European banks and payment service providers (PSPs) have entered a new operating reality. As of 9 October 2025, the EU’s Instant Payments Regulation (IPR) is fully operational, requiring euro-area institutions to support round-the-clock instant euro credit transfers as a standard service. Industry coverage has highlighted that the regulatory milestone is now translating into a live operational test for banks, as systems, controls, and staffing models adapt to an always-on payments rail.

The regulation’s activation marks the end of phased preparation and the start of continuous execution. For European payment infrastructure, instant settlement is no longer an enhancement layered on top of batch systems. It is the baseline against which reliability, safety, and customer experience are now measured.

What the Industry Is Reporting

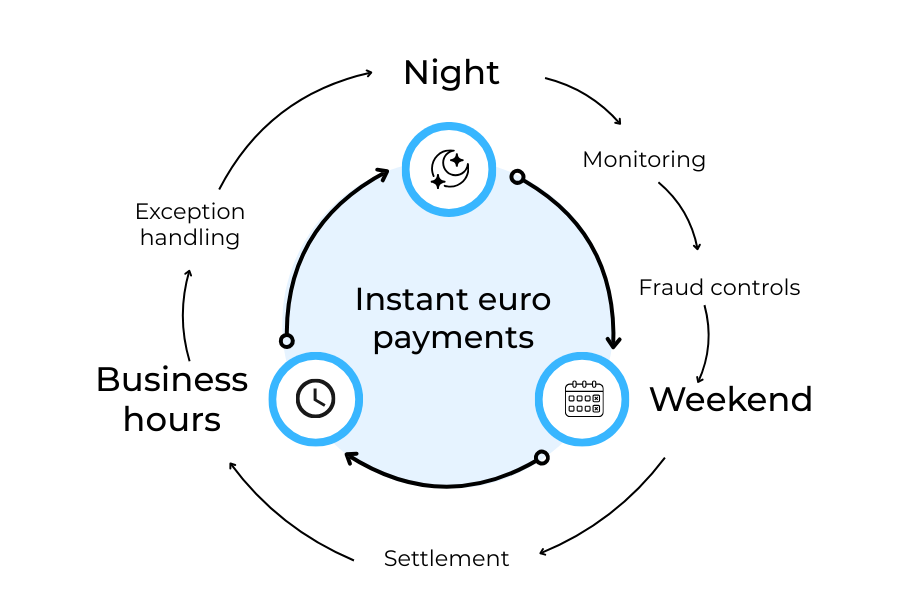

Coverage across the payments sector has focused less on the legal text and more on operational readiness. Banks and PSPs are adjusting to the fact that 24/7 availability is no longer optional or limited to specific customer segments. Payments must clear in seconds at any time of day, including weekends and holidays, with the same consistency expected during weekday business hours.

Industry commentary highlights several immediate pressures. Legacy platforms designed around cut-off times and overnight processing are being re-engineered to cope with continuous flows. Incident response models are also under review, as payment failures or delays now surface instantly and visibly to customers.

Importantly, this reporting does not suggest uncertainty about regulatory obligations. Instead, it reflects the practical challenge of delivering instant payments at scale without interruption, a challenge that only becomes apparent once the regulation is fully live.

What the Regulation Actually Requires

The IPR’s requirements are grounded in EU law and confirmed by official EU institutions. The European Commission has stated that euro-area PSPs must treat instant euro credit transfers as a standard offering, available 24 hours a day, seven days a week, and priced no higher than regular euro credit transfers.

From an operational perspective, three obligations define the new baseline:

First, PSPs must support both sending and receiving instant euro payments. Partial participation, where institutions could only receive instant payments, is no longer sufficient for a functioning instant payments ecosystem.

Second, the regulation enforces pricing parity. Instant transfers cannot be positioned as a premium product. This removes pricing as a demand-management tool and places the burden on infrastructure capacity and risk controls.

Third, safety measures are embedded into the instant payments model. These include Verification of Payee (VoP) and sanctions-screening approaches compatible with real-time execution, as outlined by the European Central Bank in its implementation guidance.

While earlier instant payment schemes applied transaction caps, the regulation removes scheme-level ceilings.PSPs may still apply internal, risk-based limits, but there is no longer a universal cap defined by the payments framework itself. This shift places more responsibility on institutions to balance speed with risk management.

Why This Matters: From Batch Banking to Always-On Rails

The move to 24/7 instant euro transfers fundamentally changes long-standing assumptions in European payments.

Batch-based processing allowed for cut-off times, end-of-day reconciliation, and delayed exception handling. Instant settlement removes those buffers. Errors, delays, or system outages are exposed immediately, often directly to end users.

As a result, payment accuracy and pre-execution controls carry greater weight. With limited scope for recall once funds are sent, mechanisms such as VoP play a more prominent role in preventing misdirected payments and certain fraud scenarios before execution.

The regulation also compresses operational timelines. Treasury teams, fraud operations, and customer support functions must align around real-time events rather than next-day reports. For many institutions, this represents a cultural as well as technical shift.

Operational Impact on Banks and PSPs

For banks and PSPs, the immediate impact of final IPR implementation is felt across infrastructure, staffing, and governance.

Infrastructure resilience is now critical. Systems supporting instant payments must operate continuously, with capacity planning that accounts for peak demand outside traditional business hours. Scheduled maintenance windows become harder to justify when instant payments are treated as essential infrastructure.

Real-time exception handling is another pressure point. Failed or delayed instant payments require rapid investigation and resolution, often without the benefit of overnight processing cycles. This drives investment in monitoring tools that can surface issues as they occur.

Fraud and compliance controls must also function at payment speed. Rather than relying on slow, transaction-by-transaction checks that would undermine instant settlement, PSPs are expected to use preventative and periodic controls compatible with the regulation’s intent.

Finally, operational staffing models are under review. Escalation paths that assume weekday availability no longer align with customer expectations when payments move continuously.

Merchant Implications

Merchants are not directly regulated by the IPR, but the shift to instant euro payments affects their operations in tangible ways.

Faster settlement becomes the norm, which can improve cash-flow visibility but also raises expectations around refund speed. Customers accustomed to instant incoming payments are less tolerant of delayed outbound refunds, particularly in sectors such as travel, marketplaces, and digital services.

Reconciliation processes also change. Instant settlement reduces the gap between payment initiation and receipt, favouring merchants with clean reference data and automated matching. Businesses reliant on manual reconciliation may experience higher operational strain.

In addition, the increased emphasis on beneficiary data accuracy, reinforced by VoP, means that inconsistencies in account naming or onboarding data can translate into payment friction rather than being absorbed silently by batch processes.

What the Market Will Now Assume by Default

As instant euro payments become the baseline, the expectations of counterparties, partners, and supervisors change with them. In 2026, delayed settlement, restricted processing windows, or inconsistent availability will no longer be viewed as acceptable operational variance. They are increasingly interpreted as signs of infrastructure weakness or control gaps. For banks and PSPs, this shift matters because trust is now measured in real time. For merchants, it means payment speed, refund responsiveness, and reconciliation accuracy are judged against an always-on standard. The regulation does not merely mandate faster payments; it resets what “normal” looks like across Europe’s euro transfer ecosystem.

Conclusion

With the Instant Payments Regulation fully operational, Europe’s payment infrastructure has crossed a threshold. 24/7 instant euro transfers are no longer aspirational or optional; they are a foundational rail underpinning everyday transactions.

Industry reporting reflects a sector adjusting to this reality, where the challenge is not understanding the rules but sustaining reliable performance under continuous load. For banks and PSPs, 2026 is less about regulatory interpretation and more about operational endurance. Systems, controls, and teams are now judged against an always-on standard.

For merchants and payment-dependent businesses, the change reshapes expectations around settlement speed, reconciliation, and customer experience. In this environment, instant payments are not simply faster payments. They redefine what “normal” looks like for euro transfers across the bloc.

FAQs

1. When did the EU Instant Payments Regulation reach final implementation?

The final operational phase took effect on 9 October 2025, requiring euro-area PSPs to support instant euro credit transfers continuously.

2. What does “24/7 instant euro transfers” mean in practice?

It means euro credit transfers must be processed at any time, including nights, weekends, and public holidays, without reliance on cut-off times or batch windows.

3. Are banks and PSPs legally required to offer instant payments now?

Yes. For euro-area PSPs that offer euro credit transfers, instant payments are now a mandatory standard service, not an optional product.

4. Can PSPs still apply transaction limits to instant payments?

The regulation removes scheme-level caps, but PSPs may apply internal, risk-based limits as part of their own risk management frameworks.

5. Does the regulation require instant payments to be free?

No. It requires pricing parity, meaning instant euro credit transfers must not cost more than standard euro credit transfers.

6. How does Verification of Payee (VoP) fit into instant payments?

VoP is a mandatory safety measure that checks whether the payee name matches the IBAN before execution, helping prevent misdirected or fraudulent payments.

7. How are sanctions checks handled with instant settlement?

Instead of per-transaction screening that could delay payments, PSPs are required to perform regular (at least daily) checks against relevant sanctions lists.

8. Are merchants directly regulated by the Instant Payments Regulation?

No. The regulation applies to PSPs and banks. Merchants are affected indirectly through faster settlement, refund expectations, and reconciliation processes.

9. Why is this considered a major operational shift for banks?

Because it replaces batch-based, business-hours processing with always-on settlement, increasing pressure on infrastructure resilience, monitoring, and staffing.

10. Will instant payments eliminate payment fraud?

No. Instant payments reduce certain risks through preventative controls like VoP, but fraud risk is mitigated, not eliminated.

11. What changes most for reconciliation teams?

Settlement occurs almost immediately, which favours continuous reconciliation and accurate reference data rather than end-of-day matching.

12. How does this affect customer expectations?

Customers increasingly expect immediate receipt of funds and faster refunds, with less tolerance for delays previously associated with traditional transfers.

13. Is this the final step in the EU instant payments regulation?

It is the final implementation milestone of the current regulation. Ongoing oversight and supervisory review follow as part of normal regulatory processes.

14. What will regulators and partners focus on in 2026?

Reliability, availability, handling of VoP outcomes, and the ability of systems and controls to operate consistently in a 24/7 environment.

15. What is the key takeaway for payment-dependent businesses?

Instant euro payments are now infrastructure, not innovation. Operational readiness matters more than awareness of the regulation itself.