The European payments landscape entered a structurally different phase after the October 2025 enforcement of the Instant Payments Regulation (IPR). What initially appeared to be a compliance-driven infrastructure upgrade has begun to reshape commercial incentives across the ecosystem. A December 2025 industry analysis by Giesecke+Devrient (G+D) brought this shift into sharp focus, estimating that 20–25% of traditional card volume is exposed to substitution risk as banks and merchants accelerate the use of account-to-account (A2A) instant payments.This is not a prediction of the end of cards. It is a signal that cost, speed, and control dynamics are changing fast enough to matter in underwriting and checkout strategy discussions today. With instant euro payments now a regulatory baseline rather than an optional rail, merchants and PSPs face a recalibration of margins, risk ownership, and consumer expectations.

The End of the 3-Day Settlement Model

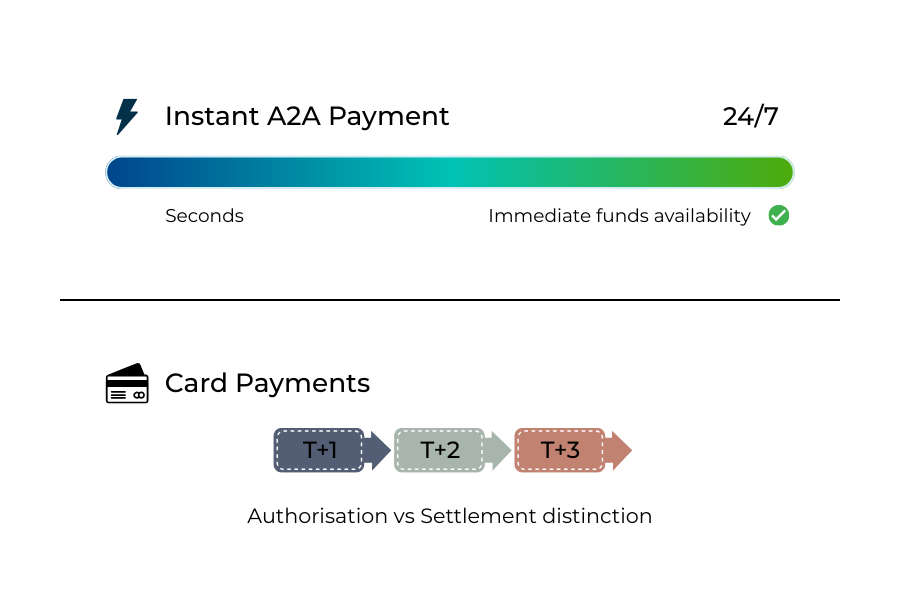

For decades, European e-commerce has been built around deferred settlement. Card payments authorised today typically settle on a T+1 to T+3 basis, depending on acquirer arrangements and cross-border routing. That delay shaped everything from cash-flow planning to refunds and reconciliation.

The IPR replaces that model with a clear operational expectation: euro payments settle within seconds, 24/7. The regulatory requirement outlined by the European Central Bank mandates that instant euro credit transfers be available continuously and executed within 10 seconds.

This matters because settlement speed changes behaviour. When consumers and merchants experience near-immediate funds availability as normal, tolerance for multi-day settlement erodes. In practice, this shifts “instant” from a premium feature to a default expectation, particularly in digital commerce where delivery of goods or services is immediate.

For merchants, faster settlement reduces working-capital drag. For PSPs and banks, it compresses operational timelines. For card networks, it removes one of the historical advantages of cards, perceived immediacy, by delivering comparable or superior speed on A2A rails.

The Margin Game: Why A2A Economics Favour Merchants

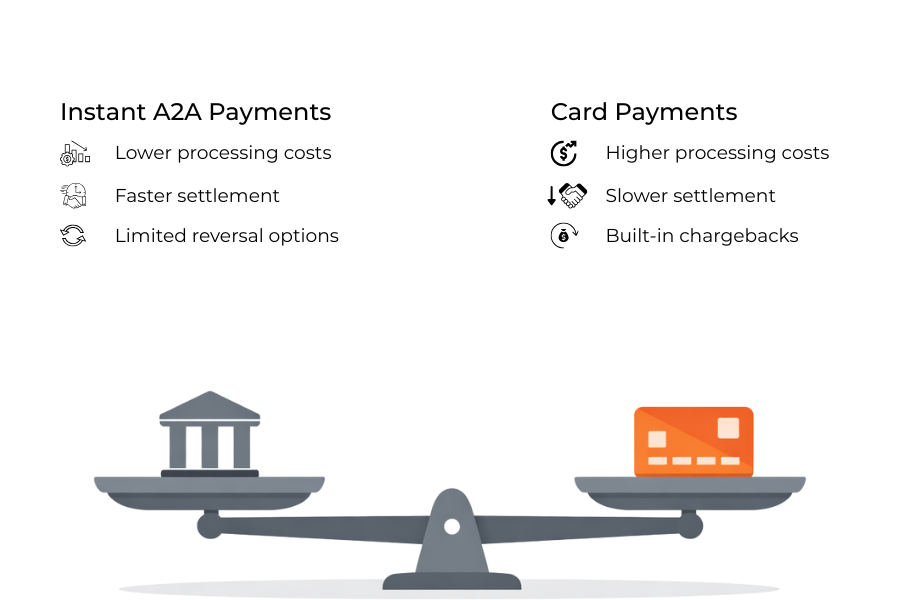

The most direct pressure on card volumes comes from economics, not regulation. Card payments carry interchange, scheme fees, and processing costs that scale with volume. In contrast, A2A instant payments operate on predictable, often materially lower cost structures, particularly for domestic and intra-EU flows.

G+D’s analysis highlights why merchants are re-examining their payment mix. Where instant payments are supported by banks at scale, merchants can bypass card network fees entirely. The result is not marginal savings but structural cost reduction, especially for high-volume, low-margin sectors such as travel, subscriptions, and digital services.

This does not require merchants to abandon cards. It incentivises them to prioritise A2A at checkout, where customer adoption allows. Over time, even partial substitution can have an outsized effect on margins. A 10–20% shift in volume away from cards can materially alter a merchant’s blended payment cost.

Crucially, these incentives align with bank strategy. Banks bear interchange costs when issuing cards, but they retain more value, both economic and informational, when payments remain on account-based rails they control.

Banks vs Card Schemes: Control, Data, and Customer Relationship

The IPR has intensified a long-running strategic contest between banks and card schemes. Card networks provide global acceptance and mature dispute frameworks, but they also intermediate the customer relationship. A2A instant payments allow banks to re-centre that relationship.

Across Europe, banks have begun actively promoting “Pay by Bank” and similar A2A options. Incentives range from fee-free transfers to embedded app-based checkout flows. The objective is not only cost efficiency but data visibility. On A2A rails, banks retain richer context about the transaction and the customer, rather than ceding that insight to scheme networks.

For card schemes, this presents a defensive challenge. Their value proposition acceptance, ubiquity, fraud protection, and chargebacks remain strong, but pricing pressure increases when merchants can point to a lower-cost, instant alternative that is now regulator-endorsed.

The result is not an immediate displacement but competitive re-balancing. Banks are no longer neutral infrastructure providers; they are active proponents of A2A adoption, supported by regulation that removes historical frictions around speed and availability.

The Chargeback Gap: The New Merchant Risk

While A2A instant payments offer compelling economics, they introduce a different risk profile. Card schemes embed chargebacks and dispute resolution into their rules. Instant credit transfers do not.

Once an SCT Inst payment settles, finality is near-absolute. There is no native mechanism equivalent to a card chargeback. This shifts responsibility for error handling, fraud mitigation, and customer remediation towards merchants and PSPs.

For merchants, this means that risk controls must move upstream. Identity verification, transaction monitoring, and confirmation flows become more critical. Refund processes must be operationally robust, because customer expectations shaped by instant settlement extend to reversals even when rails do not enforce them.

PSPs face a similar adjustment. Supporting instant payments at scale requires real-time fraud controls that operate before execution, not after. Verification of Payee (VoP) reduces misdirection risk, but it does not address all fraud scenarios. The absence of chargebacks makes preventive controls economically more important than reactive ones.

This “chargeback gap” does not negate the case for instant payments, but it changes who carries risk and how that risk must be priced and managed.

What the 20-25% Figure Really Means

The G+D estimate that 20–25% of card volume is at risk should be read carefully. It is not a forecast of card collapse, nor a guarantee of merchant savings. It is an assessment of exposure given current incentives.

Several factors influence whether that exposure materialises:

- Consumer adoption of Pay-by-Bank flows

- Merchant checkout design and default options

- Bank incentives and marketing

- Risk tolerance around non-chargeback rails

- Cross-border acceptance and usability

In sectors where margins are thin and fraud rates are manageable, A2A substitution is more attractive. In sectors with high dispute rates or complex fulfilment, cards may retain primacy despite higher cost.

The significance of the estimate lies in its directional clarity. A material share of card volume is no longer structurally protected by speed or availability. That alone is sufficient to trigger strategic reassessment.

Regulatory Neutrality Is a Myth

Although the IPR does not mandate merchants to abandon cards, it is not neutral in effect. By enforcing instant availability, settlement speed, and pricing parity for instant payments, the regulation tilts the competitive field.

Cards remain viable, but their advantages must be justified on grounds other than speed. Chargebacks, global acceptance, and mature fraud tooling become the differentiators. Where those benefits are less valued, cost pressure will dominate.

For regulators, this outcome is consistent with policy goals. Instant payments are framed as core public infrastructure, while cards are private networks. Encouraging the use of A2A rails supports competition and reduces dependency on a small number of global schemes.

Implications for PSPs and Acquirers

PSPs and acquirers sit at the intersection of these forces. Supporting instant payments is no longer optional, but neither is managing the operational complexity they introduce.

Key implications include:

- Dual-rail support: maintaining card and instant payment flows in parallel

- Real-time monitoring: fraud controls that operate within seconds

- Merchant education: setting expectations around refunds and disputes

- Pricing strategy: balancing lower A2A fees against higher support costs

For underwriting teams, the merchant payment mix becomes a risk variable. High A2A volumes may reduce processing costs but increase exposure if controls are weak. Conversely, reliance on cards may signal higher cost but lower operational risk in certain verticals.

What This Means for 2026 Checkout Strategy

By early 2026, the question is unlikely to be whether to support instant payments, but how prominently to position them. A growing number of merchants are experimenting with instant payments as the default option, relegating cards to a secondary choice.

This does not imply universal adoption. It implies segmentation. Checkout design will increasingly reflect margin sensitivity, fraud profile, and customer demographics. Instant payments become the default where they make economic and operational sense; cards remain where their protections justify the cost.

Ignoring instant rails altogether now carries its own risk: structural cost disadvantage relative to competitors who successfully migrate a portion of volume.

Conclusion

The IPR has transformed instant payments from a technical enhancement into a strategic infrastructure. Coupled with bank incentives and merchant margin pressure, this has placed card volumes under structural scrutiny. Industry analysis suggesting that 20-25% of card volume is exposed to substitution risk should be understood as a warning, not a prophecy.

Cards are not disappearing. But their role is changing. Speed and availability are no longer exclusive advantages. Economics, control, and risk allocation now drive decision-making.For merchants and PSPs, the crisis is not about choosing sides. It is about recognising that the payment mix is no longer static. In a market where instant A2A is the regulatory default, clinging to legacy assumptions carries measurable cost exposure.

FAQs

1. What triggered the current pressure on card payments in Europe?

The Instant Payments Regulation (IPR), enforced from October 2025, made instant euro payments a regulatory baseline. This removed speed and availability as differentiators for card payments and accelerated account-to-account (A2A) adoption.

2. Where does the 20-25% card volume at risk figure come from?

It comes from industry analysis, not regulation. A December 2025 report by Giesecke+Devrient estimates that a significant share of card volume is exposed to substitution risk as instant payments scale.

3. Does this mean card payments are being phased out?

No. Cards remain a core payment method. The analysis highlights pressure and exposure, not elimination. Cards continue to offer value through chargebacks, global acceptance, and established fraud protections.

4. Why are banks pushing Pay by Bank and instant A2A payments?

Banks retain more control, data visibility, and economic value on A2A rails than on card schemes. Instant payments allow banks to compete more directly for the customer relationship.

5. What role does settlement speed play in this shift?

Instant payments settle within seconds, 24/7. This matches or exceeds perceived card speed and reduces the relevance of multi-day settlement models that historically underpinned card dominance.

6. Are instant payments cheaper for merchants?

Often, yes. A2A payments typically avoid interchange and scheme fees. This can result in material cost reduction, especially for high-volume or low-margin merchants.

7. What is the main downside of instant payments for merchants?

The absence of built-in chargebacks. Once an instant payment settles, it is largely final. Merchants must rely on preventive controls and internal refund processes rather than scheme-mandated dispute mechanisms.

8. How does Verification of Payee (VoP) affect this landscape?

VoP reduces the risk of misdirected payments by matching the beneficiary name to the IBAN before execution. It improves safety but does not replace broader fraud prevention or dispute handling.

9. Does the regulation require merchants to prioritise instant payments?

No. The IPR applies to PSPs, not merchants. However, it changes incentives by making instant payments universally available and competitively priced.

10. Which sectors are most likely to shift volume away from cards?

Sectors with:

- Thin margins

- Low dispute rates

- Digital or immediate fulfilment

Examples include subscriptions, digital services, and some travel flows.

11. Will consumers adopt instant payments at checkout?

Adoption varies by market and use case. Bank incentives and user experience design play a significant role. The trend is gradual rather than uniform.

12. How does this affect PSP underwriting decisions?

Payment mix becomes a more important risk variable. High instant payment volumes may lower processing costs but increase exposure if controls are weak or refunds are poorly managed.

13. Is the regulation neutral between cards and A2A payments?

Formally, yes. In practice, it favours A2A by removing historical frictions around speed and availability, which previously supported card usage.

14. What should merchants reassess for 2026?

Merchants should reassess:

- Blended payment costs

- Checkout defaults

- Fraud prevention placement

- Refund workflows

15. What is the key takeaway from this shift?

Instant payments are no longer an optional infrastructure. While cards remain relevant, the payment mix strategy now has direct margin and risk implications that cannot be ignored.