For many global merchants, checkout design is built on a familiar assumption: cards first, everything else as an optimisation layer. In the Middle East, that assumption increasingly breaks down. By 2026, merchants operating in the Gulf are discovering that payment performance is less about how many methods they offer and more about how closely checkout behaviour aligns with local consumer expectations.

Gulf consumers are digitally sophisticated, mobile-first, and comfortable switching between payment options. Yet their behaviour does not mirror “global averages” drawn from Europe or North America. Trust signals, confirmation speed, and familiarity with local rails often matter more than minimalist UX or one-click flows. When checkout design fails to reflect this, conversion quietly suffers.

This gap is widening as regulation reshapes wallets and domestic payment rails across the region. Consumers increasingly interact with payments that feel supervised, predictable, and immediate, which raises expectations across all checkout interactions. Global templates that prioritise speed over clarity or cards over context struggle to keep pace.

This blog examines why Middle East checkout behaviour defies global assumptions, how regulation and consumer psychology interact at the point of payment, and what merchants must rethink when designing Gulf-first checkout strategies for 2026.

- Why the Gulf Consumer Defies “Global Average” Behaviour

- Cards in the Gulf: Still Critical, But No Longer the Default

- Wallets as Primary Domestic Rails (Not “Alternative Payments”)

- Saudi Arabia’s Wallet-First Behaviour Is Policy-Backed

- “Instant” Is a Behavioural Expectation, Not a Rail Choice

- Trust Signals That Matter More Than Global UX Best Practices

- What Breaks When Merchants Reuse Global Checkout Templates

- Designing Gulf-First Checkout Strategies for 2026

- Conclusion

- FAQs

Why the Gulf Consumer Defies “Global Average” Behaviour

The Gulf consumer does not behave like a statistical midpoint drawn from Europe, North America, or even broader Asia. Checkout behaviour in the UAE and Saudi Arabia is shaped by a combination of high digital maturity, strong regulatory signalling, and diverse financial backgrounds, which produces decision-making patterns that global benchmarks routinely misread.

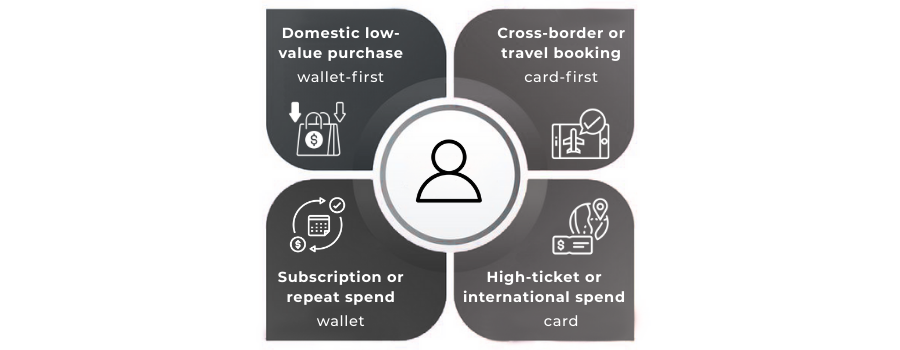

One reason is that payment choice in the Gulf is highly situational. Consumers do not anchor themselves to a single preferred method in the way many Western models assume. Instead, they switch rails depending on context: transaction size, merchant type, perceived risk, and how “controlled” the payment feels. A method that works well for a travel booking may be abandoned for a domestic subscription or a food delivery payment.

Another factor is sensitivity to uncertainty. Gulf consumers tend to react quickly to ambiguous payment states delayed confirmations, unclear error messages, or unfamiliar flows. Where global UX trends often favour speed and minimalism, Gulf users place greater value on visibility and reassurance. If a checkout does not clearly show what is happening and what happens next, trust erodes faster than in many other markets.

Issuer behaviour also plays a role. Card flows in the Gulf frequently involve OTPs, step-up authentication, or issuer-side friction that varies by bank and customer profile. Consumers have learned to anticipate this friction and will often switch away from cards if a checkout feels unnecessarily heavy for a given transaction. This makes payment choice more dynamic and less predictable than global averages suggest.

Finally, the region’s demographic mix amplifies this divergence. Long-term residents, recent expatriates, tourists, and cross-border shoppers all interact with the same checkout surfaces but bring different payment instincts with them.

Designing for an “average” Gulf consumer ignores this segmentation and leads to checkout hierarchies that satisfy no one particularly well.

The result is a market where checkout performance depends less on universal best practice and more on behavioural alignment. Merchants that understand this design checkouts that feel intuitive and trustworthy to local users. Those that rely on global assumptions see conversion leakage without an obvious technical failure.

Cards in the Gulf: Still Critical, But No Longer the Default

Cards continue to play an important role in Gulf commerce, but their position at checkout is no longer universal or automatic. In 2026, card performance in the UAE and Saudi Arabia is highly context-dependent, and merchants that assume cards should always sit at the top of the hierarchy often misread domestic behaviour.

Where cards still perform well is clear. Cross-border e-commerce, travel bookings, luxury retail, and higher-ticket purchases remain card-friendly, particularly for tourists and internationally oriented consumers. In these scenarios, cards align with expectations around protection, international acceptance, and issuer familiarity.

The challenge appears in domestic, mobile-led transactions. Card flows in the Gulf frequently involve OTPs, issuer redirects, or step-up authentication that varies widely by bank. For lower-ticket or repeat purchases, this friction feels disproportionate. Consumers recognise it instantly and respond by abandoning the flow or switching to a wallet that confirms payment more smoothly.

Issuer behaviour amplifies this effect. Different banks apply different thresholds and controls, which makes card performance unpredictable from the consumer’s perspective. A checkout that assumes card continuity after a failed attempt often underestimates how quickly Gulf users will move on to another method.

Where card-first checkout assumptions break down most often:

- OTP fatigue on mobile, especially for repeat transactions

- Higher abandonment on domestic traffic compared to cross-border

- Low recovery after a failed card attempt

- Mismatch between confirmation speed and consumer expectations

This does not mean cards are declining in relevance. It means their role has become situational rather than dominant. Merchants that treat cards as one rail among several rather than the default are better positioned to capture Gulf demand without forcing consumers through unnecessary friction.

Wallets as Primary Domestic Rails (Not “Alternative Payments”)

In the Gulf, wallets are no longer perceived as secondary options that sit behind cards. For a growing share of domestic consumers, especially in the UAE, wallets function as primary payment rails trusted, familiar, and designed for frequent use. This shift is not driven by novelty, but by how wallets now behave under regulation.

Regulated wallets change the consumer experience in subtle but important ways. Stored value feels safer to hold, confirmations arrive immediately, and payment flows are consistent across merchants. For repeat domestic spend subscriptions, food delivery, transport, digital services this reliability matters more than international acceptance or card-based protections. Consumers gravitate toward what feels controlled and predictable.

Regulation is a critical enabler here. In the UAE, wallet providers operating under the Central Bank’s Stored Value Facilities framework are required to meet licensing, safeguarding, and conduct standards that elevate wallets from convenience tools to supervised financial products. That regulatory backdrop reinforces trust and encourages reuse, which is why wallets increasingly outperform cards for certain domestic use cases.

This behavioural shift has direct implications for checkout design. When wallets are treated as “alternative payments”, they are often hidden behind secondary menus or presented only after a card attempt fails. In the Gulf, that ordering works against consumer instinct.

Users who arrive intending to pay with a wallet interpret buried placement as friction or uncertainty, not choice.

What matters most is that wallets align with how domestic consumers think about payment certainty. Immediate balance updates, familiar interfaces, and clear post-payment outcomes reduce the mental cost of paying. Over time, that consistency trains behaviour. Wallets stop being a fallback and become the default for everyday transactions.

For merchants, recognising wallets as primary domestic rails is less about adding more methods and more about reordering assumptions. The checkout that reflects local payment reality converts better, even when the same methods are technically available.

Saudi Arabia’s Wallet-First Behaviour Is Policy-Backed

In Saudi Arabia, wallet adoption is not just a consumer trend it is the outcome of deliberate policy design. Regulators have framed wallets as protected payment instruments within a broader payments framework, which shapes how consumers perceive and use them at checkout. The result is a market where wallet-first behaviour feels normal rather than experimental.

This policy backdrop matters because it removes ambiguity. Saudi consumers interact with wallets that follow consistent rules around onboarding, limits, and transaction handling. That consistency reduces hesitation, especially for domestic payments where speed and certainty are prioritised. Over time, wallets become familiar tools for everyday spend, not occasional alternatives.

The regulatory framing also influences trust. When wallet providers operate under clear oversight, consumers are more comfortable storing value and reusing wallets across merchants. That confidence carries through to checkout behaviour: users arrive expecting wallets to work smoothly, confirm immediately, and resolve issues predictably. When those expectations are met, wallets naturally move up the payment hierarchy.

From a merchant perspective, this policy-backed behaviour explains why Saudi checkout performance can differ sharply from global benchmarks. Card-first designs that perform well elsewhere may underperform domestically, not because cards are rejected, but because wallets better match consumer expectations for routine transactions. Ignoring that preference quietly erodes conversion.

This direction is reinforced by Saudi Arabia’s Electronic Wallets Rules, which sit within the wider payments and payment services framework and emphasise consumer protection, stability, and consistency across wallet providers. Regulation does not just permit wallets to grow, it actively shapes how they are trusted and used.

By 2026, wallet-first behaviour in Saudi Arabia is best understood as policy-enabled normalisation. Merchants that recognise this design checkouts that feel aligned with local expectations. Those that rely on global assumptions struggle to explain why technically sound payments convert less effectively.

“Instant” Is a Behavioural Expectation, Not a Rail Choice

In the Gulf, “instant” at checkout is less about which payment rail is used and more about how the payment feels to the consumer. Whether the underlying transaction settles via a card, wallet, or account-linked system, Gulf consumers increasingly expect the same outcome: immediate confirmation, immediate clarity, and no lingering uncertainty.

This expectation has been shaped over time by wallets, super-app experiences, and real-time notifications. As a result, consumers now judge the entire checkout experience against that benchmark even when the rail itself is not technically instant.

Instant Confirmation Matters More Than Instant Settlement

From a consumer perspective, settlement mechanics are invisible. What matters is confirmation. A payment that settles later but confirms clearly and immediately is perceived as “instant”. A payment that settles quickly but leaves the user unsure is not.

This is where many global checkout designs misfire in the Gulf. Card flows that introduce “pending” states, vague success screens, or delayed confirmations clash with local expectations. Even when the payment ultimately succeeds, the experience feels incomplete, which increases drop-off and support queries.

Wallet-led experiences have trained consumers to expect:

- Immediate balance updates

- Clear success states

- No ambiguity about whether the payment worked

Once that expectation is set, it carries across rails.

Ambiguity Is Interpreted as Risk

In the Gulf, uncertainty at checkout is often interpreted as risk rather than inconvenience. If a screen does not clearly show what happened, users assume something may have gone wrong even if the technical failure rate is low.

This sensitivity explains why:

- Consumers abandon flows quickly after unclear messages

- Repeated retries across rails are common

- Support tickets appear even after successful payments

Global UX patterns that prioritise speed over clarity can unintentionally break trust in this context.

Why “Instant” Has Become the Baseline Expectation

The expectation of immediacy is reinforced by the broader digital environment. Notifications, balance visibility, and real-time updates are now standard across many Gulf consumer services. Payments are judged against that broader experience, not against legacy banking norms.

By 2026, this means that checkout performance is as much about managing perception as it is about optimising rails. A technically slower payment that feels immediate will outperform a faster one that feels uncertain.

In practical terms, Gulf checkout design breaks when:

- Confirmation screens are vague or delayed

- “Pending” states are unexplained

- Next steps after payment are unclear

Merchants that recognise “instant” as a behavioural expectation design experiences that reassure users immediately, regardless of rail. Those that treat instant as a purely technical attribute struggle to meet local expectations, even with strong infrastructure underneath.

Trust Signals That Matter More Than Global UX Best Practices

Global checkout guidance often prioritises speed, minimalism, and reducing visible friction. In the Gulf, those principles matter but they are secondary to trust signalling. Consumers are willing to tolerate an extra step if the checkout clearly communicates legitimacy, control, and what happens next.

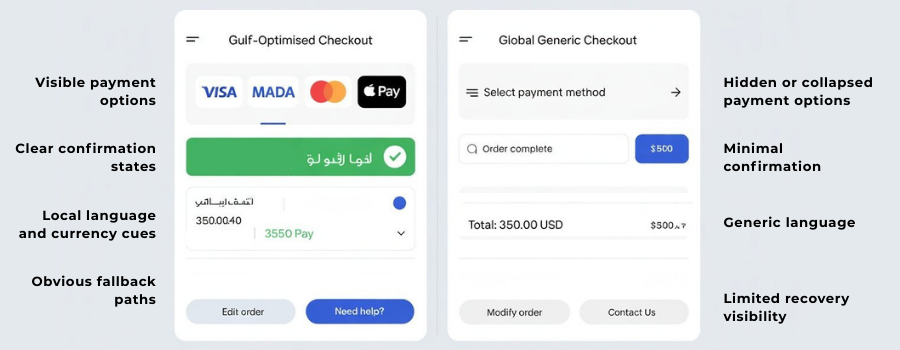

This is where many globally optimised designs underperform. By hiding options, compressing confirmation states, or over-abstracting payment choice, they remove the very cues Gulf consumers rely on to feel confident completing a transaction.

Familiarity Beats Minimalism

In the Gulf, recognisable payment brands and local rails are powerful trust anchors. A clean but unfamiliar checkout can feel riskier than a slightly busier one that shows known wallets, local cards, or regionally trusted options.

Minimalist designs that hide payment methods behind secondary clicks often reduce confidence rather than improve it. Consumers want to see how they are paying before they commit.

Visibility Beats Speed

Speed is valued, but not at the expense of clarity. Checkout screens that rush users through confirmation without clearly stating what happened or what will happen next introduce doubt. Gulf consumers tend to prefer explicit confirmation over silent success.

This is especially true on mobile, where small delays or ambiguous states are quickly interpreted as potential failure.

Local Cues Matter More Than Global Polish

Language, currency display, and regionally familiar terminology all contribute to perceived legitimacy. Global checkouts that default to generic English phrasing or unclear currency presentation often feel “foreign”, even when technically correct.

Localisation here is not cosmetic; it directly influences whether a consumer trusts the transaction enough to proceed.

High-performing Gulf checkouts consistently reinforce trust through:

- Clearly visible local payment methods

- Explicit success and confirmation messaging

- Obvious fallback options if a payment fails

- Transparent currency and language presentation

The key insight is that trust in the Gulf is earned through reassurance, not invisibility. Merchants that prioritise clarity over aggressive optimisation see stronger completion rates, even if their checkout appears less “global-best-practice” on paper.

What Breaks When Merchants Reuse Global Checkout Templates

Most checkout failures in the Gulf do not look like failures. Payments go through, infrastructure works, and nothing technically breaks. Yet performance lags. Conversion is lower than expected. Retry rates are higher. Support tickets increase quietly. This is what happens when global checkout templates are reused without behavioural adaptation.

The first thing that breaks is payment ordering. Card-first hierarchies, inherited from European or US playbooks, push wallets and local options into secondary menus. Gulf consumers who arrive intending to pay with a wallet read this as friction, not choice. Some switch methods reluctantly. Others abandon without retrying.

The second issue is mismatched confirmation logic. Global templates often rely on brief success states or implicit confirmation. In the Gulf, this creates uncertainty. Users refresh pages, attempt duplicate payments, or contact support because they are unsure whether the transaction completed. The payment may be successful, but the experience does not feel resolved.

Refund handling is another weak point. Applying a single refund policy across cards, wallets, and other rails ignores how consumers interpret post-payment outcomes. Wallet users expect balance updates and clear timelines. When refunds behave differently from expectations, trust erodes even if the money eventually returns.

There is also a subtler failure around issuer and rail fallback. Global designs often assume that a failed attempt should be retried on the same method. In the Gulf, users are more likely to switch rails immediately. Checkouts that do not surface alternatives clearly after failure lose that recovery opportunity.

The most common breakpoints look like this:

- Ambiguous success or pending states

- One refund policy applied across all rails

- Card retries encouraged where rail switching is more natural

None of these issues appear dramatic in isolation. Together, they create steady, invisible underperformance. Merchants assume demand is weak or traffic quality is poor, when the real issue sits in misaligned checkout design.

In 2026, the lesson is straightforward. The Gulf does not punish merchants for offering fewer payment methods. It punishes them for offering the right methods in the wrong way.

Designing Gulf-First Checkout Strategies for 2026

Designing checkout for the Gulf in 2026 is less about adding capability and more about making deliberate choices. The highest-performing merchants are not the ones with the longest payment lists, but the ones whose checkout reflects how Gulf consumers actually decide, hesitate, and commit.

A Gulf-first strategy starts by abandoning the idea of a single “best” payment method. Instead, checkout becomes a decision environment: one that guides users toward the method that feels most appropriate for the moment they are in. That requires clarity, not optimisation tricks.

Start with Ordering, Not Expansion

The most impactful change merchants make is often the simplest: reordering payment methods. Domestic traffic should see wallets and familiar local options first, while international traffic should surface cards more prominently. This is not personalisation theatre; it is behavioural alignment.

When ordering reflects intent, users move forward confidently instead of scanning, hesitating, or backing out to reconsider.

Design Confirmation as a Trust Moment

Confirmation is not a formality in the Gulf; it is a trust checkpoint. Clear success states, explicit messaging, and visible next steps matter as much as speed. A checkout that ends abruptly after payment leaves users unsure, even if the transaction is complete.

Merchants that treat confirmation as part of the product not just a receipt see fewer retries, fewer disputes, and lower support volume.

Make Fallback Obvious, Not Hidden

Failures happen. What matters is how visible the recovery path is. Gulf consumers are comfortable switching rails quickly, but only if alternatives are clearly presented. Forcing users to backtrack or restart the flow wastes intent.

A well-designed checkout surfaces alternatives naturally after failure, without framing them as errors or downgrades.

In practice, Gulf-first checkout design consistently prioritises:

- Intent-aligned payment ordering

- Explicit confirmation and post-payment clarity

- Visible, rail-aware fallback paths

- Wallet-specific refund and messaging logic

What distinguishes these strategies is not sophistication, but restraint. They resist global optimisation habits in favour of local behavioural fit. By 2026, that fit is what separates merchants that merely operate in the Gulf from those that convert effectively within it.

Conclusion

By 2026, payment performance in the Gulf is no longer driven by infrastructure alone. Cards, wallets, and rails are broadly available, but conversion is determined by how well checkout design reflects local consumer behaviour. Merchants that rely on global assumptions discover that nothing is technically broken yet results consistently fall short.

What differentiates successful Gulf checkouts is not speed or minimalism, but behavioural alignment. Consumers expect clarity, familiarity, and immediate reassurance. Regulation has reinforced those expectations by making wallets and domestic rails feel supervised and predictable, raising the standard across all payment experiences.

For merchants and PSPs, this reframes checkout as a product in its own right. Ordering, confirmation, fallback, and messaging choices directly influence trust and completion. Treating checkout as a static template misses this reality.

The Gulf rewards merchants who design intentionally for context, not averages. In 2026, checkout success comes from understanding how consumers think at the moment of payment and building experiences that respect that mindset rather than forcing global norms onto a local market.

FAQs

1. Why do global checkout templates underperform in the Gulf?

Because they are usually built around card-first, speed-focused assumptions that do not match how Gulf consumers prioritise trust, clarity, and familiarity at checkout.

2. Are cards still important in the Middle East in 2026?

Yes, especially for cross-border transactions, travel, and higher-value purchases. However, cards are no longer the default choice for all domestic scenarios.

3. Why are wallets becoming primary payment methods in the Gulf?

Regulation has made wallets safer, more predictable, and easier to reuse. Consumers increasingly trust them for everyday domestic payments.

4. Does “instant” mean real-time settlement in the Gulf?

Not necessarily. For consumers, “instant” means immediate confirmation and clarity, even if settlement happens later in the background.

5. How does regulation influence checkout behaviour?

Regulation increases trust in wallets and domestic rails, which reshapes consumer expectations around confirmation, refunds, and reliability.

6. Why is checkout trust more important than speed in the Gulf?

Because uncertainty is often interpreted as risk. Clear messaging and visible outcomes reduce hesitation more effectively than shaving seconds off the flow.

7. How do expatriate populations affect payment behaviour?

Different segments bring different payment habits. Tourists tend to prefer cards, while long-term residents increasingly rely on wallets for domestic spend.

8. What is the most common checkout mistake merchants make in the Gulf?

Applying a card-first hierarchy and burying wallets under “alternative payment methods”, which contradicts local consumer intent.

9. Should merchants personalise checkout for different users in the Gulf?

Personalisation helps, but even simple method ordering and clear option visibility can significantly improve performance without heavy logic.

10. Are more payment methods always better in the Gulf?

No. Offering the right methods in the right order is more effective than adding many options without clear prioritisation.

11. How should merchants handle failed payments in the Gulf?

By making fallback options obvious and encouraging rail switching rather than repeated retries on the same method.

12. Is checkout optimization in the Gulf mainly a UX problem?

It’s a behavioural problem. UX matters, but only when it aligns with how consumers think and decide at the moment of payment.