In December 2025, Reuters reported that the EU Council had endorsed a negotiating position supporting the development of a digital euro with both online and offline functionality. The emphasis on offline use, particularly its privacy characteristics, marks a clear policy signal. While the digital euro is not launching imminently, the endorsement confirms that EU institutions are converging on a design direction that treats privacy and resilience as foundational requirements, not optional features.

For payment providers and merchants, the significance lies less in timelines and more in what the EU is choosing to optimise for. Offline capability reshapes assumptions about how a future public digital payment instrument should behave alongside cash, cards, and account-to-account rails.

What the Reuters Article Reports

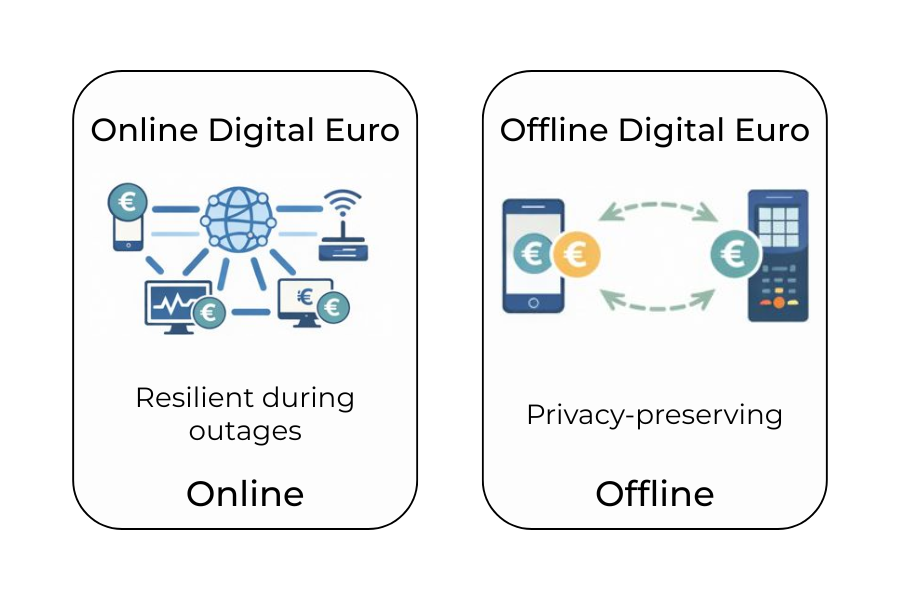

Reuters’ reporting focuses on the political dimension of the digital euro project. According to the article, the EU Council has backed a negotiating stance that explicitly supports offline payments, allowing users to transact even when connectivity is unavailable. The Council’s position does not announce a product launch or technical specification. Instead, it signals alignment among member states on key principles that should guide the digital euro’s design.

The article frames offline use as a response to two concerns. First, privacy: offline payments are intended to resemble cash-like transactions where personal data exposure is limited. Second, resilience: enabling payments during outages or network disruptions reduces dependence on continuous connectivity. Together, these concerns elevate offline capability from a technical feature to a policy objective.

Crucially, Reuters does not suggest that implementation details are finalised. The endorsement is part of an ongoing legislative and design process that remains subject to negotiation with other EU institutions.

Why Offline Privacy Is Central to the Digital Euro Debate

Offline privacy sits at the heart of the digital euro discussion because it addresses a trust gap that purely online payment instruments have struggled to close. Cash offers anonymity and immediate settlement without reliance on intermediaries or networks. Replicating some of those properties in a digital form is politically and socially sensitive, but it is central to the EU’s framing of a retail central bank digital currency.

From a policy perspective, offline capability allows transactions to occur without real-time data exchange. This reduces the amount of personal information generated and stored during everyday payments.

The aim is not absolute anonymity, but data minimisation, ensuring that small-value, routine transactions do not create detailed behavioural records by default.

Offline functionality also supports system resilience. Payments that depend entirely on network availability are vulnerable to outages, cyber incidents, or infrastructure failures. By contrast, offline payments can continue during temporary disruptions, supporting economic continuity. In this sense, offline capability is positioned as a public good rather than a competitive differentiator.

The debate also reflects a distinction between public money and commercial payment products. While private digital wallets prioritise convenience and data-driven services, the digital euro is being framed as a complement to cash, designed to preserve certain societal expectations around privacy and access.

Why This Matters for European Payments

The EU Council’s endorsement matters because it confirms that the digital euro is being treated as infrastructure planning, not a theoretical exercise. Even without a launch date, the policy direction influences how regulators, central banks, and market participants think about the future mix of payment rails.

First, it reinforces the EU’s focus on strategic autonomy in payments. A digital euro would provide a publicly governed alternative alongside cards and private account-based systems. Offline capability strengthens that position by reducing reliance on continuous private network availability.

Second, it signals that privacy considerations will shape design choices. For PSPs accustomed to online, account-linked payments, this is a meaningful departure. It suggests that not all future digital payments will be designed around full traceability or continuous connectivity.

Third, the endorsement helps frame expectations for the coming years. While the digital euro will not replace existing rails, it is being positioned as a long-term complement that could influence acceptance models, wallet design, and settlement logic across the euro area.

What This Could Mean for PSPs and Merchants (High-Level)

For now, PSPs and merchants are not being asked to build or integrate digital euro systems. The EU Council’s endorsement does not impose immediate obligations. However, it does shape the direction of travel.

For PSPs, the digital euro raises questions about wallet interoperability and acceptance infrastructure over the longer term. If offline payments become part of the design, supporting devices, terminals, and reconciliation processes will differ from purely online models. Monitoring developments early allows PSPs to assess potential impacts without committing resources prematurely.

Merchants may eventually face new acceptance scenarios. Offline digital euro payments could resemble cash transactions in their immediacy, but differ in settlement mechanics and reconciliation. While these considerations remain future-facing, awareness is important for sectors that rely heavily on point-of-sale payments or operate in environments with intermittent connectivity.

At this stage, the prudent approach for both PSPs and merchants is monitoring rather than implementation. The policy signal is clear, but the operational implications will only crystallise as design and legislative work progresses.

Risk, Privacy, and Compliance Considerations

Offline payments introduce complex trade-offs. From a compliance perspective, reduced data availability challenges traditional AML and KYC frameworks, which often rely on transaction-level visibility. Policymakers are aware of this tension, which is why discussions around offline use typically include transaction limits and risk-based safeguards.

The emphasis on privacy does not imply an absence of controls. Instead, it points to a layered approach where small-value, low-risk transactions may benefit from higher privacy, while larger or repeated transactions trigger additional checks. These design choices remain under discussion and have not been finalised.

For merchants and PSPs, the key takeaway is that compliance expectations may evolve alongside the digital euro. Offline capability will likely require new forms of risk assessment that differ from existing online payment models. This reinforces the importance of staying aligned with policy developments rather than assuming that current compliance approaches will translate directly.

Timeline and Next Steps (Carefully Framed)

The EU Council’s endorsement does not set binding milestones for launch. Official communications from EU institutions indicate that legislative negotiations and technical design work continue through 2026, with pilot phases expected later in the decade.

The European Central Bank, which leads the digital euro project, has consistently framed the initiative as a multi-year effort focused on careful design and stakeholder consultation.

Any references to specific years beyond pilot planning should be treated as indicative planning horizons, not commitments. The policy signal matters more than precise dates: EU institutions are aligning around a digital euro that prioritises privacy and resilience from the outset.

Conclusion

The EU Council’s endorsement of offline functionality marks an important moment in the digital euro’s evolution. It confirms that the project has moved beyond abstract debate and into policy-backed design choices. Offline privacy is not a secondary consideration; it is a defining feature that reflects European priorities around trust, resilience, and public money.

For PSPs and merchants, the immediate impact is informational rather than operational. There is no requirement to integrate or prepare systems today. However, the direction is clear. A future euro payment instrument is being designed to behave differently from existing digital rails, borrowing attributes from cash while operating within a digital framework.

In 2026, the digital euro remains a roadmap rather than a product. But the roadmap itself carries weight. By prioritising offline privacy, EU policymakers are signalling how they expect future payment infrastructure to balance innovation with societal expectations. For market participants, understanding that signal now is essential to navigating what comes next.

FAQs

1. What did the EU Council actually endorse in December 2025?

The EU Council endorsed a negotiating position supporting a digital euro design that includes both online and offline functionality, with a strong emphasis on offline privacy.

2. Does this mean the digital euro is launching soon?

No. The endorsement is a policy and legislative signal, not a launch announcement. There is no confirmed production rollout date.

3. Why is offline functionality such a priority?

Offline functionality supports cash-like privacy and allows payments to continue during connectivity outages. It reflects EU priorities around trust, resilience, and public access to money.

4. What does “offline privacy” mean in practice?

It generally refers to payments that can occur without real-time data exchange, limiting the amount of personal information generated for small, routine transactions.

5. Will offline digital euro payments be anonymous like cash?

No. Policymakers are not proposing full anonymity. The focus is on data minimisation, not the absence of controls, particularly for low-value transactions.

6. How does this differ from existing digital wallets?

Unlike commercial wallets, the digital euro is being designed as public money, governed by central bank and EU policy objectives rather than commercial data models.

7. Are PSPs required to integrate the digital euro today?

No. There are no immediate technical or regulatory obligations for PSPs arising from this endorsement.

8. What should PSPs do at this stage?

Monitor policy and design developments. Premature implementation is not expected, but understanding the direction helps with long-term infrastructure planning.

9. How might this affect merchants in the future?

If implemented, offline digital euro payments could introduce new acceptance and reconciliation models, particularly at physical points of sale or in low-connectivity environments.

10. What are the AML and compliance concerns with offline payments?

Offline payments raise questions about transaction visibility. Policymakers are considering limits and risk-based safeguards to balance privacy with AML expectations.

11. Has the ECB confirmed how offline payments will work technically?

No. The European Central Bank has stated that technical design and safeguards are still under development and consultation.

12. Is the digital euro intended to replace cash?

No. EU institutions consistently state that the digital euro would complement cash, not replace it.

13. Why is this policy signal important even without a launch date?

Because it shapes design priorities. Decisions made now influence how future payment infrastructure will behave and what trade-offs are considered acceptable.

14. What role did Reuters play in this news?

The development was reported by Reuters, providing insight into the EU Council’s position and the political momentum behind the project.

15. What is the key takeaway for 2026?

The digital euro is moving from concept to policy-backed roadmap. Offline privacy is now a defining design choice, even though implementation remains years away.