Instant payments have moved from “emerging” to expected in a surprisingly short amount of time. In many markets, customers now expect that moving money should take seconds, not days, and merchants are under growing pressure to support real-time rails alongside card and wallet payments. By 2026, instant payments will no longer be a differentiator; they’re part of the baseline.

What hasn’t kept pace is the merchant’s understanding of what instant actually changes behind the scenes. The term sounds benign, even positive, but it hides some uncomfortable realities. Real-time settlement doesn’t just speed things up; it removes buffers, shifts risk, and exposes operational weaknesses that card-based systems used to absorb quietly.

This gap between perception and reality is where problems start. Merchants add instant payments expecting smoother cash flow and better conversion, only to run into refund disputes they can’t resolve, reconciliation issues they didn’t anticipate, or fraud losses that hit immediately with no safety net. The payment worked exactly as designed, just not as assumed.

This blog breaks down what “real-time” really means for merchants in 2026. Not at a marketing level, but at an operational one. It explains how instant payments behave across markets, where risk actually sits, and why supporting these rails is as much a design decision as a technical one.

- What Instant Actually Means at a Payments Level

- Finality Is the Real Difference Merchants Underestimate

- Refunds: Where Instant Causes the Most Merchant Pain

- Reconciliation Gets Harder in a Real-Time World

- Who Really Carries the Risk Once Payments Are Instant

- Fraud, Mistakes, and Irreversibility

- Designing Instant Payment Flows That Don’t Break Operations

- Conclusion

- FAQs

What Instant Actually Means at a Payments Level

At a payments infrastructure level, “instant” has a very specific meaning that’s often lost in marketing language. It doesn’t describe speed alone; it describes how and when money becomes final.

Most instant payment systems operate on a real-time credit model. Funds move from the payer’s account to the merchant’s account within seconds, and once that transfer completes, it is considered settled. There is no extended authorisation window, no delayed clearing cycle, and no natural pause where transactions can be reviewed or reversed later.

This model is consistent across major instant rails, even though the branding differs by region. SEPA Instant in Europe, PIX in Brazil, and UPI or PayNow-style systems across Asia all share the same core principle: once the payment is executed, the money is credited almost immediately and treated as final.

That finality is intentional. Instant rails are designed to be always on 24/7, including weekends and holidays and to give recipients immediate access to funds. To achieve that, they sacrifice the time buffers that card networks rely on. Speed and finality are linked; you rarely get one without the other.

For merchants, this has two immediate implications. First, cash flow improves, but only if liquidity is managed correctly. Second, mistakes surface instantly. An incorrect amount, a misdirected payment, or a fraudulent transfer doesn’t sit in limbo; it lands and stays there unless the recipient cooperates.

Understanding this distinction is critical. When merchants assume that instant payments behave like faster cards, they design flows that don’t fit the underlying mechanics. In 2026, most of the friction around real-time payments comes not from the rails themselves, but from that misunderstanding.

Finality Is the Real Difference Merchants Underestimate

The most significant change instant payments introduce isn’t speed. It’s finality. That distinction sounds subtle, but for merchants it alters how errors, fraud, and customer disputes play out in practice.

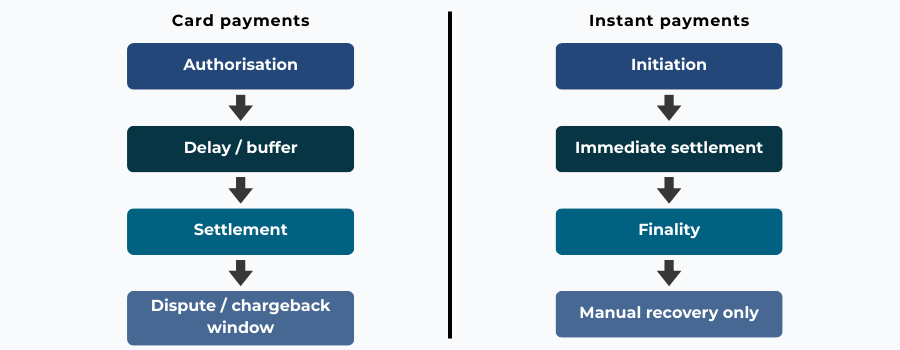

Card payments were built with a delay baked in. Authorisation happens first, settlement follows later, and in between, there is time for exceptions to be handled. If something goes wrong, the system itself provides mechanisms for reversals, chargebacks, and representation that absorb a large part of the impact. Those buffers made card payments forgiving, even when processes weren’t perfect.

Instant payments remove that cushion entirely. Once a real-time payment is completed, the money is already where it’s going to be. There’s no pending state and no system-level rollback. In Europe, for example, SEPA Instant payments are designed to be irrevocable once executed, a detail that regularly surprises merchants who are used to card-based recovery options.

This is where “no chargebacks” gets misunderstood. It’s often framed as a benefit, but in reality, it means no automatic safety net. Disputes don’t disappear; they change form. Instead of being handled through formal scheme rules, they become operational problems that require manual resolution, customer cooperation, and, in some cases, accepting the loss.

Finality also compresses response time. With cards, detection can happen after the fact. With instant payments, by the time something looks suspicious, the funds have already moved. That’s why instant rails place much more emphasis on pre-payment controls and behavioural checks and why those controls can feel stricter than merchants expect.

In 2026, many merchant pain points around instant payments trace back to this single misunderstanding. Speed is obvious. Finality is not. Until merchants design their processes around that reality, instant payments will continue to feel riskier than they need to be.

Refunds: Where Instant Causes the Most Merchant Pain

Refunds are where the promise of “instant” most visibly breaks down for merchants. Customers see money arrive in seconds and naturally expect the same speed in reverse. Operationally, that expectation is rarely realistic.

Why Refunds Don’t Behave Like Card Refunds

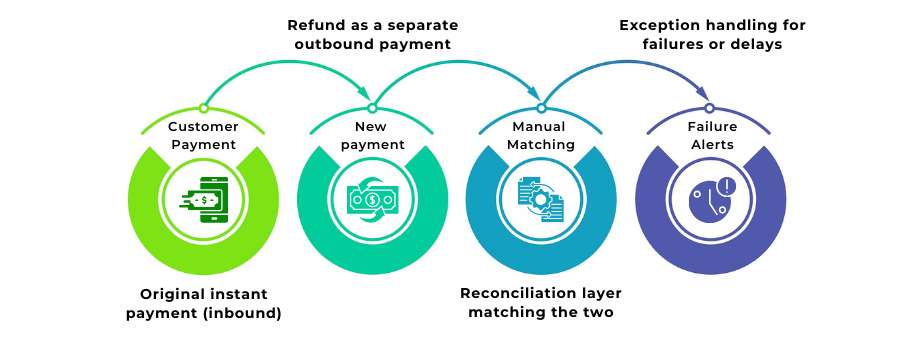

With card payments, refunds are reversals within an existing framework. The original transaction is referenced, and funds flow back through the same rails, often with scheme-level support if something goes wrong. Instant payments don’t work that way. Once the original payment is complete, there is nothing to reverse.

A refund on an instant rail is a new outbound payment. It requires:

- available liquidity at the time of refund,

- correct beneficiary details, and

- passing any outbound AML or fraud checks.

If any of those conditions aren’t met, the refund doesn’t move regardless of how quickly the original payment arrived.

This gap is particularly visible in markets where instant payments dominate consumer behaviour. In Brazil, for example, PIX has trained users to expect immediacy in everyday payments. When refunds take hours or days because they rely on manual processing or outbound payment limits, support volume spikes and trust erodes quickly.

For merchants, the challenge isn’t just technical. It’s communicational. Promising “instant refunds” without understanding the mechanics creates expectations that the system can’t consistently meet. The result is frustrated customers, escalations to PSPs, and operational work that card refunds used to absorb quietly.

In 2026, the merchants that handle refunds well are the ones that set expectations early. They explain that instant payments are fast on the way in, but refunds follow a different path. It’s not a marketing problem, it’s a design and messaging one.

Reconciliation Gets Harder in a Real-Time World

One of the quieter side effects of instant payments is that they remove the time buffers finance teams used to rely on. Settlement happens continuously, not in batches, and that changes how reconciliation actually works day to day.

With cards, delays between authorisation, clearing, and settlement created natural checkpoints. Files arrived in predictable windows. Exceptions could be reviewed before the money is fully moved. Instant payments don’t offer that rhythm. Transactions flow 24/7, including weekends and holidays, and funds are often available to use immediately. If reconciliation processes aren’t built for that pace, gaps show up quickly.

The challenge isn’t just volume, it’s data quality. Reference fields on instant rails are often shorter, inconsistent, or optional, depending on the scheme. Matching incoming payments to orders can become messy, especially when customers enter free-text references or reuse the same identifier repeatedly. Refunds, being separate outbound payments, add another layer that has to be matched back manually.

This pressure is particularly visible in parts of Asia where UPI and QR-based instant systems drive very high transaction counts at low values. The payments themselves work flawlessly, but finance teams end up dealing with large volumes of small exceptions that were previously smoothed out by batch processing.

In a real-time world, reconciliation stops being a back-office afterthought. It becomes an operational capability that needs to run continuously, with clear exception handling and ownership. Merchants that underestimate this often find that instant payments improve cash flow on paper while quietly increasing internal workload.

Who Really Carries the Risk Once Payments Are Instant

One of the least obvious changes instant payments introduce is who absorbs things when they go wrong. Merchants often assume that faster settlement simply means faster access to funds. In reality, it also means faster and more direct exposure to loss.

How Risk Shifts Away from Issuers

With card payments, issuers play a central risk-absorbing role. They authorise transactions, monitor cardholder behaviour, and ultimately sit behind the chargeback process. When fraud or error occurs, issuers and schemes share much of the burden through established dispute rules.

Instant payments reverse that dynamic. Issuers confirm funds availability and identity, but once the payment is released, their role largely ends. There is no extended dispute framework and no obligation to claw funds back on the merchant’s behalf. The transaction completes, and the system moves on.

This is why instant rails feel less forgiving. Fraud losses are realised immediately. Operational mistakes land directly on the merchant’s balance sheet. There’s no delayed settlement period to intervene and no structured recovery path to fall back on.

Why PSP Controls Feel Stricter Than Merchants Expect

Because risk shifts downstream, PSPs and payment providers compensate by tightening controls before money moves. Limits, velocity caps, behavioural monitoring, and transaction screening are far more prominent on instant rails than many merchants expect, not because providers are being conservative, but because there is no safety net later.

This pattern is visible globally. In markets adopting real-time systems such as FedNow and RTP-style rails, merchants often notice stricter onboarding questions and more conservative transaction limits than they’re used to with cards. The logic is simple: if a bad payment can’t be reversed, it has to be prevented.

For merchants, the takeaway is uncomfortable but important. Instant payments don’t just move money faster, they move responsibility closer to the point of acceptance. In 2026, understanding that shift is essential. Without it, instant payments feel risky and unpredictable. With it, they become manageable but only when risk ownership is designed into the flow, not discovered after the fact.

Fraud, Mistakes, and Irreversibility

Instant payments change the timing of fraud, but they also change its impact. With cards, fraud often unfolds slowly. Transactions are authorised, settled later, and disputes surface days or weeks after the event. With instant payments, everything happens at once, including the consequences.

The most visible example is authorised push payment (APP) fraud. In instant payment systems, customers are tricked into sending money themselves, often believing the payment is legitimate. Because the transfer is authorised and completed in real time, recovery depends on the recipient’s cooperation, not on scheme rules.

In the UK and parts of Europe, this has forced regulators to rethink reimbursement expectations, but even where protections exist, merchants and PSPs still face operational and reputational fallout.

Mistakes are just as costly. A wrong amount, an incorrect reference, or a misdirected payment doesn’t sit in a pending state waiting to be corrected. It lands immediately. Fixing it requires outbound payments, manual intervention, and sometimes accepting that recovery won’t happen. Speed leaves very little room for human error.

This is why instant payment systems place so much emphasis on confirmation, validation, and pre-payment checks. Once the payment is released, the system offers no forgiveness. From a merchant perspective, that means fraud prevention and operational accuracy have to happen before the button is pressed, not after a report is filed.

In 2026, the irreversibility of instant payments isn’t a flaw, it’s a design choice. But it demands discipline. Merchants that treat real-time rails like faster cards often experience instant payments as fragile and risky. Those who design flows around the reality of irreversibility find that the risk becomes predictable, even if it can’t be eliminated.

Designing Instant Payment Flows That Don’t Break Operations

By 2026, the merchants getting real value from instant payments aren’t the ones who simply added a new rail at checkout. They’re the ones who redesigned their flows around how real-time money actually behaves.

The first shift is selectivity. Instant payments work best in scenarios where refunds are rare, values are well understood, and mistakes are unlikely. Low-friction digital goods, bill payments, and account top-ups often fit this profile. High-refund, high-error, or high-support journeys usually don’t at least not without additional guardrails.

The second shift is expectation management. Merchants that treat instant payments as a “faster card” tend to promise too much. Clear messaging matters: payments may be instant, but refunds are conditional; support may be needed; timelines can vary. When expectations are set correctly, customer frustration drops sharply, even if the outcome is slower than they hoped.

Operationally, good design means building checks before money moves. Confirmation steps, validation of beneficiary details, and sensible limits reduce the cost of human error. These controls can feel like friction, but in a real-time environment, they replace the safety nets that no longer exist downstream.

Finally, merchants that succeed treat instant payments as an ongoing capability, not a one-off integration. Reconciliation processes run continuously. Exception handling is owned, not improvised. Support teams understand how instant rails differ from cards and can explain those differences confidently.

Instant payments don’t have to break operations. But they do force a choice. Either flows are designed with finality, risk, and reality in mind or those realities surface later, when the cost of fixing them is much higher.

Conclusion

Instant payments promise speed, but what they really demand is intentional design. In 2026, supporting real-time rails is no longer about ticking a box at checkout. It’s about understanding how finality, risk, and operations change once money starts moving immediately.

Merchants who approach instant payments as a simple upgrade often discover the hidden costs first-refund friction, reconciliation strain, and losses that can’t be reversed. Those challenges don’t mean instant payments are flawed. They mean the systems were built for a different set of assumptions than card payments ever required.

The merchants that succeed with instant payments are the ones that respect those differences. They choose where instant makes sense, set expectations honestly, and put controls in place before money moves. Speed becomes an advantage only when it’s matched with clarity and discipline.

By 2026, “real-time” isn’t a feature customers use. It’s a design choice merchants make. And the difference between a smooth instant payment experience and an operational headache lies in whether that choice was made deliberately or by assumption.

FAQs

1. Are instant payments reversible if something goes wrong?

In most cases, no. Once an instant payment is completed, it is considered final. Recovery depends on the recipient’s cooperation, not on scheme-level reversal rules.

2. Why aren’t refunds instant if the payment itself is?

Because refunds are new outbound payments, not reversals. They rely on available liquidity, correct beneficiary details, and outbound checks, which can introduce delays.

3. Do instant payments increase fraud risk for merchants?

They change the risk profile rather than simply increasing it. Fraud losses and mistakes materialise immediately, with no chargeback safety net.

4. Who absorbs losses when an instant payment is fraudulent or incorrect?

Typically the merchant or PSP. Issuers play a limited role once a real-time payment has been executed.

5. Are instant payments cheaper than card payments?

They can be, but lower transaction fees don’t account for higher operational and risk costs, especially around refunds and support.

6. Can merchants delay settlement on instant payment rails?

No. Settlement happens as part of the payment flow. Merchants need to manage liquidity and controls before the payment is initiated.

7. Why do PSPs impose limits on instant payments?

Because there is no recovery mechanism later. Limits and monitoring reduce the likelihood of irreversible losses.

8. Are instant payments suitable for all types of transactions?

Not always. They work best where refunds are rare and values are predictable. High-error or high-dispute flows need additional safeguards.

9. How should merchants explain instant payments to customers?

Clearly and early. Customers should understand that payments are fast, but refunds and corrections may take longer.

10. Do instant payments affect reconciliation processes?

Yes. Continuous settlement and inconsistent reference data make reconciliation more complex than with batch-based card systems.

11. Is this different across regions?

The mechanics are similar globally. While names and consumer behaviour vary, real-time settlement and finality are common features across instant rails.

12. Will instant payments replace cards completely?

Unlikely in the near term. They complement cards but don’t replicate card protections, especially around disputes and reversals.