Chargebacks have always been a cost of doing business for high-risk merchants, but the landscape entering 2026 reflects a far more complex reality. Issuers are no longer responding to disputes solely at the cardholder’s request; they are proactively using internal risk models, transaction-risk scoring and behavioural history to intervene before a transaction even becomes a complaint. At the same time, friendly fraud continues to rise, digital identity patterns are shifting rapidly, and networks are enforcing stricter evidence standards.

For merchants operating in sectors such as gaming, travel, digital goods, and subscription services, the result is a dispute environment where reactive handling is no longer enough. By the time a chargeback appears, the decision has often already been influenced by issuer-level assumptions built on past transaction data, customer signals and BIN-specific patterns. This shift is why the next generation of dispute management focuses on chargeback intelligence using issuer behaviour, BIN insights and predictive signals to prevent disputes before they happen.

As we move into 2026, high-risk merchants that understand these patterns and act on them early gain a structural advantage across approvals, dispute ratios and long-term compliance. Those that continue relying solely on manual representation or post-dispute workflows will find it increasingly difficult to maintain acceptable thresholds or protect revenue.

Key Takeaways

- Issuers are evaluating transactions using increasingly sophisticated risk models, making proactive chargeback prevention essential for high-risk merchants.

- BIN-level intelligence reveals which issuers are most likely to decline, challenge or dispute specific transaction patterns.

- Predictive signals such as velocity anomalies, cart deviations and device mismatches allow merchants to intervene before a dispute occurs.

- Visa and Mastercard are expanding their evidence and monitoring rules, requiring merchants to maintain stronger behavioural and transactional data trails.

- A well-designed chargeback intelligence framework becomes a competitive advantage, reducing disputes while improving issuer trust and approval rates.

- The 2025–2026 Issuer Behaviour Landscape

- Key Chargeback Intelligence Signals

- Building a Chargeback Prediction Engine

- Card Network Expectations for 2026

- Data Integration Layers That Enable Chargeback Intelligence

- Turning Intelligence Into Action

- KPIs for a Chargeback Intelligence Program

- Market-by-Market Snapshot (Short Capsules)

- Case Scenarios: How Different Merchants Use Chargeback Intelligence

- Conclusion

- FAQs

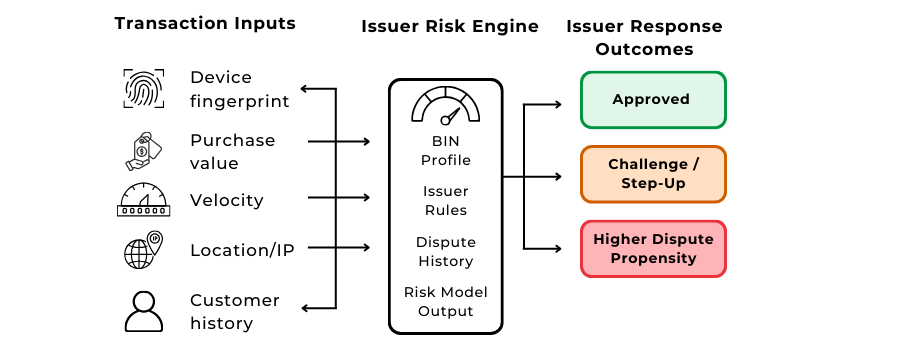

The 2025–2026 Issuer Behaviour Landscape

Issuer behaviour is one of the least understood but most influential drivers of chargebacks. In 2026, issuers rely heavily on automated risk scoring, machine-learning models and historical cardholder behaviour when deciding whether to approve a transaction, challenge it, or support a future dispute. These models evolve continually as fraud patterns shift, meaning issuers often make decisions long before a cardholder initiates a chargeback. For high-risk merchants, this results in a more sensitive and rapidly changing dispute environment one where issuer trust plays a decisive role.

Issuers are also dealing with rising levels of first-party misuse. As friendly fraud continues to grow globally, banks have become more conservative in their treatment of transactions that fall into higher-risk MCCs or display certain behavioural patterns. This shift means that merchants in categories such as gaming, digital goods, travel, financial services and subscription products face a tighter scrutiny window. Even small anomalies in customer behaviour can lead issuers to classify a transaction as dispute-prone, causing friction later in the cycle.

Against this backdrop, chargeback intelligence becomes a critical capability. By understanding how issuers respond to specific transaction patterns down to the BIN level, merchants can predict where disputes are most likely to arise and adjust their strategies accordingly.

Why issuers are auto-refusing more high-risk transactions

Issuer declines in high-risk verticals are driven by the underlying increase in synthetic identities, account takeovers and friendly fraud. Banks now maintain richer datasets about individual cardholder behaviour, comparing new transactions against past disputes, earlier login patterns, purchase histories and known fraud typologies. If a transaction exhibits characteristics common among previously disputed orders such as mismatched locations, sudden value spikes or inconsistent device activity, issuers may decline the authorisation or pre-emptively position the transaction for later dispute support.

This conservative behaviour is amplified when issuers observe a merchant with elevated dispute ratios or inconsistent data quality. Even when a transaction is legitimate, issuers may classify it as risky if the merchant historically generates high dispute volumes. In 2026, merchants must therefore maintain low dispute ratios not only for compliance reasons but also to preserve issuer trust across entire BIN ranges.

BIN-level dispute and decline trends are emerging globally

One of the most powerful tools available to merchants is BIN intelligence. Each BIN represents an issuing bank, and each bank has its own patterns, risk appetite and dispute tendencies. Some issuers challenge transactions more frequently, others rely heavily on step-up authentication, and some are more prone to escalating cardholder complaints into full chargebacks. BIN-level analysis helps merchants identify these patterns with precision.

By examining dispute and decline ratios by BIN, merchants can determine which issuers consistently struggle with certain transaction types, which payment methods are accepted reliably, and which customers require stronger authentication. Over time, these patterns reveal actionable insights. For example, a BIN that generates disproportionately high disputes may require stronger SCA enforcement, additional customer messaging or routing through a preferred acquirer. Conversely, BINs with stable performance allow merchants to reduce friction without increasing risk.

As global issuers adapt to evolving fraud risks, these BIN-specific patterns shift more frequently. Merchants that monitor them continuously can adjust their strategy long before disputes appear, while those relying on outdated assumptions will encounter higher friction, lower approvals and more chargebacks.

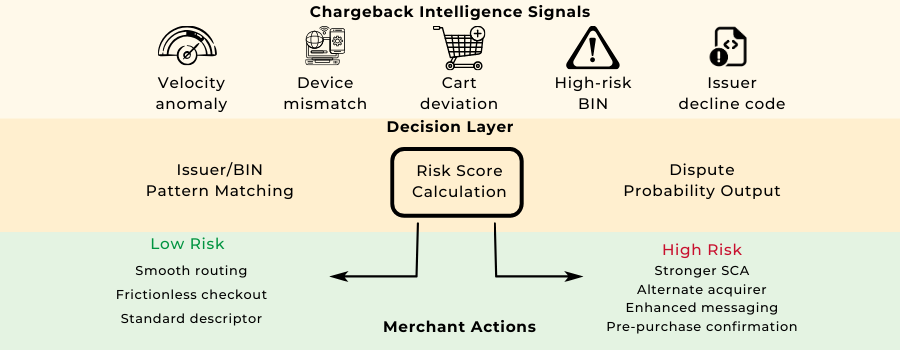

Key Chargeback Intelligence Signals

Predicting chargebacks before they occur depends on recognising the patterns that issuers and networks treat as early warning signs. In 2026, these signals sit across behavioural data, device identity, checkout patterns and issuer feedback loops. For high-risk merchants, the ability to interpret these subtle indicators is often the difference between maintaining acceptable dispute ratios and slipping into monitoring programmes. While individual signals do not always predict disputes in isolation, the combination of several patterns observed across the transaction lifecycle offers a strong basis for proactive intervention.

These signals form part of a broader chargeback intelligence framework one that analyses thousands of data points across customers, BINs, issuers and geographies. When used consistently, they help merchants understand which transactions are likely to result in disputes and which require additional friction, alternate routing or pre-emptive customer confirmation. Below are the signals that matter most for high-risk merchants in 2026.

Velocity anomalies and behavioural red flags

Velocity signals have become one of the clearest predictors of future disputes. When a customer attempts multiple transactions within a short window, switches between several cards, or performs repeated retries at increasing or decreasing amounts, issuers interpret this behaviour as instability. Even if a transaction is ultimately approved, these patterns can weaken issuer trust and increase the likelihood of a dispute being supported later.

For merchants in sectors such as gaming or digital services where customers frequently top up balances or make multiple micro-purchases velocity rules must be carefully calibrated. Overly strict velocity controls create checkout friction, while weaker controls allow risky transactions to slip through. A chargeback intelligence system must distinguish normal customer patterns from anomalies that correlate strongly with disputes, ensuring that interventions occur only when necessary.

Cart value deviation and abnormal order characteristics

Another useful predictor is deviation from a customer’s typical cart value or purchase pattern. Sudden upgrades, high-value orders placed by historically low-spend customers, unusual SKU combinations or large quantities of digital goods often signal future disputes. Issuers frequently rely on baseline behavioural profiles to assess risk, and anything that falls outside the expected pattern can flag the transaction as suspicious.

These deviations are especially relevant for subscription merchants who offer seamless upgrade paths or trial-to-paid conversions. If the customer journey is not clearly communicated or if pricing transparency is inconsistent, issuers may interpret later disputes as valid cardholder confusion, increasing the likelihood of chargeback support. Proactive intelligence allows merchants to identify which deviations require checkout reinforcement, additional messaging or pre-purchase confirmation.

Device mismatch and identity inconsistency

Device continuity is one of the strongest indicators of transaction legitimacy. When a customer uses the same device, browser and behavioural patterns across multiple purchases, issuers build a high-confidence profile. Conversely, device mismatches of new devices, anonymous browsers, VPN routing or inconsistent geolocation are viewed as higher risk and more likely to result in future complaints.

In 2026, issuers place considerable weight on device-based data, particularly given Visa’s expanding Compelling Evidence framework, which recognises consistent device signals as part of legitimate customer behaviour. For merchants operating in fast-moving sectors such as digital goods and gaming, real-time device intelligence helps distinguish genuine customers from high-risk sessions, reducing dispute exposure by blocking or challenging abnormal patterns early.

Region-specific issuer codes and geographic risk pockets

Geographic risk is another core component of chargeback prediction. Certain regions generate disproportionately high dispute rates due to local consumer behaviour, issuer policies or regulatory expectations. Issuer decline codes, step-up requests or early warning behaviours vary significantly across geographies, creating unique patterns that merchants must monitor.

For example, US issuers tend to be more aggressive with friendly-fraud-related disputes, while LATAM issuers may challenge transactions with stricter authentication requirements. European issuers under PSD2 lean heavily on SCA compliance, and mismatched authentication flows frequently lead to later disputes. A chargeback intelligence layer helps merchants identify these geographic pockets of risk, enabling smarter routing, authentication and customer messaging strategies based on regional issuer behaviour.

Building a Chargeback Prediction Engine

A modern chargeback prevention strategy is no longer built on static rules or manual judgment. Instead, high-risk merchants rely on prediction engines that analyse thousands of transactions to identify the signals most closely linked to later disputes. This predictive layer evaluates customer behaviour, issuer reactions, BIN performance, device continuity and post-purchase patterns to estimate the likelihood of a chargeback before it occurs. By identifying transactions with elevated risk, merchants can intervene early adjusting routing, applying additional authentication or offering pre-emptive customer communication.

A chargeback prediction engine combines structured transactional data with behavioural analytics, allowing merchants to anticipate disputes with far greater accuracy than traditional post-dispute workflows. It also creates a feedback loop between fraud, payments, customer support and compliance teams, ensuring that dispute insights continuously refine the merchant’s risk posture. For sectors operating near card-network thresholds, this becomes an essential component of dispute-ratio stability.

Mapping decline codes to dispute probability signals

Decline codes offer some of the clearest insights into how issuers perceive the risk of a transaction. Soft declines that request additional authentication, or codes associated with insufficient data or unusual activity, often serve as early indicators of potential disputes. When a customer retries the transaction multiple times or when different issuers return similar codes for the same transaction pattern merchants gain valuable intelligence about risk concentration.

High-risk merchants increasingly map specific decline codes against historical dispute data to identify which codes correlate most strongly with later chargebacks. Transactions that match these patterns can be routed through alternate acquirers, passed through stronger authentication flows or subjected to additional customer messaging. Over time, this mapping improves the accuracy of the entire prediction engine, helping merchants reduce future dispute volumes with minimal friction.

Machine-scoring vs rule-based prevention models

Traditional rule-based systems served merchants well when disputes followed predictable patterns. But in 2026, dynamic fraud behaviour, friendly-fraud growth and issuer-driven risk scoring have outpaced the capabilities of static rules. Machine-learning models allow merchants to evaluate multiple variables at once, detecting combinations of signals that may not appear risky in isolation but become meaningful when combined.

Machine-scoring models can incorporate device signals, velocity anomalies, historical dispute behaviour, issuer-specific patterns, cart deviations and post-purchase activity. Once trained on a merchant’s historical data, these models generate a dispute-probability score for each transaction. High-scoring transactions can then be intercepted or routed differently, while low-risk transactions pass through without added friction.

The value of machine-scoring lies in its adaptability. As issuers adjust their behaviour, as new fraud patterns emerge or as the merchant enters new markets, the model continuously learns from new disputes and new approval patterns. This keeps the prediction engine aligned with issuer expectations and reduces the likelihood of sudden spikes in dispute ratios.

Card Network Expectations for 2026

Card networks are placing greater emphasis on upstream prevention, encouraging merchants to reduce disputes long before they escalate into formal chargebacks. As fraud evolves and friendly fraud becomes more common, Visa and Mastercard have expanded their rules to demand clearer, more structured evidence and proactive dispute management. These expectations directly influence how merchants prepare their data, manage customer journeys and design their internal compliance frameworks.

For high-risk merchants, understanding these evolving standards is crucial. Networks increasingly reward businesses that submit high-quality evidence, maintain consistent device and customer-data trails and demonstrate meaningful efforts to prevent disputes at the source. Those who fall behind may face higher monitoring scrutiny or difficulty defending transactions, even when they are legitimate. Below are two of the most important developments shaping dispute management in 2026.

Visa Compelling Evidence 4.0 (2025-2026 evolution)

Visa continues to strengthen its approach to friendly fraud by expanding what qualifies as valid evidence in pre-arbitration scenarios. Under the latest evolution of Compelling Evidence (CE), merchants are encouraged to document device continuity, account login histories, prior undisputed purchases and behavioural consistency across multiple transactions. This shift reflects Visa’s recognition that friendly fraud often stems from legitimate customers disputing authorised transactions not from stolen cards.

For high-risk merchants, CE 4.0 reinforces the importance of collecting and retaining behavioural data that clearly demonstrates customer identity and intent. Transactional metadata is no longer enough; issuers expect to see session-level evidence, device fingerprints and history of usage that proves the customer was fully engaged. Merchants who lack these data layers find it harder to defend against claims, especially in verticals with repeat purchases, subscription upgrades or high digital consumption.

Mastercard’s dispute-resolution and monitoring enhancements

Mastercard’s dispute rules have also evolved, focusing on efficiency and accountability throughout the dispute cycle. Enhanced documentation expectations require merchants to submit more precise, structured evidence that clearly explains the context of the transaction, the customer journey and any post-purchase interactions. High-risk merchants, in particular, must demonstrate that their systems accurately capture authentication flows, delivery records and customer actions.

Monitoring thresholds for dispute ratios continue to be strictly enforced. Merchants operating near these limits must adopt predictive intelligence to stay compliant, as reactive dispute handling is rarely sufficient to maintain ratios below programme thresholds. Mastercard also encourages greater use of pre-dispute tools and network inquiry functions, reflecting a broader trend toward resolving issues before they escalate to formal chargebacks.

Together, these network expectations create a clear requirement: merchants must evolve from reactive evidence gathering to proactive, intelligence-driven dispute prevention. Data quality, behavioural continuity and predictive scoring now sit at the centre of every successful dispute-management strategy.

Data Integration Layers That Enable Chargeback Intelligence

Chargeback intelligence depends on data clean, connected and comprehensive. Most high-risk merchants already collect large volumes of information across checkout systems, customer accounts, fraud tools and payment providers, but the challenge in 2026 is transforming these siloed sources into a unified intelligence layer. When data sits in separate systems, merchants are unable to detect the patterns that issuers rely on to assess transaction legitimacy. Integrating these streams allows teams to construct a holistic picture of customer behaviour, issuer reactions, and dispute risk.

A well-integrated data environment becomes a foundation for predictive scoring, routing optimisation and improved evidence quality. It also ensures that customer interactions from authentication to disputes are seen in context rather than as isolated events. For high-risk merchants, this level of integration is essential, as both issuers and card networks increasingly expect merchants to demonstrate clear behavioural continuity across transactions.

Combining gateway, PSP, acquirer and device data

At the core of a chargeback intelligence framework is the consolidation of payment data. This includes gateway logs, PSP metadata, acquirer responses and issuer decline codes. Each system holds a small part of the overall picture: the gateway captures checkout behaviour, the PSP provides transaction attributes and fraud signals, and the acquirer records issuer responses. Without combining these, merchants cannot understand how specific BINs, acquirers or authentication flows relate to dispute outcomes.

Device and behavioural data add another essential layer. Device fingerprints, IP addresses, login histories and account interactions provide continuity signals that issuers increasingly depend on when evaluating the customer’s legitimacy. When a prediction engine correlates these device signals with payment outcomes, merchants gain early visibility into which customers or transaction types are most likely to dispute later. This becomes especially important in verticals where fast repeat purchases or low-friction checkout flows are common.

Tokenisation and network cryptogram data also strengthen this intelligence. Network tokens carry lifecycle signals that indicate legitimate customer behaviour across multiple purchases, while cryptogram consistency hints at device stability. When merged with issuer feedback loops such as soft declines, step-up requests or dispute alerts these signals help merchants continuously refine their routing, authentication and communication strategies.

Ultimately, data integration turns fragmented operational tools into a coordinated intelligence system. It gives merchants the ability to predict risk, intervene early and demonstrate clear evidence trails when disputes escalate. In a world where card networks expect structured, high-quality data, this integrated foundation is no longer optional; it is the backbone of effective chargeback prevention.

Turning Intelligence Into Action

Collecting chargeback intelligence is only useful when it directly shapes how merchants route transactions, design checkout flows and communicate with customers. In 2026, the most successful high-risk merchants use their predictive insights to reduce friction for low-risk customers and introduce targeted intervention for those who exhibit dispute-prone behaviour. This balance is essential: too much friction reduces approval rates, while too little increases dispute exposure. Intelligence becomes the mechanism that helps merchants apply the right action to the right customer at the right moment.

Predictive insights also create opportunities to address dispute risk before it becomes a formal complaint. Whether through smarter routing decisions, clearer pricing disclosures or improved post-purchase messaging, merchants can shift from a reactive dispute model to a proactive experience model that strengthens issuer trust while reducing operational burden.

Intelligent routing based on BIN and issuer behaviour

Routing decisions are one of the most powerful tools available to merchants seeking to reduce disputes. By analysing which BINs or issuers are more likely to challenge transactions, decline them or escalate customer complaints, merchants can route traffic to the acquirers that offer the highest approval likelihood and lowest dispute risk.

BIN-level routing may involve applying stronger authentication for high-risk issuers, switching to local acquirers for specific corridors or sending transactions through acquirers with proven issuer relationships. For high-risk merchants, this dynamic optimisation helps avoid the patterns that trigger issuer suspicion and improves overall dispute ratios while maintaining healthy approval rates.

Check out UX improvements and intent clarification

Many chargebacks arise not from fraud but from confusion. Unexpected pricing changes, unclear subscription terms or vague product descriptions often result in customers disputing legitimate purchases. Chargeback intelligence helps merchants identify which customer segments require additional clarity at checkout. This may include reinforcing renewal schedules, adding micro-frictions for risky BINs or presenting a clearer breakdown of charges.

Even small UX adjustments confirmation screens, usage reminders or dynamic SCA prompts can significantly reduce the likelihood of later disputes, especially when aligned with behavioural signals detected earlier in the transaction.

Descriptor redesign and post-purchase communication

Billing descriptors remain one of the most overlooked sources of friendly fraud. If a customer does not recognise the charge on their statement, their first instinct is often to contact the issuer rather than the merchant. High-risk merchants use intelligence to identify which transaction types or customer segments generate descriptor-related confusion, allowing them to redesign descriptors or introduce enhanced post-purchase messaging.

Email receipts, SMS confirmations, in-app notifications and renewal reminders all strengthen customer recognition and reduce issuer escalations. Combined with clear descriptors, this communication layer helps prevent avoidable disputes and reinforces customer trust.

KPIs for a Chargeback Intelligence Program

An effective chargeback intelligence strategy depends on clear, measurable KPIs. These indicators help merchants validate whether their interventions are working, whether issuer behaviour is improving and whether dispute ratios are trending in the right direction. In high-risk sectors, these metrics are especially important because card networks and acquirers monitor dispute exposure closely. Tracking the right KPIs allows merchants to demonstrate operational maturity while continuously refining their prediction models.

One of the most valuable metrics is the risk-adjusted approval rate. Rather than simply measuring approvals, this KPI compares approval performance against the predicted risk of the underlying transactions. A rising risk-adjusted approval rate indicates that routing strategies, SCA logic and UX interventions are successfully protecting high-risk transactions without unnecessary declines.

Expected vs actual dispute rates also provide insight into whether prediction models are effective. If actual disputes fall below expected levels, it suggests that pre-dispute interventions such as early refunds, customer confirmations or routing changes are preventing unnecessary escalations. When this gap widens over time, merchants gain confidence that their intelligence engine is working as intended.

Another useful KPI is issuer-level dispute clustering, which shows how disputes are distributed across specific banks or BINs. This helps merchants identify where routing adjustments or enhanced communication strategies are needed. Additionally, the alert-to-chargeback ratio highlights how many disputes are successfully resolved before becoming formal chargebacks, serving as a direct indicator of operational responsiveness.

Finally, resolution speed and pre-dispute deflection rate measure how effectively teams are responding to early warning signals. Faster resolutions reduce issuer escalations, while higher deflection rates signal a healthy, proactive dispute-management framework.

Market-by-Market Snapshot (Short Capsules)

Issuer behaviour varies significantly across global markets, and understanding these regional differences is essential for shaping effective chargeback-intelligence strategies. Each region presents unique dispute triggers, risk expectations and customer behaviours, all of which should influence how merchants authenticate, route and communicate with customers.

- EU & UK: Europe’s issuer landscape is shaped heavily by SCA, PSD3 and PSR reforms. Disputes often arise when authentication flows fail or when exemptions are misapplied. Issuers favour strong identity continuity, device stability and clear post-purchase communication.

- US: The US remains the global centre of friendly fraud. Issuers often prioritise customer experience over merchant evidence, resulting in faster escalations and higher dispute ratios. Clear descriptors and proactive post-purchase messaging are essential.

- LATAM: LATAM issuers tend to be conservative, with strong emphasis on local rails and authentication rules. Dispute cycles can be fast, and certain BINs show heightened sensitivity to high-value or cross-border-looking transactions.

- APAC: Asia’s mobile-first behaviour creates heavy reliance on device continuity. Issuers place strong emphasis on consistent behavioural signals across wallets, cards and alternative payment flows.

- MENA: MENA issuers are cautious with high-risk MCCs and high-value purchases. Disputes often stem from limited customer recognition or unclear billing descriptors, making communication and local routing central to performance.

Case Scenarios: How Different Merchants Use Chargeback Intelligence

Chargeback patterns vary widely by sector, making it essential for merchants to tailor their intelligence models to the realities of their industry. These short scenarios illustrate how different high-risk businesses apply predictive insights to reduce dispute exposure and strengthen issuer trust.

Digital Subscription Merchant

A SaaS platform notices disputes cluster around trial-to-paid conversions. By analysing device continuity and login behaviour, the merchant identifies which customers require stronger renewal reminders or clearer billing disclosures. Disputes fall as intent signals improve.

Gaming Operator

A gaming merchant faces multi-account abuse and rapid top-up behaviour. Velocity analytics and BIN-level routing help detect risky sessions early, enabling targeted friction for suspicious patterns while keeping genuine players frictionless.

Travel OTA

A travel platform sees disputes months after purchase. By mapping itinerary-change frequency and cardholder communication history, the merchant predicts which bookings require enhanced confirmations or proactive outreach.

Digital Goods Marketplace

Instant-delivery products attract synthetic identities and friendly fraud. Device fingerprinting and issuer-pattern analysis identify risk-prone BINs, enabling automatic step-up or pre-purchase verification.

Fintech App

A fintech wallet uses dispute-probability scores to adjust SCA dynamically. Customers with stable device histories enjoy streamlined flows, while high-risk signals trigger stronger authentication or alternate routing.

Conclusion

Chargeback prevention in 2026 is no longer a reactive workflow it is an intelligence discipline rooted in data, issuer behaviour and predictive modelling. High-risk merchants who analyse BIN patterns, interpret early risk signals and act before disputes arise gain higher approvals, lower dispute ratios and stronger issuer trust. As networks tighten standards and issuers depend more on behavioural scoring, proactive intelligence becomes an essential competitive edge. Those who invest early will see meaningful, sustained performance improvements across every stage of the payment lifecycle.

FAQs

1. What is chargeback intelligence and why is it important in 2026?

Chargeback intelligence refers to the use of data, behavioural analytics, BIN insights and issuer patterns to predict disputes before they occur. In 2026, issuers rely heavily on automated risk models, so merchants need proactive intelligence to maintain approval rates and stay below dispute thresholds.

2. How does BIN behaviour impact dispute rates?

Every BIN represents a specific issuer, and issuers follow unique risk rules. Some issuers challenge or dispute transactions more frequently. BIN-level analysis helps merchants identify high-risk issuers, apply targeted friction or re-route risky transactions to acquirers with stronger issuer relationships.

3. Why are high-risk merchants more affected by chargebacks?

High-risk sectors such as gaming, travel, digital goods and subscription services face higher fraud exposure, more friendly fraud and stricter regulatory oversight. Issuers apply tighter scrutiny to these categories, making predictive prevention essential.

4. How can velocity anomalies indicate future chargebacks?

Multiple rapid purchase attempts, card switching or repeated retries often signal instability or fraud. Issuers treat these patterns as high risk, which makes them strong predictors of future disputes.

5. What role does device mismatch play in dispute prediction?

If a customer frequently changes devices, browsers or geolocations, issuers may view the activity as suspicious. Consistent device data builds trust, while mismatches increase the likelihood of a chargeback.

6. How do decline codes help predict chargebacks?

Soft declines tied to authentication issues, inconsistent data or issuer-specific warnings often precede disputes. Mapping decline codes against historical dispute outcomes helps merchants identify high-risk transactions early.

7. Are machine-learning models better than rule-based systems for dispute prevention?

Yes, machine-learning models analyse thousands of data points simultaneously and adapt as issuer behaviour changes. Rule-based systems cannot keep pace with fast-moving fraud or evolving issuer risk models.

8. What is Visa Compelling Evidence 4.0 and how does it help?

Visa’s CE 4.0 expands the types of evidence merchants can use to contest friendly fraud, including device continuity, customer login history and prior undisputed transactions. Merchants with stronger behavioural data have a higher chance of winning disputes.

9. How can merchants reduce friendly fraud using chargeback intelligence?

By analysing behavioural signals like device stability, order history and cart-value spikes merchants can identify confusion or misuse early. Checkout clarity, enhanced descriptors and targeted post-purchase messaging reduce friendly-fraud-driven disputes.

10. What KPIs should merchants track to measure chargeback intelligence performance?

Key KPIs include risk-adjusted approval rates, expected vs actual dispute rates, issuer-level dispute clustering, alert-to-chargeback ratio and pre-dispute deflection rates. Together they reveal whether predictive strategies are working.

11. How does routing influence dispute and approval outcomes?

Routing transactions to acquirers that issuers trust especially for high-risk BINs can significantly reduce declines and later disputes. Intelligent routing aligns each transaction with the acquirer most likely to secure approval.

12. Can chargeback intelligence help merchants stay below card-network monitoring thresholds?

Absolutely. Predictive intelligence gives merchants early warning about dispute-prone transactions, allowing them to intervene before they escalate. This reduces overall dispute volume and helps maintain compliance with Visa and Mastercard monitoring programmes.