Introduction

For more than a decade, European e-commerce was shaped by a predictable checkout pattern: cards first, PayPal as backup, and local methods added only when needed. By 2026, that model no longer reflects how Europeans prefer to pay. Digital wallets, instant account-to-account rails and regulated alternative payment methods are accelerating across the region, with adoption driven by consumer trust, bank-led innovation and Europe’s renewed push for payment sovereignty.

For high-risk merchants, this shift is more than a UX update. Choosing the right mix of wallets and local APMs now determines approval rates, compliance alignment and market acceptance across the EU and UK. Understanding these new rails is essential to compete in a market that is rapidly moving beyond cards.

- Introduction

- Digital Wallets & APM Adoption in Europe

- The New European Wallet Player: Wero and What It Represents for Merchants

- Key APMs by Major European Market

- BNPL & Pay-Later APMs in Europe

- High-Risk Merchant Considerations: APMs That Tolerate vs Avoid Certain Sectors

- APM Risk & Compliance Considerations

- Designing a Europe-Specific APM Stack

- Measuring APM Performance in Europe

- Conclusion

- FAQs

Digital Wallets & APM Adoption in Europe

Europe’s payment landscape has become one of the most diverse globally, shaped less by a single dominant method and more by regional expectations, bank-led innovation and consumer trust in domestic rails. Wallets, bank-transfer APMs and instant payment options have steadily gained ground, particularly in markets where card acceptance has historically been fragmented or consumers prefer direct-from-account payments.

Much of this momentum comes from accelerated digitalisation trends across Europe, where policy bodies have highlighted the rapid shift toward wallet-led and account-to-account payment behaviour, as noted in the IMF’s analysis on digital payments and fintech adoption.

Merchants that once relied on cards as the universal option now find that card-only checkout funnels underperform in countries where account-to-account payments or local banking wallets have become the default.

A single global checkout stack no longer works across Germany, France, the Nordics, the Netherlands, CEE or Southern Europe. Each region has its own mix of preferred APMs, its own regulatory environment, and its own acceptance trends. The result is a continental market where localisation isn’t a nice-to-have. It is fundamental to maintaining approval rates, reducing friction and aligning with evolving compliance expectations. In practical terms, localisation is now the conversion lever in European checkout design.

What makes today’s European APM adoption different?

- Mobile-first behaviour continues to reshape how consumers engage with payments, particularly in the Nordics and Western Europe.

- Domestic payment sovereignty is becoming a core agenda item, pushing bank-led or EU-controlled wallets forward.

- Instant payments infrastructure has matured to a level where consumers expect immediate confirmation, especially for bank-based APMs.

- Wallet familiarity and perceived safety have helped accelerate adoption among younger and repeat online shoppers.

For merchants operating in sensitive verticals, understanding these shifts is essential. APM adoption is no longer simply about adding new payment buttons; it represents a deeper change in how European consumers expect risk, authentication and trust to be managed at checkout.

The New European Wallet Player: Wero and What It Represents for Merchants

Wero has quickly become one of the most meaningful developments in Europe’s payment landscape, not because it is another wallet, but because of what it symbolises: Europe’s first serious attempt at creating a sovereign, bank-backed alternative to global card schemes. Developed through the European Payments Initiative (EPI), Wero reflects a broader shift in the region toward payment autonomy, instant bank-to-bank transfers and a unified digital checkout experience that aligns with consumer expectations across multiple countries.

Wero’s initial rollout in Germany, Belgium and France created a foundation for a wallet that behaves differently from the multinational wallets already in the market. While Apple Pay and Google Pay rely on card rails, and PayPal sits somewhere between card processing and stored-balance models, Wero operates on top of domestic instant-payment infrastructure. This places it closer to local A2A methods like iDEAL or Swish, but with ambitions for far wider geographical reach.

Why Wero Matters for High-Risk Merchants

For high-risk verticals gaming, FX, travel, adult, CBD the entry of Wero introduces both opportunity and new strategic considerations.

- Bank-backed flows may provide more stable acceptance paths in markets where card issuers frequently decline high-risk MCCs.

- Reduced exposure to card chargebacks can make settlement cycles more predictable, although banks may still apply their own dispute and reversal frameworks.

- Familiarity and trust among European consumers may help improve conversion rates, especially in markets where traditional card credibility varies by region or issuer.

- Potentially lower processing costs in the long term, since Wero is designed to move funds over domestic banking rails rather than card networks.

What makes Wero particularly notable is not its UX it resembles other modern wallets but rather the strategic intent behind it. Europe wants a payment method it governs, operates and evolves without dependency on non-European schemes. For merchants targeting the EU, especially high-risk merchants seeking stability, this ambition carries practical implications: A2A-based wallets could become a core part of mainstream checkout flows over the next few years, just as iDEAL became indispensable in the Netherlands.

The pace of rollout, bank adoption, settlement behaviour and PSP readiness will determine how quickly Wero becomes mission-critical. For now, its emergence signals a shift merchants cannot afford to ignore.

Key APMs by Major European Market

Europe remains one of the most fragmented payment regions globally. Even neighbouring markets behave differently: some are deeply bank-led, some wallet-heavy, and others dominated by Pay-Later habits or mobile-first apps. For merchants, especially those operating across high-risk verticals, success depends on recognising these regional expectations and matching them with the right mix of APMs.

Rather than viewing Europe as a single payments block, it is more accurate to think of it as a set of payment clusters each shaped by local banking behaviour, cultural preferences and regulatory nuance. Below is a region-by-region overview capturing the APMs most relevant to conversion, risk tolerance and settlement behaviour.

Germany & Austria

These markets remain dominated by bank-based payment habits. Consumers have long preferred direct transfers or wallet flows that feel closely linked to their bank accounts.

- Sofort and other account-based A2A options

- Digital wallets with strong bank integration

- PayPal, still used widely for online discretionary purchases

Merchant consideration: card-only checkout sequences underperform here, particularly for returning users who favour account-linked flows.

Netherlands

The Netherlands is defined by one core rail: iDEAL. Its dominance makes it less a “recommended” option and more a prerequisite for meaningful conversion.

What shapes the market:

- A2A as the default expectation

- High consumer trust in bank-initiated payments

- Wallet adoption layered on top of bank behaviour rather than replacing it

Merchant consideration: success in NL requires at least one reliable A2A method; attempting to operate without iDEAL is commercially unworkable.

Nordics (Sweden, Denmark, Norway, Finland)

The Nordics behave like a mature mobile-first ecosystem. Consumers use mobile wallets not as alternatives, but as everyday banking touchpoints.

Typical methods include:

- Swish (Sweden)

- Vipps (Norway)

- MobilePay (Denmark/Finland)

- Invoice-based Pay-Later flows

Merchant consideration: these methods work well for subscription billing, high repeat-purchase categories and regulated services.

Central & Eastern Europe (CEE)

CEE markets show some of the fastest APM adoption in Europe. Local wallets and domestic instant-payment rails often outperform cards.

Key examples:

- BLIK in Poland

- Przelewy24 and regional A2A routes

- Localised wallet ecosystems tied to domestic banks

Merchant consideration: these methods are attractive for risk-sensitive merchants due to predictable settlement and lower disputes.

United Kingdom

The UK sits at the crossroads between global schemes and A2A innovation. Wallet adoption remains strong, while open banking PIS usage continues to grow.

What drives usage:

- Apple Pay and Google Pay

- Open banking payment initiation

- Increasing comfort with instant-pay flows

Merchant consideration: high-risk merchants often find that open banking provides more stable acceptance than cards, particularly for repeat users in FX or digital services.

BNPL & Pay-Later APMs in Europe

Buy Now, Pay Later has moved from a convenience feature to a mainstream financing tool across Europe. But unlike wallets and bank-based APMs, BNPL sits directly within the crosshairs of tightening consumer-credit rules. By 2026, Pay-Later products are no longer positioned as lightweight checkout add-ons; they are regulated credit agreements with clear obligations for both providers and merchants.

Europe’s BNPL ecosystem is dominated by a handful of well-established players Klarna, Clearpay/Afterpay, Scalapay and several regional credit invoice providers but the regulatory direction has fundamentally changed how these services operate. With CCD2 (the revised Consumer Credit Directive) and national regulators stepping up oversight, BNPL must now handle affordability checks, transparent credit disclosures and stricter repayment controls. This has reshaped the approval dynamics that merchants can expect.

For high-risk merchants, the relevance of BNPL varies dramatically by vertical. Fashion, electronics and mainstream retail see strong uplift from Klarna or Clearpay integrations, but high-risk sectors often experience tighter acceptance rules, selective onboarding or outright exclusion. BNPL providers are increasingly cautious about MCCs linked to financial speculation, adult services, gaming or volatile travel categories. This is partly due to credit risk, but also due to reputational and regulatory expectations.

Where BNPL Fits and Where It Doesn’t

BNPL thrives in markets where invoice culture or instalment habits already existed:

- The Nordics, where Klarna built its early dominance

- Germany and Austria, where invoice payment has long been trusted

- Italy and Southern Europe, where instalment cultures support rapid Scalapay adoptio

But its presence weakens when:

- Merchant categories are associated with elevated chargeback or credit-risk exposure

- Consumer protection agencies scrutinise repayment outcomes

- National regulators apply additional BNPL caps or disclosure rules

What Merchants Should Expect in 2026

BNPL can still be a powerful conversion driver, but it requires more operational diligence than before. Merchants need to understand:

- How affordability checks may slow or reroute parts of the checkout

- How BNPL refund and dispute cycles differ structurally from card chargebacks

- How credit-risk scoring affects approval rates outside retail categories

Unlike wallets and A2A rails, BNPL introduces a third layer of scrutiny: the customer’s ability to repay. For merchants in high-risk verticals, this often becomes the limiting factor, not customer demand.

High-Risk Merchant Considerations: APMs That Tolerate vs Avoid Certain Sectors

For high-risk merchants, choosing APMs is not simply about matching local consumer preferences. It is about understanding which payment methods, wallets and bank-led rails are structurally able or willing to support specific categories, a process closely aligned with how PSPs assess high-risk merchants during underwriting and ongoing monitoring. European APMs vary widely in their appetite for sectors such as gaming, FX/CFD, adult services, CBD, ticketing, or volatile travel segments. This creates a landscape where merchants must look beyond UX and assess the underlying compliance posture of each method.

APM providers also adjust their acceptance rules based on jurisdictional AML exposure; flows linked to countries listed within the FATF’s high-risk and monitored jurisdictions framework often undergo stricter checks or additional documentation requests.

Most European APMs fall into three broad behavioural categories when it comes to risk:

1. Bank-Integrated APMs with Moderate Tolerance

These methods operate close to banking rails, meaning they inherit much of the risk appetite of local banks. They tend to accept certain high-risk MCCs if the underlying transaction is well-documented and the PSP provides adequate monitoring.

Examples often include:

- A2A rails in the Nordics

- Some open-banking PIS flows

- Instant-payment methods backed by domestic banks

These can work well for sectors such as regulated gaming, FX with proper onboarding, and cross-border travel where funds settle predictably.

2. Wallets with Selective MCC Policies

Digital wallets generally sit between banks and card schemes. Their risk posture is shaped by reputational considerations and internal compliance frameworks.

Typical patterns:

- Well-established wallets avoid adult, CBD, high-volatility financial services, and unregulated gaming.

- Some permit regulated gambling or FX but with strict onboarding and monitoring.

- Wallet providers may apply geographical restrictions even within Europe, based on national licensing rules.

The key challenge here is inconsistency: a wallet that tolerates a merchant in Sweden may restrict the same flow in France or Germany due to local regulatory expectations.

3. BNPL and Pay-Later Providers with Low Risk Appetite

Pay-Later APMs rarely support high-risk verticals. Because these providers extend credit to the customer, sharp constraints apply around:

- Repayment risk

- Regulatory reporting

- Reputational exposure

- Consumer-protection oversight

For high-risk merchants, BNPL is usually not a primary method but a supplementary one available only in compliant, consumer-safe verticals.

What High-Risk Merchants Should Consider Before Selecting APMs

A European APM stack must be mapped not just by region, but also by risk behaviour. A method that works perfectly in mainstream retail may not onboard a gaming merchant, or may restrict flows for speculative FX platforms.

Key questions include:

- How does the APM classify the merchant’s MCC?

- Does the method prohibit certain payout or refund behaviours common in your vertical?

- Does the APM rely on banks that apply additional scrutiny to regulated sectors?

For high-risk merchants, choosing APMs is less about how widely used the method is and more about how reliably it supports the merchant’s regulatory posture and settlement flows.

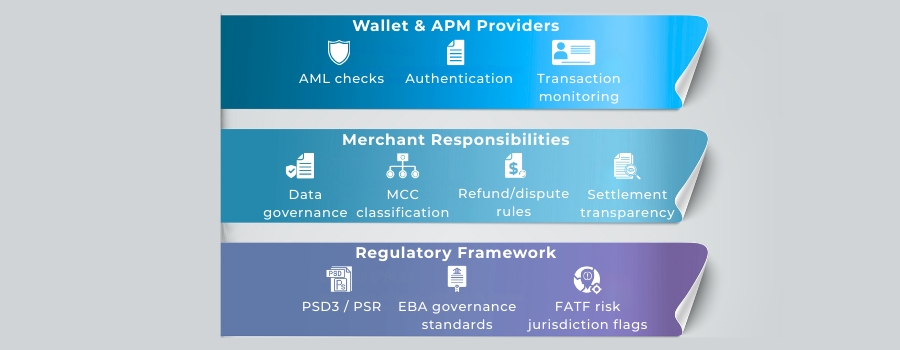

APM Risk & Compliance Considerations

Alternative payment methods do not remove regulatory obligations; in many cases, they shift them. As Europe pushes toward tighter oversight under PSD3 and the updated PSR, APM providers are increasingly treated as full payment institutions rather than lightweight checkout add-ons. This directly affects how high-risk merchants must assess their payment options.

As Europe prepares for the next regulatory cycle, wallet providers and A2A operators will be governed under stronger prudential expectations aligned with the European Commission’s PSD3 and PSR legislative framework.

Across Europe, wallet providers, A2A operators and BNPL firms must demonstrate stronger governance, risk management and fraud-monitoring capabilities. As these expectations rise, merchants are expected to match that maturity not only in onboarding, but in how they structure flows, handle fraud signals and manage customer verification. APMs therefore become both an opportunity and a regulatory responsibility.

1. Transparency Requirements Are Expanding

APMs operating as licensed payment institutions must now provide clearer information on:

- Fund flows

- Settlement timings

- Data handling

- Customer authentication

- AML escalation paths

For merchants, this means more data-sharing during onboarding and periodic reviews. High-risk verticals should expect enhanced documentation and ongoing monitoring.

2. AML Responsibility Does Not Shift Away From Merchants

Even if an APM performs AML screening, regulators continue to expect merchants to maintain their own KYC standards, risk scoring and transaction monitoring. The burden is shared, not outsourced.

This is particularly relevant for:

- Gaming platforms

- FX/CFD brokers

- CBD merchants

- Travel businesses with complex payout flows

APMs may restrict activity or freeze flows if AML gaps appear.

3. Dispute and Refund Frameworks Vary Significantly

Unlike card networks, most APMs do not operate under unified dispute rules. This affects how merchants handle:

- Refund obligations

- Customer complaints

- Regulatory reporting of transactional disputes

Some A2A systems rely on bank-led dispute mechanisms, while wallets may operate proprietary policies. High-risk merchants need clarity on this before integrating any APM.

4. Geographic Licensing Laws Still Apply

Even if an APM is technically available across multiple markets, its risk appetite may vary country by country based on local licensing obligations or consumer-protection rules. A high-risk merchant operating in France may need additional documentation that would not be required in Sweden.

What This Means in Practice

For merchants in high-risk verticals, APM expansion is not simply about diversification. It is about aligning internal compliance frameworks with the expectations of regulated wallet providers and bank-led rails while preserving the conversion–compliance balance under PSD3. Strong documentation, accurate MCC classification and transparent fund flows are non-negotiable.

Designing a Europe-Specific APM Stack

Building an APM strategy for Europe requires more than layering new payment methods on top of an existing checkout. The region’s diversity means that every method introduced has operational, regulatory and commercial consequences.

For high-risk merchants especially, adding the wrong APM can create compliance friction, increase refund complexity or distort settlement flows. The objective is not to offer every method it is to offer the right combination for each market.

Merchants that succeed in Europe typically approach APM selection as a form of segmentation. Rather than relying on a global default, they design localised checkout variants based on customer behaviour, regulatory expectations and vertical-specific risk patterns. This creates a structure that adapts to market needs without overwhelming internal operations and forms the foundation for effective Cross-Rail Payment Optimisation across cards, wallets and account-to-account rails.

Avoiding APM Bloat

One of the most common mistakes is over-expanding the payment mix. Adding too many options confuses customers, complicates reconciliation and weakens fraud monitoring. More importantly, each APM requires its own compliance and operational configuration.

APM bloat occurs when merchants:

- Support more methods than the market demands

- Introduce APMs with overlapping user profiles

- Fail to evaluate each method’s settlement and dispute characteristics

For high-risk verticals, unnecessary APMs can also trigger additional scrutiny during PSP reviews.

Balancing Consumer expectations vs. Merchant Risk

A functional APM stack sits at the intersection of three factors:

- Local adoption: Is the method widely expected in the target market?

- Risk appetite: Does the APM support the merchant’s MCC and business model?

- Operational complexity: Can the merchant manage the method’s refunds, disputes and reconciliation behaviour?

This balancing act ensures that European customers see familiar choices while merchants retain full control over compliance and cost.

Prioritisation by Market and Vertical

A practical approach is to classify APMs by market relevance:

- Must-have methods for markets like the Netherlands (iDEAL), Sweden (Swish) or Poland (BLIK).

- Context-specific methods where adoption is strong but vertical-dependent, such as BNPL in the Nordics and German-speaking countries.

- Selective methods suitable only for lower-risk verticals or narrow customer segments.

This structure ensures that the stack grows intentionally, not reactively.

Basket Size Matters

European APM performance varies by order value. Low-value retail flows behave differently from high-value FX deposits or gaming top-ups. Some APMs excel in micro-transactions; others in recurring payments; others still in large-value bank transfers. Mapping these behaviours is essential before prioritising an APM.

Measuring APM Performance in Europe

Evaluating APM performance across Europe is not simply a matter of comparing approval rates. Each method carries its own operational profile, dispute behaviour, fraud patterns and settlement rhythm. High-risk merchants in particular must treat APM measurement as a multi-layered exercise: one that considers customer behaviour, regulatory implications and the underlying infrastructure powering each flow.

While global card schemes provide a relatively uniform performance baseline, European wallets and local A2A rails behave differently by design. Some offer strong approval rates but limited refund flexibility; others settle instantly but carry additional authentication steps; and certain BNPL flows introduce credit-risk layers that vary significantly by market.

A European APM performance framework typically examines four pillars.

1. Approval Quality

Approval rate is the most visible indicator of performance, but its drivers differ for APMs.

For bank-based A2A methods, approvals depend on authentication strength and customer familiarity. Wallets often deliver stable approval rates for returning users, while BNPL performance is driven by affordability assessments and sector tolerance.

For high-risk merchants, approval patterns may shift materially by MCC. Even within the same APM, gaming or FX transactions may face additional friction due to internal scoring models.

2. Refund and Reversal Friction

APMs diverge sharply from card networks in how they handle reversals.

- A2A methods rely on bank-driven refund logic

- Some wallets support instant refunds; others delay until settlement occurs

- BNPL refunds must reconcile with the customer’s outstanding credit balance

Merchants must measure not just refund success rates but also the operational load each method introduces.

3. Fraud and Authentication Behaviour

European APMs operate without a standardised rulebook like 3-D Secure. Authentication strength varies:

- Wallets often rely on device-level identity and biometric authentication

- A2A flows depend on bank-led SCA

- BNPL providers use identity and behavioural profiling at checkout

The fraud profile of each APM matters more for high-risk merchants, where additional monitoring is typically required.

4. Cost per Acceptance

APMs rarely have uniform pricing.

Costs depend on:

- Settlement method

- Dispute frameworks

- PSP routing

- Market availability

- Value of a typical transaction

A method with a lower headline fee can still become more expensive when refund patterns or dispute handling are factored in. High-risk merchants often find that A2A flows provide the most predictable cost profile, while BNPL or wallet-based transactions may attract additional risk-adjusted pricing.

Conclusion

Europe’s payment landscape in 2026 demands more than offering a card-first checkout. Local wallets, bank-led A2A rails, Pay-Later products and region-specific payment ecosystems now shape consumer expectations across nearly every major market. For high-risk merchants, these methods are not optional enhancements they are the difference between predictable acceptance and chronic checkout underperformance.

What makes Europe unique is the interplay between consumer preference and regulatory direction. Wallets such as Wero reflect the continent’s ambition to create sovereign, bank-integrated alternatives to global schemes, while long-standing APMs like iDEAL, Swish and BLIK continue to anchor local ecosystems with strong trust and predictable settlement behaviour. BNPL remains influential but increasingly shaped by credit legislation, transforming it from a lightweight convenience into a regulated financing tool.

A successful 2026 strategy means aligning APM selection with regional behaviour, MCC tolerance, authentication patterns and operational complexity. Merchants that build a thoughtful, market-aware APM stack will outperform competitors relying on generic methods and will be better positioned to meet the evolving compliance expectations shaping the future of European payments.

FAQs

1. How should high-risk merchants prioritise European APMs when entering new markets?

High-risk merchants should start by mapping APMs against three filters: market expectation, risk appetite and operational impact. In practice, that means first identifying “must-have” local methods (e.g. iDEAL in the Netherlands, Swish in Sweden), then checking whether those APMs actually support the merchant’s MCC and business model. Finally, teams should assess how each method behaves on refunds, disputes and settlement before adding it to the core stack.

2. Are European digital wallets like Wero meant to replace cards altogether?

Not in the short term. Wero and other bank-linked wallets are designed to give Europe more control over its own payment infrastructure and reduce dependency on global schemes, but cards will remain central for many years. For merchants, the realistic scenario is a mixed environment where cards, local APMs and EU-led wallets sit side by side, with different roles by market and vertical. The strategic question is how quickly to introduce these new methods, not whether to drop cards entirely.

3. Why are account-to-account (A2A) APMs so important in Europe?

A2A methods tap directly into domestic banking rails, which are widely trusted by consumers and increasingly supported by instant-payment infrastructure. In countries like the Netherlands, Poland and across the Nordics, A2A has become a default habit rather than an alternative. For high-risk merchants, these methods can offer more predictable settlement, fewer classic card chargebacks and more stable approval behaviour provided the underlying bank rails accept the relevant MCCs.

4. Do BNPL methods work well for high-risk sectors like gaming or FX?

Generally, no. BNPL providers are cautious about categories tied to speculative financial activity, adult content, gaming or complex travel risk because they carry both credit risk and regulatory scrutiny. Even where BNPL appears technically available, providers may limit certain MCCs or require stricter onboarding. For high-risk merchants, BNPL is usually a marginal or entirely unavailable option, and other APMs (e.g. bank-based wallets, A2A) become more important to focus on.

5. How do European wallets and APMs impact fraud and chargeback management?

Most APMs do not follow card-scheme chargeback rules, which changes how risk is managed. Wallets and A2A flows often rely on bank authentication and device-level trust rather than 3-D Secure, and disputes are handled through provider- or bank-specific processes. This can reduce classic card chargeback exposure but increases the need for merchants to understand each APM’s refund, dispute and fraud-handling framework before going live.

6. What should high-risk merchants ask PSPs when evaluating European APM support?

Key questions include: which APMs are fully supported in each target market; how those methods treat the merchant’s MCC and sector; what the settlement and reconciliation flows look like; and how disputes or refunds are handled. It is also important to ask whether any APM imposes additional onboarding, monitoring or data-sharing expectations for high-risk categories, so that internal compliance and operations teams can plan accordingly.

7. How does regulation like PSD3/PSR change the risk profile of APMs?

PSD3 and the updated PSR are pushing wallets, A2A providers and other APM operators closer to a full payment-institution model, with stricter expectations on governance, safeguarding and AML. For merchants, this means more structured due diligence, more detailed risk questions and closer scrutiny of flows, especially in higher-risk verticals. APMs will still be commercially attractive, but the bar for onboarding will be higher and more uniform across Europe.

8. Are BigTech wallets (Apple Pay / Google Pay) enough for European localisation?

They help, but they are not sufficient on their own. BigTech wallets typically sit on top of card rails and therefore inherit many of the same approval patterns and risk constraints as cards. In markets like the Netherlands or Poland, or in parts of CEE, consumers expect local A2A or domestic wallets alongside global options. A localisation strategy based purely on cards plus BigTech wallets will underperform against local players that offer iDEAL, BLIK and similar methods.

9. How should merchants think about APM performance beyond approval rates?

Approval rates are a starting point, but not the whole picture. Merchants should also measure refund friction, dispute complexity, fraud signals, settlement timing and cost per accepted transaction. An APM that approves more transactions but creates operational headaches on refunds or reconciliation may be less valuable than a method with slightly lower approvals but smoother end-to-end behaviour. High-risk sectors in particular must look at these metrics by vertical and by corridor.

10. When should a merchant consider removing an APM from the stack?

An APM should be reconsidered or removed when it consistently underperforms on approvals, introduces disproportionate operational overhead, or no longer aligns with the merchant’s risk and compliance posture. Warning signs include rising dispute complexity, inconsistent settlement, frequent provider requests for additional documentation, or very low adoption in the target market. A periodic review of the APM mix is essential to keep the stack lean, compliant and commercially effective.