On 9 October 2025, the EU’s Instant Payments Regulation (IPR) moved from policy to day-to-day operating reality. For payment service providers (PSPs) in the euro area, instant euro credit transfers are no longer a premium feature or limited-hours service. They sit alongside standard credit transfers as a baseline capability, available 24/7, with no higher charges than regular euro credit transfers. The European Commission summarised the change plainly in its official update on the new rules.

This is not a “trend” in the soft sense. It is a structural shift in the euro payments rail, with direct consequences for fraud controls, reconciliation timing, and operational resilience across PSPs and the merchants that depend on them.

What Changed on 9 October 2025

From this operational date, euro-area PSPs that offer euro credit transfers must support sending instant euro credit transfers as a normal service expectation, not a special product line. The effect for users is straightforward: euro transfers clear in seconds, including outside business hours, without being priced above standard transfers.

The Commission also highlights that receiving instant euro payments was already required earlier in 2025 for euro-area PSPs. The European Central Bank’s implementation timeline sets out the staged approach, including that euro-area PSPs must be able to receive instant payments by 9 January 2025, and send instant payments by 9 October 2025.

In operational terms, this creates a new normal: euro credit transfers behave like real-time rails, not batch rails. That change is felt most sharply where businesses relied on cut-off times, next-day value assumptions, or manual exception handling.

Core Provisions: What the Regulation Requires PSPs to Deliver

The IPR is implemented through Regulation (EU) 2024/886, which amends the SEPA framework to make instant euro credit transfers widely available under defined conditions. The legal text sits on EUR-Lex as the primary reference for obligations and scope.

For PSP operations, three requirements drive the immediate workload and ongoing oversight:

1) Send and receive instant euro payments (euro area PSPs)

PSPs must support both sides of the rail. That matters because “receive-only” readiness does not produce a reliable instant payment ecosystem. If outbound capability is inconsistent, merchants and consumers can’t treat instant settlement as dependable.

2) Pricing parity

Instant euro transfers must not cost more than regular euro credit transfers. This is a commercial and operational constraint. PSPs cannot use pricing to throttle demand; they must manage demand through capacity, controls, and system design.

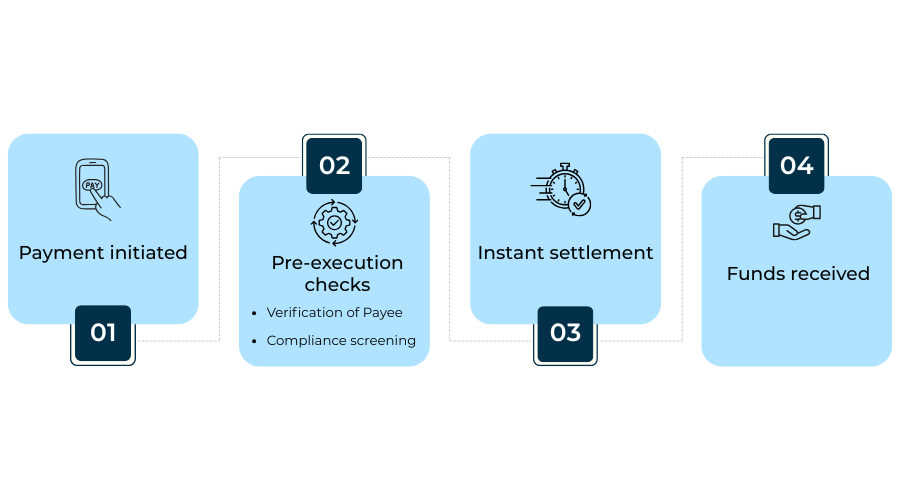

3) Safety measures built into the payment flow

The regulation’s intent is not just speed. It is speed with controls that work at instant timeframes. Two safety components are particularly visible in payment operations:

- Verification of Payee (VoP): the payer receives a result indicating whether the payee name matches the account identifier (IBAN), helping to prevent misdirection and certain types of scams. The ECB’s IPR explainer describes VoP outcomes such as “match”, “close match”, and “no match”.

- Simplified sanctions screening: rather than forcing per-transaction screening that would delay instant settlement, the ECB explains that PSPs offering instant credit transfers verify periodically, and at least daily, whether payment service users are subject to targeted restrictive measures (sanctions), with obligations tied to the IPR framework.

These controls are not “optional add-ons” in the 2026 operating practice. They are core components of how instant euro transfers remain both usable and defensible.

Why It Matters: Real-Time Settlement Becomes the Baseline

Once instant settlement is treated as the normal rail, three assumptions change for PSPs and merchants.

First, timing risk moves upstream.

With instant settlement, there is far less room to correct errors after execution. That increases the importance of pre-execution accuracy checks (like VoP), strong beneficiary data practices, and clear payer decisioning when alerts appear.

Second, reconciliation becomes continuous rather than periodic.

When funds arrive in seconds, the operational model shifts from “end-of-day matching” to near-continuous matching. For many merchants, especially those with high transaction volumes or multi-entity settlement, this changes how finance teams monitor receipts, resolve exceptions, and manage cash positioning.

Third, fraud controls must operate at payment speed.

Instant rails compress the time available for intervention. That does not mean “no controls”; it means controls must be designed to work without slowing settlement. The IPR framework pushes PSPs toward preventative measures (VoP) and operationally compatible compliance checks (periodic sanctions screening) rather than relying on slow manual review at the point of execution.

For high-risk business models, these shifts are not abstract. They change what “stable payments” looks like: stability becomes about availability + correctness + controllability.

Impact on PSPs and Merchants

PSPs: Infrastructure, resilience, and operational proof

For PSPs, becoming “instant-capable” is not only a messaging or scheme connection task. It is a resilience task. 24/7 availability means operations teams must treat instant payments like always-on infrastructure, with:

- Capacity planning for peak and off-hours demand

- Monitoring that supports rapid detection and containment

- Incident handling that does not rely on “business hours” escalation

- Controls that can be evidenced under supervisory or partner review

In 2026, the practical risk for PSPs is not the existence of the rule. It is the operational consequence of not meeting it reliably because clients will notice failed or delayed “instant” payments immediately.

Merchants: refunds, reconciliation, and beneficiary master data

Merchants don’t implement the regulation directly, but they inherit its operational effects through their PSPs and banking partners.

Common impact points include:

Refund timing and customer expectations

When customers get used to instant settlement, tolerance for slow refunds drops. Merchants that rely on manual refund processes, delayed approvals, or batch payout files feel the pressure first, especially in travel, subscription, and marketplace models.

Reconciliation timing and exception workflows

Finance teams accustomed to next-day settlement windows must adjust processes, particularly where matching relies on manual references or late-arriving statements. Instant settlement rewards clean reference data and disciplined payment operations.

Beneficiary name accuracy becomes a control surface

VoP introduces a new point of friction when payee names do not align cleanly with bank-held names. Marketplaces and B2B payout models are especially exposed because they hold large beneficiary datasets that may include abbreviations, trading names, or inconsistent formatting. The result is not “regulatory failure” for the merchant, but operational friction that can reduce payment success rates and increase support load.

What Comes Next in 2026: Oversight Becomes Operational

Once a regulation is operational, the next phase is usually not another announcement. It is oversight through normal supervisory and scheme channels: examinations, partner reviews, and operational testing. In 2026, the practical test for PSPs is whether they can demonstrate:

- Continuous availability (including weekends and off-hours)

- Consistent processing times

- Controlled handling of VoP outcomes and exceptions

- Compliance processes compatible with instant execution, including sanctions obligations as described in the ECB’s IPR overview

For merchants and high-risk operators, the key change is that euro instant transfers are treated as a foundational rail. That affects expectations around settlement speed, operational transparency, and dispute handling.

Conclusion: Instant Euro Transfers Are No Longer Optional

The IPR’s 9 October 2025 operational milestone changes the baseline for euro payments. Instant settlement is now embedded into the SEPA environment as a standard service expectation always on, priced comparably to standard transfers, and paired with safety measures designed for real-time execution.

For PSPs, the requirement is not just “support instant payments”. It is to support them reliably and defensibly, at scale, with controls that work at payment speed.

For merchants, the shift shows up in reconciliation timing, refund expectations, and the quality of beneficiary data.

In 2026 operations, instant euro transfers sit firmly in the category of “infrastructure”. The winners are not the organisations that can describe the regulation, but the ones whose systems and processes behave as if real-time settlement is the default because it is.

FAQs

1. When did the EU Instant Payments Regulation become operational?

The regulation became operational on 9 October 2025, making instant euro credit transfers a baseline requirement for euro-area PSPs.

2. Does the regulation apply to all EU countries?

The operational requirements apply primarily to euro-area PSPs. Non-euro-area PSPs are subject to different timelines and obligations.

3. Are instant euro payments now mandatory for PSPs?

Yes. PSPs offering euro credit transfers must support instant euro credit transfers as part of their standard service offering.

4. Can PSPs charge more for instant payments than regular transfers?

No. The regulation requires pricing parity, meaning instant euro credit transfers must not cost more than standard euro credit transfers.

5. Do PSPs need to support both sending and receiving instant payments?

Yes. The regulation requires euro-area PSPs to support both receiving and sending instant euro credit transfers.

6. Is Verification of Payee (VoP) mandatory under the regulation?

Yes. VoP is a required safety measure, providing a payee name check before execution of instant euro credit transfers.

7. How does sanctions screening work with instant payments?

Instead of per-transaction screening that would delay settlement, PSPs are required to perform regular (at least daily) checks against sanctions lists, as outlined in the regulatory framework.

8. Does the regulation affect refunds?

Indirectly, yes. As instant settlement becomes standard, customer expectations for faster refunds increase, even though refund execution still depends on merchant and PSP processes.

9. Will instant payments replace regular credit transfers?

No. Regular credit transfers continue to exist, but instant payments now function as a foundational rail, changing expectations around speed and availability.

10. Are merchants directly regulated by the Instant Payments Regulation?

No. The regulation applies to PSPs. However, merchants are affected operationally through settlement timing, reconciliation, and beneficiary data accuracy.

11. What happens if a PSP cannot process instant payments reliably?

Operational unreliability can surface through scheme monitoring, supervisory scrutiny, and partner reviews, particularly once instant payments are treated as standard infrastructure.

12. Does the regulation remove fraud risk from euro payments?

No. The regulation improves prevention by embedding controls such as VoP, but fraud risk is reduced, not eliminated.

13. Why is this regulation considered a major change?

Because it shifts euro payments from batch-based, business-hours processing to real-time, always-on settlement as the default expectation.

14. What should PSPs focus on in 2026 following go-live?

Reliability, resilience, handling of VoP outcomes, reconciliation accuracy, and compliance processes that operate effectively at instant payment speeds.

15. What is the biggest operational takeaway for merchants?

Instant settlement changes assumptions around payment timing, refunds, and data accuracy. Merchants relying on euro transfers must adapt processes to a real-time environment.