Until recently, Central Bank Digital Currencies (CBDCs) sounded like a distant policy experiment interesting to economists, but disconnected from real merchant operations. That changes in 2026. With the European Central Bank progressing the digital euro, India’s e₹ expanding into live retail pilots, and cross-border CBDC collaborations accelerating among G20 members, CBDCs are now poised to influence how high-risk digital merchants get paid, settle funds, and manage compliance.

What makes this moment disruptive is not that CBDCs are simply new payment methods. It’s that they shift the foundation layer of digital payments from commercial bank money to central bank money for instant settlement and 24/7 payment rails with no scheme middle layers. For high-risk verticals such as iGaming, FX/CFD trading, adult content, digital entertainment, travel, and emerging regulated industries (CBD/supplements), this isn’t just an incremental change. It affects the economics, risk posture, AML scrutiny, and operational design of the entire payment stack.

The appeal is clear. Instant settlement means faster liquidity, predictable treasury operations, fewer reversals, and less exposure to cross-border friction. But with those benefits comes a new level of traceability, meaning regulators gain far more visibility into cross-border flows, behavioural patterns, and high-risk merchant activity. For acquirers and PSPs, CBDCs require upgrading infrastructure, risk engines, and AML pipelines to handle higher-fidelity data and new compliance obligations.

In other words: CBDCs won’t replace PSPs or acquirers, they will redefine them. They turn traditional processors into settlement orchestrators, compliance gateways, and risk-intelligence providers. High-risk merchants who adapt early will access faster cashflow, more resilient acceptance and better operating leverage. Those who delay will find onboarding tougher, monitoring stricter, and PSP expectations significantly higher.

2026 is the year CBDCs stop being theoretical and start reshaping how high-risk digital commerce actually works. This blog breaks down what’s changing, how it affects acquiring and settlement flows, and what merchants must do now to stay ahead of the regulatory and commercial shift.

- Understanding CBDC Architecture (Retail, Wholesale & How They Affect Merchants)

- What CBDCs Change for Merchant Settlements (The Real Transformation)

- Acquirer & PSP-Level Impacts

- High-Risk Use Cases: How CBDCs Reshape Real-World Merchant Flows

- Regulatory Implications for High-Risk Merchants

- Commercial Impact: Cost, Revenue & Settlement Economics in a CBDC World

- Faster, Final Settlement: The Most Valuable Change for High-Risk Merchants

- FX Becomes Cheaper and More Predictable

- Acquiring Costs May Drop: But Infrastructure Costs Rise

- Chargeback Exposure Shrinks, Operational Costs Decline

- Treasury Management and Liquidity Become Real-Time Capabilities

- Closing Perspective: CBDCs Create Both Savings and New Complexity

- Merchant Readiness Checklist for 2026

- Technical Readiness: Preparing Platforms to Accept CBDC Flows

- Operational Readiness: Adjusting Workflows for 24/7 Settlement

- Compliance Readiness: Aligning With AMLD6, FATF & CBDC Transparency

- Financial Readiness: Rebalancing Treasury, FX & Cash Flow Models

- Strategic Readiness: Deciding When and Where to Use CBDCs

- Conclusion

Understanding CBDC Architecture (Retail, Wholesale & How They Affect Merchants)

CBDCs don’t simply introduce a new way for customers to pay. They change the financial plumbing that merchants rely on every day, including settlement orchestration layers across rails that decide how value moves, clears, and becomes usable across different payment systems. For high-risk verticals in particular, where margins depend on fast payouts, predictable cashflow and minimal settlement friction, the shift from commercial bank settlement to central bank settlement is one of the most consequential changes in the past decade.

Retail vs Wholesale CBDCs: Two Very Different Systems

Central banks typically explore CBDCs in two formats, but only one affects merchant payments directly.

Retail CBDC (Consumer-to-Merchant Payments)

This is the model relevant to online transactions, mobile checkout, POS, recurring billing, and high-risk digital commerce. A retail CBDC allows everyday users to pay merchants using a digital form of national currency issued by the central bank.

Key attributes:

- Available to the general public

- Usable for online and in-store payments

- Stored in a wallet managed by a regulated intermediary (bank or PSP)

- Designed for daily commerce and merchant acceptance

Projects like the digital euro and India’s ₹ fall into this category. These are the CBDCs that will reshape acquiring and merchant settlement.

Wholesale CBDC (Bank-to-Bank Settlement)

Wholesale CBDCs function at the infrastructure layer, targeting interbank settlement efficiency and cross-border liquidity management. They do not directly reshape the consumer checkout experience.

Current pilot programs are many coordinated through the BIS Innovation Hub to focus on upgrading or complementing RTGS systems rather than enabling retail payment acceptance.

For merchants:

- Wholesale CBDCs matter indirectly

- They speed up acquirer-to-settlement flows

- They reduce FX and correspondent banking costs

- They support real-time treasury operations for PSPs

Retail CBDCs affect checkout. Wholesale CBDCs affect the infrastructure beneath the PSP.

Token-Based vs Account-Based Models: What Merchants Should Expect

CBDCs can follow two broad models, and central banks often blend elements of both:

Token-Based CBDCs

- Function similar to digital cash

- Require proof of possession, not identity

- Make offline payments possible

- Lower fraud but require secure hardware or device binding

For merchants in regions adopting token-style CBDCs (such as some Asian pilots), this can reduce friction in micro-transactions and offline purchases.

Account-Based CBDCs

- Linked to a verified identity held by a regulated intermediary

- Aligned with strong AML/CFT requirements

- Easier integration with PSPs, banks and acquirers

- Favoured by most major central banks (ECB, Federal Reserve research, Bank of England discussions)

For high-risk merchants, account-based models mean:

- Stricter KYC expectations

- Less anonymity

- More predictable fraud signals, since user identity anchors transactions

Why This Architecture Matters for High-Risk Verticals

High-risk industries, iGaming, FX, adult, travel, digital goods, depend heavily on:

- Fast approvals

- Transparent settlement

- Reliable identity

- Predictable chargeback behaviour

CBDC architecture enhances these conditions but also strengthens regulatory visibility. Retail CBDCs bring stronger, cleaner data. Account-based identity reduces fraud vectors. Tokenisation plus intermediated infrastructure create a hybrid model where PSPs still manage onboarding, fraud controls and merchant verification.

In simple terms: CBDCs modernise the base layer of payment rails in a way that forces high-risk merchants to mature their compliance, but rewards them with faster, safer, lower-cost settlements.

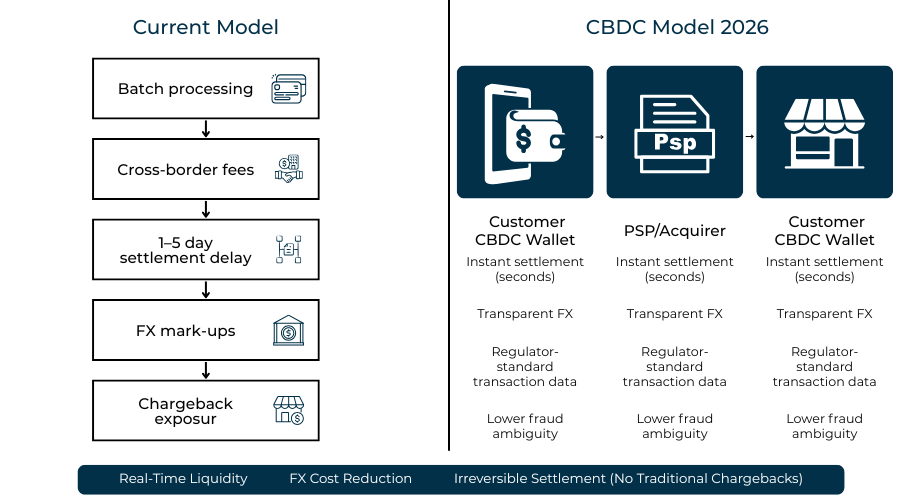

What CBDCs Change for Merchant Settlements (The Real Transformation)

CBDCs don’t simply introduce a new way for customers to pay. They change the financial plumbing that merchants rely on every day. For high-risk verticals in particular where margins depend on fast payouts, predictable cashflow and minimal settlement friction the shift from commercial bank settlement to central bank settlement is one of the most consequential changes in the past decade.

At the heart of this transition is finality. A CBDC transaction, once processed, becomes settled in central bank money. There is no waiting for acquirer batches, no dependency on issuer release cycles, and no multi-day delays caused by intermediary banks. Instead, funds move from the payer’s CBDC wallet to the merchant’s designated settlement wallet almost instantly. This significantly reduces liquidity uncertainty and makes treasury planning more stable, especially in high-risk businesses where operating capital often moves quickly.

CBDCs also reshape how cross-border settlement behaves. Traditional routes depend on correspondent banks, currency intermediaries and scheme-defined FX processes, all of which increase cost and unpredictability.

Multi-CBDC projects led by the BIS and G20 regulators are aiming to streamline this entirely, allowing two countries’ CBDCs to exchange value directly.

For merchants who operate across LATAM, GCC, APAC or Europe, this promises far cleaner FX outcomes and fewer settlement delays. Travel, remittance-heavy digital services and cross-border subscription models may be the biggest beneficiaries.

Another major shift affects reconciliation. Because CBDC transactions follow a uniform, regulator-defined data structure, the settlement trail becomes more coherent than card-based or legacy A2A flows. PSPs will be able to map transactions with fewer exceptions, and merchants gain clearer visibility into when and how funds moved. However, this also introduces rigidity. Unlike card payments, CBDC flows cannot be reversed by issuers or schemes. Errors, fraud disputes or dissatisfaction must be addressed through merchant-led refunds or platform-level remediation. This requires high-risk merchants to mature their service and refund processes, because the safety net of issuer-driven chargebacks does not exist in a CBDC system.

The End of Traditional Chargebacks

Perhaps the most radical operational change comes from the removal of forced reversals. CBDC settlement is irrevocable by design. For high-risk merchants especially gaming, adult or digital subscription models this reduces friendly fraud and eliminates chargeback abuse. But it also places responsibility on merchants and PSPs to create transparent, fast and credible refund processes. Without a scheme-driven dispute path, the quality of support and refund workflows becomes a critical part of the customer experience and regulatory expectations.

Liquidity Becomes a Real-Time Asset

Because CBDCs operate continuously, merchants no longer navigate bank holidays, cut-off windows or batch settlement cycles. Payouts can occur at any time, including weekends and evenings, which reshapes how high-risk operators manage operational buffers. Liquidity becomes a real-time asset rather than a delayed one, enabling better scaling of marketing spend, balances, bankroll management (for gaming), and vendor payouts.

In summary, CBDCs overhaul settlement mechanics in ways that offer high-risk merchants compelling advantages speed, predictability and reduced dispute exposure, but they also demand stronger operational discipline. Faster settlement comes with higher expectations for compliance, refunds, and customer transparency, marking a significant evolution in how digital merchants must operate.

Acquirer & PSP-Level Impacts

For all the discussion around CBDCs transforming payments, one misconception persists: the idea that CBDCs will remove the need for acquirers and PSPs. In reality, the opposite is happening. Central banks are designing CBDCs in intermediated models, meaning banks and PSPs remain responsible for the commercial interfaces merchant onboarding, acceptance tools, fraud management, AML oversight and day-to-day payment operations. CBDCs change the settlement asset, but the infrastructure that connects merchants to that asset becomes even more important.

As CBDCs enter mainstream adoption, acquirers must rethink their technology stack. A traditional acquirer integrates with card schemes, risk engines and banking partners. A 2026 acquirer needs to integrate with CBDC wallet infrastructure, central bank settlement APIs and new identity layers embedded in CBDC systems. The role becomes more technical, more compliance-driven and more oriented around orchestration rather than simple payment processing. PSPs will essentially serve as the access layer between merchants and central bank rails, handling everything from customer authentication to ledger reconciliation.

There is also a structural shift in how acquirers handle compliance. CBDCs introduce far more visible, regulator-defined transaction data. This means acquirers must enhance AML programs, KYB onboarding flows and transaction monitoring systems.

In high-risk sectors such as gaming, adult, FX and cross-border travel PSPs will be expected to maintain deeper insight into merchant behaviour, corridor-specific risk and anomalous activity patterns. Unlike card schemes, CBDCs provide no optionality in how much information flows through the system; the data is rich by design, and intermediaries must act on it.

Scheme Bypass and New Economic Models

One of the most commercially disruptive outcomes of CBDCs is the partial bypassing of card schemes for certain transaction types. While CBDCs will not replace cards across the board, they do create scenarios where merchants can receive payments directly through central bank rails. For acquirers, this means interchange-based revenue models begin to weaken. Their value must shift toward risk services, orchestration logic, compliance automation, analytics, fraud mitigation and merchant intelligence.

PSPs who fail to evolve away from a pure processing business will lose relevance. Those who embrace CBDC-compatible orchestration deciding dynamically whether to route a user to card, A2A, CBDC, wallet or alternative payment method will define the next generation of acquiring.

The Rise of Wallet Infrastructure

CBDCs are distributed through wallet systems operated by banks and licensed intermediaries. For PSPs, integrating these wallets becomes a mandatory capability. This includes supporting QR-based CBDC flows, near-field communication methods, app-to-app handoffs and settlement wallet tracking. Much like the early days of Apple Pay and Google Pay, the PSP who builds the cleanest, most intuitive merchant integration will gain a disproportionate market advantage.

But there’s a key difference: CBDC wallets tie directly to central bank settlement, creating a low-latency, low-cost, high-trust payment environment that merchants increasingly prefer. PSPs that adopt early will shape merchant expectations; PSPs that delay will find their legacy flows rapidly losing traction.

High-Risk Use Cases: How CBDCs Reshape Real-World Merchant Flows

High-risk verticals feel the impact of CBDCs earlier and more intensely than most industries. These merchants operate on tight liquidity cycles, navigate heavy fraud exposure, and depend on fast cross-border settlement. As CBDCs move from experimentation into practical adoption, they unlock advantages that traditional rails can’t match while also tightening the regulatory lens on certain business models.

The following examples illustrate how CBDC settlement transforms operational realities across high-risk sectors.

iGaming: Instant Deposits and Payouts Become Standard

CBDCs align naturally with iGaming behaviour. Players expect immediate balance updates and fast withdrawals, and operators struggle with chargebacks, high decline rates and unpredictable payout timing. With CBDC settlement completed in real time, operators gain a level of liquidity control that card rails simply cannot offer.

Short operational benefits include:

- Faster deposits lead to higher session continuity

- Withdrawals can settle instantly, improving player trust

- No chargeback abuse once a CBDC transaction is final

- Better visibility into session behaviour thanks to uniform CBDC metadata

However, the transparency of CBDC flows also increases regulatory expectations. Gambling regulators and financial authorities gain clearer transaction trails and stronger AML visibility.

Travel & Ticketing: Cross-Border Settlement Without the Uncertainty

Travel merchants face volatile corridors, high cross-border fees and a constant risk of chargeback fraud from last-minute cancellations. CBDCs directly reduce the settlement friction in these flows. Because multi-CBDC corridors bypass correspondent banks, merchants experience cleaner FX rates and faster payout certainty.

This matters most for:

- Global airlines and OTAs operating across LATAM, EU and GCC

- Merchants selling dynamic pricing products like tickets or reservations

- High-refund-volume businesses that depend on cashflow stability

CBDCs do not eliminate risk, but they soften the biggest operational pain points in travel commerce delays, FX volatility and settlement disputes.

FX, CFD & Trading Platforms: Programmable Settlement Reduces Exposure

Regulated trading environments depend on proof-of-funds, reserve stability and near-instant settlement between user accounts and platform treasury. CBDCs allow programmability features conditional settlement, automatic release on verification, or intra-day liquidity windows that dramatically improve these flows.

Some platforms may use CBDCs to:

- Hold user deposits in central bank money

- Improve fund segregation and transparency for regulators

- Reduce payout delays during high-volume trading periods

Because this sector is heavily monitored, CBDCs also give regulators stronger oversight into transaction flow legitimacy.

CBD, Supplements & Age-Restricted Retail: A Safer Compliance Trail

These merchants struggle with onboarding because banks often treat their verticals as reputationally risky. CBDC payment trails, however, are inherently more transparent and regulator-friendly. Acquirers evaluating CBD merchants gain access to structured, uniform data that supports stronger compliance.

Key shifts include:

- Lower perceived chargeback risk

- More predictable settlement flows

- A clearer audit trail for AML checks

- Higher merchant approval probability when documentation is clean

CBDC acceptance will not remove industry stigma, but it strengthens the evidence merchants can present during underwriting.

Why These Use Cases Matter

Across all high-risk sectors, one theme is consistent: CBDCs reduce settlement friction but increase regulatory scrutiny.

Merchants who manage this trade-off well through clean onboarding, better AML processes, and CBDC-aware risk orchestration gain a competitive advantage. Those who don’t will face more intense compliance challenges as CBDC ecosystems expand.

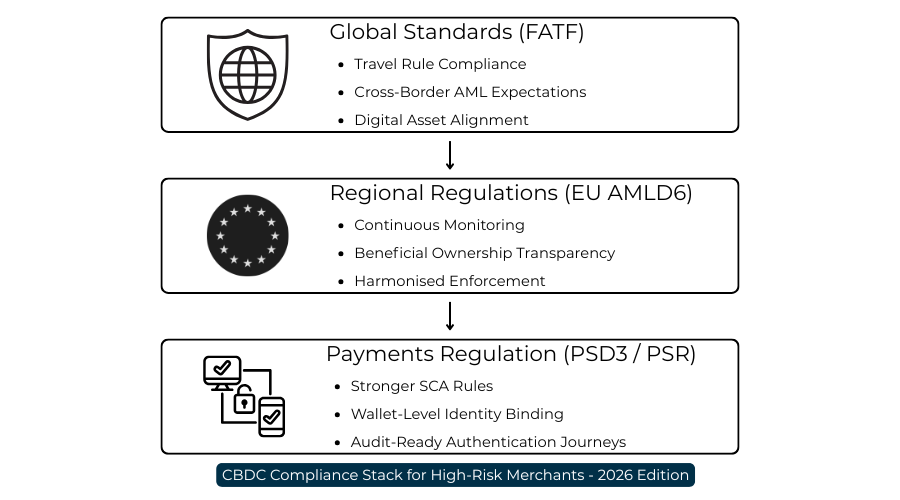

Regulatory Implications for High-Risk Merchants

CBDCs do more than modernise payments; they fundamentally reshape how regulators interpret, supervise and enforce compliance obligations. Because CBDC transactions are recorded using consistent, regulator-defined data structures, financial authorities gain a level of transparency that simply does not exist in today’s card or A2A systems. For high-risk merchants, this introduces a stricter but more predictable environment, where compliance becomes both a requirement and a competitive differentiator.

AMLD6 and the Shift to Continuous Oversight

Europe’s AMLD6 represents a major tightening of responsibilities across the payment ecosystem. While it applies broadly, CBDCs make its enforcement sharper by giving authorities higher-quality data on transaction flows, identities and cross-border patterns.

Rather than relying on acquirers to manually reconcile suspicious activity reports or inconsistencies, regulators will increasingly depend on CBDC transaction metadata timestamps, structured identifiers and wallet-level information to assess merchant compliance.

What This Means for High-Risk Merchants

High-risk verticals gaming, FX/CFDs, digital entertainment and adult can expect deeper scrutiny in three specific areas:

- Consistent monitoring of user behaviour, not just onboarding;

- Stronger explanations for cross-border money flows;

- Closer examination of beneficial ownership structures.

These expectations stem directly from the quality of CBDC data, not from new obligations invented for merchants. CBDCs simply make existing regulatory expectations easier to enforce. For merchants operating in sensitive categories, this raises the bar for AML & KYC operating model maturity, particularly when facing enhanced bank and PSP due diligence in 2026.

FATF’s Position on Digital Transactions and CBDC Visibility

The Financial Action Task Force (FATF) has clarified that CBDCs must operate within the existing AML/CFT framework, including the principles that apply to digital asset transfers. Even though CBDCs are issued by sovereign central banks, they are still subject to risk-based AML standards, record-keeping expectations and transaction monitoring obligations.

CBDCs reinforce FATF’s direction because, by design, they eliminate the ambiguity often associated with cross-border payments. For example, when a high-risk merchant receives funds from multiple jurisdictions, CBDC flows make it easier for PSPs and regulators to detect anomalies or unusual behavioural clusters.

Implications for Cross-Border Commerce

This increased clarity means merchants must:

- Maintain tighter documentation for high-risk corridors;

- Ensure their PSP can justify large or irregular flows;

- Align refund and remediation policies with CBDC transaction finality.

PSD3, SCA and the Evolution of Authentication in a CBDC Environment

While CBDCs introduce new identity models, they do not replace the authentication requirements set out under PSD3 and the revised Payment Services Regulation (PSR). Instead, CBDC wallets are expected to integrate with strong customer authentication (SCA) in a way that improves reliability and reduces false frictions.

A CBDC wallet may already contain device binding, biometric verification or trust scoring, which enhances SCA rather than competes with it. For merchants, this results in more consistent authentication outcomes, fewer issuer-driven anomalies and smoother approval behaviour.

How Merchants Should Prepare

Going into the 2026 cycle, merchants must ensure that:

- Their PSP can orchestrate CBDC authentication alongside 3DS2/SCA

- Refund and dispute journeys align with the irrevocability of CBDC payments

- Customer communication reflects the finality and security of CBDC transactions.

A New Compliance Baseline for High-Risk Verticals

The introduction of CBDCs effectively raises the compliance floor for every merchant, but high-risk sectors will feel this most acutely. Regulators will expect:

- Cleaner operational processes

- Stronger documentation

- Ongoing transaction analysis rather than periodic reviews

- Tighter merchant-PSP collaboration

CBDCs don’t create stricter rules; they simply make compliance gaps more visible. Merchants who invest early in AML maturity, transparent refund processes and well-structured onboarding documentation will benefit from smoother approvals, lower reserve requirements and better PSP relationships.

Commercial Impact: Cost, Revenue & Settlement Economics in a CBDC World

CBDCs are not just a regulatory milestone; they rewrite the commercial foundations of how high-risk merchants move, receive and manage money. Faster settlement, reduced FX exposure and lower operational friction can meaningfully improve profitability. At the same time, CBDCs introduce new cost models, infrastructure demands and liquidity considerations that PSPs and acquirers must adapt to before merchants can fully benefit.

This section focuses on the real economic impact CBDCs create across acquiring, settlement, payouts, reconciliation and treasury management specifically in high-risk environments where margins are tighter and approval rates fluctuate more dramatically.

Faster, Final Settlement: The Most Valuable Change for High-Risk Merchants

One of the defining features of retail CBDCs is their ability to support near-instant settlement, often within seconds. Unlike card schemes where settlement can take two to five business days, CBDCs allow PSPs to settle merchant funds continuously, even on weekends and public holidays.

For high-risk verticals, this solves chronic issues:

- Delayed payouts that affect gaming operators and ticketing platforms

- Rolling reserve dependencies used by PSPs to hedge chargeback risk

- Cash flow volatility caused by mixed settlement cycles across geographies

How Instant Settlement Changes Merchant Strategy

Merchants gain the ability to:

- Manage liquidity in real time instead of waiting for batched settlements;

- Offer faster withdrawals or refunds without degrading operational cash flow;

- Reduce reliance on external credit lines for payout-heavy products (e.g., gaming, remittance-like flows).

Faster settlement also reduces PSP cost exposure, making pricing more competitive for merchants.

FX Becomes Cheaper and More Predictable

CBDCs directly impact cross-border commerce by lowering FX volatility. If central banks establish multi-CBDC corridors (as tested under the BIS mBridge initiative), exchange rates can be:

- More stable

- More transparent

- And settled with lower intermediary costs

Today, high-risk merchants pay meaningful hidden costs — scheme FX markups, acquirer spreads and cross-border interchange. CBDCs compress these layers. In the interim, many PSPs are already experimenting with stablecoins as a settlement bridge, particularly in Asia–Pacific corridors where regulatory frameworks now recognise stablecoins for wholesale value transfer rather than retail payments.

Economic Effects on High-Risk Verticals

- Travel merchants see smoother multi-currency settlement for global bookings.

- Forex and CFD platforms gain predictable liquidity positions.

- Digital goods merchants reduce losses from issuer-driven FX inconsistencies.

This enables clearer financial planning and stronger corridor-level optimisation.

Acquiring Costs May Drop: But Infrastructure Costs Rise

Because CBDCs can settle directly through central bank infrastructure, some traditional scheme fees and cross-border premiums may shrink over time. However, this does not mean payment processing becomes “free.”

PSPs must invest in:

- CBDC-enabled wallet rails

- Upgraded transaction orchestration engines

- New AML/KYC monitoring models

- Dedicated compliance reporting pipelines

Merchants will feel the economic benefits, but PSPs will incur significant upgrade costs meaning pricing changes will vary by provider.

What Merchants Should Expect in Pricing Models

You may see:

- Lower FX markups

- New CBDC settlement service fees

- Or risk-adjusted pricing tied to CBDC transaction visibility

The overall trend is downward for high-risk sectors that historically suffered inflated acquiring fees due to perceived uncertainty.

Chargeback Exposure Shrinks, Operational Costs Decline

CBDC-based payments shift risk models because settlement finality reduces many chargeback scenarios. Traditional disputes processing errors, merchant initiated fraud, misuse still exist, but card-scheme chargebacks (fraudulent use, friendly fraud, issuer-policed disputes) become less common when using CBDCs.

For high-risk merchants, this is a major cost-saving opportunity.

Where Costs Reduce Most

- Fewer chargebacks → fewer reserve requirements

- Fewer disputes → lower operational cost for support and risk teams

- Clear audit trails → faster resolution and fewer evidentiary disputes

CBDCs cannot eliminate fraud, but they reduce ambiguous dispute categories that disproportionately impact high-risk MCCs.

Treasury Management and Liquidity Become Real-Time Capabilities

The commercial impact extends to treasury strategy. High-risk merchants, especially those operating across multiple regions typically hold liquidity in several currencies and reconcile funds through multiple partners.

CBDCs fundamentally shift this because settlement becomes predictable, atomic and continuous.

Treasury Impacts

- Daily reconciliation becomes hourly or real-time

- Liquidity buffers shrink due to predictable inflows

- Merchants gain visibility into net positions across corridors

- Automated treasury tooling becomes standard, not optional.

This creates major advantages for gaming, travel, subscription and crypto-adjacent merchants.

Closing Perspective: CBDCs Create Both Savings and New Complexity

CBDCs reduce costs related to settlement delays, FX friction and chargeback exposure. But they also require merchants to prepare operationally for:

- New wallet flows

- Richer compliance reporting

- Upgraded payout logic

- And corridor-specific CBDC behaviours

High-risk merchants that modernise their systems early will experience smoother approvals, lower operating costs and more predictable cash flow three of the most strategic advantages in payments.

Merchant Readiness Checklist for 2026

Even though CBDCs promise faster settlement, lower FX exposure and stronger compliance structure, merchants especially high-risk ones cannot simply “switch on” CBDC acceptance. A readiness framework is essential, because PSPs will require merchants to demonstrate that their operational, technical and compliance foundations can support CBDC rails without increasing systemic risk.

This section outlines the merchant preparation path, using a narrative-first structure with light structuring where necessary.

Technical Readiness: Preparing Platforms to Accept CBDC Flows

Most CBDC designs follow an intermediated model, meaning PSPs or financial institutions provide the actual merchant-facing infrastructure. Even so, merchants must modernise their payment stack to ensure CBDC transactions flow smoothly, without creating friction or compliance gaps.

Before integrating CBDCs, merchants should verify that their platform:

- Supports real-time API callbacks instead of batch-based reconciliation;

- Can ingest structured CBDC metadata (payer ID, timestamp, wallet attributes);

- Handles instant settlement logic, including partial and full refunds;

- Maintains uptime consistent with central bank-operated rails.

While CBDCs remove many external frictions, they expose internal ones, particularly outdated systems built for card-based asynchronous settlement cycles.

Operational Readiness: Adjusting Workflows for 24/7 Settlement

One of the biggest operational shifts CBDCs introduce is that settlement is no longer constrained by cut-off times or banking hours. This changes how support, treasury and finance teams must operate.

Merchants need to prepare for:

- Continuous settlement flows, rather than batch-based daily reconciliations

- Real-time dispute triage, as transactions become instantly traceable

- Instant payouts or withdrawals, which customers may expect in gaming, trading or travel contexts

- Automated reporting, since manual reconciliation cannot keep pace with CBDC settlement frequency

These operational upgrades don’t just improve efficiency, they become a requirement in a world where payments clear in seconds.

Compliance Readiness: Aligning With AMLD6, FATF & CBDC Transparency

CBDCs dramatically increase the visibility regulators have into merchant activity. This reduces ambiguity but raises expectations for merchants with complex business models or historically high risk.

To meet 2026 compliance standards, merchants must ensure:

- Their AML framework includes continuous monitoring, not periodic reviews;

- Policies and procedures document how CBDC transactions are screened;

- Customer disclosures reflect the irrevocability of CBDC settlements;

- Suspicious activity can be escalated using structured CBDC metadata;

- The PSP can generate audit trails aligned with AMLD6 and FATF standards.

Merchants should also be aware that CBDCs eliminate inconsistent data fields that today occasionally benefit high-risk actors. Clean, standardised data means compliance gaps become more noticeable.

Financial Readiness: Rebalancing Treasury, FX & Cash Flow Models

CBDCs introduce a fundamentally different liquidity pattern. High-risk merchants that rely on rolling reserves, payout cycles or settlement timing strategies must reassess how funds move and how risk is priced.

Key shifts high-risk merchants should prepare for:

- Liquidity buffers decrease because settlement becomes predictable and immediate

- FX hedging strategies change when CBDCs support multi-currency corridors

- Treasury operations must adapt to real-time visibility of global balances

CBDCs make financial management more efficient, but only if merchants update their internal frameworks.

Strategic Readiness: Deciding When and Where to Use CBDCs

CBDC adoption will not be uniform across markets. Some regions (like China and the Caribbean) are moving faster, while others remain in research phases. Merchants need a strategic view of where CBDCs fit into their global payment plan.

Merchants should consider:

- Which markets already support merchant-facing CBDC rails

- How customer behaviour varies across CBDC-enabled ecosystems

- Whether CBDCs can replace or complement existing payment methods

- How to integrate CBDC routing into multi-rail optimisation strategies

In high-risk environments, adopting CBDCs early may increase PSP trust and reduce compliance friction, positioning merchants for better onboarding outcomes.

Conclusion

CBDCs are not merely another payment method; they represent a structural shift in how money moves, how compliance is enforced and how merchants operate across global markets. For high-risk verticals, where settlement delays, opaque issuer behaviour, cross-border FX friction and unpredictable chargebacks have long undermined profitability, CBDCs offer a rare opportunity: a cleaner, faster and more transparent ecosystem that reduces operational strain while improving financial certainty.

Central banks are making it clear that CBDCs are designed with traceability, compliance and stability in mind. This means high-risk merchants will no longer compete on how well they navigate complex scheme rules or fragmented payment rails. Instead, they will compete on how quickly they adapt to CBDC-driven expectations: real-time settlement, interoperable identity, continuous AML monitoring and structured transaction metadata that regulators can easily interpret.

At the same time, CBDCs are not a magic solution. They demand readiness across every dimension of a merchant’s business:

- Technical systems capable of consuming real-time data

- Operational processes aligned to 24/7 liquidity

- Financial models built for instant movement of funds

- Compliance frameworks that match increased transparency

- Strategic planning for when and where to deploy CBDC acceptance

Merchants who modernise early especially in high-risk sectors will enjoy smoother onboarding, lower reserve burdens, fewer disputes, and a more predictable cost base. PSPs will gain richer data and more consistent risk signals, making underwriting and ongoing monitoring more accurate.

As CBDCs expand through 2026 and beyond, they will gradually integrate into acquiring, settlement, routing and even risk engines. The payment stacks that evolve alongside them will be the ones delivering the highest approval rates, the lowest operational friction and the strongest regulatory alignment.

1. Will CBDCs replace card payments and open banking for high-risk merchants?

No. CBDCs are expected to coexist with cards, A2A, wallets and alternative payment rails. However, CBDCs will gradually become a core settlement layer, especially for payouts, cross-border flows and high-risk sectors where trust and transparency issues are common.

2. Are CBDC payments reversible? Do they allow chargebacks?

CBDCs typically support irrevocable settlement, meaning traditional card-style chargebacks do not apply. However, regulators may require structured dispute processes for errors or unauthorised transactions. This reduces fraud-driven chargebacks but increases the importance of clear refund policies.

3. How will CBDCs impact my approval rates?

Approval rates should improve because CBDCs bypass issuer-level risk decisions and rely on central-bank-driven rails. This eliminates many false declines related to cross-border traffic, issuer unfamiliarity or scheme-specific friction.

4. Do CBDCs reduce fraud for high-risk verticals?

Yes, fraud is reduced through:

- Authenticated CBDC wallets

- Stronger identity binding

- Traceable transaction metadata

- Elimination of anonymous payment sources

High-risk merchants still require robust internal risk controls, but CBDCs significantly shrink blind spots.

5. Will CBDCs eliminate rolling reserves?

Not entirely, but reserves may drop significantly. Instant settlement and lower fraud ambiguity reduce PSP exposure, enabling more favourable reserve terms for merchants with high-risk MCCs.

6. How do CBDCs affect cross-border FX costs?

Multi-CBDC corridors (e.g., BIS mBridge trials) aim to enable direct currency conversion between central banks. This removes intermediary bank spreads and reduces FX volatility particularly valuable in travel, gaming, FX/CFDs and digital entertainment.

7. Will I need new compliance documents to accept CBDCs?

Yes. Merchants must demonstrate that AML, KYC, transaction monitoring and dispute-handling frameworks can operate in a CBDC environment, where transparency is higher and regulator expectations are stricter.

8. Do CBDCs require new merchant integrations?

Your PSP or acquirer will provide most of the technical infrastructure, but merchants still need:

- Support workflows aligned with 24/7 payment movement

- Real-time API capabilities

- Instant settlement reconciliation systems

- Upgraded reporting tooling

9. Will CBDC acceptance create additional regulatory risk for high-risk merchants?

Only if the merchant’s compliance framework is weak. CBDCs actually reduce onboarding friction and improve PSP trust provided that merchants maintain strong AML controls and clean operational processes.

10. Are CBDC transactions anonymous?

No. CBDCs are not designed for anonymity. They prioritise privacy but maintain traceability for AML and CFT oversight. High-risk merchants must prepare for greater visibility into their flows.

11. Which high-risk sectors benefit the most from CBDCs?

Gaming & betting (instant deposits/withdrawals, fewer disputes)

Travel (smoother cross-border settlement, lower FX risk)

FX/CFD trading (real-time liquidity management)

CBD & digital goods (clear compliance trails reduce PSP friction)

12. When will CBDCs become mainstream for merchant payments?

Adoption will grow gradually, but by 2026–2028 many markets will have production-ready CBDC rails especially in Asia, the Middle East, and selected European markets.