, tax registrations or domestic settlement accounts. This model works well for early-stage testing or low-risk digital goods where issuer tolerance for foreign acquirers is high. However, merchants should expect to transition to local acquiring as volume grows, customer expectations evolve or access to local payment methods becomes essential.

4. Is local acquiring mandatory in some markets?

Yes, regulatory and market conditions in countries such as India, Brazil, Mexico and Turkey effectively require local acquiring to access key payment methods or comply with sector rules. Some high-risk verticals also face licensing or MCC restrictions that limit cross-border processing. Even when not mandatory, local acquiring often delivers better performance and long-term resilience due to issuer familiarity and domestic scheme participation.

5. Can cross-border acquiring support local payment methods like PIX or UPI?

Generally, no. Local APMs rely on domestic clearing systems and regulatory frameworks that cross-border acquirers cannot access. Methods such as PIX, UPI, BLIK, Bancontact, iDEAL, PayNow and PromptPay require local connections or domestic PSP partnerships. While some providers offer indirect support, performance and reliability usually decline. For merchants expanding into markets dominated by APMs, local acquiring becomes essential.

6. Does cross-border acquiring always mean higher processing costs?

Not always, but it often introduces additional cost layers such as cross-border interchange, FX margins and enhanced scheme fees. Local acquiring typically provides lower domestic rates and eliminates cross-border uplifts. However, it may require investment in local onboarding, compliance and settlement accounts. The most cost-efficient model depends on transaction volume, market complexity and long-term growth plans.

7. How does orchestration support both acquiring models?

Orchestration platforms allow merchants to route transactions dynamically between acquirers based on customer location, issuer behaviour, risk signals and performance trends. This makes hybrid strategies far more effective. Cross-border connections support early testing, while local acquiring handles domestic traffic for higher approvals and access to APMs. Orchestration ensures each transaction flows through the best-performing route without adding friction to the user journey.

8. What should merchants evaluate before choosing an acquiring model?

Key considerations include regulatory obligations, MCC restrictions, preferred payment methods in the target market, settlement requirements and the merchant’s operational capacity. Merchants should also assess PSP capabilities, long-term compliance expectations and anticipated transaction volumes. Understanding these factors early helps avoid onboarding delays and ensures the expansion strategy is both scalable and resilient.

9. Is a hybrid acquiring model common in 2026?

Yes, most global merchants now adopt a hybrid model, launching markets quickly using cross-border acquiring and later adding local acquirers to improve approvals and reduce costs. With orchestration in place, businesses can combine both routes seamlessly, sending each transaction to the acquirer most likely to approve it. This approach supports both early-market agility and long-term optimisation.

10. Which model is better for high-risk merchants?

High-risk merchants generally benefit more from local acquiring because issuers apply stricter scrutiny to cross-border traffic in regulated sectors. Local routes provide stronger signals, better authentication support and clearer compliance alignment. Cross-border acquiring may still be useful during the testing phase, but sustainable performance typically requires domestic acquirer relationships.