Chargebacks rarely begin at the moment a customer files a dispute. By 2026, PSPs will have learned that the earliest signs appear weeks earlier in subtle behavioural cues, issuer friction, dissatisfaction signals and risk patterns merchants simply cannot see. What once felt like a sudden revenue loss has now become a predictable journey, shaped long before a dispute ever reaches the acquirer.

Chargebacks in 2026 don’t happen suddenly; they form slowly, and PSPs have learned how to read the early signals.

This shift has redefined the role of PSPs from post-dispute processors to predictive intelligence partners. For high-risk merchants in particular, the ability to detect chargebacks before they materialise is now essential to staying compliant, profitable and out of scheme monitoring.

- The New Reality: Chargebacks No Longer Start at Checkout

- The Data Universe Behind Chargeback Prediction

- The Dispute Lifecycle Graph: How PSPs See Risk Before Merchants Do

- The Engines Behind Prediction: Machine Learning Models of 2026

- A Chargeback Predicted: A Four-Week Timeline

- The PSP Intervention Playbook: Acting Before Chargebacks Hit

- Why High-Risk Merchants Benefit Most From Predictive Early-Warning Systems

- High-Risk Merchants Operate Close to Scheme Thresholds

- Predictive Compliance 2026: The New Expectations

- Regulators Expect Merchants to Prevent Disputes, Not Just Respond to Them

- Acquirers Now Score Merchants on “Early-Risk Visibility”

- Scheme Monitoring Programs Expect Predictive Controls

- Subscription, Gaming, and Digital Goods Face Stricter CX Obligations

- Documentation Requirements: Proving Predictive Controls Exist

- Why Predictive Compliance Defines Merchant Viability

- Conclusion

- FAQs

The New Reality: Chargebacks No Longer Start at Checkout

Merchants usually experience chargebacks as isolated incidents. A customer disputes a transaction, funds are reversed, and the merchant reacts after the damage is done. But PSPs in 2026 see chargebacks forming long before this point. They observe micro-signals like rising soft declines on certain BINs, traffic anomalies from specific campaigns, or early dissatisfaction patterns that mirror past dispute cycles.

The dispute doesn’t begin when the customer clicks “dispute.” It begins when the conditions for a dispute start to appear.

Issuer behaviour often gives the first signal. Soft declines, sudden authentication step-ups or unusual 3DS requests indicate changing risk posture. When combined with refund spikes, browsing hesitation or early fraud notifications, the dispute trajectory becomes clear before the first formal chargeback is filed.

The Data Universe Behind Chargeback Prediction

Chargeback prediction relies on four interconnected data layers that work together to reveal risk patterns early.

Transaction Memory

Historical disputes teach PSP models which combinations of MCCs, BIN ranges, device types and authentication flows most often lead to chargebacks. When new transactions resemble these patterns, early risk flags are raised.

Behavioural & Session Intelligence

User hesitation, policy-page reviews, device switching and repeated attempts often precede disputes. Behaviour tells a story long before a chargeback appears, especially in high-risk verticals where friendly fraud is common.

Issuer, Network & Scheme Signals

Issuer friction and early alerts like TC40 or SAFE reports reveal rising fraud or dispute risk. These signals often appear weeks before a customer files a claim. Scheme frameworks reinforce the expectation of early detection.

Customer Experience Signals

Refund spikes, subscription confusion, slow support or unclear descriptors often predict friendly fraud. Dissatisfied users frequently dispute instead of resolving issues with the merchant.

When these layers converge, they form a clear early-warning picture that merchants alone cannot detect.

The Dispute Lifecycle Graph: How PSPs See Risk Before Merchants Do

Merchants view disputes transaction by transaction, but PSPs operate across thousands of merchants and millions of data points. This broader visibility allows them to build a dispute lifecycle graph, a network map showing how devices, cards, BINs, affiliates and customer segments move across ecosystems.

PSPs don’t see isolated disputes, they see patterns forming across the entire portfolio.

A device ID appearing across multiple merchants, a BIN showing rising declines across several industries, or an affiliate driving similar refund spikes across unrelated brands all signal emerging risk. These patterns allow PSPs to warn merchants before their own dispute numbers even begin to rise.

The Engines Behind Prediction: Machine Learning Models of 2026

Predictive systems rely on four key ML engines:

Chargeback Probability Models

These evaluate new transactions based on similarity to past disputed patterns, generating early risk scores.

Behavioural Anomaly Detection

Models flag journeys that deviate from expected patterns of hesitation, erratic navigation or inconsistent device behaviour.

Portfolio Drift Monitoring

This detects shifts in merchant-level performance such as issuer sentiment changes, refund spikes or traffic deterioration.

Graph-Based Cluster Analysis

Fraud and friendly fraud clusters rarely affect one merchant alone. Graph-based models reveal ecosystem-level patterns long before merchants see issues.

Together, these engines form the backbone of dispute prediction, identifying risk before the first dispute ever arrives.

A Chargeback Predicted: A Four-Week Timeline

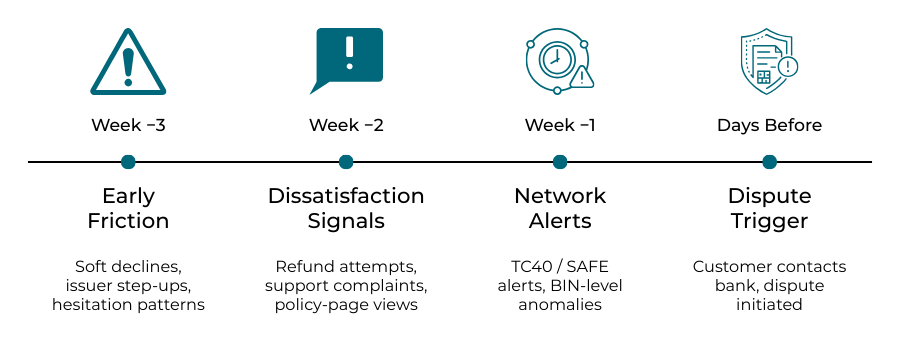

Chargebacks rarely surface without warning. When viewed through a PSP’s predictive lens, they follow a recognisable timeline, one that often begins weeks before the dispute itself. By tracing this journey, merchants can clearly see how predictive signals reveal the problem long before it becomes a financial loss.

Every chargeback has a story. The only difference in 2026 is that PSPs can read the first chapter.

Below is a compressed but realistic timeline of how a dispute begins, long before the chargeback code appears.

Week 3: The First Friction Signals

Three weeks before the dispute, early patterns emerge. Issuer behaviour begins to shift: soft declines occur slightly more often, 3DS step-ups appear unexpectedly, or a specific BIN range starts rejecting low-risk transactions. These changes rarely concern merchants, but PSPs recognise them as the earliest signs of tightening issuer scrutiny.

Customer behaviour may also show subtle warning signs, hesitation at checkout, repeated visits to refund policies, or multiple failed attempts that resemble journeys historically linked to disputes.

Nothing looks serious yet, but the pattern has begun.

Week 2: Dissatisfaction Starts to Surface

By week two, customer sentiment begins to appear in operational data. Merchants may see a handful of refund requests or minor complaints, but PSPs can detect the underlying trend: the issues are coming from the same traffic source, issuing country or customer segment.

If the merchant is subscription-based, support logs may show renewal confusion repeating across similar profiles. In travel or ticketing, confirmation delays or fulfilment gaps often drive early frustration.

At this stage, PSPs often know that the risk trajectory is shifting, even if dispute numbers remain at zero.

Week 1: Network Alerts and Early Fraud Signals

A week before the chargeback, more concrete indicators appear. PSPs may receive TC40 (Visa) or SAFE (Mastercard) notifications of early fraud signals submitted by issuers before a dispute is formally initiated. These alerts rarely occur in isolation; they often cluster around specific BINs, device IDs or geographies.

If the customer has already contacted their bank expressing dissatisfaction, pre-dispute alerts such as Ethoca or Verifi may fire. To merchants, this may feel sudden. To PSPs, it is simply the next step in the dispute lifecycle that has been building for weeks.

By now, the PSP recognises that the probability of a dispute has moved from possible to likely.

Days Before the Dispute, The Trigger Moment

In the final days, the customer takes the decisive step.

They may attempt a refund again, fail to reach support, dispute a recurring charge, or simply recognise the merchant’s descriptor and choose the easiest path: calling their bank.

Issuer systems often treat these calls as frictionless dispute initiation, especially for high-risk MCCs or categories prone to friendly fraud.

The chargeback that arrives in the merchant portal feels abrupt but for the PSP, it was predictable, measurable and visible long before the moment of filing.

Why This Timeline Matters in 2026

Understanding this timeline allows merchants to intervene early.

By identifying the week-3 and week-2 signals, PSPs can:

- Adjust authentication flows

- Tighten routing for high-risk BINs

- Recommend refunds before disputes occur

- Flag failing campaigns or affiliates

- Alert merchants when dissatisfaction begins to accelerate

A predictable chargeback is a preventable chargeback but only if merchants act before the final trigger.

The PSP Intervention Playbook: Acting Before Chargebacks Hit

When predictive systems detect the early signs of a dispute cycle, PSPs don’t wait for the first chargeback to appear. By 2026, leading providers will follow a structured intervention model that aims to reduce, reroute or neutralise the emerging risk before it crystallises into disputes.

Prediction is only useful when it leads to intervention and intervention is where PSPs prove their value.

Below is the modern PSP playbook for acting early and preventing chargebacks long before they enter scheme monitoring thresholds.

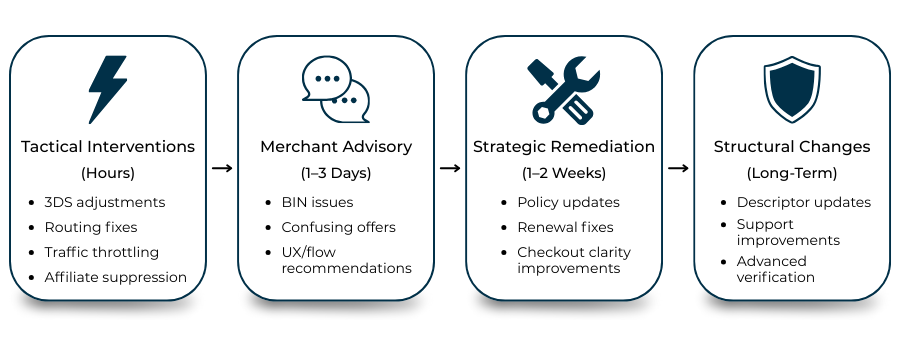

Tactical Interventions (Within Hours)

These fast responses occur as soon as a pattern emerges.

PSPs may:

- Adjust 3DS enforcement for specific BIN ranges

- Route transactions to acquirers with stronger issuer relationships

- Temporarily tighten risk models to stop problematic traffic

- Pause affiliate campaigns producing refund-heavy cohorts

These actions are subtle and typically invisible to customers; however, they immediately reduce the inflow of dispute-prone transactions.

The goal is to stabilise the risk curve before it accelerates.

Merchant Advisory (1-3 Days)

If patterns persist, PSPs shift from silent intervention to direct communication.

This is where merchants begin to feel the benefit of early-warning systems.

PSPs may notify merchants about:

- Increases in dissatisfaction tied to a specific offer or subscription plan

- Device or IP clusters predicting upcoming friendly fraud

- Emerging BIN-level issues affecting multiple merchants

- Checkout flows that are triggering buyer confusion

This advisory phase is less about technical intervention and more about business corrections. Even small adjustments to policies, descriptors or flow clarity often defuse a large portion of future disputes.

A three-minute fix today can eliminate dozens of chargebacks three weeks from now.

Strategic Remediation (1-2 Weeks)

If the indicators show the risk environment escalating, PSPs escalate too.

Strategic remediation focuses on correcting the underlying causes of dispute-prone patterns.

This may include:

- Revising subscription renewal logic or pre-renewal messaging

- Rebuilding refund processes to be more user-friendly

- Redesigning checkout elements to reduce ambiguity

- Recalibrating transaction risk scoring thresholds

- Modifying dispute-sensitive offers or pricing bundles

In high-risk verticals such as gaming, ticketing, or adult this phase is often crucial for preventing scheme escalation.

Merchants who respond early experience dramatically lower dispute ratios long before schemes intervene.

Structural Changes (Long-Term Risk Reduction)

Finally, PSPs address foundational issues that produce recurring dispute cycles.

These aren’t quick fixes; they are operational improvements that create long-term stability.

Examples include:

- Rebuilding the customer support workflow to reduce frustration-based disputes

- Deploying issuer-friendly descriptors and post-checkout messaging

- Adding machine learning–based retry logic to reduce soft declines

- Implementing advanced verification for risky user segments

These structural improvements create more resilient transaction ecosystems and significantly reduce the cost of operating in high-risk markets.

Why This Playbook Matters

Merchants typically only react once disputes enter dashboards or scheme thresholds.

By then, the remediation window is already shrinking.

PSPs, however, intervene when the problem is still forming not when it is fully visible.

This shift from reactive dispute management to proactive intervention defines the 2026 risk landscape. Merchants who adopt this approach experience fewer losses, lower operational stress, and far better compliance standing across acquirers and schemes.

Why High-Risk Merchants Benefit Most From Predictive Early-Warning Systems

High-risk merchants operate in an environment where even small increases in disputes can trigger major consequences: higher reserves, stricter monitoring, MID closures, or acquirer offboarding. This means early-warning systems are not just useful; they are mission-critical.

In high-risk categories, prediction isn’t an optimisation tool it’s a survival mechanism.

Below are the reasons why these merchants gain the strongest advantage from predictive dispute intelligence.

Dispute Cycles Hit High-Risk Verticals Faster

In sectors like gaming, adult, ticketing, FX, and subscription services, customer friction escalates quickly. A confusing offer, a delayed order, or unclear renewal communication can snowball into a major dispute surge within weeks.

Predictive systems help merchants catch these triggers early by highlighting:

- Dissatisfaction clusters

- Risky cohorts from affiliates

- BIN-level shifts in issuer tolerance

- Behavioural patterns linked to friendly fraud

The earlier a merchant sees the pattern, the easier it is to stop the cycle.

Issuers Apply Stricter Sentiment Scoring to High-Risk MCCs

Certain MCCs naturally face higher scrutiny. Issuers often apply stricter risk thresholds to categories associated with buyer remorse, ambiguous fulfilment, or aggressive marketing funnels.

For these merchants, predictive models help decode issuer sentiment:

- Are BINs tightening authentication?

- Are soft declines clustering by region?

- Are networks flagging the merchant more often?

Understanding these patterns early allows merchants to adjust routing, messaging, or flows before issuers begin auto-declining an entire segment of traffic.

High-Risk Merchants Operate Close to Scheme Thresholds

Visa and Mastercard monitoring programs leave little room for error.

A merchant hovering near thresholds has almost no margin to absorb a sudden dispute spike.

Predictive early-warning systems provide the buffer they need:

- Identifying patterns three weeks before disputes hit

- Advising refunds or communication to defuse customer frustration

- Helping merchants avoid entering monitoring altogether

Staying out of monitoring is far cheaper than trying to exit it.

Revenue Impact Is Larger When Approval Rates Are Volatile

In high-risk sectors, approval rate volatility directly impacts profit margins.

A dip in issuer trust leads not only to higher chargebacks but also to:

- More authentication friction

- More soft declines

- More abandoned checkouts

Predictive signals allow PSPs to adjust authentication, routing and risk thresholds before approval drops become visible.

Prediction protects both sides of the equation lower disputes AND higher approvals.

Reserves and Rolling Holds Decrease When Risk Becomes Predictable

Acquirers and PSPs are more comfortable lowering reserves when merchants demonstrate:

- Stability

- Reduced dispute volatility

- Predictable risk patterns

Early-warning systems produce exactly this kind of predictability.

This transparency builds trust, which leads to better commercial terms.

Why High-Risk Merchants Gain the Most

Traditional dispute management reacts only after financial damage occurs.

Predictive systems, however, prevent damage entirely, reducing chargebacks, improving issuer relationships and protecting long-term payment health.

In 2026, the high-risk merchants who win are the ones who detect the cycle early not the ones who fight it late.

Predictive Compliance 2026: The New Expectations

PSPs aren’t the only ones shifting toward predictive models. Regulators in 2026 expect merchants, especially high-risk ones to demonstrate that they can identify and mitigate dispute risk before it escalates. What began as an operational advantage has now become a compliance expectation tied directly to onboarding, licensing and ongoing monitoring.

Predictive compliance is no longer optional; it is the new definition of being “fit and proper” in high-risk payments.

Below are the compliance shifts shaping merchant obligations in 2026.

Regulators Expect Merchants to Prevent Disputes, Not Just Respond to Them

Under PSD3, PSR, FCA Consumer Duty, and multiple national frameworks, merchants must show they are actively reducing downstream harm to consumers.

This includes:

- Improving transparency

- Preventing billing confusion

- Detecting dissatisfaction early

- Providing frictionless refund pathways

Disputes are now interpreted as symptoms of poor customer outcomes, not isolated issues. Merchants who cannot control dispute risk face onboarding difficulties, reserve increases, or termination from high-risk programs.

Acquirers Now Score Merchants on “Early-Risk Visibility”

PSPs and acquirers increasingly score merchants on their ability to detect and act on early signals. This score influences:

- Reserve levels

- Onboarding decisions

- Corridor approvals

- Volume thresholds

A merchant with predictable dispute cycles is considered low risk. A merchant with surprise dispute spikes is seen as structurally dangerous.

Predictability is now a compliance asset.

Scheme Monitoring Programs Expect Predictive Controls

Visa and Mastercard monitoring programs have evolved to emphasise early remediation. Merchants who wait until they breach thresholds are penalised heavily, but merchants who demonstrate predictive controls benefit from:

- Lighter monitoring

- Longer grace periods

- Lower financial penalties

- More favourable remediation pathways

Predictive frameworks allow merchants to intervene weeks before their ratios worsen, aligning with scheme expectations for proactive management.

Subscription, Gaming, and Digital Goods Face Stricter CX Obligations

High-risk verticals are expected to show:

- Clear renewal flows

- Transparent cancellation journeys

- Upfront pricing and guarantee disclosures

- User-friendly refund experiences

Regulators increasingly view poor UX as a root cause of disputes. Predictive compliance frameworks evaluate whether merchants can detect trouble before it becomes customer harm.

Documentation Requirements: Proving Predictive Controls Exist

Regulators and acquirers now ask merchants to document their internal controls, including:

- Early-warning dashboards

- Dispute-prevention procedures

- Customer sentiment monitoring flows

- Affiliate governance

- Risk escalation rules

In 2026, showing evidence of predictive processes directly improves underwriting outcomes.

Why Predictive Compliance Defines Merchant Viability

Merchants who meet predictive compliance standards benefit from:

- Smoother onboarding

- Lower reserves

- Better issuer trust

- Improved dispute ratios

- Stronger cross-border acceptance

Merchants who ignore predictive compliance, however, face:

- Shortened MID lifespans

- More scheme penalties

- Higher dispute volatility

- Reduced acquirer appetite

Compliance has moved from document-based to behaviour-based and merchants must adapt.

Conclusion

By 2026, chargebacks will no longer be unpredictable shocks they are measurable, detectable patterns that form long before disputes appear. PSPs now operate with early-warning systems that analyse behavioural signals, issuer sentiment, fraud alerts, network data and customer dissatisfaction weeks in advance. The merchants who thrive in this environment are the ones who treat prediction not as a luxury, but as a core operational discipline.

The future of dispute management is not reactive. It’s anticipation.

High-risk businesses, in particular, benefit from this shift. Their verticals face tighter issuer scrutiny, faster dispute cycles and lower tolerance for volatility. Predictive compliance, early intervention and proactive customer recovery workflows give them the stability needed to maintain trust with acquirers, schemes and regulators.

At the same time, regulators across jurisdictions expect merchants to prevent consumer harm, not merely document it. Merchants who demonstrate predictive controls, clean dispute trajectories and stable behavioural patterns experience smoother onboarding, lower reserves and longer MID lifespans.

Predictive systems don’t eliminate disputes but they prevent the dispute cycles that threaten entire payment programs.

Going forward, the next evolution will be full-cycle protection: pre-dispute AI detecting patterns before they form, paired with post-dispute AI optimising recovery, representation and long-term remediation. Together, they give merchants and PSPs a complete ecosystem that protects revenue while improving customer outcomes.

In a payments world defined by complexity, the merchants who win are the ones who see trouble coming early and act while they still have time.

FAQs

1. How far in advance can PSPs predict chargebacks in 2026?

Most predictive models identify dispute-prone patterns 2-4 weeks before a chargeback occurs. Indicators like issuer friction, behavioural anomalies and early network alerts give PSPs enough time to intervene before a customer contacts their bank.

2. What’s the main difference between reactive and predictive dispute management?

Reactive systems respond after the chargeback is filed. Predictive systems detect the risk before the dispute forms, using behavioural, issuer and network signals to stop the cycle before losses occur.

3. Do high-risk merchants benefit more from predictive early-warning systems?

Yes. High-risk merchants face faster dispute cycles, stricter issuer scoring and tighter scheme thresholds. Predictive intelligence gives them the buffer needed to prevent volume spikes that can trigger reserves or MID termination.

4. What data sources do PSPs use to forecast chargebacks?

PSPs combine:

- Transaction history and dispute patterns

- Behavioural/session intelligence

- BIN and issuer sentiment signals

- TC40/SAFE alerts

- Customer support trends and refund spikes

- Graph-based patterns across multiple merchants

Together, these provide a reliable early-stage risk picture.

5. Does friendly fraud also generate early signals?

Yes. Friendly fraud is often predictable. Behavioural hesitation, repeated policy page views, descriptor confusion, subscription renewal friction and early refund requests can all signal upcoming disputes.

6. How do issuers contribute to early-warning systems?

Issuer soft declines, authentication step-ups, increased friction for certain BINs and early fraud alerts (TC40/SAFE) serve as pre-dispute indicators. Issuer shifts often appear weeks before the dispute.

7. Can predictive systems reduce reserves for high-risk merchants?

In many cases, yes. Merchants who demonstrate predictable dispute patterns and proactive controls qualify for lower reserves, better pricing and stronger acquirer trust.

8. What happens when PSPs detect early dispute risk?

PSPs trigger their intervention playbook:

- Adjust routing and 3DS

- Recommend policy or UX fixes

- Identify problematic traffic sources

- Issue customer-recovery prompts

These steps prevent the risk from escalating into a dispute cycle.

9. Are predictive models required for compliance under PSD3, FCA and global AML standards?

Not explicitly but regulators expect merchants to prevent consumer harm, not simply manage disputes after they occur. Early detection supports Consumer Duty, transparency, and risk-based monitoring obligations.

10. Do merchants need their own internal predictive system?

Merchants don’t need to build full ML engines, but they do need:

- Early-signal dashboards

- CX monitoring

- Rapid-response workflows

- Checkout/policy governance

Without these, predictive signals cannot be acted upon.

11. Can predictive systems eliminate chargebacks?

No system can eliminate disputes. But predictive intelligence reduces their frequency, severity and volatility, helping merchants stay out of scheme monitoring.

12. How do predictive systems impact approval rates?

By identifying risky segments early, PSPs adjust routing and authentication to maintain issuer trust. This stabilises approval rates especially for merchants in high-risk MCCs or cross-border corridors.

13. Can predictive systems flag fraud rings before they strike multiple merchants?

Yes. Graph-based models detect shared device fingerprints, cards, IPs or behavioural clusters across the PSP’s entire portfolio, revealing fraud rings before they attack a merchant at scale.

14. Are early-warning systems only for enterprise-level merchants?

No. In 2026, PSPs will increasingly offer predictive tools to mid-market and high-risk SMB merchants because their dispute cycles are more volatile and require tighter control.

15. What is the biggest advantage of predictive dispute management?

Time.

The earlier merchants see risk forming, the easier and cheaper it is to prevent chargebacks, protect approval rates, and maintain compliance across multiple acquirers and schemes.