For many global merchants, “Asia” is still treated as a single expansion decision. One checkout flow, one set of payment methods, one regional strategy. In 2026, that assumption is one of the fastest ways to lose conversion, increase operational cost, and frustrate customers before they even reach the confirmation page.

Asia’s payment landscape is fragmented by design. Each market has evolved around its own rails, regulatory constraints, and consumer trust signals. What works in India often fails in Japan. What converts in Southeast Asia may feel unfamiliar or unreliable elsewhere. The problem is not a lack of payment options, but the mismatch between how merchants design checkout and how customers actually expect to pay.

This fragmentation has become more visible as digital payments scale. Cards still matter, but they no longer behave as a universal default. Wallets, instant bank transfers, QR-based systems, and app-to-app flows dominate everyday commerce in many markets, each with their own expectations around speed, refunds, and customer support. Treating these differences as secondary details increasingly undermines performance.

This blog explains why regional scaling fails without local strategy, how fragmentation shows up in real merchant metrics, and what a country-by-country checkout design looks like in practice. For merchants operating across Asia in 2026, precision is no longer a nice-to-have. It is the difference between growth that compounds and growth that quietly leaks at the checkout.

- Why Regional Scaling Fails Without a Local Strategy

- What Fragmentation Actually Looks Like on the Ground

- Regulatory & Cultural Barriers Merchants Underestimate

- Payment Method Mismatch & Conversion Loss

- Operational Costs of Over-Standardisation

- Designing Asia-Specific Payment Blueprints

- KPIs to Track Per Country

- Conclusion

- FAQs

Why Regional Scaling Fails Without a Local Strategy

The appeal of regional scaling is obvious. One integration, one checkout flow, one operational model across multiple countries. On paper, it promises speed and efficiency. In practice, it usually delivers the opposite. By 2026, merchants that pursue a “one Asia checkout” approach often discover that they have standardised away the very things that drive trust and completion at the point of payment.

The core issue is that payment behaviour in Asia is not just different by country; it is contextual. Customers bring expectations shaped by local rails, everyday payment habits, and how problems are resolved when something goes wrong.

A checkout that feels familiar and safe in one market can feel slow, confusing, or even suspicious in another.

When merchants ignore this, the failure rarely shows up as a dramatic outage. It shows up quietly, as drop-off, retries, and support tickets.

Regional scaling also tends to flatten method hierarchy. Merchants present the same set of options everywhere, often ordered by internal preference rather than local relevance. Customers are then forced to search for what they trust, or worse, abandon the transaction when they do not immediately recognise a familiar method. What looks like “choice” from a product perspective often feels like friction from a customer perspective.

The consequences of this approach are remarkably consistent across markets:

- Lower conversion at the payment step, especially on mobile

- Authentication and verification failures where local norms are ignored

- Refund dissatisfaction, because expectations vary by rail and country

- Rising support volume, driven by unclear payment states and error handling

Operationally, these issues compound. Support teams deal with country-specific complaints using region-wide scripts. Finance teams reconcile transactions that behave differently across rails. Risk teams struggle to explain patterns that make sense locally but look anomalous in aggregate. None of this is solved by adding more payment methods to the same generic flow.

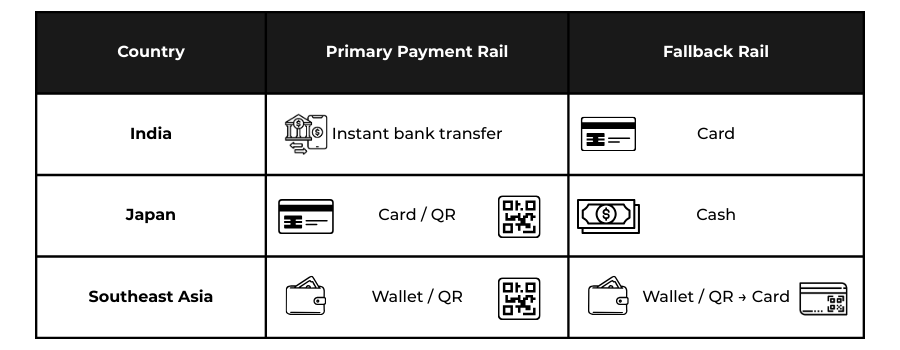

By contrast, merchants that design locally do not abandon scale. They sequence it. They decide which rail leads in each country, which method acts as a fallback, and how trust is signalled at the moment of payment. This does not require building a separate product for every market. It requires accepting that checkout is not a technical endpoint, but a customer interaction shaped by local norms.

In Asia, regional ambition without local strategy does not fail loudly. It fails quietly, one incomplete checkout at a time.

What Fragmentation Actually Looks Like on the Ground

Asia’s payment fragmentation becomes most visible when merchants compare how checkout behaviour changes from country to country. The differences are not cosmetic. They shape which payment methods customers trust, how quickly transactions complete, and how problems are escalated when something goes wrong.

India

In India, everyday digital commerce is built around account-to-account and instant payment behaviour. Customers are used to app-based flows that confirm transactions immediately and reflect balances in real time. Cards still exist, but in many domestic use cases they are secondary rather than default.

Merchants run into friction when card-first checkouts dominate the experience. Even if cards work technically, they feel misaligned with how customers normally pay. Refund expectations are also shaped by instant rails, where delays tolerated elsewhere quickly become unacceptable. This is why system-level initiatives to connect domestic instant payment systems, such as the work being explored under the Bank for International Settlements’ Project Nexus matter for infrastructure, but do not remove the need for locally designed checkout flows.

Southeast Asia

Southeast Asia highlights how fragmentation persists even within a region that is actively collaborating. Wallets, QR standards, and bank transfer flows differ across markets such as Singapore, Thailand, Indonesia, and Vietnam. Customers expect to see what is familiar locally, not what works next door.

Regional efforts to improve cross-border usability, including central bank–led initiatives under the ASEAN Regional Payment Connectivity framework help tourists and cross-border consumers transact more easily. However, these initiatives do not standardise merchant operations. Refund handling, settlement timing, and support expectations still follow domestic norms, which merchants must design for explicitly.

Japan

Japan’s fragmentation is quieter but equally important. Cash remains visible, cards are widely accepted, and domestic QR and wallet ecosystems continue to grow. Customers choose differently depending on context: location, transaction size, and environment. Problems arise when merchants oversimplify this mix leaning too heavily on one method and creating friction elsewhere.

Across all three markets, the pattern is consistent. Fragmentation is not a temporary inconvenience waiting to be solved by regional infrastructure. It reflects deeply embedded payment habits and expectations. By 2026, merchants that acknowledge these realities upfront build checkouts that feel natural and trustworthy. Those that do not spend the year explaining failed payments after the fact.

Regulatory & Cultural Barriers Merchants Underestimate

Payment fragmentation in Asia is reinforced by more than technology. Regulation and culture quietly shape how customers trust payment methods and how PSPs assess merchants. These barriers are easy to underestimate because they rarely appear as hard stop-signs. Instead, they surface as friction, delays, and inconsistent outcomes across markets.

From a regulatory perspective, Asia does not move as a bloc. Data localisation rules, licensing expectations, and domestic consumer protection frameworks vary widely.

A checkout flow that works compliantly in one country may require changes in another, even when the same payment rail is used.

Merchants often discover this only after onboarding delays, additional PSP questions, or restrictions on how funds can be settled or refunded.

Cultural barriers are just as influential. Payment trust in Asia is deeply local. Customers are more likely to complete a transaction when they see familiar method names, local language cues, and payment flows that match what they use day to day. When those signals are missing, even technically sound payment options can feel unreliable. This is why merchants sometimes see strong traffic but weak checkout completion despite “full coverage” on paper.

Several barriers consistently shape outcomes across Asian markets:

- Local regulatory expectations around data handling, reporting, and consumer protection

- Payment trust signals, including method familiarity and language at checkout

- Refund norms, which differ by country and by rail

- PSP risk posture, which is influenced by how well a merchant aligns with local behaviour

These factors explain why regional infrastructure improvements alone do not solve fragmentation. Even as cross-border payment systems improve, merchants still need to adapt checkout design to local rules and expectations. Ignoring these barriers does not usually result in outright failure. It results in slower scaling, higher support costs, and avoidable friction with payment partners.

By 2026, successful merchants are those that treat regulation and culture as design inputs rather than compliance afterthoughts. In Asia, understanding these subtleties is not about perfection. It is about avoiding predictable mistakes that quietly undermine conversion and credibility.

Payment Method Mismatch & Conversion Loss

Picture a customer in Manila, Mumbai, or Jakarta who is ready to pay on mobile. They reach checkout, see cards first, and have to hunt for the method they actually trust. Nothing “fails” technically, but momentum breaks. In Asia, that half-second of doubt is often the real decline.

Mismatch isn’t missing methods, it’s poor method hierarchy

Most merchants don’t lose conversion because they offer too few payment methods. They lose it because the right method is:

- Not visible early enough

- Framed as secondary

- Placed behind extra taps that feel like a risk

In mobile-first markets, checkout is not a menu. It’s a sequence. And sequence affects trust.

Why cards can underperform even when they’re accepted

Cards remain essential in Asia (especially for higher-value and cross-border spend), but they are not always the default mental model for everyday payments. In many countries, customers expect app-to-app flows, wallet balance logic, QR behaviours, or instant bank transfer confirmations. A card-first layout can therefore feel like the merchant is “not local”, even if the business is legitimate.

This is why conversion drop-offs often show up as “customer behaviour issues” when the real cause is checkout design.

The conversion leakage pattern merchants should watch

Instead of focusing only on decline rates, look for this pattern:

- Users reach payment selection but do not choose a method

- Customers retry with a different device or browser

- “Payment done but order not confirmed” complaints rise

- Refund complaints spike because expectations differ by rail

These are mismatch symptoms: the customer didn’t trust the flow enough to complete cleanly, or didn’t get the post-payment signals they expected.

What good looks like in 2026

Winning merchants do three small things consistently:

- Lead with the locally trusted method

- Provide one clean fallback (not a long list)

- Make confirmation and refunds rail-aware (wallet language ≠ card language)

That’s the difference between “we support local methods” and “our checkout feels local”.

Operational Costs of Over-Standardisation

Over-standardisation is often sold internally as discipline. One checkout flow, one refund policy, one support script across Asia. The reality is that this approach usually shifts complexity out of product and into operations where it becomes harder to see, harder to measure, and more expensive to fix.

The first place this shows up is customer support. When payment behaviour differs by country but support processes do not, teams spend time translating local issues into generic categories. Customers describe problems in terms of wallets, QR references, or instant confirmations, while agents respond with card-centric explanations. Even when issues are resolved, resolution time stretches and satisfaction drops.

Finance teams feel the strain next. Different rails settle differently. Some confirm instantly, some batch, some reverse cleanly, others do not. When all of these are forced into a single reconciliation model, manual intervention becomes routine. What looked like a simplified regional setup quietly generates recurring clean-up work.

Risk and compliance teams face a similar problem. Generic flows obscure local patterns. Fraud signals that are obvious in one country disappear in regional aggregates. Refund behaviour that is normal in one market looks anomalous when viewed through a single lens. This does not reduce risk; it makes it harder to explain.

Instead of listing every downstream issue, it is more useful to understand where over-standardisation creates hidden cost:

- Support debt grows as agents handle local payment issues with non-local tools

- Reconciliation effort increases due to inconsistent settlement and refund behaviour

- Operational noise rises, masking genuine fraud or abuse signals

- PSP scrutiny intensifies when merchants cannot clearly explain country-level behaviour

What makes these costs particularly damaging is that they scale with volume. The more successful a merchant becomes in Asia, the more visible the cracks appear. At that point, fixing them often requires retrofitting localisation under pressure, redesigning flows, retraining teams, and re-explaining behaviour to PSPs.

By 2026, the more sustainable approach is not perfect localisation everywhere, but intentional variation. Merchants that allow checkout, refunds, and reporting to flex by country reduce long-term operational load. In Asia, standardisation feels efficient at launch. Precision is what keeps operations stable as scale arrives.

Designing Asia-Specific Payment Blueprints

Designing for Asia in 2026 does not mean building a separate checkout for every country. It means creating repeatable blueprints that respect local behaviour while remaining operationally manageable. The mistake merchants make is treating localisation as an exception. The merchants that scale treat it as a design principle.

Start with country intent, not coverage. For each market, define what customers expect to see first when they reach checkout. That expectation is shaped by everyday usage, not by what is technically available. Once the primary rail is clear, everything else becomes simpler: fallback choice, messaging, refunds, and support.

Next, focus on method hierarchy, not method count. A short, confident hierarchy converts better than a long list. Customers should recognise the first option immediately and understand why alternatives exist. Hiding local methods behind generic labels or secondary screens undermines trust and slows decision-making, particularly on mobile.

Blueprints also need to account for post-payment reality. Confirmation messages, settlement timing, and refund language should match the rail used. Treating all methods as interchangeable creates confusion after payment, which is where support and reconciliation costs quietly rise.

A practical Asia-specific blueprint usually rests on a small number of consistent principles:

- One primary rail per country, chosen for local trust and frequency

- One clear fallback, positioned as a safety net rather than an alternative maze

- Rail-aware confirmation and refund messaging, aligned with customer expectations

- Local trust cues, including language, method naming, and currency clarity

Importantly, these blueprints should be clustered, not isolated. Markets with similar behaviour can share a pattern, even if the methods differ. This allows merchants to scale learning and tooling without forcing uniformity where it does not belong.

By 2026, checkout design in Asia is less about adding complexity and more about removing the wrong assumptions.

Merchants that build disciplined, country-aware blueprints reduce friction at checkout, lower operational noise, and present themselves as credible, local-aware partners to PSPs. Precision here is not an optimisation exercise. It is a prerequisite for sustainable growth.

KPIs to Track Per Country

Once checkout is designed country by country, measurement must follow the same logic. One of the most common mistakes merchants make in Asia is relying on regional averages. Those averages smooth out exactly the signals that indicate whether localisation is working or quietly failing.

In a fragmented region, performance problems rarely appear everywhere at once. They surface in specific countries, on specific rails, and at specific moments in the payment journey. If those signals are not tracked locally, teams react too late or fix the wrong problem.

Rather than building a long dashboard, merchants benefit more from tracking a small set of country-level indicators that reveal friction early.

Think of KPIs in three layers: conversion, operations, and trust.

Conversion layer:

This shows whether the checkout design matches local behaviour.

- Payment conversion rate by method and by device

- Drop-off rate at the payment selection step

- Retry or repeat attempt rate within the same session

Operational layer:

This reveals the hidden cost of fragmentation.

- Refund completion time by rail

- Manual reconciliation effort per country

- Support contact rate after successful payment

Trust and risk layer:

This indicates whether payment flows are creating confusion or scrutiny.

- Dispute or escalation rate by method

- PSP queries or reviews triggered by country-level patterns

The key is not volume, but comparison. A wallet that performs well regionally may underperform in one country. A refund process that looks efficient overall may be driving complaints in a specific market. These differences only become visible when KPIs are segmented deliberately.

By 2026, merchants that win in Asia treat metrics as a localisation tool, not just a reporting requirement. Country-level KPIs allow teams to refine blueprints, justify changes internally, and demonstrate operational maturity to PSPs. In a fragmented region, what you measure locally determines how well you scale globally.

Conclusion

Asia’s payments landscape is not fragmented because it is unfinished. It is fragmented because it reflects how different markets have evolved, how customers build trust, and how regulation shapes everyday commerce. By 2026, infrastructure improvements and regional initiatives will make cross-border payments smoother, but they will not erase local behaviour at checkout.

For merchants, the implication is clear. Scaling across Asia is no longer about finding a single regional solution. It is about designing checkout as a product that adapts by country, balances local trust with operational control, and treats payment methods as part of the customer experience rather than a technical afterthought.

The merchants that succeed are not those with the longest list of payment options, but those with the clearest intent. They lead with what customers expect, manage refunds and support in a rail-aware way, and measure performance where it actually diverges. That precision reduces conversion loss, lowers operational noise, and strengthens relationships with PSPs and acquirers.

Asia does not reward uniformity. It rewards merchants who understand that localisation is not a compromise on scale, but the mechanism that makes scale sustainable.

FAQs

1. Why is Asia considered more fragmented than other regions for payments?

Because payment behaviour in Asia is shaped locally by rails, regulation, and trust. Unlike Europe, there is no single standard that governs how customers expect to pay across countries.

2. Is offering cards plus one wallet enough for Asia in 2026?

In most cases, no. Cards remain important, but many markets rely on domestic wallets, QR systems, or instant bank transfers as the default for everyday transactions.

3. What is the biggest checkout mistake merchants make in Asia?

Treating Asia as a single market and applying the same payment hierarchy everywhere. This often leads to conversion loss even when payment methods are technically available.

4. How does payment fragmentation affect refunds and customer support?

Different rails have different refund speeds, confirmation messages, and dispute expectations. When these differences are ignored, support tickets and dissatisfaction increase.

5. Do regional payment initiatives reduce the need for localisation?

They help improve infrastructure, but they do not remove local expectations. Merchants still need country-specific checkout design and messaging.

6. How can merchants localise checkout without building separate systems per country?

By using country-level blueprints: one primary rail, one fallback rail, localised messaging, and shared operational tooling behind the scenes.

7. What KPIs best reveal payment problems in Asia?

Country-level conversion by method, refund completion time by rail, and post-payment support contact rates are strong early indicators.

8. How do PSPs assess merchants operating across multiple Asian markets?

They look for clarity: why the payment mix fits each country, how refunds are handled per rail, and whether risk patterns are understood locally.

9. Is localisation mainly a UX concern or an operational one?

It is both. Poor localisation affects conversion first, but the larger cost often appears later in reconciliation, support, and PSP scrutiny.

10. What changes most for merchants between now and 2026?

Customer expectations for local payment methods rise, and tolerance for generic checkout flows falls. Precision becomes essential, not optional.