The era of relying on a single payment rail is over. By 2026, merchants operating in high-risk and cross-border environments must support cards, open banking payments, mobile wallets and local APMs if they want to stay competitive. But simply “adding more payment methods” is no longer enough. The real competitive advantage now comes from understanding which rail performs best at any moment, for any customer, in any region and shifting transactions intelligently between them.

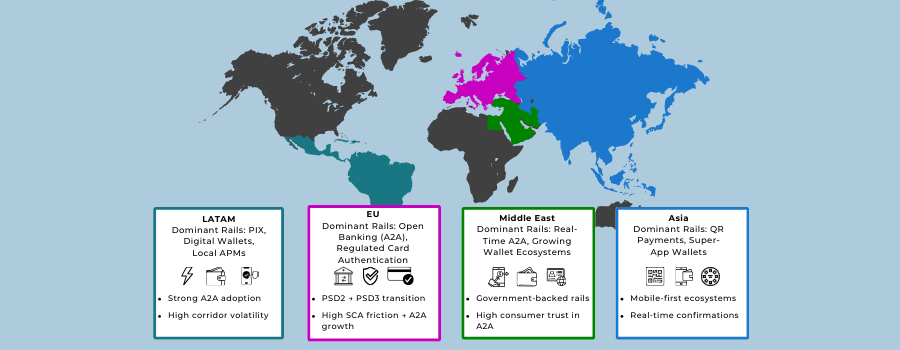

Consumer behaviour has fragmented. LATAM shoppers expect PIX or wallets, European customers increasingly choose A2A over cards, and Asian markets continue to consolidate around QR ecosystems and super-apps. Meanwhile, issuers continue tightening risk controls, acquirers vary widely by corridor, and card performance can swing dramatically for high-risk MCCs. In this environment, merchants can no longer afford to guess which rail will convert best.

Modern multi-rail optimisation is a deeply data-driven discipline. It depends on real-time interpretations of approval likelihood, fraud probability, token health, authentication friction, region-specific behaviour and net processing cost. The merchants who succeed treat each payment method as a performance algorithm not a static checkout option.

This blog breaks down the new cross-rail landscape, explains the data signals required to make the right routing decisions, and shows how high-risk merchants can use these insights to stabilise acceptance, reduce fraud exposure and grow margins in markets where traditional card rails alone no longer guarantee success.

- The New Rail Landscape: How Cards, A2A, Wallets & APMs Compete in 2026

- Consumer Behaviour Patterns by Region (2026 Market Reality)

- Optimising the Rail Mix for High-Risk Verticals

- Designing a Data-Driven Rail Prioritisation Model

- Routing Across Rails: 2026 Best Practices

- Settlement & FX Optimisation in Multi-Rail Environments

- Compliance & Risk Requirements for Non-Card Rails

- Local KYC Rules & Data-Residency Requirements

- Conclusion

- FAQ

The New Rail Landscape: How Cards, A2A, Wallets & APMs Compete in 2026

Payments in 2026 no longer revolve around a single dominant method. Instead, the landscape has evolved into a multi-rail ecosystem where cards, account-to-account payments, mobile wallets, and regional APMs each play different roles depending on market, transaction value, risk profile, and consumer expectations. High-risk merchants, in particular, must navigate these rails strategically; issuer tightening, regional trust patterns and rail-specific regulations mean that performance can vary dramatically even within the same customer base.

Cards remain the most universal rail, but they are no longer the default choice. Approval rates fluctuate based on corridor, BIN clusters and issuer sentiment, especially in high-risk categories. A2A payments continue to gain momentum across the UK and EU, offering strong conversion and predictable authentication without the dispute burden associated with cards. Wallets such as Apple Pay, Google Pay and regional super-app solutions deliver exceptional mobile performance, benefiting from embedded authentication and consumer familiarity. Meanwhile, APMs like PIX, UPI, iDEAL and PayNow dominate daily spending in their respective regions and in some markets, they are an essential requirement for meaningful merchant penetration.

Each rail has become its own performance engine, with unique behavioural signals, risk dynamics and operational considerations. Merchants who treat these rails as interchangeable will struggle; those who interpret their signals correctly can rebalance traffic in a way that dramatically improves conversion, reduces fraud exposure and aligns with regional regulations.

Rail-Level Performance Signals Merchants Need

To optimise the rail mix effectively, merchants must understand the unique performance attributes of each rail not in isolation, but relative to one another. Card performance is shaped by issuer trust, SCA friction and token lifecycle health. A2A flows depend on bank uptime, authentication reliability and corridor-specific adoption patterns.

Wallet performance shifts with device ecosystem trends, token provisioning, and consumer risk perceptions. And APMs reflect the stability and regulatory clarity of domestic payment networks.

These signals form the foundation of rail selection. When interpreted correctly, they reveal not only which rail behaves best for a particular market or user segment, but also when performance changes due to real-time system stress, fraud pattern shifts or regulatory touchpoints. Rail optimisation becomes a continuous analytical process rather than a static checkout design task.

Consumer Behaviour Patterns by Region (2026 Market Reality)

Cross-rail optimisation becomes powerful only when merchants understand how consumers actually choose to pay. By 2026, payment preferences will no longer be driven by convenience alone; they will be shaped by regional infrastructure, regulatory incentives, mobile adoption, trust in domestic systems, and cultural habits around digital identity. Each region has developed its own dominant rails, and merchants who fail to align with these behaviours face higher abandonment, lower approval rates and reduced local credibility.

Consumers don’t evaluate rails the way merchants or PSPs do. They choose what feels safe, fast and familiar. In some markets, that means real-time bank transfers; in others, it means wallets tied to national ID systems. In high-risk corridors, consumer preference often reflects local trust dynamics rather than global payment trends. Understanding these behavioural patterns is essential for designing a rail mix that resonates with each market’s reality.

- LATAM: PIX, Digital Wallets and Corridor Volatility

Latin America continues to be one of the most dynamic regions in global payments. PIX in Brazil has normalised instant, low-cost transactions, displacing both cards and traditional bank transfers. Digital wallets also hold a significant share, especially in markets with fragmented banking infrastructure. For merchants, rail optimisation in LATAM focuses on understanding the corridor-specific behaviour: cards may perform reliably for domestic transactions but struggle cross-border; PIX eliminates chargebacks but introduces settlement timing considerations; wallets vary by country and adoption pattern.

This regional complexity requires merchants to monitor rail performance continuously. A rail performing well in one LATAM corridor may experience afternoon declines or issuer sensitivity in another. Behaviour is fluid, and optimisation depends on interpreting real-time signals.

- EU: Open Banking Adoption and Regulated Authentication

Europe’s payment landscape is heavily shaped by PSD2 and the upcoming PSD3/PSR regulatory shifts. Open banking is no longer experimental; it is a mainstream rail for e-commerce and increasingly for high-risk use cases where card issuers apply stricter risk controls. SCA requirements influence card performance, making A2A rails attractive for merchants seeking smoother authentication and lower fraud exposure.

European consumers are developing trust in bank-to-bank payments, especially for high-value purchases. Meanwhile, cards remain strong in markets with established domestic schemes, but friction during SCA peaks can trigger consumer deflection toward A2A or wallet-based alternatives. For merchants, cross-rail optimisation means balancing regulatory compliance with performance forecasting.

- Asia: QR Ecosystems and Super-App Payment Dominance

Asia’s payment behaviour is unique due to the widespread use of super-app ecosystems. Consumers prefer payments embedded within platforms they already use daily, whether through QR codes, stored-value wallets or app-linked bank accounts. These rails are deeply integrated with identity systems, making them highly trusted and exceptionally fast.

Card behaviour is secondary in many Asian markets. Merchants entering this region must prioritise regional wallets, QR-based APMs and real-time bank transfers. Performance optimisation focuses on understanding the reliability of these domestic systems and ensuring that checkout flows accommodate mobile-first behaviours.

- Middle East: Real-Time A2A Rails and Growing Wallet Ecosystems

The Middle East is rapidly deploying real-time A2A payment infrastructure, often backed by government-led digital transformation initiatives. At the same time, wallets are growing quickly as consumers adopt mobile-first lifestyles. Cards remain relevant, but domestic payments are expanding at a pace that reshapes how merchants must prioritise rails.

For high-risk merchants, the key insight is that consumer trust is strongly influenced by regulatory endorsement. When national authorities promote an instant-pay rail, consumers shift quickly, and merchants must adapt their strategies accordingly.

Optimising the Rail Mix for High-Risk Verticals

High-risk merchants face a set of challenges that make rail optimisation not just beneficial, but essential. Decline rates can fluctuate unpredictably, issuer trust varies sharply across corridors, and fraud pressure is consistently higher than in mainstream ecommerce. In this environment, relying on a single rail, especially cards, is far too fragile.

What separates resilient high-risk businesses from unstable ones in 2026 is their ability to understand which rails offer the strongest performance profile for their specific risk category, customer behaviour and regional footprint.

For many high-risk sectors, the card ecosystem introduces additional friction: issuers impose stricter risk filters, authentication flows can break at higher rates, and dispute liability exposes merchants to financial and operational strain. By contrast, A2A payments and certain regional APMs eliminate chargebacks, reduce fraud vectors and often improve conversion when issuers apply tighter rules to specific MCCs. Wallets, with their embedded authentication and device-bound trust signals, can outperform cards dramatically for mobile-first audiences.

Optimising the rail mix requires a clear understanding of how each payment method behaves when applied to high-risk contexts. Some rails provide reliability but expose merchants to operational risk; others reduce fraud but introduce liquidity considerations; some excel in user experience but vary in settlement clarity. The merchant’s goal is to build a rail strategy that balances these factors, ensuring stable acceptance without compromising compliance or profitability.

Fraud Exposure and Rail-Specific Risk Behaviours

Fraud patterns manifest differently across rails. Card payments remain highly targeted by fraudsters, especially in industries where digital goods, subscriptions or high-ticket bookings are involved. Issuers respond by tightening risk models, which can reduce approval rates for legitimate customers. A2A rails mitigate much of this exposure by removing card credentials entirely and authenticating directly with the user’s bank, reducing both synthetic identity fraud and card-not-present attacks.

Wallets introduce their own unique fraud profile: while device-based authentication reduces unauthorised use, compromised accounts or SIM-swap events can still affect performance. APMs, particularly instant-payment rails, benefit from strong domestic identity verification, but merchants must still consider how these rails handle dispute processes. For high-risk merchants, the aim is not to eliminate fraud but to match the right rail to each transaction based on risk probability.

Chargeback Probability and the Role of Dispute-Free Rails

Chargebacks are one of the most disruptive cost centres for high-risk merchants. Traditional rails expose merchants to financial losses, dispute fees, representment complexity and reputational risk. A2A, PIX, UPI, QR-based systems and certain wallets remove chargebacks entirely, replacing them with simpler, rules-based dispute workflows handled by banks rather than card schemes. These rails dramatically reduce operational strain and financial unpredictability.

However, removing chargebacks also shifts responsibility for consumer protection, which means merchants must invest in robust refund flows, customer communication strategies and transparent dispute processes. When implemented well, dispute-free rails can stabilise margins and reduce reserve requirements.

Net Processing Cost and FX Exposure

For high-risk merchants, cost efficiency goes beyond interchange or provider fees. The true cost of accepting a transaction is determined by a combination of approval rate, fraud rate, dispute exposure and settlement structure.

A rail with lower headline fees may still have a higher net processing cost if approval rates are weak or failed transactions drive additional retries.

A2A and many APMs typically offer lower fees and minimal dispute exposure, but merchants must consider integration overhead, settlement timing and FX execution risk when operating cross-border. Cards remain costly in some regions but offer liquidity predictability and chargeback rights that certain businesses still require. Optimising the rail mix becomes a balancing act: choose rails that maximise revenue stability while managing the total cost of acceptance.

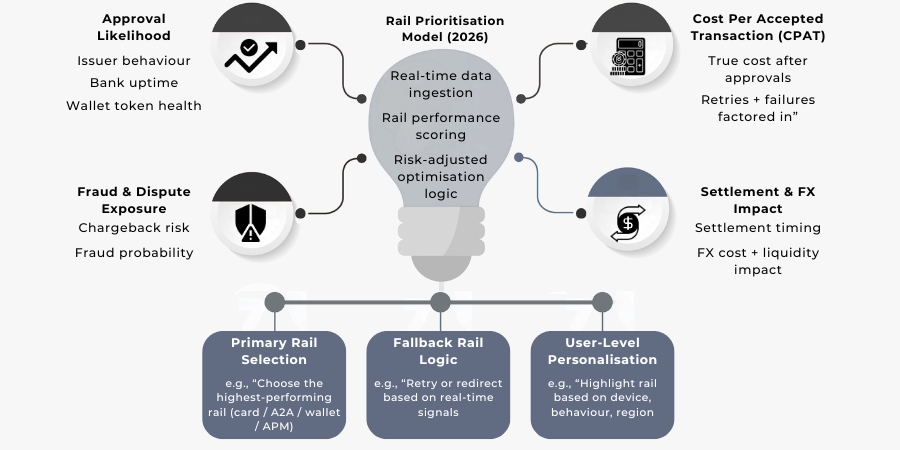

Designing a Data-Driven Rail Prioritisation Model

Choosing the right rail for each transaction is no longer an instinctive or purely commercial decision; it is a data-driven exercise based on real-time performance insights. In 2026, merchants build rail prioritisation models that measure not only the cost of a payment method, but the likelihood it will convert, the risk it introduces, and the operational impact it carries across the entire transaction lifecycle. A rail that looks attractive on paper may underperform in a specific corridor, time window, device type or merchant vertical. This is why rail optimisation cannot rely on static rules; it must be informed by dynamic metrics that reveal true commercial value.

A strong prioritisation model takes into account the full journey of a transaction from initial intent to settlement and assigns weight to the factors that define success: cost, acceptance, fraud exposure and reliability. For high-risk merchants, this model becomes especially important because declines, disputes and fraud spikes are not random events; they are signals that a specific rail is misaligned with the merchant’s risk profile or with regional issuer expectations. By interpreting these shifts correctly, merchants can adapt in real time, increasing approval probability and protecting margin.

Cost Per Accepted Transaction (CPAT)

Traditional cost metrics such as interchange, scheme fees or PSP pricing cannot provide an accurate view of rail efficiency. What matters is the cost per accepted transaction, because a rail with low fees but weak approval rates may end up costing the business far more than a rail with higher fees but stronger conversion. CPAT reframes the cost question entirely: it evaluates the effective cost of generating confirmed revenue, not just initiating a payment attempt.

For example, if A2A payments cost significantly less than cards but experience a drop-off during bank authentication at certain times of day, the CPAT may fluctuate. Likewise, card rails with higher fees might still outperform if issuer trust is strong in a given corridor. Merchants who manage CPAT dynamically rather than relying on static fee schedules gain a significant competitive advantage.

Fraud-Adjusted Revenue Modelling

A rail’s true revenue contribution must also account for fraud losses, dispute costs and reserve impact. Card rails expose merchants to fraud-related chargebacks and network penalties, which may erode profits even when approval rates are strong.

A2A and instant-payment rails eliminate chargebacks, but merchants must assess whether removing disputes changes customer expectations or refund behaviours.

Fraud-adjusted modelling helps quantify the real value of each rail. A method with lower approval rates may still outperform if it drastically reduces fraud exposure; conversely, a method with strong approvals may underdeliver if its dispute costs outweigh its revenue contribution.

Speed vs Reliability Across Rails

Speed matters, but reliability matters more. Instant-payment rails offer near-instant confirmation, yet can suffer from regional outages or bank-level throttling. Cards remain relatively stable but may experience authentication-related friction. Wallets perform exceptionally well in mobile-first markets but depend on token lifecycle accuracy.

Merchants must measure not just the nominal speed of a rail, but its consistency. A fast rail that frequently experiences downtime or bank-side issues creates volatility that high-risk merchants cannot afford. A reliable rail with predictable flow may deliver a more stable revenue curve even if it is not the fastest option.

Routing Across Rails: 2026 Best Practices

By 2026, routing will no longer be limited to selecting the best acquirer for card transactions. The modern payments stack demands cross-rail routing, where the system decides not only which acquirer or issuer path to use, but which payment rail gives each transaction the highest probability of success. This shift reflects a broader reality: consumer behaviour varies by region, issuer performance fluctuates by hour, and risk signals change in real time. As a result, merchants must build routing logic that treats cards, A2A flows, wallets and APMs as dynamic performance channels rather than static checkout buttons.

Effective cross-rail routing has two layers. The first layer determines which rail the customer should see first in the checkout journey, based on historical performance, regional norms and user-device signals. The second layer decides what to do when something goes wrong, how to reformat the transaction, which rail to retry through, and how to maintain trust without introducing unnecessary friction. This is where data-driven optimisation becomes transformative: merchants can pivot from one rail to another before the customer abandons the flow, preserving conversion in a way that was impossible with traditional routing.

Routing across rails is not about forcing customers into specific payment methods. Instead, it’s about using intelligence to surface the rail that aligns with the user’s intent, geography, device and risk profile. When done correctly, this approach stabilises acceptance, reduces operational risks and gives merchants a powerful buffer against issuer or rail-level volatility.

Intelligent Rail Selection Based on Real-Time Performance

Modern orchestration systems interpret live signals from issuers, banks, wallet providers and APM networks to determine which rail is currently healthiest. If card approvals deteriorate during a certain hour or geography, the routing logic may prioritise A2A or a trusted local APM. If a bank’s open banking interface becomes slow or returns elevated authentication failures, the system can promote wallet options that require fewer redirections.

This fluidity lets merchants avoid conversion drops that would previously go unnoticed until daily reports surfaced. Cross-rail routing becomes a continuous optimisation cycle that favours the rail with the strongest acceptance probability in that exact moment.

Adaptive Retry Logic Across Rails

Retry strategies have evolved significantly from the era of “retry through another acquirer.” In 2026, merchants often retry through another rail entirely. A failed card attempt may be re-presented through an A2A rail if the user’s bank is already known to support instant authentication. Conversely, an A2A dropout during authentication may trigger a soft promotion of a wallet option that offers a faster, device-native flow.

Each retry is guided by what the data indicates about user behaviour and real-time performance preventing unnecessary friction and avoiding repeated failures that frustrate customers.

Checkout Personalisation and Rail Preference Modelling

Not every user responds the same way to every rail. Personalisation models now help merchants determine which rail to highlight based on user profile, device type, historical preference or region-specific trust patterns. A returning customer on a mobile device may see a wallet option first, while a high-value transaction from a European corridor may lean toward A2A due to lower SCA friction.

This reduces decision fatigue for customers and aligns the checkout experience with behavioural expectations, improving conversion without forcing a particular payment method.

Settlement & FX Optimisation in Multi-Rail Environments

As merchants diversify across cards, A2A rails, wallets and regional APMs, the operational complexity shifts from simply converting a transaction to managing how, when and in what currency funds are settled. Settlement behaviour is one of the most overlooked but financially consequential aspects of cross-rail optimisation.

In 2026, merchants operating across multiple rails must think carefully about treasury flow, FX exposure, liquidity timing and reconciliation effort because each rail introduces distinct operational patterns that influence margin and cash-flow stability.

Card payments typically follow predictable settlement cycles, with clear-cut-off times and established reconciliation frameworks. But this stability comes at the cost of interchange fees, dispute exposure and FX markups for cross-border flows. A2A rails, by contrast, settle quickly, often instantly or within hours but can introduce fragmentation if settlements occur bank-by-bank rather than centrally. Wallets vary widely: global wallets often settle in batches, while regional wallets may require local bank accounts or subject merchants to country-specific settlement rules. APMs like PIX or UPI add their own layers, offering rapid settlement but requiring merchants to align treasury operations with domestic banking infrastructure.

This diversity means merchants must evaluate rails not solely on approval performance or cost per transaction, but also on how each rail affects their broader financial operation. A rail that settles instantly may improve liquidity but increase reconciliation complexity. A rail with predictable settlement cycles may simplify treasury management but expose merchants to FX fluctuations. Optimisation, therefore, becomes a matter of balancing cash-flow reliability with profitability and operational effort.

Managing FX Exposure Across Rails

Cross-border merchants face FX exposure in multiple layers of the payment process not only when funds are settled, but when customers choose their rail. Card payments often introduce hidden FX costs when issuers or schemes convert currency at unfavourable rates. Wallets may settle in local currency, requiring merchants to manage FX repatriation. Instant-payment systems typically settle in domestic currency, which can stabilise local operations but complicate global treasury consolidation.

Optimising FX requires a clear understanding of which rails introduce conversion at the point of payment, which defer it to settlement, and which give merchants more control over execution. High-risk merchants especially benefit from rails with predictable FX structures because volatility in treasury flows can directly influence reserve requirements and cash-flow buffers.

Aligning Treasury Operations With Rail-Specific Settlement Cycles

Merchants who treat all settlement patterns as equal often encounter avoidable operational friction. For example, A2A rails may offer same-day settlement but vary by bank; wallet providers may settle weekly; certain APMs settle multiple times per day. These patterns dictate how funds move, how quickly liquidity becomes usable, and how reconciliation teams manage reporting.

A well-structured multi-rail treasury model identifies which rails should support day-to-day liquidity, which support regional operations and which rails are best used for high-value transactions where settlement predictability matters more than speed.

In high-risk verticals, treasury optimisation can also reduce the likelihood of reserve uplifts by demonstrating financial stability and predictable cash-flow cycles.

Compliance & Risk Requirements for Non-Card Rails

As merchants expand their payment mixes beyond cards, they often underestimate how different the compliance landscape becomes. Non-card rails, especially instant-payment systems, A2A flows, and regional wallets operate under local regulatory frameworks that impose obligations very different from card scheme rules. These rails may remove chargebacks and reduce issuer friction, but they introduce their own set of compliance expectations around identity verification, data handling, consumer protection, dispute processing and transaction monitoring. For high-risk merchants, understanding these requirements is essential not only for onboarding but for sustained access to the rails themselves.

Unlike card networks, which operate under globally harmonised rules, non-card rails are deeply shaped by domestic regulators. Local banking authorities, real-time payments infrastructure operators and national payment schemes define how merchants must authenticate users, how fraud must be handled, what disclosures must be shown at checkout and how refunds must be issued. As adoption increases across 2026, regulators are tightening oversight to ensure these rails maintain consumer trust and merchants must adapt if they want to participate meaningfully.

Confirmation of Payee (CoP) for A2A & Fraud Prevention

A2A rails in the UK, EU and several APAC markets now rely on “Confirmation of Payee” checks that validate whether the account details provided by the customer match the intended recipient. This requirement is designed to prevent social engineering and misdirected payments, but it also affects conversion if not implemented carefully. High-risk merchants must design CoP flows that minimise friction while still delivering clear disclosures, because regulators increasingly expect transparent user communication during account confirmation.

CoP also introduces new audit trails: PSPs and merchants must retain verification logs and demonstrate that mismatches were handled according to regulatory expectations. For A2A-heavy markets, this becomes a fundamental compliance responsibility.

SCA & Authentication Requirements Across Non-Card Rails

Strong Customer Authentication (SCA) no longer applies exclusively to cards. PSD3/PSR and equivalent regional reforms extend authentication obligations to many types of bank-based payments and certain wallets. This pushes merchants to design consistent, secure flows regardless of rail. In A2A systems, authentication is often performed by the bank, but merchants are still responsible for initiating flows with the correct metadata and ensuring users understand when and why authentication is required.

For wallets, authentication is embedded within the device or OS ecosystem. While this reduces friction, it also imposes technical and contractual obligations around token handling, device validation and consent management. Regulators increasingly scrutinise these flows for clarity and accessibility.

Local KYC Rules & Data-Residency Requirements

Many APMs, especially instant-payment rails like PIX, UPI, PayNow or TROY require merchants to comply with local KYC standards that can exceed what is needed for global card acceptance. Some demand domestic registration, local representation, or adherence to national AML guidelines. In markets like India or Brazil, data-residency rules dictate where transaction and user information must be stored, adding another operational layer to multi-rail adoption.

These requirements are not optional. Merchants that fail to meet local expectations risk performance degradation, increased scrutiny or, in extreme cases, removal from the rail.

Conclusion

By 2026, the most successful merchants are no longer those who simply offer multiple payment methods, they are the ones who know how to orchestrate those methods with precision. Cards, A2A, wallets and regional APMs each have distinct strengths, risk profiles and regulatory constraints. Treating them as interchangeable options leaves revenue on the table. Treating them as dynamic performance channels each capable of outperforming the others under the right conditions is what separates market leaders from struggling operators.

For high-risk merchants especially, rail optimisation is no longer a luxury. It is the mechanism that stabilises approval rates, protects against issuer volatility, reduces fraud exposure and delivers predictable margins even in corridors historically marked by risk and unpredictability. With data guiding which rail leads, which rail supports retries, and which rail should be suppressed during volatility, merchants can build a payment stack that responds intelligently to real-world signals rather than relying on static assumptions.

This evolution is also reshaping how merchants think about operations. Settlement patterns, FX exposure, local compliance rules and regulatory obligations all influence rail selection just as much as approval rates do. The future of payments belongs to merchants who understand this full lifecycle not just the moment of checkout, but the financial, operational and compliance impact each rail carries from initiation to settlement.

Ultimately, rail diversification becomes truly valuable only when paired with data. It is this combination of offering multiple rails and knowing exactly when and how to use them that delivers sustainable margin growth in a world where consumer behaviour, regulation and infrastructure continue to evolve rapidly. Merchants who embrace this model will not only convert more transactions, but also build a payment architecture resilient enough to thrive in high-risk, high-growth markets.

FAQ

1. What does “cross-rail payment optimisation” mean in 2026?

It refers to using data to intelligently balance cards, A2A, wallets and APMs so each transaction is sent through the rail most likely to be approved. Instead of offering multiple methods passively, merchants actively route and prioritise rails based on performance, cost and risk signals.

2. Why do high-risk merchants benefit the most from rail diversification?

Because high-risk MCCs face stricter issuer filters, volatile approval rates and higher fraud exposure. Alternative rails like A2A and instant-payment systems reduce disputes, minimise fraud vectors, and often deliver more stable conversion than cards.

3. Are A2A payments replacing cards in high-risk markets?

Not entirely but they are becoming the preferred rail in many corridors. A2A removes chargebacks, reduces fraud, and benefits from strong regulatory support (EU, UK, India, Singapore). Cards remain essential for global acceptance but are no longer the single default rail.

4. How does consumer behaviour influence rail optimisation?

Consumer trust and familiarity shape which methods convert best. For example:

- LATAM prefers PIX and wallets

- Europe is increasingly adopting open banking

- Asia relies heavily on QR and super-apps

- The Middle East is moving toward real-time A2A

Optimisation must reflect these regional patterns.

5. What data do merchants need to optimise rails effectively?

Key signals include issuer approval likelihood, A2A authentication success, wallet token health, APM uptime, fraud probability, device intelligence and rail-specific cost data. Without real-time visibility, optimisation becomes guesswork.

6. How does rail selection impact fraud and dispute exposure?

Different rails carry different risk profiles. Cards introduce chargebacks and friendly fraud; A2A and instant-payment rails eliminate disputes; wallets reduce unauthorised usage through device-bound identity. Choosing the right rail reduces fraud overhead and reserve requirements.

7. What is CPAT and why is it critical?

CPAT (Cost Per Accepted Transaction) measures the effective cost of a successful payment by factoring in approval rate, fraud, disputes, retries and settlement. A rail with lower fees may still have a higher CPAT if it converts poorly.

8. Can routing shift a user automatically from one rail to another?

Yes. Modern orchestration engines can retry failed cards through A2A, promote wallets if authentication friction rises, or suppress a struggling rail during downtime. This avoids unnecessary drop-offs and recovers revenue that would otherwise be lost.

9. How do settlement and FX affect rail strategy?

Rails settle in different cycles and currencies. A rail with fast settlement may create reconciliation complexity; another may simplify treasury but expose the merchant to FX swings. Merchants must match rail selection to liquidity, margin and operational needs.

10. Do non-card rails have regulatory requirements merchants must follow?

Yes. A2A flows require Confirmation of Payee checks; open banking rails must comply with SCA; instant-payment systems often require local KYC, data-residency compliance and domestic licensing. These rules influence whether a merchant can use a rail and how it must be implemented.

11. Can cross-rail optimisation reduce operational costs?

Absolutely. By shifting volume to lower-cost, higher-acceptance rails and by reducing chargebacks and fraud merchants can significantly reduce net processing costs while increasing revenue stability.

12. How do merchants know when to prioritise a rail?

Prioritisation is based on live data: approval rates, issuer behaviour, rail uptime, authentication friction, device profile, and historical user preference. The highest-performing rail at that moment should become the primary checkout option.