Entering multiple new markets in 2026 is no longer just about localisation of language or pricing. The real differentiation now comes from how well merchants adapt their payment experience to local expectations. Consumers increasingly expect their preferred payment method to appear first, in their local currency, and without unnecessary friction. When it doesn’t, conversion drops often more sharply than most merchants anticipate.

A common mistake is assuming that simply adding every available payment method will increase acceptance. In practice, the opposite happens. Unplanned APM expansion leads to operational overhead, inconsistent approval rates and avoidable compliance complexity. Merchants launching across five or more markets quickly discover that payment behaviour varies dramatically: PIX dominates in Brazil, UPI rules in India, iDEAL shapes Dutch e-commerce, and wallets remain central to Southeast Asia.

What works well in one region can underperform elsewhere. The order in which APMs are displayed, the currency shown at checkout and the underlying settlement setup all influence trust and conversion. A poorly sequenced checkout whether overcrowded or misaligned with local habits can have the same effect as high pricing or a weak product funnel.

As competition intensifies and regulatory frameworks evolve, merchants need a more deliberate approach to choosing and sequencing payment methods. The goal is not to offer everything it’s to offer the right combination, in the right order, for each market. This guide explains how to build that strategy, market by market, using data-driven sequencing instead of APM dumping.

- Understanding APM Archetypes: The Global Payment Landscape in 2026

- The Hidden Cost of APM Sprawl: Why More Methods ≠ More Conversion

- Step 1: Build a Payment Culture Profile for Each Target Market

- Step 2: Decide the Minimum Viable APM Stack for the First 6-12 Months

- Step 3: Currency Sequencing: The Other Half of the Conversion Equation

- Step 4: Phase 2 Expansion: Adding More APMs Using Real Performance Data

- Regional APM & Currency Prioritisation: 5 Market Capsules

- Risk & Compliance Implications of Each APM Type

- How Orchestration Enables Smart APM & Currency Sequencing

- Execution Dashboard: KPIs to Track APM and Currency Sequencing

- 13. 2026 Sequencing Framework — Prioritise → Launch → Optimise

- Conclusion

- FAQs

Understanding APM Archetypes: The Global Payment Landscape in 2026

Before deciding which payment methods to prioritise in a new market, merchants need a clear view of the major APM categories and how they behave. Not all alternative payment methods operate in the same way, and their risk, refund and settlement characteristics can be very different. Understanding these archetypes helps merchants avoid overextending themselves with methods that add more complexity than value.

Cards vs Wallets vs Instant A2A vs BNPL vs Cash Vouchers

Cards: Remain universally recognised, especially in developed markets, but they perform unevenly across emerging economies where domestic schemes or bank-led payment systems dominate. Refundability is strong, but chargebacks are a key operational risk.

Digital Wallets: Such as mobile-pay apps or stored-value solutions offer trust and convenience, but their KYC standards and settlement timelines vary widely. In many regions, wallets have become the default method particularly for mobile-first consumers.

Instant A2A (account-to-account): Payments, such as PIX, UPI, iDEAL and PayNow, have grown rapidly because of instant settlement, strong authentication and low cost. For many merchants, these rails now deliver higher acceptance than cards, but they can limit refund flexibility.

BNPL: Provides a boost for conversion in specific verticals, especially higher-ticket retail. However, it introduces additional regulatory and compliance oversight, making it a selective not universal APM.

Cash vouchers: Or over-the-counter payment codes remain relevant in markets with low bank penetration. They support reach, but settlement delays and operational overhead make them a secondary choice for most digital-first businesses.

Developed vs Emerging Markets: Who Uses What

Payment behaviour differs significantly between mature and emerging regions. Developed markets favour cards and regulated open-banking A2A methods, while emerging markets lean heavily on instant-pay systems, mobile wallets or cash-based APMs. These differences explain why a universal APM strategy rarely succeeds.

Expansion across five or more markets requires a tailored approach one that respects how each region actually pays, not how the merchant wishes to standardise its checkout.

The Hidden Cost of APM Sprawl: Why More Methods ≠ More Conversion

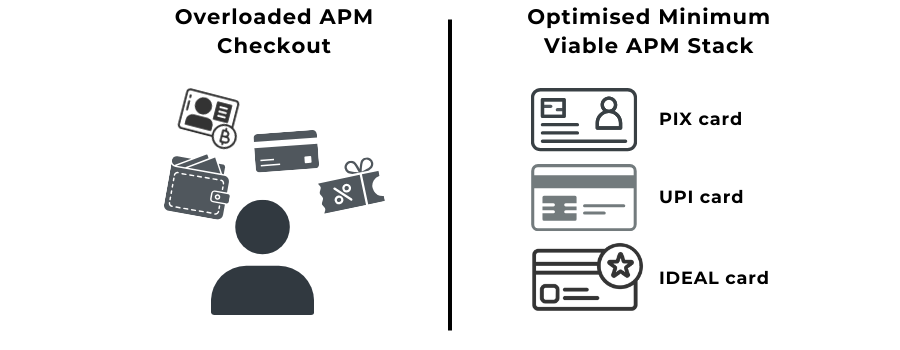

As merchants expand into multiple regions, it’s easy to assume that offering every available payment method will boost acceptance. In practice, this “APM dumping” approach often creates more problems than it solves. Every additional method brings its own operational requirements, settlement flow, reconciliation rules and regulatory obligations. Without careful sequencing, the checkout becomes cluttered and confusing, reducing rather than improving conversion.

Operational overhead is one of the biggest challenges. Each APM behaves differently when it comes to refunds, disputes, chargeback handling or settlement timing. Wallets may settle quickly but require identity verification; instant A2A schemes offer strong performance but can limit the reversibility of transactions; BNPL providers add cost and regulatory checks. When too many of these methods are introduced at once, the payment team can quickly become overwhelmed.

Compliance risk also increases. Many APMs fall under different AML or KYC obligations, and adding them without understanding local rules can expose merchants to audits or onboarding delays. Fragmented PSP setups can further complicate visibility, making it difficult to identify where declines occur or which method is underperforming.

Ultimately, APM sprawl weakens the customer experience. Consumers expect a focused, intuitive checkout with the methods they trust most, not a crowded list of unfamiliar options. Successful expansion into five or more markets requires strategic curation. The goal isn’t to offer everything, it’s to offer what matters in the right order.

Step 1: Build a Payment Culture Profile for Each Target Market

Before choosing any APMs, merchants need to understand how people in each market actually pay. Every country has a distinct payment culture shaped by trust, regulation, technology adoption and consumer behaviour. Entering five or more markets in 2026 without understanding these nuances often leads to avoidable drop-offs and unnecessary operational burdens.

Identifying True Consumer Preferences

Preferences differ not just between regions, but within them. Younger consumers may prefer mobile-led wallets, while older demographics lean toward cards or bank transfers. Income level also affects method choice: markets with a large unbanked population continue to use cash vouchers or agent-based payments. Trust plays a central role for many consumers who select the method they recognise from daily use, not necessarily the one with the lowest cost or fastest speed.

Understanding where the customer pays (mobile apps, desktop, in-app browser) influences which APM deserves prominence. Mobile-first markets particularly across Southeast Asia see higher wallet adoption, while desktop-heavy regions favour methods like iDEAL or card-based flows.

Understanding Ticket Size and Recurring Behaviour

Local payment culture also varies by transaction frequency and value. Instant A2A methods such as PIX or UPI thrive in high-volume, low-ticket markets where speed and convenience matter more than credit access. On the other hand, higher-ticket verticals electronics, travel, and luxury perform better with cards or wallet-based credit extensions.

Subscription and recurring-billing models introduce another layer of complexity. Not all APMs support seamless rebilling, and some require customer re-authentication at intervals. For merchants planning long-term market entry, these dynamics are crucial in determining which APMs should be prioritised first.

By building a complete payment culture profile, merchants can avoid relying on outdated assumptions and instead select methods that reflect real consumer habits.

Step 2: Decide the Minimum Viable APM Stack for the First 6-12 Months

Once the payment culture of each target market is understood, the next step is to design a lean, focused APM stack that supports the first phase of expansion. Many merchants feel pressure to launch with an extensive range of options, but most markets only need two or three well-chosen methods to achieve strong early conversion. The objective is to balance customer trust with operational control, allowing the business to scale gradually without overwhelming its payments infrastructure.

Criteria for Selecting the First Set of APMs

The initial stack should prioritise methods that combine reach, reliability and compliance clarity. Trust is often the strongest indicator of early adoption; consumers tend to select the brand or rail they know best, even when multiple options exist. Reach is equally important. A widely used instant-payment system or national wallet can often outperform cards during market entry simply because more consumers use it daily.

Refundability and dispute handling must also be considered. APMs vary significantly in how reversals work. Some instant-payment systems support only forward transactions, making customer refunds operationally heavier. BNPL and wallet-based flows may introduce longer settlement cycles or additional steps in dispute resolution. Merchants entering new markets must ensure their initial APM stack does not create complexity that their teams are unprepared to manage.

Chargeback behaviour is another practical constraint. Card schemes offer structured dispute processes, while many APMs do not. For high-risk categories or markets with sensitive regulatory oversight, starting with a controlled mix helps prevent unexpected operational strain.

How Many APMs Are “Enough” for Launch?

For most markets, two to three APMs are sufficient for the first six to twelve months. This typically includes one globally familiar method (such as cards) and one or two locally dominant methods. Adding too many options early creates noise in the checkout, slows decision-making and complicates reporting. A lean approach also enables clear benchmarking: if an APM underperforms, merchants can isolate the issue without interference from unrelated methods.

A minimum viable APM stack does not limit growth it lays the foundation for sustainable expansion. Once performance data accumulates, merchants can make informed decisions about which additional methods will genuinely improve approval rates and conversion.

Step 3: Currency Sequencing: The Other Half of the Conversion Equation

Choosing the right payment method is only half of the localisation strategy. The currency a customer sees the one in which prices are displayed, authorised and settled plays an equally important role in how trustworthy a checkout feels. In many emerging and established markets, an otherwise well-designed payment experience can see conversion drop simply because the merchant defaulted to USD or EUR instead of presenting a familiar local currency.

When to Display Local Currency vs USD/EUR

Local currency display is almost always the safer choice for consumer-facing goods and services. It reduces cognitive load, aligns expectations and removes the suspicion that FX margins are hidden in the price. However, certain high-risk or B2B segments may still use hard currencies for operational reasons, particularly when settlement flows are centralised.

The key is consistency. If a merchant chooses to present a non-local currency, the pricing must remain stable to avoid customer hesitation.

FX Impact on Conversion and Issuer Approval

FX considerations extend beyond user preference. In some regions, issuers approve transactions more reliably when the currency matches domestic norms. Cross-border transactions in unfamiliar currencies can trigger additional authentication or soft declines. This is particularly common in markets where foreign-currency exposure is closely monitored by regulators or where fraud teams treat mismatched currencies as higher risk. By aligning currency with consumer expectations, merchants reduce friction while improving issuer trust signals.

Settlement Considerations for Multi-Market PSP Setups

Settlement flows also influence currency sequencing. Merchants expanding across five or more markets often centralise settlement in one or two currencies for financial control. While operationally efficient, this approach requires careful PSP configuration to ensure the customer sees the correct local currency even if the merchant settles in a different one. Transparent FX handling and clear reconciliation rules are essential. Poorly configured setups can lead to mismatched receipts, unexpected deductions and avoidable disputes.

Currency sequencing is therefore not just a pricing decision it is a conversion and trust multiplier. When paired with the right APM stack, it forms a complete localisation experience that supports both user confidence and operational precision.

Step 4: Phase 2 Expansion: Adding More APMs Using Real Performance Data

Once the initial APM stack and currency setup have been tested in-market, the next phase is expansion adding methods that genuinely improve conversion rather than creating noise. This stage should always be driven by real performance data, not by assumptions or competitor pressure. When merchants follow a data-first approach, they avoid unnecessary operational sprawl and ensure each new APM delivers measurable impact.

Using PSP Dashboards to Identify When to Add a New APM

Most PSPs now provide granular reporting on conversion funnels, decline types and APM-specific behaviour. By reviewing approval rates, drop-off points, refund friction and cost per acceptance, merchants can isolate where existing methods fall short. For example, if cards show high soft-decline rates in a mobile-first market, introducing a local wallet may reduce friction. If a fast-growing user segment frequently selects a bank-transfer flow, activating a domestic A2A option may unlock additional volume.

When to Add Wallets, BNPL or Instant Payment Methods

Local wallets are often the first APM to be added in phase two, especially in regions where mobile penetration is high. Wallets offer strong brand familiarity and quick authentication, making them valuable complements to cards. BNPL, on the other hand, should be added selectively and typically later, since it introduces compliance, affordability checks and cost considerations. Instant-payment systems such as PIX, UPI or PayNow are high-impact additions but require operational readiness for reconciliation and refund handling.

Scaling Without Overestimation

It is easy to assume that every new APM will improve acceptance, but phase-two expansion should be incremental. Merchants should wait for sufficient transaction volume before evaluating whether an added method performs as expected. If a newly introduced APM sees low adoption or high operational overhead, it may need to be repositioned in the checkout or removed entirely. The goal is continuous optimisation, not accumulation.

By grounding APM expansion in real data, merchants ensure their multi-market strategy remains scalable, efficient and aligned with genuine customer behaviour.

Regional APM & Currency Prioritisation: 5 Market Capsules

Payment behaviour varies widely across regions, making it essential for merchants to tailor APM and currency sequencing to each market rather than applying a single global template. These short capsules outline what should typically be prioritised when entering five key regions in 2026.

- Brazil: PIX First, BRL Display Required

PIX has become the dominant payment method across Brazil, used for everything from P2P transfers to ecommerce purchases. Any merchant entering the market should treat PIX as a foundational APM. Domestic card rails remain relevant, but foreign-acquired transactions often face higher scrutiny. BRL pricing is strongly preferred, and in many categories expected. Checkout flows that default to USD or EUR commonly see higher drop-off due to distrust and FX uncertainty.

- India: UPI Mandatory, Wallets as Secondary Options

UPI’s widespread adoption, strong authentication and instant settlement make it the primary APM for nearly all online commerce in India. Merchants launching here need UPI access via local acquiring or PSP partnerships. Wallets retain niche usage but no longer lead transaction volume. INR display is critical, as foreign currency pricing can introduce regulatory friction or user hesitation. Subscription models require additional planning because not all UPI flows support recurring billing.

- Netherlands: iDEAL Dominant, EUR Checkout Essential

iDEAL continues to shape Dutch e-commerce, offering high trust and predictable conversion. For most merchants, iDEAL should appear above cards at checkout. Cards and open-banking alternatives still play a role but serve as secondary options. EUR display is expected, with non-EU currencies undermining trust. Refund processes should be configured carefully, as iDEAL flows differ from typical card logic.

- Singapore: PayNow-Led, Wallets Growing

Singapore’s PayNow rail has become central to digital payments, making it one of the first methods merchants should enable. Mobile wallets such as GrabPay and ShopeePay are also influential, particularly for retail and mobile-first audiences. SGD pricing is strongly preferred, even for international brands, and contributes significantly to trust. Multi-currency displays can work, but the default should remain SGD.

- UAE: Cards + Wallets First, A2A on the Rise

The UAE features a mixed landscape where cards remain dominant but wallets and account-to-account methods are gaining traction, particularly for recurring and utility-style payments. Merchants should prioritise cards and widely used wallets, adding A2A flows as they mature. AED pricing is encouraged but not always mandatory, though consistent FX rules help reduce customer friction.

Risk & Compliance Implications of Each APM Type

Every payment method comes with its own compliance expectations, regulatory oversight and operational responsibilities. When merchants expand into multiple markets, these differences become more noticeable and more important to manage. Selecting an APM without understanding its underlying regulatory obligations can introduce delays, trigger enhanced checks or lead to unresolved disputes.

Wallet KYC and Identity Requirements

Digital wallets vary widely in how they verify users. Some require full KYC before transaction approval, while others allow low-limit payments for lightly verified users. This affects fraud exposure and refund handling. In regions like Southeast Asia, wallet providers may impose additional onboarding checks on merchants, which should be factored into launch timelines.

Instant-Payment Schemes and Fraud Controls

Instant account-to-account rails such as PIX, UPI and PayNow offer strong authentication by design, but they also reduce the window for fraud monitoring because funds settle immediately. Regulators therefore encourage PSPs and merchants to adopt robust behavioural analytics and bank-matching checks. Refunds can also be more complex, as reversals are not always supported by the scheme.

BNPL: Affordability Rules and Merchant Liability

BNPL providers must comply with affordability and credit-assessment rules in many regions, including the EU and parts of APAC. For merchants, this introduces operational dependencies: approvals rely on the BNPL provider’s credit decisioning, and refunds follow different workflows compared with cards or bank payments. Integration is straightforward, but compliance responsibilities should not be underestimated.

Cash Vouchers and AML Oversight

Cash-based APMs, including over-the-counter vouchers, are subject to strict AML controls. These methods often require enhanced monitoring because users may not be fully banked, and reconciliation cycles can be longer. For merchants, the regulatory burden can outweigh the benefits unless the target market has significant cash-reliant segments.

Regional Regulatory Alignment

Markets such as the EU, India, Brazil and Singapore each apply different standards to APMs. EU PSD3 will introduce more transparent risk and authentication expectations; India maintains tight oversight of UPI and wallet licensing; Brazil’s Central Bank governs PIX rules; and Singapore’s MAS enforces strong risk frameworks across wallets and instant rails. When entering multiple markets, merchants must map APM choices to these regulatory environments.

Understanding these compliance nuances early helps merchants choose methods that support both customer expectations and long-term operational resilience.

How Orchestration Enables Smart APM & Currency Sequencing

As merchants expand into multiple regions, the complexity of managing APMs, currency preferences and routing logic increases quickly. This is where payment orchestration becomes essential. Rather than relying on a single gateway or PSP, orchestration layers provide the flexibility to connect multiple providers, prioritise local methods and personalise checkout experiences based on the customer’s context.

Orchestration enables dynamic APM sequencing, meaning the checkout can adapt its payment-method order depending on the user’s geography, device type or historical success patterns. For example, Brazilian shoppers may see PIX placed above cards, while Dutch customers see iDEAL first. In Singapore, PayNow might appear as the default, while UAE users are offered card and wallet flows.

Currency presentation benefits from the same logic. Instead of manually configuring each market, orchestration rules can automatically display the most appropriate currency based on IP signals, issuer geography or user preferences. This reduces friction and helps maintain consistency, especially when settlement workflows differ across PSPs.

Another advantage is operational clarity. Orchestration platforms aggregate reporting, allowing merchants to track APM-specific approval rates, decline reasons and cost performance in one place. This unified view helps identify when to add or remove APMs during expansion, preventing checkout clutter and supporting informed decision-making.

In fast-growing businesses, orchestration becomes the structural backbone that enables multi-market APM strategies to scale without overwhelming internal teams. It allows merchants to maintain a clean, optimised checkout while adapting intelligently to local expectations.

Execution Dashboard: KPIs to Track APM and Currency Sequencing

Once an APM strategy is live across multiple markets, monitoring the right metrics becomes essential. Without a structured KPI dashboard, merchants risk misinterpreting performance or making changes based on assumptions rather than data. The goal is to evaluate each payment method’s real contribution to conversion, cost efficiency and customer satisfaction.

APM-Specific Approval Rates

Each APM behaves differently depending on the region, issuer base and authentication flow. Tracking approval rates individually helps isolate underperforming methods. For example, low approval on cards in Brazil may justify prioritising PIX, while strong iDEAL acceptance in the Netherlands confirms its position at the top of checkout.

Drop-Off and Abandonment by APM

Seeing how many users select an APM and then exit mid-flow is a powerful indicator of trust and usability. High drop-off may signal UX friction, unclear instructions or a mismatch between customer expectations and the actual payment experience.

Refund Friction and Dispute Handling

Different APMs create different operational loads. Merchants should measure the time taken to process refunds, how disputes are handled and whether customer support volumes increase after certain APMs are introduced. This avoids choosing methods that appear popular but strain internal teams.

Cost per Acceptance

APMs come with varying fee structures, settlement timelines and FX implications. By calculating the true cost per accepted transaction, merchants can compare methods fairly and decide whether an APM is worth expanding.

FX Exposure and Currency Impact

Tracking the effect of currency sequencing helps merchants understand whether local pricing improves approval and conversion. It also highlights where FX volatility may be hurting margins.

Optimal Number of APMs Per Market

Too many methods dilute user focus, while too few limit reach. Merchants should monitor how many APMs meaningfully contribute to volume. In most markets, two or three core APMs perform best without overloading the checkout.

A well-designed KPI dashboard ensures merchants scale APM adoption intentionally, based on performance rather than assumptions.

13. 2026 Sequencing Framework — Prioritise → Launch → Optimise

Entering multiple new markets successfully in 2026 requires more than enabling popular payment methods. It demands a structured, repeatable approach that balances speed of entry with the realities of local behaviour, regulation and operational capacity. This framework brings together the core elements of APM and currency sequencing into a practical roadmap merchants can apply across five or more regions.

Prioritise: Identify What Matters in Each Market

Begin by mapping the dominant payment culture in each country—what consumers trust, how they authenticate, and which APMs align with local habits. Evaluate whether the market is wallet-led, instant-payment-led or card-reliant, and assess regulatory constraints early. Prioritisation at this stage ensures you avoid adding methods that bring complexity without delivering meaningful reach.

Launch: Start with a Minimum Viable APM + Currency Setup

The launch phase should remain lean. Select two or three APMs that cover the widest share of local demand while ensuring compliance and operational clarity. Combine this with the right currency strategy—usually local currency display paired with consistent settlement rules. A lean launch stack accelerates onboarding and helps isolate the drivers of early conversion, rather than masking them behind too many variables.

Optimise: Expand Based on Real Performance Data

After launch, expansion should be data-led. Review PSP dashboards for APM-specific approvals, drop-off patterns and FX friction. Identify where new APMs could fill gaps—such as introducing a wallet in a mobile-first market or an instant-payment method where cards underperform. Optimisation also includes removing underperforming APMs and adjusting checkout sequencing to reflect evolving user behaviour.

By following this three-step framework, merchants avoid overbuilding their payment infrastructure and instead grow in a controlled, scalable way. It ensures each new market receives the right methods, in the right order, based on real-world performance rather than assumptions.

Conclusion

Expanding into multiple markets in 2026 requires discipline. While it may be tempting to add every available APM, the merchants who scale successfully are the ones who prioritise thoughtfully, launch with precision and expand only when the data supports it. Local payment behaviour varies widely, and the methods that dominate in one region may offer little value in another. Currency sequencing plays an equally important role, shaping trust and approval outcomes long before the payment is processed.

A structured approach starting with a clear understanding of each market’s payment culture, selecting a focused APM stack and using performance metrics to guide further expansion prevents operational overload and protects conversion. As domestic schemes, instant-payment rails and regional wallets continue to grow, merchants must adapt strategically rather than reactively.

In a landscape where speed and localisation define success, sequencing APMs and currencies correctly is no longer a back-office decision. It is a core part of international growth.

FAQs

1. Why isn’t adding every APM the best strategy for new markets?

Offering too many payment methods creates operational complexity, increases compliance overhead and can confuse customers. Each APM has its own settlement rules, refund processes and regulatory expectations. Instead of boosting conversion, an overloaded checkout often makes it harder for users to choose. A focused, well-sequenced set of APMs aligned with local behaviour delivers significantly stronger performance.

2. How many APMs should a merchant launch within a new market?

Most markets only need two or three carefully selected APMs for the first 6-12 months. This ensures broad reach without overwhelming the checkout. A lean launch also makes it easier to benchmark performance and identify issues early. Additional methods should be added only when data shows they will meaningfully improve conversion.

3. Why does currency sequencing matter as much as APM choice?

Currency influences trust and perception. When customers see prices in their familiar local currency, they feel more confident completing the transaction. Misaligned currency displays such as showing USD in a local-currency market can trigger hesitation or additional issuer checks. Aligning currency with customer expectations removes psychological friction and often improves approval rates.

4. Should merchants always offer the dominant APM in a market?

Usually yes, but timing matters. Some dominant APMs require specific compliance checks, local acquirer relationships or operational readiness (such as instant refunds or bank-match dependencies). Merchants should first confirm they can support the operational workload before enabling these methods. Prioritising the right APMs at the right time is more effective than simply offering the most popular one.

5. How do PSP dashboards help with APM sequencing?

PSP dashboards show APM-level approval rates, drop-off points, refund friction and cost per acceptance. This data helps merchants identify which methods perform well and which require adjustment. It also highlights when a new APM is justified—for example, if card declines spike or instant-payment adoption grows. Data-led decisions prevent unnecessary checkout clutter.

6. What role does orchestration play in multi-market expansion?

Orchestration simplifies multi-market operations by routing transactions to the best-performing PSP or APM, based on geography, device type or issuer behaviour. It allows merchants to personalise checkout sequences and manage APM complexity without overwhelming internal teams. Orchestration also centralises reporting, making optimisation far easier as markets scale.

7. How do refunds differ across APMs?

Refund workflows vary significantly. Card refunds typically follow structured chargeback rules, while instant-payment rails may require manual reversals or alternative refund channels. Wallet refunds depend on the provider’s internal policies. Merchants should understand refund timelines and operational burdens before adding an APM, especially in high-volume verticals.

8. How can merchants avoid APM sprawl during global expansion?

Start with a minimal viable stack, expand only based on proven performance data and regularly review which APMs meaningfully contribute to volume. Removing underperforming methods keeps the checkout clean and prevents operational overload. Orchestration and unified reporting help maintain control as new markets are added.

9. Is BNPL essential for every market?

No. BNPL performs best in markets with strong credit adoption and higher shopping cart values. In mobile-first or instant-payment-led regions, its impact may be limited. BNPL also introduces additional regulatory and operational requirements. Merchants should add it only where customer demand and transaction value justify the complexity.

10. When should merchants introduce Phase-2 APMs?

Phase-2 APMs should be introduced once the merchant has sufficient transaction volume to measure gaps in the customer journey. If users abandon card flows at high rates, or if local A2A methods dominate the market, adding a complementary APM can boost conversion. The timing should always be tied to measurable insights not assumptions.