Across the Gulf, digital wallets are no longer treated as lightweight fintech add-ons. By 2026, regulators in the UAE and Saudi Arabia are positioning wallets as core consumer payment instruments, governed by licensing, safeguarding, conduct, and supervision rules that look far closer to traditional financial products than to casual apps.

This shift matters because it changes how wallets behave in everyday commerce. Regulation is reshaping onboarding, usage limits, refunds, dispute handling, and the way stored value is protected. As a result, consumer trust is rising and with it, wallet usage for routine, repeat payments. What once felt experimental is becoming mainstream, but only within a clearly defined regulatory perimeter.

For merchants and PSPs, the implications are practical rather than theoretical. Wallet regulation affects checkout design, settlement expectations, reconciliation workflows, and acceptance decisions especially in higher-risk categories where stored value and fast-moving funds attract closer scrutiny. Treating wallets like “just another APM” increasingly creates friction.

This blog explains how wallet regulation in the UAE and Saudi Arabia is reshaping consumer payments, why regulators are pushing wallets into a more formal role, and what merchants and PSPs need to adjust as wallets become heavier, more trusted rails in the Gulf’s payment ecosystem.

- Why the Gulf’s Wallet Growth Is Regulation-Led, Not Just Consumer-Led

- UAE: How SVF Regulation Is Reshaping Wallet Behaviour

- Saudi Arabia: Wallet Rules as a Consumer Protection Mechanism

- What “Wallet Regulation” Changes at Checkout (Not Just Licensing)

- Risk, AML, and Consumer Protection: Where PSPs Tighten in 2026

- Merchant Reality: Why Wallets Can’t Be Treated Like “Just Another APM”

- Designing Wallet Acceptance for the Gulf in 2026

- Conclusion

- FAQs

Why the Gulf’s Wallet Growth Is Regulation-Led, Not Just Consumer-Led

Digital wallet adoption in the Gulf is often framed as a consumer trend, driven by convenience and mobile penetration. In reality, the momentum behind wallets in the UAE and Saudi Arabia is far more policy-driven. Regulators are using wallets as a tool to reshape how everyday payments move away from informal, cash-like behaviour and toward supervised, traceable, and resilient payment rails.

This matters because regulation changes incentives on both sides of the market. For consumers, regulated wallets feel safer. Clear rules around licensing, safeguarding of funds, and dispute handling reduce hesitation about storing value digitally and using wallets repeatedly. For providers, regulation raises the bar on operational discipline, which in turn filters out weaker models and increases consistency across the ecosystem.

The result is a feedback loop. As wallets become more tightly regulated, they become more trustworthy. As trust increases, usage expands beyond niche or promotional use cases into routine spending transport, food, subscriptions, and peer-to-peer transfers. This is not organic adoption alone; it is adoption guided by regulatory design.

Importantly, this approach reflects how Gulf regulators think about payments infrastructure. Wallets are not seen as optional overlays on top of cards and bank transfers. They are being positioned as foundational consumer payment rails, especially for domestic transactions. Regulation is the mechanism that allows this expansion without sacrificing financial stability, AML controls, or consumer protection.

For merchants and PSPs, this explains why wallet behaviour in the Gulf feels different from many other markets. The growth curve is smoother, more controlled, and more predictable, but also less forgiving of informal practices. Wallets scale because regulation makes them reliable, not because they are left ungoverned.

UAE: How SVF Regulation Is Reshaping Wallet Behaviour

In the UAE, digital wallets are shaped less by market experimentation and more by a clear regulatory framework. The Central Bank’s Stored Value Facilities (SVF) regulation defines how wallet-like products can issue, hold, and manage customer value, effectively turning wallets into supervised payment instruments rather than informal stored balances.

What this changes first is consumer confidence. SVF regulation introduces licensing, safeguarding of funds, and conducts expectations that make wallets feel closer to regulated financial products. When users know that balances are protected and providers are supervised, wallets move from promotional tools to something people are comfortable using repeatedly for everyday payments.

SVF regulation also reshapes wallet behaviour at checkout. Licensed wallet providers must operate within defined rules around transaction handling, refunds, and dispute processes. That consistency matters. Consumers begin to expect predictable outcomes when something goes wrong, and merchants see fewer edge cases where wallet behaviour feels opaque or unreliable.

From a PSP and ecosystem perspective, SVF regulation also structures the market. Entry requires meeting regulatory standards, which naturally reduces fragmentation and pushes the ecosystem toward fewer, better-controlled wallet models. Over time, this makes integration easier for merchants and reduces operational surprises.

The regulatory intent behind SVF is explicit: to support the development of digital payment services while maintaining safety and trust within the financial system CBUAE Stored Value Facilities Regulation. That balance is what allows wallets to scale without undermining consumer protection or AML objectives.

In practical terms, SVF regulation reshapes consumer wallet usage by:

- Increasing trust in stored balances through regulated safeguarding

- Encouraging repeat use for domestic, everyday transactions

- Standardising refund and dispute expectations

- Making wallet acceptance more predictable for merchants

By 2026, the impact is clear. In the UAE, wallets succeed not because they are lighter than other rails, but because regulation makes them reliable enough to become routine.

Saudi Arabia: Wallet Rules as a Consumer Protection Mechanism

In Saudi Arabia, wallet regulation is framed less around experimentation and more around system stability and consumer protection. The Saudi Central Bank (SAMA) has positioned electronic wallets firmly inside the country’s regulated payments framework, making it clear that wallets are not informal payment tools but supervised financial products with defined obligations.

This approach shapes wallet behaviour from the moment a user signs up. Wallet rules set expectations around identity verification, account access, limits, and disclosures, which reduces ambiguity for consumers and creates a more uniform experience across providers. As a result, wallets in Saudi Arabia tend to feel consistent and predictable, even when offered by different PSPs.

From a consumer perspective, this consistency matters. Clear rules around account management, transaction visibility, and error handling make wallets easier to trust for everyday spending. Consumers are less reliant on trial and error because wallet usage follows recognisable patterns, closer to traditional payment instruments than to experimental fintech products.

For PSPs, SAMA’s approach also raises the operational bar. Wallet providers are expected to embed compliance, monitoring, and governance directly into the product. That includes how transactions are authorised, how limits are applied, and how issues are resolved. The objective is not to slow innovation, but to ensure that growth does not outpace control.

This intent is formalised through SAMA’s Electronic Wallets Rules, which sit within the wider payments and payment services legal framework and emphasise participant protection and market stability.

In practice, Saudi wallet regulation reshapes consumer payments by:

- Standardising wallet onboarding and account controls

- Making limits, access, and disclosures clearer to users

- Improving predictability around transaction handling

- Reducing variability between wallet providers

By 2026, the effect is a wallet ecosystem that feels less fragmented and more dependable. Regulation does not remove choice, but it ensures that whichever wallet a consumer uses, the experience meets a baseline of safety and clarity.

What “Wallet Regulation” Changes at Checkout (Not Just Licensing)

When wallets become regulated financial products, the most visible changes are not found in licensing documents they show up at checkout. Regulation reshapes how wallets behave in moments that matter to consumers: confirmation, reversals, refunds, and error handling. By 2026 in the Gulf, these behavioural shifts are what make wallets feel credible for everyday use.

One immediate change is predictability. Regulated wallets tend to follow clearer rules around authorisation, balance updates, and transaction status. Consumers see confirmations that align with expectations, and merchants see fewer ambiguous states where a payment appears completed on one side but unresolved on the other. This reduces support noise and increases confidence to retry or reuse the method.

Refunds are another pressure point that regulation directly influences. As wallet providers are brought under conduct and consumer protection standards, refund handling becomes more structured. Timelines, references, and communication improve, which changes consumer expectations. Shoppers begin to trust wallets for repeat spend when they know reversals are handled consistently rather than ad hoc.

Regulation also affects limits and controls at checkout. Wallet tiers, balance caps, and transaction thresholds are applied more transparently, which reduces sudden declines or unexplained failures. While this introduces constraints, it also removes guesswork. Consumers understand why a transaction may not proceed, and merchants can design clearer fallback paths.

Crucially, these changes narrow the behavioural gap between wallets and traditional payment instruments. Wallets start to feel less like experimental APMs and more like everyday payment rails, especially for domestic transactions. That perception shift is what drives adoption at scale, not marketing, but reliability.

For merchants, the takeaway is subtle but important. As regulation standardises wallet behaviour, checkout design needs to adapt. Messaging, error handling, and post-payment flows must be wallet-aware, not card-centric. The merchants that make this adjustment experience smoother conversion and fewer post-payment issues as wallets take a larger share of Gulf consumer spend.

Risk, AML, and Consumer Protection: Where PSPs Tighten in 2026

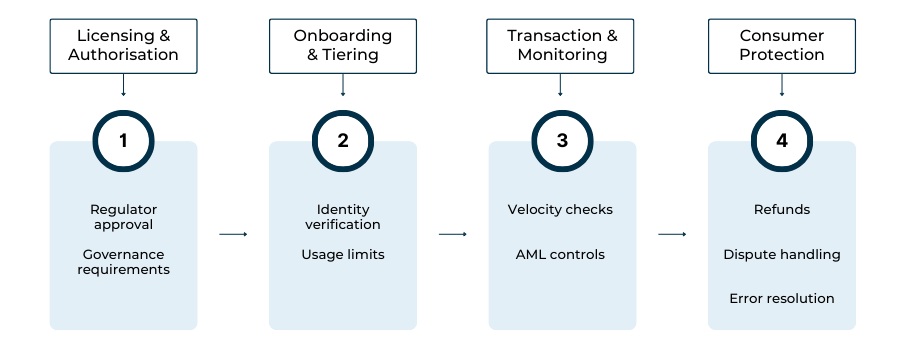

As wallets become regulated payment instruments in the UAE and Saudi Arabia, PSP scrutiny intensifies in three distinct but connected areas. This is where H3s genuinely add value, because each tightening vector operates differently and affects merchants in different ways.

Wallets as High-Velocity Risk Surfaces

From a PSP perspective, wallets are not just another acceptance method, they are high-frequency, high-velocity risk surfaces. Funds move quickly, balances can be stored, and transactions often involve smaller but repeated values. This combination is attractive for abuse if controls are weak.

By 2026, PSPs in the Gulf treat wallet flows as inherently higher-monitoring environments than traditional card payments. The expectation is not that wallets are “riskier by default”, but that they require continuous visibility. Sudden changes in usage patterns, velocity spikes, or unusual transaction sequences are scrutinised far more closely than before.

This is one reason why wallet acceptance in high-risk verticals is often conditional. PSPs want confidence that abnormal behaviour can be detected and acted on quickly, without disrupting legitimate users.

AML, KYC, and Tiering Embedded Into Wallet Design

Regulation is pushing AML and KYC controls deeper into the wallet product itself, rather than treating them as external checks. In practice, this shows up as tiered wallets, usage limits, and dynamic controls tied to customer verification and behaviour.

For consumers, this often feels like sensible guardrails. For merchants and platforms, it means wallet acceptance comes with clearer constraints. Transaction caps, balance limits, and re-verification triggers are no longer optional design choices; they are regulatory expectations that PSPs must enforce consistently.

This is also where high-risk merchants feel friction first. Wallet-enabled flows attract more detailed questions around customer profiles, transaction purpose, and monitoring logic. PSPs want to ensure that wallet usage aligns with the merchant’s stated business model, not just with technical integration.

Consumer Protection Expectations Rise with Stored Value

The moment wallets hold stored value, consumer protection expectations change. Regulators expect PSPs to handle errors, disputes, and complaints in a structured, predictable way. This goes beyond refunds and into areas like transaction visibility, account access issues, and balance discrepancies.

For PSPs, this means tighter internal processes and clearer escalation paths. For merchants, it means wallet-related customer issues cannot be treated like edge cases. As wallets take on a more “financial product” role, consumers expect resolution standards closer to those of banks than of experimental payment apps.

In practical terms, PSP tightening in 2026 focuses on:

- Stronger monitoring of wallet transaction patterns and velocity

- Clear AML/KYC tiering tied to wallet usage and limits

- Defined consumer protection and complaint-handling standards

Taken together, these shifts explain why wallet acceptance in the Gulf feels more structured than before. Regulation is not slowing wallets down; it is forcing them to grow up. For PSPs, that maturity is non-negotiable. For merchants, understanding these tightening points is essential to avoid surprises as wallets become a core consumer payment rail.

Merchant Reality: Why Wallets Can’t Be Treated Like “Just Another APM”

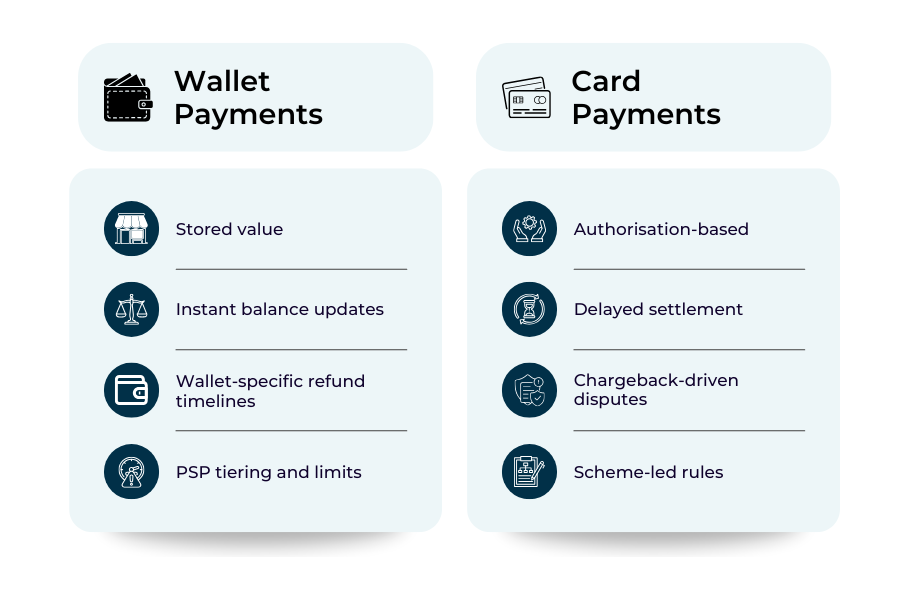

For merchants operating in the Gulf, the biggest mistake in 2026 is assuming that regulated wallets behave like cards with a different logo. They don’t. As wallets move under formal regulatory frameworks, they introduce different operational expectations, and those differences surface quickly once volumes grow.

The first friction point is usually refund handling. Wallet refunds often follow different timelines and references than card refunds, and consumers expect outcomes that align with how their wallet balance normally behaves. When merchants apply card-centric refund logic or generic support scripts, wallet-related complaints rise even when the payment itself was successful.

Reconciliation is the next challenge. Wallet transactions can generate different identifiers, settlement patterns, and reporting structures. Finance teams that are not prepared for this often fall back on manual checks and workarounds, which scale poorly and increase error risk. What looks like a simple new payment method quietly adds operational load if it is not integrated thoughtfully.

High-risk merchants feel additional pressure because wallets concentrate scrutiny. Stored value, fast-moving balances, and repeat usage attract closer PSP attention. Acceptance decisions increasingly depend on whether the merchant can explain wallet flows clearly: who pays, who receives value, how refunds work, and how abnormal behaviour is monitored.

Where merchants typically struggle first is not technology, but alignment:

- Refund expectations that differ from card norms

- Settlement and reporting formats that require new reconciliation logic

- Customer support scripts that are not wallet-aware

- PSP reviews triggered by unclear wallet usage patterns

The shift underway is subtle but important. Wallets in the Gulf are becoming primary domestic payment rails, not optional add-ons. Merchants that integrate them with the same discipline they apply to cards and bank transfers benefit from smoother operations and higher trust. Those that treat wallets as lightweight APMs spend 2026 reacting to issues they could have anticipated.

Designing Wallet Acceptance for the Gulf in 2026

Designing wallet acceptance in the Gulf is no longer about adding another option to the checkout page. By 2026, it is about aligning acceptance strategy with how regulated wallets actually behave operationally, commercially, and from a risk perspective.

The starting point is prioritisation. In both the UAE and Saudi Arabia, regulated wallets are increasingly used for domestic, repeat spend rather than occasional or high-ticket purchases. That means wallets should often be positioned as a primary domestic rail, not hidden behind generic “alternative payment methods” labels. When customers expect to pay with a wallet, burying it increases friction rather than choice.

Checkout design also needs to become wallet-aware. Confirmation messaging, error handling, and fallback flows should reflect wallet behaviour rather than card assumptions. A wallet payment that updates a balance instantly creates different expectations from one that settles days later. Merchants that mirror card language for wallet transactions create confusion even when payments succeed.

Refund and post-payment handling is where acceptance design either holds or breaks. Wallet refunds need clear timelines, references, and customer communication aligned with how the wallet operates. This is not a compliance nuance; it directly affects trust and repeat usage. In regulated wallet environments, consumers expect consistency, and PSPs expect merchants to support that consistency operationally.

From a risk and PSP-relationship perspective, acceptance design must also match merchant reality. High-risk merchants benefit from being explicit about wallet use cases: which transactions use wallets, typical ticket sizes, refund frequency, and monitoring approach. Clarity here reduces PSP friction and makes wallet acceptance sustainable rather than conditional.

In practice, strong wallet acceptance design in the Gulf tends to share a few characteristics:

- Wallets positioned intentionally for domestic, repeat-use scenarios

- Checkout and post-payment messaging tailored to wallet behaviour

- Refund and reconciliation processes designed specifically for wallet rails

- Clear internal understanding of how wallets fit the merchant’s risk profile

By 2026, wallets are not a shortcut to higher conversion they are a core payment rail with rules, expectations, and consequences. Merchants that design acceptance with this in mind unlock the benefits of regulation-driven trust. Those that don’t spend time unlearning card-centric assumptions as wallets continue to mature.

Conclusion

By 2026, digital wallets in the Gulf are no longer peripheral payment options. Regulation in the UAE and Saudi Arabia has repositioned them as supervised financial products, with clear expectations around safeguarding, conduct, and consumer protection. That shift is changing how wallets behave and how consumers use them far more than any individual feature or incentive.

For PSPs, wallets now demand the same level of operational discipline as other core payment rails. Monitoring, tiering, refund handling, and governance are no longer optional layers; they are built into the product. This maturity increases trust, but it also raises the bar for merchants who want to accept wallets without friction.

For merchants, the message is straightforward. Wallets can drive meaningful domestic conversion and repeat usage, but only when they are integrated with intent. Treating wallets as lightweight APMs leads to reconciliation issues, support problems, and PSP scrutiny. Treating them as regulated rails aligns checkout design, operations, and risk management with how wallets now function.The Gulf’s wallet push is not about making payments trendier. It is about making them safer, more predictable, and more scalable. In that environment, wallets stop being shortcuts and become infrastructure and the merchants and PSPs that adapt early are the ones best positioned for 2026 and beyond.

FAQs

1. Why are digital wallets being regulated more tightly in the UAE and Saudi Arabia?

Because regulators want wallets to function as safe, reliable consumer payment instruments. Licensing and supervision reduce risk while increasing trust and everyday usage.

2. Are wallets replacing cards in the Gulf?

Not entirely. Cards remain important, especially for cross-border and higher-value transactions, but wallets are becoming primary rails for domestic, repeat spend.

3. What does wallet regulation change for consumers?

It improves predictability. Consumers see clearer onboarding, defined limits, safer storage of value, and more consistent refund and dispute handling.

4. How does wallet regulation affect merchants at checkout?

Wallets behave differently from cards. Confirmation, refunds, and customer expectations change, requiring wallet-aware checkout and support flows.

5. Are regulated wallets safer from an AML perspective?

They are more controlled. Tiering, limits, and embedded monitoring reduce abuse, but they also raise expectations for merchant transparency and behaviour.

6. Why do high-risk merchants face more scrutiny when using wallets?

Because wallets involve stored value and frequent transactions. PSPs expect clearer explanations of flows, refund logic, and monitoring controls.

7. Do wallet refunds work the same way as card refunds?

No. Wallet refunds often follow different timelines and references, and customers expect outcomes aligned with wallet balance behaviour.

8. What operational changes do merchants need for wallet acceptance?

Merchants need wallet-specific reconciliation, refund processes, and customer support scripts, rather than reusing card-based logic.

9. Are unlicensed wallets still viable in the Gulf?

Increasingly, no. Regulation is pushing the market toward licensed, supervised providers, reducing tolerance for informal or lightly governed models.

10. How should merchants prioritise wallets versus other payment methods?

Wallets should be prioritised for domestic, repeat-use scenarios, while cards and bank transfers continue to serve other use cases.

11. Do wallets increase conversion by default?

Only when implemented correctly. Poor wallet integration can increase friction instead of reducing it.

12. What is the biggest mistake merchants make with wallets in the Gulf?

Treating them as lightweight APMs instead of regulated payment rails with distinct operational and risk requirements.