Instant euro transfers are no longer an optional upgrade. With the Instant Payments Regulation (IPR), they are becoming a regulatory expectation.

For merchants operating in Europe, this marks a structural shift. Payments that once moved within banking hours will now move around the clock. A settlement that could be delayed for operational comfort will happen in seconds. Screening, verification, refunds, and reconciliation processes that rely on batch timing will be transitioned to real-time paths.

Merchants that treat IPR as a banking or PSP issue are likely to experience downstream problems, including refunds that fail because accounts are closed, sanctions checks that block legitimate payments, customer support teams unable to explain rejected transfers, and reconciliation processes that no longer align with ledger timing. None of these failures looks dramatic in isolation, but together they erode trust and operational control.

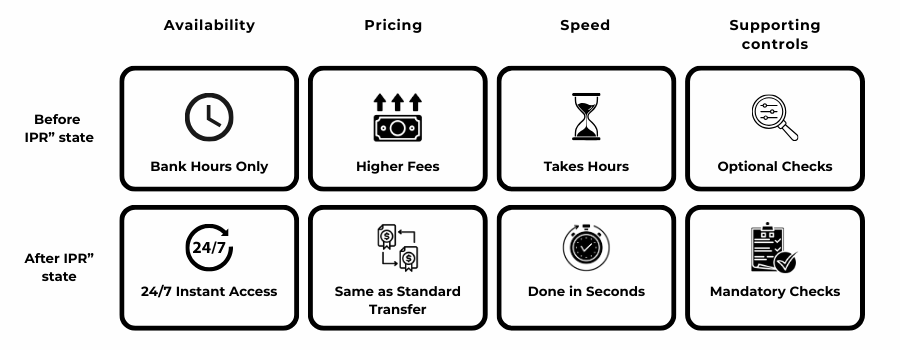

IPR does not introduce instant payments to Europe. SEPA Instant already exists. What it does is remove optionality. It standardises availability, tightens timelines, and forces supporting controls verification, screening, and refunds to operate at the same speed as money itself.

Merchant readiness, therefore, is not about enabling a new rail. It is about making sure existing payment, risk, and finance processes can function when euro transfers never sleep.

- What IPR mandates and timelines

- What changes for merchants using SEPA Instant

- Verification of Payee and CX impact

- Sanctions screening in real time

- Refund and reconciliation readiness

- Merchant KPIs post-IPR

- Latency becomes a risk signal, not a performance metric

- First-contact resolution for payment queries matters more than volume

- Refund initiation time replaces refund completion time

- Screening false positives surface commercially, not just compliantly

- Reconciliation backlog becomes a leading indicator

- KPI alignment matters more than KPI count

- Conclusion

- FAQs

What IPR mandates and timelines

The Instant Payments Regulation is not a policy signal. It is an operational mandate with fixed deadlines.

At its core, IPR requires that euro credit transfers offered by payment service providers must be available in instant form, twenty-four hours a day, every day of the year. The regulation removes the distinction between “standard” and “instant” as optional product tiers and reframes instant execution as the default expectation for euro transfers within scope.

For merchants, the significance lies less in the availability of the rail and more in the conditions attached to it. IPR does not simply accelerate payment execution. It pulls surrounding obligations pricing, screening, verification, and availability into the same real-time frame.

Mandatory availability, not selective rollout

Under IPR, PSPs that already offer euro credit transfers must also offer instant euro transfers, subject to limited transitional periods. This removes the ability to segment customers, hours, or corridors based on operational convenience. If a merchant can receive or send a euro transfer, that transfer may now arrive instantly, regardless of time or day.

From a merchant perspective, this eliminates predictable “quiet periods”. Payment inflows and outflows can occur at any moment, which has knock-on effects for cash visibility, refund timing, and customer communications.

Price parity requirements

One of the less discussed but more impactful mandates is price parity. Instant euro transfers cannot be priced higher than equivalent non-instant transfers.

This matters because it changes behaviour. When instant execution carries no additional cost, customers will default to it. Merchants should assume that, over time, a growing proportion of bank-based payments and refunds will move via instant rails, even if they did not actively promote them.

Operational models built on a mix of slow and fast transfers will gradually skew toward fast-only reality.

Tight execution timelines

IPR formalises execution expectations measured in seconds, not hours. Once initiated, an instant transfer must be credited to the beneficiary’s account almost immediately, with clear confirmation of success or failure.

For merchants, this compresses decision windows. Controls that relied on post-submission checks, end-of-day reconciliation, or delayed exception handling will no longer sit comfortably within the payment flow. Either a decision is made in real time, or the payment fails.

Phased enforcement, permanent impact

While the regulation includes staged implementation dates to allow PSPs to adapt, the end state is clear. Once fully in force, instant availability becomes a baseline requirement, not a premium feature.

Merchants should treat the timeline as a countdown to a steady state, not a grace period to defer preparation. The earlier processes are adapted to real-time assumptions, the less disruptive the transition will be.

The critical point is this: IPR standardises speed, but it also standardises responsibility. When money moves instantly, delays, reversals, and explanations must keep pace.

What changes for merchants using SEPA Instant

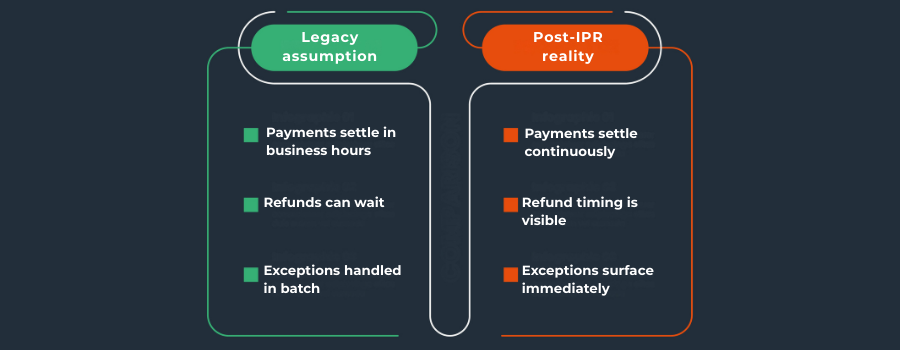

For merchants already connected to SEPA Instant, IPR does not introduce a new rail. It changes how unavoidable that rail becomes and what is expected to happen around it.

Before IPR, SEPA Instant could be treated as conditional. Some payments arrived instantly, others followed standard clearing cycles. That variability allowed merchants to design processes around probability. After IPR, instant execution becomes the norm, and probabilistic thinking starts to break down.

Payment acceptance stops being time-bound

One of the most immediate shifts is the loss of temporal buffering.

SEPA Instant payments can arrive outside business hours, weekends included, and under IPR that behaviour is no longer exceptional. For merchants, this means authorisation, booking, and fulfilment logic must assume that funds may be irrevocably credited at any time.

If downstream systems still assume “next business day” confirmation, gaps emerge quickly. Orders may be released without inventory updates. Digital access may be provisioned without final state confirmation. Support teams may see payments customers can already see, but internal systems cannot yet reconcile.

The change is subtle, but persistent. Time-based assumptions that once failed occasionally will now fail systematically.

Irrevocability becomes operationally visible

SEPA Instant has always been irrevocable in practice, but IPR makes that characteristic unavoidable.

Merchants that relied on informal recall expectations, manual intervention, or post-payment adjustments will find those paths increasingly unreliable. Once a transfer settles, funds are gone. There is no equivalent of a card reversal window or a soft dispute phase.

This increases the importance of pre-acceptance confidence. If a payment is accepted and processed, the merchant must be comfortable living with that decision. The room for correction shifts earlier in the flow.

Exception handling moves from batch to real time

Many merchants built SEPA-related exception handling around batches: end-of-day reviews, queued refunds, delayed account corrections.

Instant execution compresses those workflows. Exceptions now surface in real time, and customers notice immediately. A rejected payment, a blocked refund, or a delayed confirmation becomes a live customer experience issue rather than a back-office adjustment.

This is where operational friction often appears first not in payment success rates, but in support volume and response quality.

Treasury and cash visibility tighten, not loosen

It is tempting to assume that instant settlement improves treasury visibility automatically. In reality, it removes smoothing effects.

Cash positions update continuously, not predictably. Inflows and outflows no longer cluster around clearing cycles. For merchants with automated liquidity management, this can be an advantage. For those relying on manual forecasting or scheduled sweeps, it introduces noise.

The practical implication is that treasury, finance, and payments teams need to agree on what “available” means in a 24/7 environment.

SEPA Instant stops being a “special case”

Perhaps the most important change is psychological.

Under IPR, SEPA Instant is no longer something merchants opt into, test cautiously, or isolate operationally. It becomes part of the baseline payment fabric. Processes designed to treat it as an edge case will increasingly feel brittle.

Merchants that adapt successfully are the ones that stop asking how to handle instant payments and start asking how their core operations behave when speed is no longer optional.

Verification of Payee and CX impact

Verification of Payee (VoP) is one of the most visible consequences of IPR for merchants, because it inserts risk logic directly into the customer journey. Unlike sanctions screening or settlement timing, VoP does not sit quietly in the background. It intervenes at the moment a payer confirms details and it does so in plain language.

For merchants, the challenge is not understanding what VoP does. It is understanding how customers interpret it.

What VoP actually verifies

VoP does not validate identity in a broad sense. It checks consistency.

Specifically, it compares the beneficiary name provided by the payer with the name held by the beneficiary’s bank for the destination account. The outcome is not binary approval or rejection. It is a match signal, typically expressed as a confirmation, a close match, or a mismatch.

That nuance matters. VoP is designed to reduce misdirected payments and certain fraud types, not to certify trustworthiness. Treating it as a fraud verdict leads to poor CX decisions.

Why customers experience VoP as friction

From a customer’s perspective, VoP interrupts a flow that previously felt final. They have entered details, initiated a payment, and are now being asked to reconcile names they may not fully control or recognise.

This friction shows up in predictable ways:

- Confusion over trading names versus legal entities

- Mismatch warnings for marketplaces or PSP collection accounts

- Abandoned payments when the warning feels accusatory

Customers do not distinguish between a warning and a block. They interpret both as risks.

Where merchants unintentionally amplify the problem

Many merchants worsen the CX impact of VoP through language choices rather than technical implementation.

Using phrasing that implies error or fault rather than inconsistency pushes customers into doubt. So does failing to prepare support teams to explain why a warning appeared and what it actually means.

Another common mistake is inconsistency across channels. If the name displayed at checkout does not match the name registered with the bank, VoP warnings become inevitable. The customer sees two “official” names and assumes one of them is wrong.

Designing for VoP without undermining trust

Merchants that handle VoP well do two things early. First, they align naming across customer touchpoints. The name customers see when they pay should be the name VoP expects to verify. Where that is not possible such as in marketplace or PSP-led collection models they explain this clearly before payment initiation.

Second, they treat VoP outcomes as guidance, not judgement. A mismatch does not automatically mean fraud. For many legitimate payments, it reflects structural realities of how accounts are held.

The goal is not to eliminate VoP warnings. It is to ensure customers understand them quickly enough to continue with confidence.

The broader CX trade-off

VoP improves safety by slowing things down slightly at a critical moment. That trade-off is intentional. Under IPR, speed without verification increases systemic risk; verification without explanation increases abandonment.

Merchants that get the balance right recognise that VoP is now part of the payment conversation. It needs copy, design, and support training not just compliance sign-off.

Sanctions screening in real time

Sanctions screening has always existed in euro payments. What IPR changes is when the decision must be made.

Under batch-based models, screening could sit alongside clearing cycles. Alerts could be reviewed, queued, and resolved before settlement without the customer ever noticing. Instant execution removes that cushion. Screening outcomes now need to resolve in seconds, not hours and they do so in the middle of a live payment flow.

For merchants, this is less a compliance problem than a latency problem.

Screening moves from safety net to gatekeeper

In an instant environment, sanctions screening is no longer a backstop. It becomes a gatekeeper.

Payments cannot be conditionally accepted while checks complete. They either pass immediately, or they fail visibly. This forces a hard choice: screen fast enough to keep the flow moving, or block payments that would previously have cleared without issue.

The operational implication is simple but uncomfortable. Screening systems that were “good enough” in batch contexts become sources of friction when forced into real time.

False positives become customer-facing events

In batch screening, false positives are inconvenient. In real time, they are experiential.

A flagged payment now looks like a rejection, not a review. Customers see failure messages, not queues. For legitimate users, this feels indistinguishable from a technical error or a lack of funds.

Merchants often underestimate how quickly this escalates into support volume. Customers do not ask about sanctions lists. They ask why their payment “didn’t work.”

The cost of over-screening rises sharply

To avoid regulatory risk, some merchants default to conservative screening thresholds. In real time, that strategy becomes expensive.

Every additional false positive interrupts conversion, delays fulfilment, and generates manual follow-up. Over time, this erodes trust in instant payments as a channel even though the underlying rail is functioning correctly.

IPR does not change sanctions obligations. It changes the price of imprecision.

Designing escalation paths that still fit instant flows

The most resilient models separate decision from resolution.

Instead of treating every alert as a hard stop, merchants design graduated responses. Low-confidence matches may trigger delayed fulfilment rather than outright rejection. Higher-confidence matches result in immediate failure with clear customer messaging.

This approach accepts that not all risk decisions can be perfect in real time but that not all decisions need to be final either.

What breaks first when screening is not ready

When sanctions screening cannot keep pace with instant execution, the failures are predictable:

- Increased payment abandonment

- Rising “technical error” complaints

- Manual review backlogs created after the fact

- Tension between compliance and commercial teams

None of these look like sanctions issues on a dashboard. They look like payment performance problems.

The merchant reality under IPR

Real-time screening forces a reframing. The question is no longer “Are we compliant?” It is “Can we make compliant decisions at the speed of money?”

Merchants that invest in reducing screening latency and improving alert quality protect both conversion and compliance. Those that do not may technically meet regulatory obligations while operationally undermining instant payments as a usable channel.

Refund and reconciliation readiness

Instant payments compress time in one direction. Refunds and reconciliation are where that compression is felt most sharply.

Under pre-IPR models, merchants could rely on asymmetry. Inbound payments might arrive slowly, but refunds could be processed in batches. Reconciliation could catch up overnight. Exceptions could be parked until the next working day. IPR collapses those buffers. When money arrives instantly, customers expect money to return just as fast and systems are judged accordingly.

Refund expectations shift from policy to capability

From a customer’s point of view, instant payments redefine what a “reasonable” refund looks like.

If a euro transfer arrives in seconds, a refund that takes days feels broken, even if it complies with stated policy. Support teams may explain processing timelines, but customers increasingly compare experience, not terms. The result is higher dispute initiation for what are technically correct, but operationally slow, refunds.

For merchants, the issue is not whether refunds are allowed. It is whether refund paths can operate at the same cadence as inbound instant flows. Where they cannot, friction appears immediately.

Closed accounts and one-way money flows

Instant payments increase the likelihood of structural refund failures. Customers may send funds from accounts that are later closed, switched, or inaccessible. In a batch world, this was rare and often resolved manually. In a real-time world, it becomes routine. Refund attempts fail, funds are returned late or via alternative channels, and reconciliation complexity rises.

Merchants that assume refunds are a mirror image of payments quickly discover they are not. Instant in does not guarantee instant or even possible out.

Reconciliation stops being a daily exercise

Traditional reconciliation relies on predictability. Files arrive at known times. Balances move in expected windows. Exceptions are grouped.

Instant execution breaks that rhythm. Transactions post continuously. Ledger balances change outside finance team hours. Exceptions surface one by one, not in batches.

The risk here is not loss, but opacity. When reconciliation processes remain time-bound while payments become time-agnostic, visibility gaps open. Teams see balances that move faster than explanations.

Preparing refunds and reconciliation for a 24/7 reality

Merchant readiness does not require instant refunds in all cases. It requires clarity.

Clear customer messaging about refund timing.

Clear internal rules about when instant refunds are possible.

Clear reconciliation logic that distinguishes “received”, “available”, and “accounted”.

IPR does not demand that every back-office process become instant. It demands that merchants understand which ones must, and which ones must at least be honest about their limits.

Merchant KPIs post-IPR

Once instant euro transfers become the default, many familiar metrics lose their explanatory power. Success rates stay high. Volumes grow. Yet operational friction increases anyway. The reason is simple: IPR shifts where stress appears. Merchant KPIs need to move with it.

The goal is not to track instant payments as a product. It is to measure whether the business still functions smoothly when time is removed as a buffer.

Latency becomes a risk signal, not a performance metric

Under batch models, latency was largely invisible to merchants. Under IPR, it becomes diagnostic.

The most useful question is no longer “Did the payment succeed?” but “How long did the decision take?” This applies across the flow: sanctions screening, payee verification outcomes, refund initiation, and exception handling.

Rising decision latency is often the earliest indicator that systems are struggling to keep up with real-time demands, even if success rates remain stable.

First-contact resolution for payment queries matters more than volume

Instant payments change customer behaviour. When something fails or looks wrong, customers ask immediately.

Tracking payment-related support volume alone misses the point. The more revealing KPI is first-contact resolution for instant-payment queries. A drop here usually signals that frontline teams lack either visibility or authority to explain outcomes created by real-time controls.

Where this KPI deteriorates, dispute risk often follows.

Refund initiation time replaces refund completion time

Traditional refund KPIs focus on completion: how long it takes for money to reach the customer. Under IPR, initiation timing becomes just as important.

Merchants should distinguish clearly between:

- Time to refund initiation

- Time to refund completion

Customers judge responsiveness based on the first. Schemes and regulators often judge compliance based on the second. Tracking both prevents teams from optimising one at the expense of the other.

Screening false positives surface commercially, not just compliantly

Sanctions screening has always been monitored through compliance dashboards. Under IPR, its commercial impact needs visibility too.

Useful indicators include:

- Payment failures attributed to screening

- Repeat attempts after screening rejection

- Drop-off following unexplained payment errors

These metrics help identify when conservative screening thresholds are undermining conversion, even while remaining technically compliant.

Reconciliation backlog becomes a leading indicator

In a 24/7 payment environment, reconciliation delays accumulate quietly.

Rather than measuring end-of-day completion, merchants benefit from tracking:

- Outstanding unreconciled instant transactions

- Average time to explanation for balance changes

- Exception ageing by hour, not day

When these numbers creep up, finance teams are being asked to explain movement faster than systems can support.

KPI alignment matters more than KPI count

The biggest post-IPR risk is not missing a metric. It is measuring the same event differently across teams.

Payments may report success.

Finance may report unexplained variance.

Support may report rising confusion.

All three can be true at once.

Merchants that succeed under IPR align KPIs around shared moments: payment initiation, decision, customer notification, and accounting recognition. When those moments drift apart, friction grows even if individual dashboards look healthy.

Conclusion

The Instant Payments Regulation does not introduce a new way to move euros. It removes the option to move them slowly.

For merchants, that distinction matters. IPR forces payment execution, verification, screening, refunds, and reconciliation onto the same timeline. Processes that once relied on delay, batching, or manual catch-up are now exposed in real time, often in front of customers. The friction that follows is rarely dramatic, but it is persistent and it compounds.

What this readiness assessment shows is that instant payments are not primarily a payments team problem. They are an operating-model problem. Verification decisions now affect conversion. Sanctions screening shapes customer experience. Refund mechanics influence dispute risk. Reconciliation speed determines trust between finance, support, and payments teams.

Merchants that struggle under IPR will not do so because they failed to enable SEPA Instant. They will struggle because adjacent systems were never designed to operate continuously, visibly, and without recovery windows.

Merchant readiness, therefore, is not about ticking regulatory boxes. It is about removing assumptions that time will absorb mistakes. In a 24/7 euro environment, time no longer does.

Those who adapt early treat instant execution as the new baseline and redesign around it. Those who do not will remain compliant on paper while absorbing unnecessary friction in practice.

FAQs

1. Does the Instant Payments Regulation apply directly to merchants?

No. IPR obligations apply primarily to payment service providers. However, merchants are indirectly affected because the regulation changes how euro transfers are executed, verified, and screened. If merchant systems and processes cannot operate in real time, friction will surface quickly even if the PSP is technically compliant.

2. Will all euro payments become instant under IPR?

Not all payments, but instant execution becomes the default expectation wherever euro credit transfers are offered. Customers will increasingly assume that euro payments and refunds move immediately, regardless of whether the merchant actively promotes instant transfers.

3. Does IPR make refunds instant by default?

IPR does not mandate instant refunds. What it changes is customer expectation and operational pressure. When payments arrive instantly, slow refunds feel broken, even if they are policy-compliant. Merchants need to distinguish clearly between refund initiation and completion to manage this gap.

4. How does Verification of Payee affect conversion?

Verification of Payee introduces a warning layer into the payment flow when beneficiary names do not match. This can reduce misdirected payments but may also cause confusion or abandonment if merchant naming is inconsistent or poorly explained. The impact on conversion depends largely on copy, design, and customer education.

5. Why is sanctions screening more difficult with instant payments?

Instant execution removes the time buffer that batch screening relied on. Screening decisions must now resolve in seconds, not hours. False positives therefore become visible customer-facing failures rather than back-office exceptions, increasing both support volume and conversion risk.

6. What breaks first when merchants are not IPR-ready?

Typically, not payments themselves. The earliest stress appears in customer support, refund handling, and reconciliation. Customers see payments succeed but refunds fail or explanations lag. Internally, finance teams struggle to explain continuously moving balances.

7. Which KPIs matter most after IPR goes live?

Latency, not volume. Metrics that track decision speed, refund initiation time, first-contact resolution for payment queries, and reconciliation backlog become more meaningful than traditional success-rate reporting in a 24/7 environment.

8. Is IPR mainly a compliance issue or an operational one?

Operational. Compliance determines whether instant payments are offered. Operations determine whether they work smoothly. Most merchant pain under IPR comes from processes that still assume business hours, batch timing, or delayed exception handling.