For four decades, card networks have shaped how global commerce works. They enabled online payments, cross-border acceptance, and scale but by 2026, merchants and PSPs are increasingly running into the limitations of card infrastructure. Settlement delays, rising scheme fees, unpredictable issuer declines and escalating fraud costs have made cards a less efficient default for digital commerce, especially in high-risk verticals.

This shift doesn’t mean cards are disappearing. Instead, they are losing their position as the primary payment rail. In their place, a new ecosystem is emerging, one built around tokenised bank deposits, instant A2A transfers, and embedded finance wallets that move money faster, with greater transparency and significantly lower dispute exposure.

Banks are now issuing deposits in tokenised form; PSPs are building orchestration layers that route between cards, A2A and token rails; and regulators across the UK, EU and Asia are encouraging real-time, programmable settlement frameworks. The result is a payment landscape where merchants can finally optimise for speed, cost, compliance and user experience not just card approval rates.

The post-card era isn’t a prediction. It’s a transition already underway.

- What Tokenised Deposits Actually Are (2026 Definition)

- Why Banks & PSPs Are Moving Toward Tokenised Rails

- Embedded Finance Inside Merchant Platforms (Wallets, A2A, In-App Token Vaults)

- Impact on High-Risk Verticals (Gaming, Travel, FX, Digital Commerce)

- Multi-Rail Environments (Cards + Tokens + A2A): How They Work Together

- Regulatory Landscape: PSD3, SPAA & the Global Shift Toward Tokenised Settlement

- Merchant Adoption Roadmap: How to Prepare for the Post-Card Era

- Conclusion

- FAQs

What Tokenised Deposits Actually Are (2026 Definition)

Tokenised deposits are one of the most significant shifts happening inside regulated banking. Unlike stablecoins or crypto assets, tokenised deposits represent commercial bank money the same money customers hold today expressed in a digital, programmable format. Instead of sitting as a static balance inside a traditional core banking system, the funds are issued as digital tokens on a secure ledger, enabling near-instant movement across merchant platforms, PSPs and financial institutions.

This format doesn’t change the nature of the money; it changes how fast, safely, and intelligently the money can move. Regulators and central banks, including the BIS and the Bank of England, have endorsed the model as a safe, regulated path toward modernising payments without exposing consumers to the volatility or governance issues seen in private stablecoins.

Tokenised deposits carry embedded identity metadata, can interact seamlessly with real-time payment systems and enable programmable payment logic features that make them particularly attractive to high-risk merchants and PSPs dealing with fraud, chargebacks and complex settlement workflows.

How They Differ From Crypto, Stablecoins & CBDCs

- Not crypto: No volatility, no decentralised issuance, and full regulatory oversight.

- Not stablecoins: No reliance on external reserves or issuer solvency risk.

- Not CBDCs: CBDCs are issued by central banks; tokenised deposits are issued by commercial banks to support merchant payments and PSP-led innovation.

Why They Matter to Merchants

Tokenised deposits provide faster settlement, improved transaction traceability, lower dispute exposure and smoother cross-rail routing. For the first time, money moves at the same speed as merchant operations.

Why Banks & PSPs Are Moving Toward Tokenised Rails

By 2026, banks and PSPs are under pressure to support payment flows that are faster, safer, and far more transparent than what legacy card systems can deliver. Tokenised rails solve multiple pain points at once: settlement delays, rising scheme fees, dependence on issuer behaviour, and fraud patterns that card logic cannot respond to in real time. As a result, banks and PSPs are increasingly shifting their innovation budgets toward tokenised money infrastructure not as a replacement for cards, but as a modern complement.

Merchants are also demanding alternatives. High-risk, high-volume sectors have long struggled with unnecessary declines, unpredictable chargebacks, and slow payouts. Tokenised deposits reduce these inefficiencies by enabling instant settlement, embedded identity signalling and programmable payment logic. For PSPs, this means fewer operational escalations, lower dispute-management overhead and improved routing performance across rails.

Regulators are aligned. Frameworks like PSD3 and real-time settlement initiatives across the EU, UK, UAE, and Singapore support tokenised rail adoption because they reduce systemic risk and increase payment transparency.

Faster Settlement = Stronger Cash Flow

Traditional card settlement can take 1–3 days (or longer cross-border). Tokenised deposits settle in seconds, giving merchants predictable liquidity and enabling PSPs to reduce treasury strain.

Lower Dispute & Fraud Costs

Token rails embed identity and behavioural metadata, allowing fraud checks and dispute prevention earlier in the transaction journey. This reduces costly chargebacks, an advantage particularly relevant for high-risk merchants.

Improved Routing Flexibility

PSPs can route between cards, A2A rails, and tokenised deposits dynamically based on real-time performance, issuer behaviour, corridor risk and cost.

Embedded Finance Inside Merchant Platforms (Wallets, A2A, In-App Token Vaults)

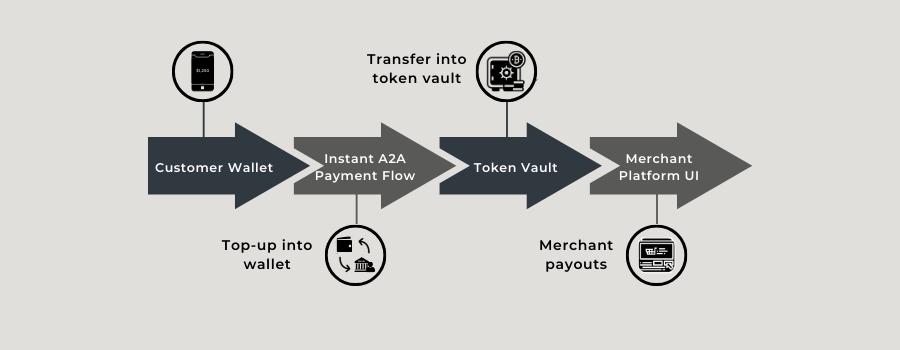

As merchants evolve from simple payment acceptors into full financial ecosystems, embedded finance has become central to how platforms operate. Wallets, instant A2A payments, and internal token vaults let merchants move money inside their own environment without depending on card rails for every step. Tokenised deposits accelerate this transition by giving merchants a settlement asset that is instant, programmable, and identity-aware, making it far easier to build financial features directly into the user journey.

This shift also reflects changing consumer expectations. Users now expect immediate value transfer: instant refunds, real-time withdrawals, wallet top-ups that don’t fail due to issuer friction, and in-platform balances that move seamlessly. Tokenised deposits support these experiences by removing the traditional delays and approval dependencies baked into card payments.

Wallets Become the Default Financial Layer

Digital wallets are no longer add-ons; they are now core revenue tools. With tokenised deposits, wallet top-ups settle instantly, internal transfers behave like closed-loop systems, and loyalty mechanisms can be automated without PSP reconciliation delays. High-risk sectors benefit significantly because wallets create predictable deposit flows and reduce transaction failure rates.

Direct A2A Rails Reinforced by Tokenisation

A2A rails such as SEPA Instant, PIX, UPI, and Faster Payments offer speed, but lack programmability. Tokenised deposits bridge this gap, enabling merchants to add conditions, hold-and-release logic, and richer compliance data turning A2A into a smart settlement tool.

In-App Token Vaults Modernise Merchant Infrastructure

Token vaults let merchants store value internally for gaming credits, travel holds, pre-funding, payouts or marketplace flows. Their key advantage: they reduce reliance on external settlement cycles and give merchants full control over value movement.

Impact on High-Risk Verticals (Gaming, Travel, FX, Digital Commerce)

High-risk verticals feel the limitations of card rails more than any other category. Issuer-driven friction, inconsistent approval rates, chargeback exposure and cross-border settlement delays have always made card-based operations unpredictable. Tokenised deposits, combined with embedded finance and instant A2A infrastructure, offer these merchants a structurally different payment foundation, one that reduces risk and stabilises revenue.

By 2026, gaming operators, travel merchants, FX platforms and digital commerce aggregators increasingly adopt tokenised rails not because they are “new,” but because they solve long-standing operational problems cards cannot fix.

- Gaming: Faster Deposits, Controlled Withdrawals, Lower Fraud

Gaming platforms rely on instant movement of value. Tokenised deposits enable immediate wallet top-ups and controlled withdrawal flows, reducing disputes and eliminating the lag introduced by issuer approvals. Fraud signals tied to token metadata help pre-empt chargebacks and bonus abuse.

- Travel: Lower FX Exposure & Reduced Disputes

Travel merchants depend on predictable settlement when dealing with volatile cross-border corridors. Tokenised deposits reduce FX risk by supporting near-real-time settlement and enabling clearer compliance trails. This is particularly useful for high-dispute categories such as last-minute bookings and high-value itineraries.

- FX/CFD: Better Treasury Mobility & Real-Time Risk Controls

Tokenised deposits allow FX platforms to move liquidity instantly across internal ledgers and hedging accounts. Fraud and AML checks can operate within the token flow, reducing synthetic identity abuse and high-velocity fraud patterns.

- Digital Commerce: Fewer Failed Payments & Faster Fulfilment

Merchants selling subscriptions, digital goods, or cross-border items benefit from lower decline rates and programmable settlement rules, enabling faster delivery and reduced disputes.

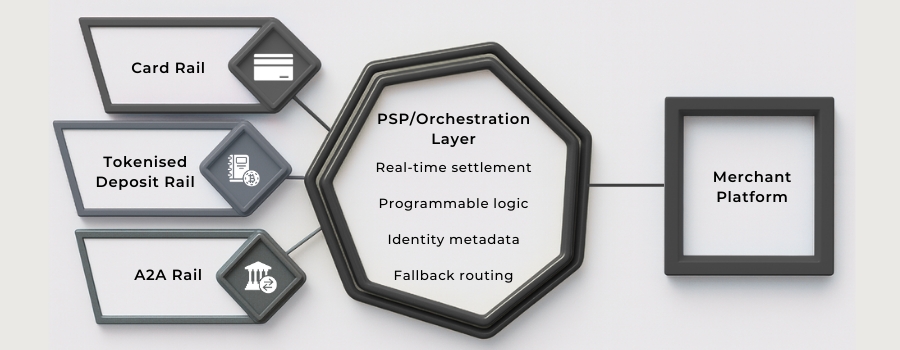

Multi-Rail Environments (Cards + Tokens + A2A): How They Work Together

The future of payments isn’t a replacement of cards, it’s coexistence. By 2026, most PSPs operate in multi-rail mode, where cards, tokenised deposits, A2A payments and embedded wallets function side-by-side. The real value emerges not from any single rail, but from the orchestration engine that decides which rail should process which transaction, under which conditions, and with what risk posture.

This is where tokenised deposits fundamentally shift the architecture. Cards offer reach, A2A offers speed, and token rails offer programmable intelligence. Together, they create a payment environment where merchants no longer rely on a single network’s limitations; they route dynamically to whichever rail delivers the best conversion, cost efficiency or compliance alignment at that moment.

When Cards Still Make Sense

Cards remain the strongest option for:

- Cross-border customers without local A2A rails

- Initial deposits where trust depends on issuer oversight

- Sectors in which tokens are still in pilot phases

The key difference: cards are no longer the default, just one of several strategic options.

When Tokens Deliver the Best Outcome

Tokenised deposits perform best when merchants need:

- Instant settlement

- Automated refund logic

- Internal ledger movement

- Rich identity metadata for fraud evaluations

They operate like “smart money,” carrying behaviour and compliance context with every transfer.

When A2A Is the Optimal Rail

A2A rails such as SEPA Instant, UPI, PIX and FedNow shine in:

- Domestic high-volume traffic

- Low-value, high-frequency purchases

- Checkout flows requiring near-zero friction

Tokenization enhances A2A by adding programmability and improving fraud controls.

Regulatory Landscape: PSD3, SPAA & the Global Shift Toward Tokenised Settlement

The move toward tokenised money and multi-rail payment stacks isn’t happening in isolation. Regulators across the UK, EU, and high-growth markets are actively shaping how merchants, PSPs and banks must operate these new systems.

By 2026, compliance frameworks such as PSD3, PSR, and SPAA (SEPA Payment Account Access) are accelerating the shift away from card dependency and toward real-time, identity-rich settlement rails.

Rather than treating tokenised deposits and A2A payments as emerging technologies, regulators now view them as essential tools for improving payment transparency, consumer protection, and fraud control. This regulatory momentum is one of the biggest reasons PSPs are modernising their stacks.

PSD3: Authentication, Data Accuracy & Rail Transparency

PSD3 pushes for stronger authentication controls and clearer visibility into payment routing. For tokenised rails, this is an advantage: tokens carry identity metadata by default, making compliance easier.

Key regulatory priorities include:

- Ensuring SCA logic works consistently across new rails

- Improving fraud-rate accountability in TRA exemptions

- Stricter issuer/PSP reporting on settlement and routing behaviour

SPAA: The Framework Enabling Real-Time A2A Competition

SPAA introduces commercial rules and API standards for premium instant payments across Europe. This enables stronger competition with cards and gives merchants regulated access to:

- Real-time bank data

- Verified account information

- Higher-performing A2A payment experiences

Tokenised deposits integrate naturally with these APIs, providing an authenticated settlement asset alongside A2A flows.

Global Regulators Favour Transparent, Programmable Money

Whether it’s MAS in Singapore, the UAE Central Bank, or the Bank of England, regulators share the same goals:

- Reduce fraud and merchant disputes

- Enable instant settlement

- Increase data integrity across payment journeys

Tokenised deposits meet these requirements far better than legacy card rails.

Merchant Adoption Roadmap: How to Prepare for the Post-Card Era

For most merchants, shifting toward tokenised deposits and multi-rail environments isn’t a sudden transformation, it’s a staged, strategic upgrade. The winning merchants in 2026 aren’t the ones who replace cards overnight, but those who layer tokenised settlement, A2A flows and embedded wallets into their stack in a controlled, ROI-driven way.

Adoption begins with understanding where cards create operational drag: delays in settlement, high decline rates, chargeback exposure and unnecessary scheme fees. From there, merchants can align internal teams, PSP partners and treasury workflows to gradually integrate tokenised rails without disrupting customer experience.

Step 1: Assess Your Current Rail Performance

Merchants should map out:

- Approval rates by issuer, geography and BIN

- Dispute ratios and chargeback drivers

- Settlement delays across acquirers

- FX losses on cross-border traffic

This identifies the problem areas tokenised rails can solve.

Step 2: Introduce Instant A2A or Wallets Where They Perform Best

Start with use cases where tokens or A2A rails provide clear uplift:

- Fast withdrawals

- Micro-purchases

- Recurring value transfers

- Internal ledger movements

This builds user trust in non-card rails.

Step 3: Integrate Tokenised Deposits via PSP Orchestration

Token rails should enter the stack through a PSP or gateway offering:

- Multi-rail routing

- Real-time fraud intelligence

- Programmable settlement logic

- Unified reconciliation

Step 4: Prepare Compliance & Treasury Teams

Teams should understand updated PSD3/PSR obligations, data structures for token flows and treasury impact of instant settlement.

Conclusion

The global payment ecosystem is entering a structural transition. Cards remain important, but they no longer define how money must move. Tokenised deposits, instant A2A rails and embedded finance infrastructures are offering merchants something that card rails could never fully deliver: real-time settlement, programmable flows, lower dispute exposure and richer identity data at the moment of payment.

For high-risk and high-volume merchants, this shift is particularly meaningful. Instead of fighting issuer friction, unpredictable chargebacks or multi-day settlement delays, they can now operate on rails designed for speed, transparency and compliance. PSPs, in turn, gain the flexibility to route transactions intelligently across cards, tokens and A2A networks choosing whichever rail offers the best cost, conversion and risk profile.

Regulators are reinforcing this transformation through PSD3, SPAA and global instant-payment standards, pushing the industry toward more transparent and efficient settlement models.

The post-card era isn’t about replacing cards, it’s about finally giving merchants choice. Payments are no longer defined by one rail but orchestrated across many, with tokenised deposits emerging as the settlement layer powering the next generation of digital commerce.

FAQs

1. Are tokenised deposits the same as cryptocurrency?

No. Tokenised deposits are issued by regulated banks and represent commercial bank money in digital form. They carry no volatility and sit fully inside traditional banking rules, unlike crypto assets.

2. Will tokenised deposits replace card payments entirely?

Not in the short term. Cards will remain important for customer familiarity and global acceptance. However, for high-risk verticals and digital platforms, tokenised rails will increasingly handle settlement, payouts and internal value transfers.

3. Why are tokenised deposits better for high-risk merchants?

They reduce chargeback exposure, enable instant settlement, and include identity-rich metadata. This lowers fraud risk and removes many operational delays associated with card-based flows.

4. How do tokenised deposits interact with A2A rails like SEPA Instant, PIX or UPI?

Tokenised deposits complement A2A rails by adding programmability, fraud controls and clearer compliance trails. Together, they deliver faster and safer real-time payments.

5. Can merchants start using tokenised deposits without major system changes?

Most merchants adopt token rails through a PSP or payment orchestrator. This avoids direct integration complexity while enabling multi-rail routing and instant settlement.

6. Are tokenised deposits allowed under PSD3 and EU regulations?

Yes. PSD3 and the European Commission support modernised settlement models as long as they maintain transparency, fraud controls and consumer protection. Tokenised deposits fit within these frameworks.

7. Do tokenised rails eliminate chargebacks completely?

Chargebacks as defined in card schemes do not apply to tokenised deposits. However, merchants must still manage refunds, fraud claims and regulatory dispute processes.

8. How do tokenised rails help with cross-border payments?

They allow PSPs to settle instantly inside multi-currency ledgers, bypass some scheme fees and reduce FX slippage. This is especially useful for travel, gaming and global digital commerce.

9. Are customers comfortable using token-based payments?

Most users don’t even see the token layer. They interact with a wallet or instant-pay experience, while the token settlement happens behind the scenes similar to how card tokenisation works today.

10. What is the biggest advantage for merchants adopting tokenised deposits in 2026?

Control. Merchants gain predictable settlement, reduced risk, better routing flexibility and lower operational cost. Payments become a strategic asset not a bottleneck.