Europe has always been a paradox for high-risk merchants. It is one of the world’s most advanced digital payments regions, with deep card penetration, real-time banking infrastructure, and some of the most sophisticated regulatory frameworks globally. At the same time, it is one of the most fragmented and unforgiving regions when it comes to high-risk payment acceptance.

By 2026, this tension becomes unavoidable. PSD3 and the new Payment Services Regulation (PSR) tighten expectations around fraud monitoring, transparency, and authentication. Card schemes apply increasing pressure through integrity and brand protection programmes. Domestic banks across several EU countries have reduced risk appetite entirely for certain merchant categories. Yet paradoxically, Europe is also leading global innovation in instant payments, open banking, EMI-based settlement models, and corridor-specific acquiring strategies.

For high-risk merchants, the result is a region that is neither closed nor open by default. Success depends on understanding where processing is realistically available, where settlement is viable, which jurisdictions actively support specific verticals, and which markets have effectively shut their doors regardless of compliance quality.

This article maps the real European high-risk payments landscape in 2026, country by country and vertical by vertical, so merchants can stop guessing and start planning with precision.

- Europe’s 2026 High-Risk Landscape: Why Acquirer Appetite Diverges by Country

- Regional Clusters: Where High-Risk Merchants Are Welcome vs. Frozen Out

- Vertical-by-Vertical Reality Across Europe

- The PSP and Acquirer Types That Power High-Risk Payments in Europe

- PSD3 and PSR: How Regulation Reshapes High-Risk Acceptance

- Instant Payments and Open Banking: Relief, Not Replacement

- Choosing European Corridors by Risk Appetite

- Merchant Checklist: Preparing for Europe in 2026

- Conclusion

- FAQs

Europe’s 2026 High-Risk Landscape: Why Acquirer Appetite Diverges by Country

Although Europe operates under shared regulatory frameworks such as PSD3, PSR, and AMLD6, payment acceptance is still shaped at the national level. Domestic regulators, local banking culture, political pressure, and historical risk exposure all influence how acquirers interpret and apply those rules. As a result, two countries inside the EU can take completely opposite positions on the same high-risk merchant.

In 2026, these divergences become sharper. Acquirers are reassessing portfolio concentration, issuers are more aggressive with declines in sensitive categories, and regulators are examining how risk controls operate in practice rather than on paper. This has created a European market where access to payments is determined less by what the law technically allows and more by how risk is perceived locally.

At the EU level, PSD3 and PSR push for stronger authentication, tighter fraud thresholds, and clearer transaction-level reporting. In theory, this creates harmonisation. In practice, national supervisors interpret enforcement very differently. Some jurisdictions work collaboratively with acquirers and specialist PSPs to manage high-risk categories. Others adopt a zero-tolerance approach, effectively forcing banks to exit entire verticals.

Five forces drive these differences. First, national AML enforcement styles vary widely. Germany, France, and Spain apply far stricter interpretations than many smaller or more specialised jurisdictions, making high-risk onboarding extremely difficult regardless of documentation quality. Second, consumer protection culture plays a significant role. Markets with strong refund rights and aggressive complaint handling tend to generate higher chargeback exposure, which reduces acquirer appetite. Third, local licensing requirements create friction for cross-border merchants, especially in gaming, FX, and adult content. Fourth, scheme-level pressure through programmes such as BRAM and VAMP disproportionately affects conservative banking markets. Finally, the domestic political climate matters more than merchants expect. Public focus on gambling harm, investment scams, or youth protection can trigger abrupt policy tightening.

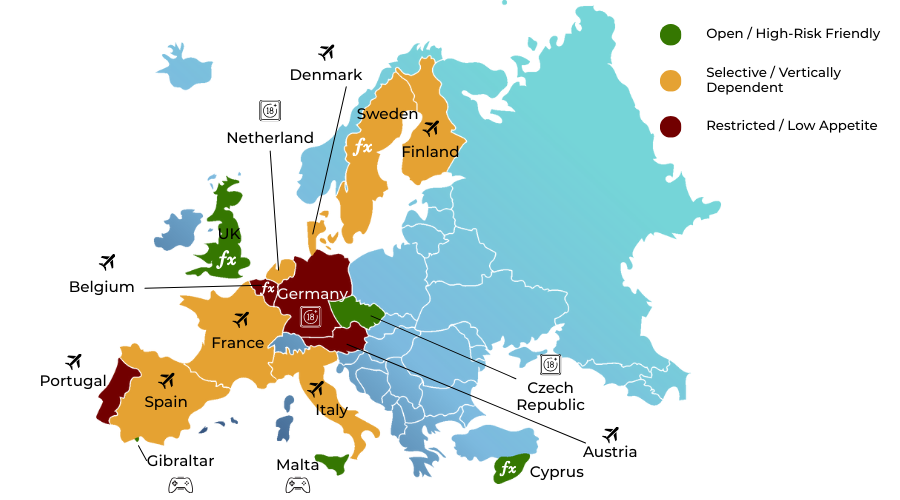

The result is a highly uneven playing field. By 2026, the UK, Malta, Cyprus, Gibraltar, and parts of Central and Eastern Europe remain relatively open to high-risk models. The Netherlands, Nordics, Ireland, and Portugal occupy a middle ground, supportive of digital commerce but selective with sensitive verticals. Germany, France, Spain, Italy, and Belgium sit firmly at the restrictive end of the spectrum.

For merchants, this means Europe can no longer be treated as a single market. Corridor selection is now a strategic decision, not an operational afterthought.

Regional Clusters: Where High-Risk Merchants Are Welcome vs. Frozen Out

Europe is best understood not as a collection of individual countries, but as four distinct payment corridors, each with its own regulatory mindset and acquiring behaviour. These clusters determine whether onboarding is straightforward, slow, or effectively impossible.

High-Risk Friendly Hubs

The UK, Malta, Cyprus, and Gibraltar continue to form the backbone of Europe’s high-risk ecosystem. These jurisdictions have long-standing regulatory frameworks for sensitive industries and supervisors who understand the commercial realities of gaming, trading, and digital entertainment.

The UK remains the most important Western European corridor. FCA oversight, combined with structured EMI regulation and a mature PSP ecosystem, allows specialist acquirers to operate with relative confidence. Malta retains its position as Europe’s iGaming capital, supported by the MGA and a dense network of high-risk PSPs. Cyprus continues to dominate FX and CFD processing through CySEC-regulated operators, while Gibraltar provides a niche but valuable gaming corridor tied closely to the UK market.

Merchants choose these hubs because onboarding appetite still exists, regulators understand the industries, and settlement infrastructure is mature enough to support complex, multi-market models.

Digital Services Corridors

The Netherlands, Nordics, and parts of Western Europe represent digitally advanced markets with excellent payment infrastructure but limited tolerance for traditional high-risk verticals. These countries perform exceptionally well for SaaS, subscriptions, e-commerce, and travel. Card performance is strong, open banking adoption is high, and consumer trust is deeply embedded.

However, when it comes to gaming, FX, adult content, or CBD, acceptance drops sharply unless merchants are locally licensed and tightly controlled. For many high-risk operators, these markets are valuable for customer reach but rarely suitable as primary acquiring anchors.

Conservative Banking Zones

Germany, France, Spain, Italy, and Belgium are the most challenging markets for high-risk merchants in 2026. These countries combine strict AML enforcement, strong consumer protection regimes, and high regulatory scrutiny of acquirer portfolios. As a result, banks often avoid entire merchant categories rather than managing them selectively.

While these markets offer large populations and significant purchasing power, onboarding success rates for high-risk verticals are extremely low. Most merchants who serve these countries do so through cross-border acquiring or alternative payment rails rather than local acquirers.

Niche-Friendly and Emerging Corridors

Central and Eastern European markets, along with the Baltics, occupy a growing middle ground. Countries such as the Czech Republic, Romania, Poland, Lithuania, and Estonia do not actively market themselves as high-risk hubs, but their EMI-led settlement ecosystems provide flexibility where traditional acquiring is limited.

These corridors are particularly valuable for adult content, CBD, niche digital services, and fintech intermediary models. While local acquiring appetite may be limited, settlement routes are often more adaptable than in Western Europe.

Understanding these clusters allows merchants to design expansion strategies that reduce friction, avoid wasted onboarding attempts, and align payment infrastructure with real-world acceptance.

Vertical-by-Vertical Reality Across Europe

Europe’s fragmentation becomes even more pronounced when viewed through the lens of individual verticals. Two merchants with identical corporate structures can experience completely different onboarding outcomes solely based on industry classification.

iGaming and Betting

iGaming remains one of the most regulated and scrutinised verticals in Europe. Licensing is the primary gatekeeper to payment access. The UK and Malta continue to offer the strongest corridors, supported by specialist acquirers who understand gambling-specific risk controls. Parts of Central and Eastern Europe provide partial coverage, often tied to local licensing footprints.

In contrast, markets such as Germany, France, Spain, and the Netherlands impose strict national regimes that make cross-border onboarding extremely difficult. High AML scrutiny, gambling harm regulation, and scheme-level controls combine to limit acceptance.

FX, CFD, and Crypto-Adjacent Trading

This vertical faces dual scrutiny from financial regulators and payment providers. Cyprus remains the core European hub due to its established CySEC licensing ecosystem. The UK supports FX and trading on a case-by-case basis through specialist acquirers and EMIs. The Baltics play an important role in settlement, particularly for non-card rails.

Western Europe is far less accommodating. France, Belgium, and Spain apply ESMA-level restrictions aggressively, while Nordics have become increasingly conservative following retail investment warnings. High fraud exposure and political sensitivity make this one of the most challenging categories to process consistently.

Adult Content and Dating

Adult merchants face unique challenges driven not only by regulation but by card scheme reputation programmes. The UK remains one of the few major markets where case-by-case onboarding is still possible. The Czech Republic and parts of Central and Eastern Europe are among the most flexible corridors for adult content and recurring billing models.

France, Germany, Italy, Spain, and the Nordics offer almost no tolerance due to cultural norms, content rules, and scheme pressure. Continuous monitoring requirements under BRAM and VAMP have led many banks to exit the vertical entirely.

CBD, Hemp, and Supplements

CBD acceptance varies widely due to inconsistent interpretations of THC limits, medical claims, and food safety regulations. The UK and Czech Republic are among the most tolerant corridors when product transparency is strong. Switzerland, while outside the EU, plays an important role in cross-border settlement and distribution.

France and Sweden remain highly restrictive, while Southern Europe presents mixed outcomes depending on product classification. For CBD merchants, corridor selection is often the difference between scalable processing and complete rejection.

Travel, Ticketing, and Experiences

Travel is challenged less by regulation than by operational risk. High refund volumes, chargeback exposure, and seasonal volatility make acquirers cautious. The UK, Spain, Portugal, and Nordics remain strong corridors due to their tourism economies and experienced PSPs.

Germany, France, and Italy are more restrictive due to refund laws and SCA friction, while Eastern Europe often relies on EMI settlement structures to support travel merchants.

The PSP and Acquirer Types That Power High-Risk Payments in Europe

When merchants struggle to access European payments, the issue is rarely that Europe has no solutions. More often, it is that merchants are approaching the wrong type of provider.

Tier-1 EU acquirers offer excellent scheme connectivity and approval performance for low-risk merchants, but they are highly sensitive to reputational and regulatory pressure. For most high-risk verticals, they are unsuitable as primary partners.

Specialist high-risk acquirers, by contrast, build their businesses around complex sectors. They understand vertical-specific risk patterns, issuer behaviour, and scheme compliance requirements. While pricing is higher and underwriting more intensive, these acquirers form the core of most successful European high-risk strategies.

EMIs and fintech PSPs fill the critical settlement gap. They provide multi-currency wallets, alternative payout structures, and access to non-card rails. For many high-risk merchants, EMIs are the key to getting paid even when local acquiring is unavailable.

In practice, successful merchants design blended stacks that combine these provider types rather than relying on a single solution.

PSD3 and PSR: How Regulation Reshapes High-Risk Acceptance

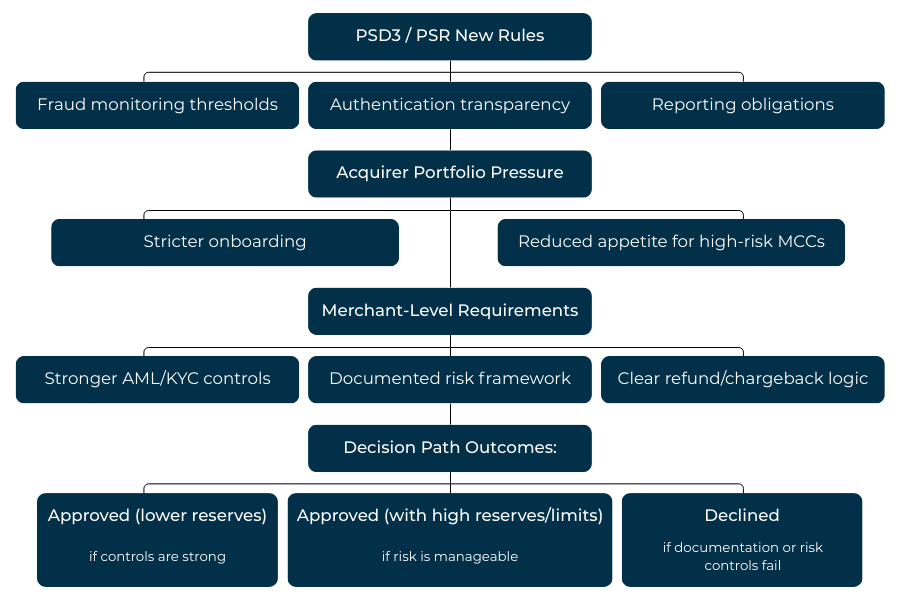

PSD3 and PSR do not prohibit high-risk processing, but they raise expectations around transparency, monitoring, and accountability. Acquirers face stricter fraud thresholds, more detailed reporting requirements, and greater scrutiny of portfolio concentration.

Supervisors increasingly evaluate how acquirers manage risk in practice, not just how policies are written. As a result, many banks have reduced exposure to volatile verticals to avoid regulatory friction.

For merchants, this means approval depends less on category labels and more on demonstrable risk control. Strong fraud prevention, clear authentication strategies, and predictable transaction behaviour directly influence onboarding outcomes.

Settlement structures are also under greater scrutiny. Merchants relying on EMIs or alternative payout routes must demonstrate safeguarding compliance and audit-ready fund flows. Settlement is no longer just a financial consideration; it is a regulatory one.

Instant Payments and Open Banking: Relief, Not Replacement

As card acceptance tightens, instant payments and open banking have become essential pressure valves for high-risk merchants. The EU’s Instant Payments Regulation mandates widespread availability of real-time transfers, while the UK continues to lead open banking adoption.

These rails offer fast settlement, reduced chargeback exposure, and strong authentication. They are particularly valuable in markets where card acquiring is restricted. However, they do not replace cards entirely. Refund handling, consumer protection expectations, and recurring billing still require traditional acquiring.

The future European stack is multi-rail by design. Cards drive scale, instant payments provide stability, and orchestration across rails determines profitability.

Choosing European Corridors by Risk Appetite

By 2026, successful expansion into Europe depends on selecting corridors that match a merchant’s risk profile. Regulated but open markets such as the UK, Malta, Cyprus, and the Czech Republic remain the best entry points for most high-risk verticals. Digital-friendly but conservative markets suit subscription and SaaS models. Highly conservative countries are rarely viable entry points and are best served via cross-border strategies. Emerging corridors offer settlement flexibility when paired with established acquiring hubs.

Choosing the wrong corridor can delay onboarding by months or lead to outright rejection. Choosing the right one accelerates approvals, reduces reserves, and unlocks sustainable growth.

Merchant Checklist: Preparing for Europe in 2026

High-risk success in Europe comes from preparation. Merchants must understand licensing requirements, define realistic corridor strategies, present acquirer-grade documentation, and demonstrate robust risk controls. Multi-rail payment strategies, disciplined refund management, and compliant settlement structures are no longer optional.

Merchants who launch in controlled phases, test performance by corridor, and adapt based on real data signal maturity to acquirers and regulators alike.

Conclusion

Europe has not closed its doors to high-risk merchants, but it has raised its standards. In 2026, access to processing and settlement depends on corridor precision, regulatory readiness, and intelligent provider selection. Merchants who understand Europe’s fragmented risk landscape and design their payment strategies accordingly will continue to thrive. Those who rely on generic expansion models will increasingly find themselves locked out.

Europe rewards merchants who respect complexity, invest in compliance, and align themselves with the corridors built for their vertical.

FAQs

1. Which European countries are the best starting point for high-risk merchants in 2026?

The strongest corridors remain the UK, Malta, Cyprus, Gibraltar and the Czech Republic, depending on your vertical. These markets have established licensing regimes, specialist acquirers and EMIs that support onboarding for gaming, FX/CFD, adult, CBD and complex digital models.

2. Can high-risk merchants still get traditional card acquiring in the EU?

Yes, but only in selected jurisdictions. Western Europe (Germany, France, Spain, Italy) is far more restrictive, while Malta, Cyprus, the UK and certain CEE countries still offer card acquiring for high-risk MCCs. A corridor-specific approach is essential.

3. Which verticals face the most resistance from European acquirers?

The toughest are:

- iGaming (without licensing)

- FX/CFD trading

- Adult and dating content

- CBD and ingestible supplements

- High-refund travel and ticketing models

These categories face a mix of regulatory, scheme and reputational friction.

4. Does PSD3 make underwriting harder for high-risk merchants?

Indirectly, yes. PSD3 and PSR introduce tighter fraud monitoring, authentication transparency and reporting obligations for acquirers. This pushes many banks to shrink their high-risk exposure. Merchants must show stronger documentation and risk controls to be approved.

5. Will instant payments or open banking replace card acquiring in high-risk markets?

No. A2A rails provide stability, especially where card issuing is conservative but they do not offer chargebacks, card-like trust signals or recurring billing support. In 2026, cards + instant payments + EMIs form a combined stack, not replacements for each other.

6. Can high-risk merchants rely only on EMIs for settlements?

EMIs play a crucial role, but they don’t replace acquiring. Merchants still need card/acquirer partners to handle pay-ins. EMIs are best for multi-currency settlement, cross-border payment flows, and routing around restrictive banking markets.

7. Which European countries are strictest about onboarding high-risk merchants?

Germany, France, Spain, Italy and Belgium are the most conservative. Local banks avoid high-risk MCCs entirely. Even with perfect compliance, onboarding is rare unless the merchant is licensed locally and offers low operational risk.

8. Do CBD merchants have opportunities in Europe?

Yes, but they must be extremely careful. The UK, Czech Republic and Switzerland offer the most stable acceptance. France, Sweden and Italy have inconsistent or restrictive interpretations. Product labelling and THC compliance determine approval likelihood.

9. For iGaming, which licences matter most for payment acceptance?

The UKGC and MGA remain the primary gold-standard licences. Local licences in regulated EU markets (e.g., Netherlands, Sweden) are mandatory for local acquiring. Without these, merchants rely on cross-border acquiring, which has lower approval rates.

10. How should merchants choose the right European corridor?

Base the decision on:

- Your vertical’s regulatory requirements

- Appetite of PSPs in that corridor

- Settlement structure (bank vs EMI)

- Expected chargeback profile

- Your licensing footprint

- Your operational risk posture

Choosing the wrong corridor can result in months of failed onboarding.

11. What documentation do high-risk merchants need for European acquirers?

Acquirers expect:

- Full corporate documents

- UBO/KYC evidence

- Financial history

- AML & compliance policies

- Detailed product explanations

- Website, checkout and refund-flow screenshots

- Marketing materials

Well-prepared documentation significantly increases approval odds.

12. Can high-risk merchants succeed in Europe without local entities?

Yes, but only via cross-border acquiring + A2A rails + EMI settlement. For certain verticals (gaming, FX, regulated services), a local entity or licence is mandatory for best results.

13. Which rail performs best for high-risk merchants, cards or A2A?

Neither alone is sufficient. Cards drive top-line revenue and trust; A2A rails stabilise performance where card declines are high. The strongest 2026 setups use multi-rail orchestration.

14. Are approval rates in Europe improving or declining for high-risk sectors?

Declining, but not uniformly. Conservative corridors have tightened significantly, while specialist hubs (UK, Malta, Cyprus) continue to onboard strong, compliant merchants.