Japan has been saying goodbye to cash for years, just not loudly. Unlike markets where governments force abrupt transitions, Japan’s move toward digital payments has been slow, deliberate, and often misunderstood. Cash still plays a visible role in daily life, but behind the scenes, merchant economics, policy nudges, and changing customer expectations are steadily reshaping how payments are accepted.

By 2026, this shift stops being theoretical for merchants. Rising labour costs, reconciliation friction, and the operational drag of handling cash are colliding with a more mature digital payments ecosystem built around cards, QR wallets, and transport-linked e-money. The result is not a cash ban, but a growing reality where cash becomes harder to justify at scale especially for businesses serving tourists, running high-volume physical locations, or operating across channels.

For merchants, the real change is not about adding more payment methods. It is about rethinking acceptance as a strategic decision. Which methods actually convert customers? Which ones protect margins? And which ones introduce risk or friction when volume grows? In Japan, these questions now matter as much as brand or location.

This blog breaks down why Japan’s “long goodbye to cash” is accelerating, what recent digital payment policies and ecosystem developments really mean for merchants, and how acceptance choices in 2026 increasingly affect cost control, customer experience, and PSP appetite particularly for higher-risk or cross-border businesses.

- Why Japan Still Loves Cash (and why that’s changing anyway)

- The Policy Push Behind the Scenes (what ‘digital payment policy’ really means in Japan)

- Acceptance Reality in 2026 (Cards, QR, Wallets, and Cash)

- Merchant Economics (why ‘cash is cheap’ is increasingly false)

- Risk and Compliance Shift (what changes for high-risk merchants as digital grows)

- What Merchants Must Rethink by 2026

- Merchant Checklist (Japan 2026 Acceptance Readiness)

- Conclusion

- FAQs

Why Japan Still Loves Cash (and why that’s changing anyway)

Japan’s attachment to cash is rooted in trust, reliability, and habit. Cash works exceptionally well in a society with low crime, high service standards, and a long history of face-to-face commerce. For many small merchants, especially outside major cities, cash has also felt predictable: no processing fees, no settlement delays, and no technical dependencies. These factors explain why cash has remained resilient long after other developed markets tipped decisively towards digital.

That resilience, however, masks a growing mismatch between cultural comfort and operational reality. Cash is trusted by consumers, but it is increasingly inconvenient for merchants. Handling physical money consumes staff time, complicates reconciliation, and introduces logistical costs that rarely appear on a simple profit-and-loss line. As labour shortages deepen and retail formats become more automated, the hidden cost of cash becomes harder to ignore.

Demographics are another quiet driver of change. Japan’s ageing population has historically reinforced cash usage, but it is also accelerating the adoption of unattended retail, self-checkout, and streamlined service models.

These formats favour payment methods that are fast, traceable, and easy to integrate into automated workflows. At the same time, inbound tourism has altered expectations in high-traffic areas, where cash-only acceptance now feels like friction rather than tradition.

What is changing, therefore, is not consumer sentiment overnight, but merchant tolerance. Cash still feels safe, but it no longer scales cleanly. As digital alternatives become more reliable and interoperable, merchants are starting to question whether preserving cash as a default makes economic sense in 2026.

Several forces are now nudging behaviour away from cash, even without mandates:

- Rising operational costs, as staffing, cash handling, and reconciliation consume more time and resources

- Productivity pressure, particularly in convenience retail, food service, and transport-adjacent locations

- Tourist-driven expectations, where cashless acceptance is assumed rather than optional

- Automation and self-service growth, which expose cash as a bottleneck rather than a facilitator

The result is a gradual but meaningful shift. Cash is not disappearing from Japan, and it is unlikely to do so soon. But its role is changing from a universal default to a contextual option, used where it genuinely adds value rather than out of habit. For merchants planning for 2026, understanding this distinction is critical. The question is no longer whether customers still like cash, but whether the business can afford to rely on it in the same way as before.

The Policy Push Behind the Scenes (what ‘digital payment policy’ really means in Japan)

Japan’s digital payment policy is often misunderstood because it does not behave like policy in other markets. There are no deadlines for going cashless, no public crackdowns on cash usage, and no aggressive mandates for merchants. Instead, the signal is delivered through where effort, funding, and coordination are directed.

If you look at policy outcomes rather than policy language, a pattern emerges. Authorities are not trying to remove cash from consumer behaviour. They are trying to make digital acceptance easier to operate at scale than cash.

What policy is really optimising for

At its core, Japan’s approach treats payments as infrastructure. The focus is on reducing friction for merchants who want to support multiple digital methods without increasing complexity. This is why so much emphasis is placed on standardisation, interoperability, and ecosystem coordination rather than on promoting individual payment brands.

From a merchant’s perspective, the most important shift is that fragmentation is no longer being tolerated as a cost of doing business. Where managing several QR schemes or wallet providers once meant juggling terminals, settlements, and support processes, policy-backed standardisation is designed to flatten that operational burden.

This is not a consumer-facing change. Most customers will not notice it directly. Merchants will.

How this shows up in practice by 2026

Rather than rewriting the rules overnight, policy nudges show up as changed expectations across the ecosystem. PSPs, acquirers, and platforms align their products and onboarding logic to these signals.

By 2026, merchants increasingly encounter a world where:

- Supporting multiple digital methods is assumed, not exceptional

- QR and wallet acceptance is expected to be cleanly integrated, not bolted on

- Acceptance choices are viewed as a proxy for operational maturity

Notice that none of this requires banning cash. The pressure comes from comparison. As digital acceptance becomes easier to deploy and manage, cash begins to look like the least efficient option, not the safest one.

Why this matters for high-risk and cross-border merchants

For higher-risk merchants, this policy direction has a second-order effect. Digital payments create data. Data creates visibility.

Visibility changes how PSPs evaluate merchants. As digital volumes rise, underwriters expect clearer explanations of transaction behaviour, refund logic, and customer funding patterns.

This is why policy in Japan should be read as preparatory, not coercive. It lays the groundwork for a payments environment where digital acceptance is normalised and scrutinised, while cash gradually loses its role as a neutral fallback.

For merchants planning for 2026, the key insight is simple: policy is not telling you to stop accepting cash. It is telling you that the system is being built around digital first. Aligning acceptance strategy with that direction early reduces friction later operationally, commercially, and with PSP partners.

Acceptance Reality in 2026 (Cards, QR, Wallets, and Cash)

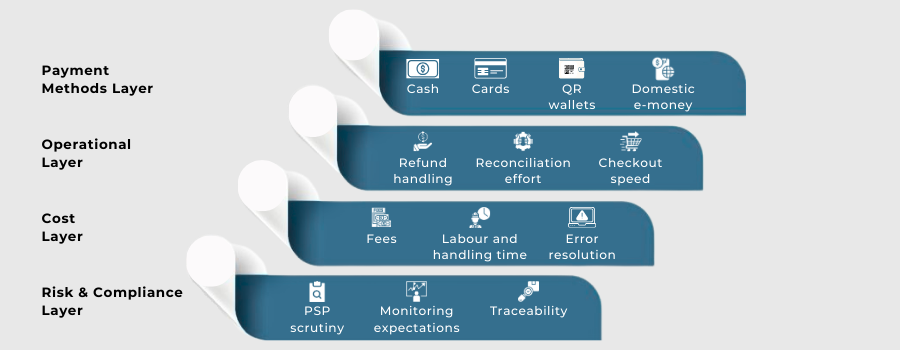

By 2026, payment acceptance in Japan will no longer be a binary choice between cash and cards. It is a layered acceptance mix, shaped by where a merchant operates, who they serve, and how much operational complexity they can absorb. The mistake many businesses still make is treating acceptance as a checklist rather than a design decision.

What matters most is not which method is growing fastest in headlines, but which combinations actually work in day-to-day operations.

Cards: still the anchor, but no longer the whole solution

Cards remain the backbone of value-heavy transactions in Japan. They are familiar, trusted, and essential for inbound tourism, higher-ticket retail, and cross-border commerce. For many merchants, cards still account for a disproportionate share of revenue even as other methods grow by volume.

However, relying on cards alone exposes two pressures. First, cost sensitivity remains acute for low-margin domestic merchants. Second, cards are not always the fastest or most reliable option in high-throughput physical environments such as convenience retail or food service. By 2026, cards are expected, but they are no longer sufficient on their own.

QR wallets: from optional add-on to mainstream acceptance

QR wallets have crossed an important threshold in Japan. What began as fragmented experimentation has matured into everyday usage, particularly for small-value, high-frequency transactions. Large wallet ecosystems now operate at national scale, which changes merchant calculus: ignoring QR acceptance increasingly means turning away routine spend.

Operationally, QR wallets succeed where they reduce friction at the point of sale and shorten queues. Their weakness appears when merchants add them without orchestration, creating staff confusion, reconciliation headaches, and inconsistent refund handling. In 2026, the difference between success and frustration is not whether a merchant accepts QR wallets, but how cleanly they are integrated.

Domestic wallets and transport-linked e-money

Transport-linked e-money and domestic wallets continue to play a distinct role in physical retail. Their strength lies in speed and familiarity for local customers, particularly in urban commuting corridors. For merchants, these methods often feel invisible when they work well and painfully disruptive when systems fail or offline fallback is poorly planned.

These rails rarely replace cards or QR wallets entirely, but they form an important part of the acceptance mix in locations where throughput and reliability matter more than flexibility.

Where cash still fits and where it doesn’t

Cash has not vanished, and it likely will not. In some neighbourhoods and merchant categories, it remains culturally comfortable and operationally simple. The difference in 2026 is that cash increasingly fails the scalability test. Staffing constraints, reconciliation effort, and the opportunity cost of slower checkout make cash harder to justify in growth-oriented environments.

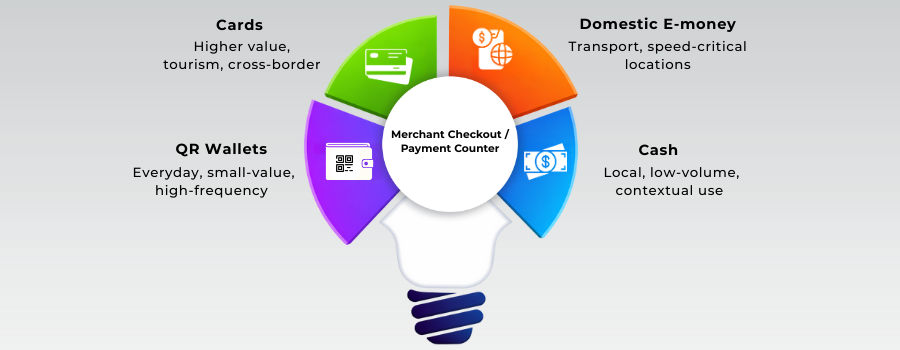

Seen together, Japan’s acceptance reality by 2026 tends to settle around a few practical truths:

- Cards handle higher-value and cross-border spend reliably

- QR wallets absorb everyday, high-frequency transactions efficiently

- Domestic e-money supports speed-critical physical locations

- Cash persists where volumes are low and expectations are local

The merchants that perform best are not those chasing every new payment method, but those that deliberately balance this mix. Acceptance in Japan has become less about coverage and more about coherence ensuring that each method serves a clear purpose, fits operational capacity, and aligns with customer behaviour.

Merchant Economics (why ‘cash is cheap’ is increasingly false)

For many Japanese merchants, cash has long felt inexpensive because its costs are indirect. There is no explicit processing fee, settlement feels immediate, and the workflow is familiar. But by 2026, this perception increasingly breaks down once merchants look beyond the surface and account for time, labour, and operational drag.

The first pressure point is staffing. Counting tills, preparing floats, handling discrepancies, and making bank deposits all consume staff hours that do not generate revenue. In a labour-constrained environment, those hours become expensive. As stores extend opening times or adopt self-service formats, cash handling becomes a bottleneck rather than a convenience.

Reconciliation is the second hidden cost. Cash does not integrate neatly with modern reporting systems. Errors surface late, audits take longer, and identifying the root cause of discrepancies often requires manual investigation. As transaction volumes rise, these inefficiencies compound, creating management overhead that digital rails largely avoid.

There is also an opportunity cost that merchants increasingly recognise. Cash slows throughput. In high-traffic environments, even small delays at the till translate into longer queues, lost impulse purchases, and customer frustration. Digital payments, when implemented cleanly, shorten transaction time and smooth peak demand — a benefit that rarely appears in simple fee comparisons.

When merchants evaluate acceptance purely on headline costs, they miss the broader economic picture. By 2026, the true cost comparison looks more like this:

- Labour and handling time outweigh visible processing fees

- Delayed error detection increases operational risk and management effort

- Lower throughput limits revenue during busy periods

- Cash logistics (storage, transport, deposits) add friction as scale grows

Digital payments are not free, and merchants are right to scrutinise fees. The difference is that digital costs are predictable and scalable, while cash costs grow unevenly and often invisibly. As businesses expand, the gap between perceived cost and real cost widens.

This is why acceptance decisions in Japan are shifting from habit to analysis. Merchants are no longer asking which method feels cheapest today, but which one supports sustainable operations tomorrow. In 2026, cash still has a role, but it is no longer the low-cost default many businesses once assumed it to be.

Risk and Compliance Shift (what changes for high-risk merchants as digital grows)

As Japan’s acceptance mix tilts further towards digital payments, risk and compliance do not suddenly become stricter by decree. Instead, they become more visible and harder to ignore. For high-risk merchants, this shift matters because digital payments remove the ambiguity that cash once provided and replace it with data, patterns, and expectations.

When cash dominated, many risk issues stayed buried in operational noise. Refunds were informal, transaction trails were thin, and unusual behaviour was difficult to spot in real time. As more volume moves onto cards, QR wallets, and domestic digital rails, those blind spots close. Every transaction leaves a record, and those records invite questions.

Why digital growth changes the compliance conversation

The most important change is not regulation itself, but how merchants are evaluated. PSPs and acquirers increasingly view payment acceptance as a signal of operational maturity.

A merchant that routes meaningful volume through digital rails is expected to understand where funds come from, how refunds work, and what “normal” behaviour looks like across channels.

This is particularly relevant for higher-risk categories such as digital services, marketplaces, subscription models, or cross-border commerce. As digital share grows, underwriters look less at static documentation and more at whether a merchant’s day-to-day behaviour makes sense.

In practice, scrutiny shifts towards questions like:

- Are transaction sizes and frequencies consistent with the business model?

- Do refund patterns align with the payment methods used?

- Can the merchant explain spikes, promotions, or seasonal anomalies?

- Is there clear ownership of risk and compliance internally?

The quiet tightening of expectations

Japan’s approach to compliance mirrors its approach to payments policy: gradual, indirect, and expectation-driven. There are few dramatic announcements, but the baseline steadily rises. As digital payments become normal, “we didn’t know” stops being an acceptable answer.

Several risk dynamics become more pronounced as digital volume increases:

- Traceability improves, making inconsistencies easier to detect

- Velocity and pattern analysis become more relevant than single large transactions

- Refund and chargeback behaviour attracts more attention across wallets and cards

- Cross-border flows are examined more closely as data quality improves

For high-risk merchants, this means that acceptance design and compliance design can no longer be separated. How customers pay affects how the business is assessed.

What this means operationally

Merchants that adapt well tend to professionalise quietly. They document payment flows, align refund logic with each rail, and ensure that customer support, finance, and risk teams share the same understanding of how money moves. This does not require heavy-handed controls or customer friction, but it does require intentional design.

Those that do not adapt often experience compliance pressure indirectly: slower onboarding, additional PSP questions, delayed settlements, or unexpected reviews. These are rarely framed as punishment, but they signal misalignment with how the ecosystem now operates.

By 2026, digital growth in Japan does not mean higher risk by default. It means less tolerance for opacity. For high-risk merchants, the opportunity lies in using digital acceptance to demonstrate clarity and control, rather than treating it as a compliance burden imposed from outside.

What Merchants Must Rethink by 2026

By 2026, the biggest mistake merchants make in Japan is treating payment acceptance as a static decision. The market no longer rewards businesses that simply “add” methods over time. Instead, it favours those that design acceptance intentionally, with a clear understanding of cost, customer behaviour, and operational risk.

The first rethink is about default behaviour. Many merchants still present cash as the primary option and digital methods as alternatives. As digital usage grows, this hierarchy quietly works against efficiency. Customers follow cues. When digital methods are hidden, inconsistently signposted, or awkward at the till, cash continues to dominate even when it is slower and more expensive for the business.

The second rethink is about complexity management. Japan’s acceptance landscape includes cards, multiple QR wallets, domestic e-money, and cash. Adding each method independently creates confusion for staff, fragmented settlements, and reconciliation delays. By 2026, merchants that perform best are those that simplify the experience behind the scenes, even if the front-end choice appears broad.

Several acceptance assumptions no longer hold and need to be challenged:

- Cash keeps things simple in reality, it shifts complexity into staffing, reconciliation, and audit

- More methods always improve conversion unmanaged choice often increases errors and support load

- Refunds are the same everywhere digital rails behave differently and require rail-specific handling

- Compliance is separate from payments acceptance choices increasingly influence PSP risk assessments

Another area that requires rethinking is customer segmentation. Japan’s payment behaviour is not uniform. Local customers, commuters, tourists, and online buyers all bring different expectations. Treating acceptance as one-size-fits-all leads to overengineering in some contexts and underperformance in others. By 2026, merchants increasingly tailor acceptance by location, channel, and transaction size.

Finally, merchants must rethink how acceptance connects to internal ownership. Payment decisions often sit between operations, finance, and customer support, with no single owner accountable for outcomes. As digital volume grows, this fragmentation creates blind spots. Successful merchants bring acceptance design, reconciliation, refunds, and risk under a shared operational framework.

The shift required is not dramatic, but it is deliberate. Japan’s move away from cash does not demand radical change overnight. It demands that merchants stop treating acceptance as an afterthought and start treating it as part of their core operating model. Those that do so by 2026 find that digital payments are not just easier to manage than cash, but more supportive of sustainable growth.

Merchant Checklist (Japan 2026 Acceptance Readiness)

This checklist is designed as a final readiness filter, not a to-do list. If most of these statements are true for your business, your acceptance strategy is likely aligned with where Japan is heading in 2026.

Start with the acceptance mix itself. Merchants that are ready for 2026 have clarity on why each payment method exists and what role it plays.

- Our core payment methods reflect how our customers actually pay (local customers, commuters, and tourists).

- Cards, QR wallets, and any domestic e-money options are orchestrated, not added independently.

- Cash is supported where it adds value, but it is not required for day-to-day operations to function smoothly.

Next, look at operations and cost control. Digital acceptance only delivers value when it reduces friction rather than shifting it elsewhere.

- Staff are trained to handle multiple payment methods confidently, without slowing checkout.

- Reconciliation is largely automated and does not rely on manual end-of-day fixes.

- Refunds are handled differently by rail, with clear rules and customer communication.

Finally, consider risk and PSP alignment. As digital volume grows, acceptance maturity becomes part of how merchants are assessed.

- We can clearly explain our payment flows, refund logic, and transaction patterns to PSPs or acquirers.

- Monitoring and reporting scale with transaction volume rather than reacting after issues arise.

This checklist is not about eliminating cash or chasing every new payment method. It is about ensuring that acceptance supports the business rather than constraining it. Merchants that can answer “yes” to most of these points enter 2026 with flexibility, lower operational stress, and stronger credibility with payment partners.

Conclusion

Japan’s shift away from cash has never been about speed. It has been about control, reliability, and economic sense. By 2026, that quiet approach reaches a point where merchants can no longer ignore the operational trade-offs of holding on to cash as a default. Digital payments are not replacing cash out of ideology; they are doing so because they increasingly fit how modern businesses need to operate.

For merchants, the real change is not which payment methods exist, but how acceptance is designed. Cards, QR wallets, domestic e-money, and cash all still have roles to play. The difference is that those roles must now be intentional. Acceptance decisions directly affect checkout efficiency, cost structure, reconciliation workload, and how payment partners assess risk and professionalism.

High-risk and cross-border merchants feel this shift first. As digital volumes rise, traceability improves and tolerance for ambiguity falls. Businesses that treat acceptance as part of their operating model, rather than a surface-level choice, find it easier to scale, onboard with PSPs, and respond to scrutiny without disruption.

Japan’s long goodbye to cash is not an abrupt ending, but it is no longer optional to plan for it. Merchants that rethink acceptance now balancing customer expectations, operational reality, and risk enter 2026 with resilience. Those that delay may still accept cash, but they do so in a system that has quietly moved on.

FAQs

1. Is Japan becoming cashless by 2026?

No. Japan is not eliminating cash. Instead, cash is gradually becoming less practical for merchants at scale, while digital payments take on a larger operational role.

2. Why does cash still play such a strong role in Japan?

Cash remains trusted, familiar, and culturally accepted. Low crime, reliable infrastructure, and long-standing habits all contribute to its continued use.

3. What payment methods matter most for merchants in Japan by 2026?

Cards, QR wallets, and domestic e-money schemes form the core acceptance mix. Cash still exists, but it no longer supports growth efficiently on its own.

4. Are QR wallets replacing cards in Japan?

No. QR wallets complement cards rather than replace them. Cards remain important for higher-value and cross-border spend, while QR wallets handle everyday transactions.

5. Why is acceptance design becoming more important for merchants?

Because payment methods now affect cost control, checkout speed, reconciliation effort, and how PSPs assess operational maturity.

6. How does digital acceptance change risk and compliance expectations?

Digital payments create clearer transaction trails. This increases visibility and reduces tolerance for unclear refund logic, inconsistent patterns, or weak monitoring.

7. What challenges do merchants face when adding multiple payment methods?

Poor orchestration can lead to staff confusion, reconciliation issues, and inconsistent customer experiences, even if conversion initially improves.

8. Do tourists influence Japan’s move towards digital payments?

Yes. Inbound tourism has raised expectations for card and wallet acceptance, particularly in urban and high-traffic areas.

9. Should merchants still accept cash in 2026?

In many cases, yes, but as a contextual option rather than a default. Cash works best where volumes are low and expectations are local.

10. What is the biggest acceptance mistake merchants make today?

Adding payment methods without a clear strategy, resulting in higher complexity, higher costs, and operational friction rather than better performance.