By late December 2025, Europe’s long crypto transition quietly ended. The Markets in Crypto-Assets Regulation (MiCA) moved from framework to hard enforcement reality, and the effects are now visible in market access, listings, banking relationships, and liquidity patterns. National AML-only registrations that once allowed firms to operate domestically no longer provide a legal bridge to the EU single market.

For Crypto-Asset Service Providers (CASPs), the choice has narrowed to two viable paths: obtain a full MiCA authorisation and passport across the Union, or exit Europe through delisting and loss of access.This is not a headline about raids or sudden bans. It is about structural exclusion. The enforcement lever is market access, who can list, who can clear payments, and who can bank. And it is working.

- December 2025: The End of National Crypto Licensing

- Stablecoin Rotation: Capital Moves to MiCA-Compliant Tokens

- The Passporting Prize: One Licence, 27 Markets

- ESMA’s Enforcement Signals: Grandfathering Is Over

- Who Is Exiting and Why

- Payments Access Is the Fulcrum

- The Market Has Internalised the Rulebook

- What This Means for 2026

- Conclusion

- FAQs

December 2025: The End of National Crypto Licensing

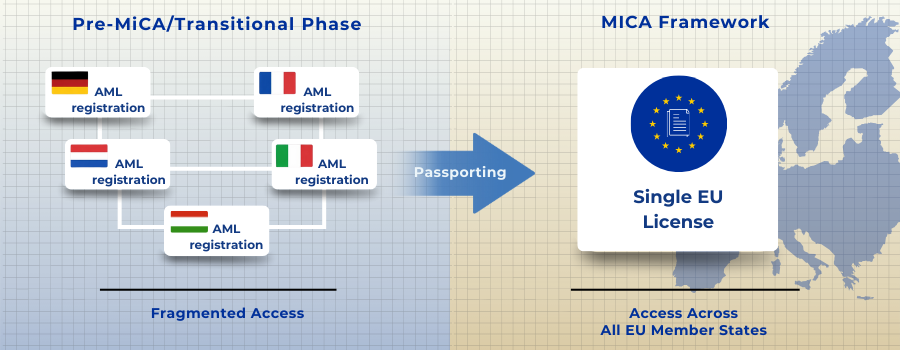

MiCA’s implementation timetable always pointed to a cliff edge at the end of 2025. What has changed is not the law itself, but the absence of tolerance for operating between regimes. National AML registries, useful during the transition, are now insufficient for cross-border activity. They do not confer passporting rights, and they do not satisfy the governance, capital, disclosure, and conduct standards MiCA requires.

The supervisory signal has been consistent: authorisation under MiCA is the only route to EU-wide activity. Firms attempting to continue based on legacy national permissions are discovering that counterparties will not meet them halfway. Exchanges remove pairs, PSPs withdraw services, and banks de-risk. Enforcement, in practice, is access denial.

This posture is anchored in guidance and supervisory convergence led by the European Securities and Markets Authority, which has been explicit that reliance on grandfathering cannot substitute for authorisation. The result is a market that has stopped waiting.

Stablecoin Rotation: Capital Moves to MiCA-Compliant Tokens

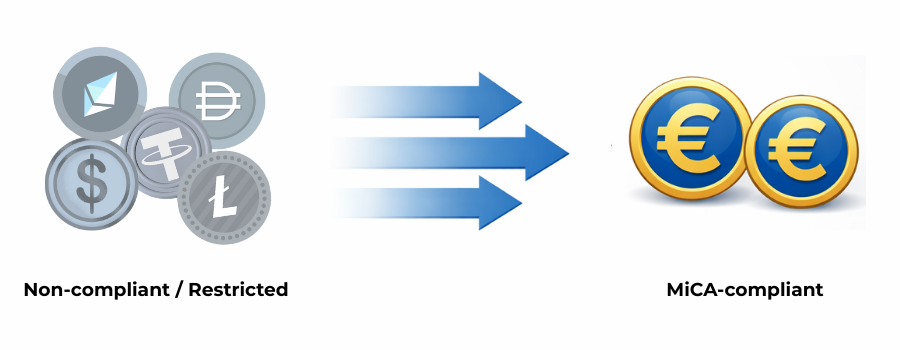

The most visible market reaction has been a rotation in stablecoin usage. As MiCA’s asset-referenced token (ART) and e-money token (EMT) rules bite, exchanges and payment partners are narrowing support to instruments that clearly fit the framework, particularly euro-denominated, MiCA-compliant stablecoins.

This is not ideological. It is operational. Stablecoins sit at the intersection of trading, custody, payments, and fiat on-/off-ramps. Where compliance is uncertain, counterparties pull back. Where compliance is clear, liquidity concentrates.

Industry data and transaction patterns show pairs being consolidated, incentives shifting, and non-compliant instruments losing distribution. The effect is cumulative: fewer pairs reduce utility, which reduces volume, which accelerates delisting. Capital follows certainty.

Contextual market analysis from Chainalysis underscores this convergence across jurisdictions, with Europe now among the most structured regimes. The EU’s message is simple: if a token underpins payments or settlement, it must be regulated as such.

The Passporting Prize: One Licence, 27 Markets

MiCA’s central economic incentive is passporting. A single authorisation unlocks access to 27 markets under a harmonised rulebook. For firms that invested early in governance, capital, and controls, the payoff is immediate: distribution without fragmentation.

Passporting is not merely an administrative convenience. It reshapes competition. Compliance becomes a barrier to entry that favours scale and discipline. Firms that clear the bar can price more aggressively, negotiate better banking terms, and integrate deeper into the EU payments infrastructure.

This advantage is already visible. Licensed CASPs are expanding services across borders while peers without authorisation shrink their footprints. Liquidity pools deepen where compliance is settled; they evaporate where it is not.

ESMA’s Enforcement Signals: Grandfathering Is Over

ESMA’s role has been to drive supervisory convergence, ensuring national competent authorities apply MiCA consistently. The practical effect has been to shorten the leash. Warnings about continued operation without authorisation are not abstract. They translate into coordination with exchanges, PSPs, and banks that underpin market functioning.

Notably, enforcement is risk-based. Authorities are not chasing marginal edge cases; they are targeting systemic exposure. Firms that touch retail flows, stablecoins, or fiat rails face the highest pressure. The consequence is predictable: firms most dependent on banking access are the first to exit.

This approach is deliberate. MiCA’s architects understood that direct bans are blunt. Access denial is precise.

Who Is Exiting and Why

The exits are not random. They cluster around four profiles:

- Small exchanges are unable to meet capital, governance, or reporting thresholds at the EU scale.

- Offshore platforms that relied on light-touch national registrations to reach EU users.

- High-risk token issuers whose structures do not fit ART/EMT requirements.

- Intermediaries without banking resilience, exposed to rapid de-risking once compliance doubts arise.

For these firms, the cost of compliance exceeds the expected EU revenue. Exit, consolidation, or pivot becomes rational.

Payments Access Is the Fulcrum

For PSPs and banks, MiCA hard enforcement has clarified counterparty risk. Payment access is now a binary decision: authorised or not. Grey zones are shrinking because they are expensive to manage.

This has second-order effects. Merchants, payment facilitators, and wallet providers increasingly demand proof of authorisation before integration. Compliance artefacts, licence numbers, and passporting confirmations have become commercial prerequisites.

The knock-on is consolidation. As access tightens, volume migrates to compliant venues, reinforcing their advantage.

The Market Has Internalised the Rulebook

Perhaps the most telling signal is behavioural. Firms are no longer waiting for enforcement letters. They are self-selecting. Listings are pruned proactively. Products are geo-fenced. Marketing is adjusted. In effect, the market is enforcing MiCA on itself.

This is what mature regulation looks like. The rulebook becomes embedded in decision-making. Risk managers, not regulators, drive outcomes.

What This Means for 2026

MiCA’s “hard border” has implications beyond crypto. It offers a template for how the EU intends to regulate digital finance more broadly: harmonise, raise the bar, then enforce through access.

For CASPs still undecided, the window for optionality has closed. Authorisation is no longer a strategic experiment; it is a survival requirement for EU operations. For those authorised, the opportunity is equally clear: scale within a permissioned market while competitors fall away.

Conclusion

MiCA has crossed from theory into market reality. By late December 2025, the grace period ended not with a bang, but with delistings, de-risking, and liquidity migration. The EU has, in effect, built a digital fortress around its crypto market. Entry is possible. Exit is easy. The middle ground is gone.For CASPs, the decision is immediate and binary: get licensed, consolidate, or get out.

FAQs

1. Is MiCA now fully in force across the EU?

Yes. As of late December 2025, MiCA is fully applicable. The transitional phase has ended, and EU-wide crypto activity now requires MiCA-compliant authorisation.

2. Does a national AML registration still allow crypto firms to operate in Europe?

No. National AML-only registrations are no longer sufficient for cross-border or EU-wide activity. They do not confer MiCA passporting rights.

3. Is this what regulators mean by hard enforcement?

Yes. Enforcement is occurring primarily through loss of market access delistings, banking de-risking, and PSP withdrawals rather than public shutdowns.

4. Are CASPs being ordered to shut down immediately?

Not typically. Instead, firms without MiCA authorisation are being excluded from essential infrastructure, making continued operation commercially unviable.

5. What role is ESMA playing in this phase?

European Securities and Markets Authority is driving supervisory convergence and has warned that reliance on grandfathering is no longer acceptable.

6. Why are stablecoins particularly affected?

Stablecoins underpin trading, settlement, and payments. Under MiCA, only ARTs and EMTs that meet strict requirements can be widely supported, leading to rapid delisting of non-compliant tokens.

7. Is there evidence of a shift toward MiCA-compliant euro stablecoins?

Yes. Market behaviour shows liquidity and listings concentrating in euro-denominated, MiCA-aligned stablecoins as exchanges and PSPs reduce regulatory exposure.

8. What is the passporting advantage under MiCA?

A single MiCA licence allows a CASP to operate across all 27 EU Member States, eliminating fragmented national permissions and reducing compliance duplication.

9. Which firms are most likely to exit the EU market?

Typically:

- Firms without resilient banking relationships

- Small or under-capitalised exchanges

- Offshore platforms relying on light-touch regimes

- Token issuers unable to meet ART/EMT standards

10. How are banks and PSPs responding to MiCA enforcement?

They are tightening onboarding and ongoing monitoring. Authorisation status is now a prerequisite, not a discussion point, for payment access.

11. Is MiCA enforcement uniform across all EU countries?

The objective is convergence. While tactics vary, the direction is consistent, with ESMA coordinating supervisory alignment among national authorities.

12. Can firms still apply for MiCA authorisation in 2026?

Yes. The pathway remains open, but firms operating without authorisation face shrinking tolerance and increasing commercial isolation during the application process.

13. Does MiCA eliminate crypto activity in Europe?

No. It re-shapes the market into a permissioned environment. Compliant firms gain scale; non-compliant firms lose access.

14. What does this mean for merchants using crypto payments?

Merchants are indirectly affected. They increasingly rely on licensed intermediaries to ensure continuity of settlement and banking access.

15. What is the single most important takeaway for CASPs?

The EU crypto market is now licence-gated. MiCA compliance is no longer a strategic option it is a condition of survival.