Europe’s payment landscape is undergoing one of its most significant structural shifts in a decade. With the EU’s Instant Payments Regulation setting 10-second euro transfers as the standard and open banking reaching mass-market adoption across both the UK and the EU, account-to-account (A2A) payments are rapidly moving from an alternative option to a mainstream expectation. For consumers, the value lies in speed and transparency; for regulators, it’s a step toward deeper financial resilience and lower dependency on international card schemes.

For high-risk merchants, this shift is far more than a technical upgrade. Instant settlement, bank-verified authentication and lower dispute exposure offer a foundation that cards cannot replicate consistently across Europe’s fragmented markets. Sectors like gaming, FX, travel and digital services increasingly rely on fast deposits and even faster payouts and A2A is becoming the only rail capable of supporting those flows reliably.

As Europe aligns around instant, bank-to-bank infrastructure, the question is no longer whether A2A can replace cards, but where and how quickly this transformation will reach critical mass.

IPR (Instant Payments Regulation) Market Impact

The EU’s Instant Payments Regulation (IPR) is reshaping how money moves across the eurozone. By requiring all payment service providers to send and receive instant SEPA Credit Transfers (SCT Inst), regulators are effectively repositioning instant A2A transfers as the baseline infrastructure for European commerce. What was once a premium service is now becoming a default obligation, and this shift fundamentally changes how merchants, especially high-risk merchants manage deposits, payouts and customer experience.

The most notable operational effect is the removal of settlement uncertainty. Traditional batch-based SEPA transfers created windows of delay that complicated cash flow and reconciliation. Under IPR, euro payments must move within ten seconds, regardless of the hour or day. This expectation of immediacy is transforming customer behaviour, making instant transfers feel less like an optional upgrade and more like the standard European payment behaviour.

For high-risk merchants, speed is only one part of the equation. A2A instant transfers reduce dependency on card issuers which, in many EU markets, heavily scrutinise or throttle certain MCCs associated with gaming, FX, ticketing or high-risk digital content. Instant transfers remove issuer approval as a failure point and shift authentication to the customer’s bank via strong customer authentication (SCA). This makes the approval dynamic more predictable and reduces friction for repeat users.

Why IPR Matters for High-Risk Verticals

IPR has a disproportionate impact on categories that rely on real-time movement of funds:

- Gaming and betting operators depend on instant deposits and payouts to maintain player trust and reduce support escalations.

- FX and CFD platforms benefit from predictable, fast funding events that eliminate card declines caused by issuer risk scoring.

- Travel and ticketing merchants experience fewer disputes and better refund visibility when payments move outside the card chargeback framework.

What changes with IPR is not simply speed, it’s the shift in user expectations. Once instant settlement becomes universal across euro accounts, users will judge merchants harshly when deposits or withdrawals feel slow.

Market-Wide Implications

IPR effectively levels the infrastructure playing field across the EU. PSPs that previously treated instant payments as an optional enhancement must now redesign their core architecture, liquidity buffers and fraud monitoring to comply. For high-risk merchants, this leads to:

- More reliable instant payout corridors

- Reduced dependency on card issuer risk thresholds

- Greater settlement transparency

- More uniform behaviour across EU markets

The introduction of IPR moves Europe a step closer to being an A2A-first ecosystem, one where cards remain important, but no longer function as the default “fast money” rail.

Open Banking Penetration by European Market

Open banking has matured unevenly across Europe, creating a landscape where some countries treat A2A initiation as a default behaviour while others are still building consumer trust and bank connectivity. Much of this divergence stems from how each market implemented the EBA’s payment services and open banking standards, which define API readiness, authentication rules and PSP obligations

Market studies on open banking adoption across Europe show a clear split between mature, early-adopter markets and those still in the enablement phase.

For high-risk merchants, these differences matter: the strength of a market’s open banking ecosystem directly shapes approval stability, payout reliability and conversion performance.

The overall trajectory is clear: Europe is moving toward deeper bank-led initiation, stronger API performance and rising consumer familiarity with secure, app-based authentication. Comparative overviews of open banking penetration by region highlight how the UK, Nordics and parts of Western Europe are now structurally different from emerging markets in CEE and Southern Europe. Those variations define where A2A can already outperform cards and where card rails still dominate.

United Kingdom: The Most Mature Open Banking Market

The UK remains Europe’s benchmark for open banking adoption. Years of investment in Faster Payments, strong API governance and well-capitalised PIS providers have created an ecosystem where A2A payments feel fast, predictable and safe. Industry reviews of open banking in the UK and Europe frequently highlight the UK’s role as the reference point for other markets. Variable Recurring Payments (VRP), although still in limited rollout, demonstrates the next phase of innovation: automated, bank-authorised pull payments that could replace cards in subscription and high-frequency-payment models.

For high-risk merchants, the UK offers:

- High authentication success due to mobile banking familiarity

- Strong conversion, especially for returning users in gaming and FX

- Predictable payout corridors using Faster Payments

The UK is also the region where A2A has the most visible potential to replace cards entirely for certain verticals.

Nordics, Benelux & Germany: Strong Adoption Driven by Bank Culture

These regions show consistently high usage of bank-led payment methods. In many cases, consumers have trusted direct-from-account payment flows long before PSD2 introduced open banking API standards. Open banking overviews from European providers specialising in A2A underline how the Nordics and Benelux markets, in particular, demonstrate high readiness for PIS-based payments.

Typical behaviours:

- High mobile-banking penetration

- Strong cultural preference for account-linked payments

- High comfort with SCA authentication

- Faster adoption of domestic instant-payment schemes

Countries like Sweden, Denmark and the Netherlands are demonstrating that card-based checkouts are no longer essential for high-frequency, low-friction transactions.

CEE & Southern Europe: Emerging, Growing, but Uneven

Open banking availability is strong across the region, but consumer adoption and bank readiness are variable. In some markets Poland, for example domestic A2A methods like BLIK are already dominant, creating a natural foundation for PIS adoption. In others, banks are still enhancing API performance and consumers are early in awareness-building.

For high-risk merchants, these regions can provide strong A2A performance once adoption crosses a usability threshold. However, fallback payment methods (typically cards or wallets) remain important for maintaining conversion.

Where A2A Is Already Outperforming Cards

Account-to-account payments have moved far beyond the experimental stage in Europe. In several markets, A2A is already outperforming cards across approval stability, deposit speed and customer trust particularly in sectors where friction or issuer scrutiny can cause major conversion losses.

The combination of instant settlement and bank-verified authentication has made A2A a reliable alternative in regions with mature digital banking ecosystems.

This shift is especially visible in verticals where timing defines customer experience. In gaming and betting, for example, players expect near-instant deposits and withdrawals; cards often fail to meet this expectation due to issuer risk controls or delayed settlement windows. A2A transactions initiated through domestic rails or open banking typically complete within seconds, reducing abandoned sessions and customer support escalations. Regulatory guidance from the European Central Bank’s instant payments programme highlights how instant A2A rails are now positioned as core infrastructure across EU financial markets, not optional add-ons.

A2A is also gaining ground in travel, ticketing and digital content categories frequently affected by chargebacks, refund delays and issuer scepticism. Because many A2A flows operate outside card dispute frameworks, merchants gain clearer visibility on settlements and fewer involuntary reversals. This is particularly valuable for high-risk sectors where dispute ratios directly influence PSP risk scoring.

In the UK and Nordics, where digital banking adoption is extremely high, A2A is now the preferred method for repeat purchases and high-value transactions. Mobile banking familiarity makes authentication fast and intuitive, resulting in higher approval rates than cards for many returning users. In these markets, A2A is not merely catching up it is becoming structurally better suited for verticals that require speed, predictability and low dispute friction.

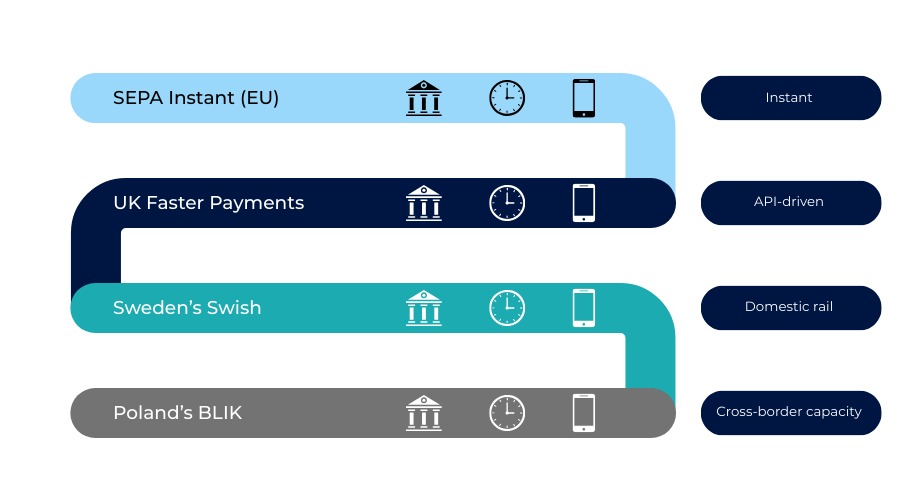

Rail-by-Rail Map for Europe

Europe’s account-to-account landscape is not a single system but a network of interconnected domestic and regional rails, each with its own settlement rhythm, authentication behaviour and coverage. Understanding how these rails differ is essential for high-risk merchants, because each corridor has varying levels of reliability, dispute exposure and regulatory protection. Some rails were built for speed, others for reach; some already support instant movement of funds, while others are still evolving.

SEPA Instant (Eurozone)

SEPA Instant is the backbone of euro-denominated A2A payments, enabling transfers across participating European markets within ten seconds. As adoption expands under the Instant Payments Regulation (IPR), euro payments are becoming more predictable across borders, eliminating many of the delays associated with legacy SEPA Credit Transfers.

The increasing adoption of SCT Inst aligns with broader global trends in instant bank-to-bank transfers, as highlighted in the Bank for International Settlements’ research on fast payment systems, which emphasises how real-time rails are becoming foundational to modern payment infrastructure.

UK Faster Payments & Open Banking PIS

The UK operates the most mature A2A environment in Europe, driven by Faster Payments and well-established open banking infrastructure. API reliability is strong, authentication is familiar to consumers and settlement is near-instant, making the rail particularly effective for high-risk sectors that require real-time deposits and payouts.

VRP (Variable Recurring Payments) also suggests a possible shift toward card-replacement models for subscription and high-frequency billing flows.

Domestic Rails Across Europe

Domestic A2A systems continue to outperform cards in several markets due to long-standing user trust and mobile-first banking adoption.

Notable examples:

- Swish (Sweden) – real-time mobile A2A with near-universal coverage

- Bizum (Spain) – fast-growing bank-integrated payment method

- BLIK (Poland) – dominant A2A rail with strong consumer trust

- Giropay / Paydirekt (Germany) – part of Germany’s bank-led payment ecosystem

These systems thrive because they were designed around domestic banking habits rather than cards, making them extremely effective for repeat users and high-engagement transactions.

Cross-Border Expectations

As more domestic rails integrate with SCT Inst or open banking PIS, cross-border A2A corridors will become more stable. High-risk merchants will gain more predictable deposit timing, fewer issuer-driven declines and clearer visibility into settlement paths.

Regulatory & Fraud Considerations

As A2A gains traction across Europe, regulators are intensifying their scrutiny of how instant payments and open banking transactions are authenticated, monitored and reimbursed. The rise of real-time money movement introduces both operational advantages and new types of fraud risks, particularly authorised push payment (APP) fraud, where the customer initiates a payment but is manipulated into sending funds to the wrong party. For merchants operating in high-risk verticals, understanding these obligations is essential, because A2A rails do not inherit the dispute protection frameworks associated with card schemes.

APP Fraud and Reimbursement Rules Are Evolving

Under updated regulatory expectations, banks and PSPs face stronger obligations around preventing APP scams and, in some cases, reimbursing customers when failures in verification occur. This is reshaping authentication flows across Europe, especially as markets adopt name-checking tools and enhanced behavioural analysis. Regulatory updates from the European Banking Authority’s payment services and fraud-prevention standards underline how PSPs must strengthen monitoring for real-time A2A transactions, aligning fraud controls with the growing speed and volume of instant payments.

For merchants, the impact is twofold:

- Fraud systems must adapt to real-time contexts where decisions cannot depend on batch-driven analysis.

Stronger Identity and Authentication Expectations

Strong Customer Authentication (SCA) remains central, but regulators increasingly expect banks to supplement SCA with contextual risk scoring, device intelligence and anomaly detection. This enhances security but also shapes user experience: high-risk transactions may encounter additional friction, while trusted or returning customers often benefit from smoother flows.

AML Visibility Increases for High-Risk Sectors

Because A2A rails move funds instantly, AML monitoring must operate continuously. High-risk merchants should expect:

- Stricter documentation during onboarding

- Ongoing reviews of transactional behaviour

- Possible corridor restrictions for certain jurisdictions

Regulators now expect PSPs to ensure that instant payments do not weaken AML standards simply because they operate outside of card-network review cycles.

Dispute Expectations Differ from Cards

Unlike chargebacks, A2A disputes depend on domestic schemes, bank policies and regulatory frameworks. Merchants must understand:

- How refunds operate within each rail

- Whether user error or fraud is reimbursable

- How banks handle retrieval requests

- What documentation must be provided

These differences influence operational planning: high-risk merchants may gain lower dispute exposure, but they must support A2A’s governance model with accurate record-keeping and responsive refund handling.

High-Risk Use Cases for A2A in Europe

A2A has become one of the most strategically important rails for high-risk merchants across Europe. The ability to move funds instantly, authenticate users via their banks and avoid issuer-driven declines makes A2A uniquely aligned with the needs of sectors that depend on rapid deposits and withdrawals. As consumer familiarity with mobile banking grows, A2A is no longer seen as a secondary option but a fast, predictable, and transparent method of moving money.

Instant Deposits and Payouts in Gaming and Betting

In gaming and betting, user confidence is strongly influenced by how quickly funds appear in their accounts and how reliably winnings are paid out. A2A removes issuer risk checks a major point of failure in card deposits and shifts authentication to secure bank channels. Instant payout corridors help operators differentiate on speed, a key decision factor for returning users in regulated markets.

FX, CFD and Digital Trading Platforms

For trading platforms, delays in deposits can mean missed opportunities. A2A supports immediate funding events, allowing customers to respond to market conditions without waiting for card settlements. Faster withdrawals also strengthen platform credibility, reducing complaints and support tickets tied to slow card refunds. Regulatory guidance from the European Central Bank’s retail payments framework outlines the expectations around instant transfers, fraud monitoring and payout transparency principles that directly influence how A2A rails support high-risk sectors operating with high transaction velocity.

Travel, Ticketing and High-Value eCommerce

These sectors benefit from the reduced dispute exposure inherent to A2A. While consumers still expect clear refund processes, the absence of chargebacks improves predictability for merchants. High-value bookings, ticketing and last-minute purchases often see better stability on A2A rails, where bank authentication is more robust than card issuer scoring.

Reduced Chargeback Exposure but Higher AML Monitoring

Because A2A avoids card chargebacks, high-risk merchants face fewer involuntary write-offs and less unpredictable dispute behaviour. However, the trade-off is an increase in AML visibility expectations. Instant payments require continuous monitoring, and PSPs expect merchants in high-risk verticals to demonstrate stronger controls, clearer documentation and reliable identity verification.

A2A as a Long-Term Card Alternative

Across Europe, A2A is evolving from a supporting payment option into a core infrastructure rail for high-risk sectors. Its appeal lies not only in speed but in the stability gained when issuers no longer serve as a dynamic risk gatekeeper. For many high-risk merchants, A2A is becoming the safest and most predictable payment method available provided that compliance and AML governance remain robust.

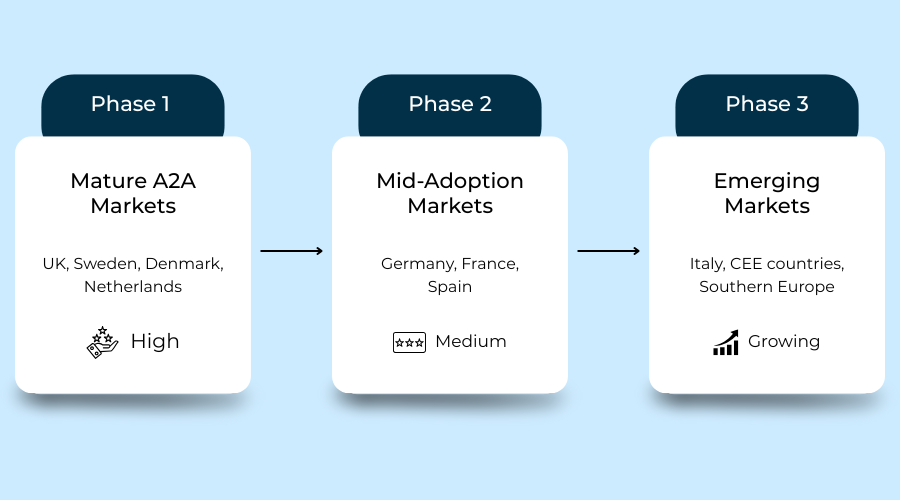

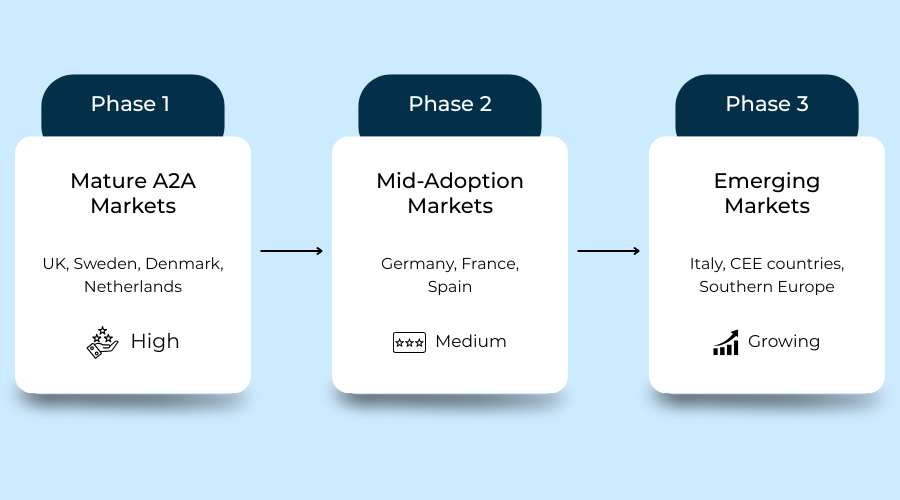

Implementation Roadmap by Market

Rolling out A2A across Europe requires more than simply activating a PIS provider. Each market has its own payment culture, regulatory environment and bank API behaviour meaning merchants must tailor their approach country by country. High-risk sectors, in particular, need structured rollout planning to ensure stable conversion, predictable settlements and strong compliance outcomes.

1. Prioritise Markets with Proven A2A Maturity

Merchants typically begin with countries where A2A adoption is already mainstream. The UK and Nordics offer the cleanest implementation paths due to strong mobile-banking habits and reliable API infrastructure. Benelux markets and Germany also provide robust performance, especially where domestic A2A rails complement open banking payments.

These regions often require minimal user education, making them ideal for early launch phases.

2. Assess Regulatory and Rail Readiness

Instant payments are not equally implemented across Europe. Some markets rely heavily on SCT Inst, while others use mature domestic rails or hybrid infrastructures. The European Commission’s SEPA and instant payments overview provides clarity on how instant transfers and settlement obligations apply country by country, helping merchants identify which markets support the fastest deposit and payout corridors.

This matters especially for gaming, FX and travel merchants that depend on predictable liquidity timing.

3. Validate PSP Coverage and API Stability

Even when A2A rails exist, provider quality varies. Some PSPs offer strong nationwide bank coverage; others may have gaps that force fallback to cards or manual processes. Merchants should evaluate:

- API uptime

- Redirect stability for mobile authentication

- Settlement visibility

- Consistency of SCA handling across banks

Markets with fragmented banking ecosystems (e.g., Italy, parts of CEE) may require more testing before scaling A2A to production volumes.

4. Localise User Experience

The user interface must follow regional expectations. For example:

- Nordic markets prefer mobile authentication flows

- German users are accustomed to bank-linked online payments

- Dutch users expect iDEAL-like behaviour

- UK users respond well to app-to-app authentication

Failure to match local payment culture often hurts conversion more than the payment rail itself.

5. Define Compliance Controls Per Market

A2A increases AML obligations because funds move instantly. High-risk merchants should prepare:

- Enhanced customer verification

- Clear source-of-funds justification in regulated industries

- Tighter transaction monitoring rules

- Local documentation aligned with PSP onboarding needs

Each market has its own reporting cadence and AML triggers, and PSPs will assess whether your controls meet regulatory expectations before enabling A2A for high-risk flows.

6. Build a Market-by-Market Scaling Plan

After initial rollout, merchants typically expand using a phased model:

- Phase 1: Mature markets (UK, Nordics, Benelux)

- Phase 2: High-population, mixed-readiness markets (France, Germany, Spain)

- Phase 3: Emerging A2A markets (CEE, Southern Europe)

This approach ensures predictable operational load, stable liquidity planning and high-performing checkout behaviour.

Conclusion

Europe’s payment landscape is moving toward an account-to-account foundation, driven by instant settlement rules, stronger authentication frameworks and growing consumer familiarity with mobile banking. For high-risk merchants, this shift offers something card rails have struggled to provide consistently across markets: predictable approval behaviour, transparent settlement flows and real-time access to liquidity. The result is not simply faster transactions, but a structural reduction in friction that directly improves customer experience and operational stability.

But A2A success depends on localisation. Each European market carries its own expectations around domestic rails, issuer behaviour, API performance and regulatory oversight. Merchants that attempt a one-size-fits-all rollout will see uneven results; those that tailor checkout experiences, compliance documentation and settlement workflows to each corridor will benefit from higher conversion and lower dispute exposure.

In 2026, A2A isn’t just an alternative payment option, it’s the emerging core infrastructure for sectors where speed, transparency and risk control define competitive advantage. High-risk merchants that invest in market-specific A2A strategies today will be positioned to outperform as instant payments become the continent’s default standard.

FAQs

1. How do instant A2A payments improve conversion for high-risk merchants?

Instant A2A flows remove issuer-based approval friction, which is a major blocker for sectors like gaming, FX and ticketing. Because authentication happens through the customer’s bank instead of a card issuer, declines are less frequent and returning users move through checkout faster. This produces more predictable conversion rates, especially in markets where card risk-scoring can be overly cautious.

2. Why do European markets vary so much in open banking adoption?

Each country has different levels of banking API maturity, consumer familiarity with mobile authentication and reliance on domestic instant-payment systems. The UK and Nordics adopted A2A habits early, while Southern and Eastern Europe still rely more on cards. These gaps influence how quickly merchants can scale A2A across multiple regions.

3. What makes A2A especially suitable for gaming, betting and FX?

These sectors depend heavily on fast deposits and withdrawals. A2A avoids issuer scrutiny linked to high-risk MCCs, enabling players or traders to fund accounts instantly and receive payouts with minimal delay. The clearer settlement path also reduces customer service disputes tied to slow card refunds.

4. Does A2A reduce the risk of chargebacks?

Yes. A2A payments do not use card scheme chargeback rules, so merchants face significantly fewer involuntary reversals. However, this places more responsibility on merchants to manage refunds transparently and maintain strong AML documentation, since disputes follow domestic banking rules rather than card frameworks.

5. How do instant payments affect merchant treasury operations?

Instant settlement can simplify liquidity planning by shortening the time between deposit and available funds. But it also requires real-time treasury visibility, because funds move 24/7. Merchants operating across multiple markets may need staggered liquidity buffers to account for differences in domestic rail behaviour.

6. What fraud risks increase with faster A2A payments?

Authorised push payment (APP) fraud is the main concern, as customers can be manipulated into sending money to criminal accounts. While SCA reduces many risks, merchants and PSPs still need continuous monitoring of transaction patterns, device behaviour and unusual payment flows to prevent abuse.

7. Are refunds on A2A payments slower than card refunds?

Refund speeds vary by rail. Some domestic systems return funds instantly, while others rely on standard SEPA cycles. While A2A refunds generally avoid multi-day card refund delays, merchants must understand each rail’s rules to provide accurate payout expectations to customers.

8. Can A2A fully replace cards in Europe?

Not everywhere, but in high-adoption markets (UK, Netherlands, Nordics), A2A already outperforms cards in speed, reliability and cost for many verticals. However, for subscriptions, international payments and long-tail merchants, cards still play an important role unless VRP and cross-border instant rails expand further.

9. What integrations are needed to support A2A across Europe?

Merchants usually integrate via a PIS provider or orchestration platform offering bank coverage across multiple markets. Additional work is required to map country-specific flows, user journeys, authentication styles and settlement expectations. High-risk merchants may also need stronger AML rule sets.

10. How should merchants decide which markets to prioritise for A2A?

Start with countries where A2A is already mainstream UK, Sweden, Denmark, Netherlands, Finland and expand into larger mixed-readiness markets like Germany, France and Spain. Prioritisation should align with where customers expect instant payments and where domestic rails already outperform cards.