In 2026, global expansion teams can no longer rely on the old sequence of launching a product, proving demand, and addressing compliance once volumes grow. Payment service providers and acquirers are derisking aggressively, especially in markets with tight FX controls, local licensing requirements or heightened AML expectations. Regulators are also paying closer attention to cross-border payment flows, data transfers and the licensing status of firms serving local customers from abroad.

As a result, compliance has shifted from a late-stage operational task to the foundation of market entry strategy. UK merchants now need to map licensing, FX controls, data rules and AML obligations before switching on payments because in many jurisdictions, compliance is what determines whether a launch is possible at all.

- Step 1: Regulatory Mapping by Market Type

- Step 2: FX and Capital Controls as a Payments Constraint

- Step 3: AML / KYC Alignment Across Markets

- Step 4: Structuring the Legal & Entity Footprint

- Step 5: Building a “Regulatory Readiness Pack” for PSPs & Acquirers

- Core Components of a PSP Readiness Pack

- Practical Templates: Market Entry Compliance Checklist

- One-Page Intake Sheet (High-Level Template)

- How Expansion Teams Use the Template

- FAQs

Step 1: Regulatory Mapping by Market Type

Before any merchant activates payments in a new market, the first task is to build a regulatory map that defines what is legally required to operate there. Market-entry failures almost always stem from unclear licensing obligations, overlooked data-transfer restrictions or assumptions that “UK-grade compliance” is enough everywhere. In 2026, it isn’t. Regulators expect firms to demonstrate they understand the local payment environment before switching on cross-border services.

Understanding Payments Licensing Regimes

Every market categorises payment activity differently. Some mirror the UK’s PI/EMI framework, while others require sector-specific licences or domestic operating permissions. Mapping these requirements early helps determine whether a merchant can operate cross-border or must establish a local footprint.

A regulatory map typically distinguishes between:

- PI/EMI-style regimes (common in the EU and advanced markets)

- Local operator licences for gateways, wallets or collection services

- Markets requiring in-country entities to offer payments or payouts

- Territories permitting cross-border services with limited thresholds

For markets aligned with EU rules, the European Commission’s PSD3/PSR hub provides the clearest view of how payment institutions and EMIs will be supervised under the incoming regime.

Reference: EU PSD3–PSR Official Hub (European Commission)

Data Localisation & Cross-Border Transfer Rules

Data policy now plays a decisive role in determining how merchants structure payments. Several jurisdictions require customer or transaction data to remain within their borders, which affects PSP selection, settlement routing and incident reporting.

Merchants should validate:

- Whether customer data must be stored locally

- Whether payment data may be accessed from the UK

- Whether outbound transfers require consent, notification or registration

- Whether cloud providers must host infrastructure inside the jurisdiction

- Whether certain data types (KYC, biometrics, identity attributes) are restricted

Ignoring these constraints can prevent PSPs or acquirers from supporting the market even when licensing requirements are technically met.

Market-Type Categorisation

A practical way for expansion teams to begin is by placing candidate markets into three categories:

- Open regulatory markets: flexible licensing, no strong localisation rules

- Structured regulatory markets: licensing is clear but data/FX constraints apply

- Restricted markets: local entity required, strict capital controls, heightened AML scrutiny

This classification helps prioritise launch order and resource allocation.

Step 2: FX and Capital Controls as a Payments Constraint

Even when licensing and data permissions are clear, many markets restrict how money flows into and out of the country. These FX and capital controls shape everything from settlement timing to how refunds are processed. For UK merchants entering new regions, understanding these controls early prevents unexpected payout delays, PSP rejection, or the need for costly restructuring after launch.

Markets with Strict FX or Capital Control Regimes

Some jurisdictions impose daily limits, pre-approval requirements, restricted currencies, or mandatory conversion windows. Others regulate outbound flows tightly to protect reserves. These rules can influence the operational design of your payment stack more than any licensing requirement.

Common examples include:

- Mandatory use of local currency for settlement or refunds

- Outbound remittance caps that restrict repatriation of revenue

- Fixed FX conversion windows that slow multi-currency settlement

- Central bank approvals for high-value transactions

- Restrictions on foreign PSPs handling local funds

For deeper context, the IMF’s analysis of digital payments and FX control environments highlights how emerging markets manage capital flows and the operational challenges these create for cross-border businesses.

How FX Controls Affect Settlement and Refunds

FX restrictions shape the merchant experience far beyond currency pricing. They influence when funds settle, how PSPs batch transactions, and whether refunds can be issued from offshore accounts. In strict jurisdictions, merchants may be required to:

- Settle funds with a local banking partner

- Hold multi-currency wallets in market to support refunds

- Maintain additional liquidity buffers tied to FX availability

- Accept slower settlement cycles due to central bank oversight

These constraints directly affect reconciliation accuracy and operational continuity.

FX Controls and PSP Selection

Not all PSPs support controlled markets. Many will not onboard merchants unless the flows comply with local FX rules before processing begins. Early mapping helps merchants avoid last-minute surprises, such as:

- PSPs refusing to provide local acquiring

- Settlement delays caused by forced FX conversion

- Additional documentation requests tied to outbound flows

- Suspended payouts triggered by central bank scrutiny

Choosing PSPs familiar with the relevant controls ensures more predictable settlement behaviour.

Key Takeaway

- FX and capital controls determine how fast revenue can be repatriated

- Refunds, settlement and liquidity planning must account for local currency rules

- PSP selection relies heavily on understanding these constraints upfront

Step 3: AML / KYC Alignment Across Markets

Even when licensing and FX rules are addressed, many market-entry failures happen when a merchant’s KYC framework does not meet the expectations of the new jurisdiction. In 2026, AML requirements vary considerably across markets, and PSPs increasingly expect merchants to demonstrate a clear gap analysis before onboarding.

The assumption that “UK-standard KYC is sufficient everywhere” is no longer accurate, especially as regulators tighten scrutiny on cross-border flows.

Understanding the KYC Gap

Your existing KYC stack document checks, risk scoring, enhanced due diligence may align with UK expectations but diverge from rules in markets where regulators require additional identity attributes, local address verification, or stricter screening of permanent residents vs foreign nationals.

Expansion teams should examine:

- What customer attributes are mandatory in the new market

- Whether enhanced due diligence triggers differ by risk tier

- If identity verification must use local verification providers

- How residency, nationality or business classification affects onboarding

- Whether onboarding must be revalidated after a fixed interval

This review helps avoid delays when PSPs or acquirers test your compliance posture before activating payments.

FATF High-Risk & Grey-Listed Jurisdictions

A core consideration in 2026 is whether the target market appears on the FATF list of High-Risk and Other Monitored Jurisdictions. FATF’s classification significantly influences PSP appetite, onboarding timelines and the level of scrutiny applied to customers originating from or transacting with those regions.

If a target market appears on the high-risk list, merchants may face:

- Longer PSP onboarding cycles

- More restrictive payout and settlement rules

- Mandatory enhanced due diligence for specific customer groups

- Additional documentation requirements for compliance oversight

If it appears on the grey list, PSPs may proceed but with tighter controls, lower tolerance for risk spikes and more frequent compliance reviews.

Reference: FATF – High-Risk and Other Monitored Jurisdictions

Why AML Alignment Matters for PSP Support

PSPs evaluate a merchant’s AML posture before agreeing to process live transactions, especially when entering markets with heightened geopolitical, financial or fraud risks. An inadequate AML framework is now one of the leading reasons PSPs decline new-market applications.

PSPs increasingly look for:

- Clear risk scoring logic supported by real data

- Documented enhanced due diligence procedures

- Screening rules appropriate for local naming conventions and data formats

- Evidence of ongoing monitoring not just onboarding controls

- Internal ownership of AML decisions

Merchants that can demonstrate these controls gain faster approvals and more flexible settlement options.

Step 4: Structuring the Legal & Entity Footprint

Before switching on payments in a new market, merchants must determine the legal structure through which services will operate. This choice influences licensing requirements, PSP appetite, tax exposure, data obligations and the level of scrutiny regulators apply.

In 2026, PSPs expect merchants to justify their entity design as part of onboarding particularly in markets where FX controls, localisation rules or AML expectations raise the risk profile.

Local Entity

A local entity is often required in markets with strict licensing regimes or strong consumer-protection oversight. Establishing a subsidiary signals long-term commitment and can simplify access to domestic payment rails or settlement accounts. Merchants choosing this route typically accept higher operational cost in exchange for:

- Greater regulatory acceptance

- Access to in-market acquiring or payout capabilities

- Smoother onboarding with PSPs that must comply with local supervision

However, a local entity also brings additional governance duties. Supervisors in some regions expect local directors, in-market compliance officers or locally stored operational records. These expectations are becoming more defined under regional reforms aligned with the European Banking Authority’s supervisory approach to payment institutions.

Branch Model

Branches sit between local entities and fully cross-border operations. They allow merchants to present a domestic presence without incorporating a new legal company. A branch is often a suitable structure in markets that are licensing-light but still require contactable oversight or documented accountability.

Cross-Border Provision of Services

Some markets permit fully cross-border payment services as long as customers are not deemed “domestically acquired”. This model avoids the cost of incorporation, but it narrows PSP choice: many acquirers prefer merchants with a local presence to reduce transaction risk and simplify dispute handling. Cross-border operating models also tend to face:

- Higher scrutiny of AML controls

- Stricter due-diligence questionnaires

- Limitations on using local payment methods or payout rails

This structure works best in markets with open regulatory regimes and no data localisation requirements.

High-Level Tax & Regulatory Trade-Offs

While no tax advice is provided, expansion teams should understand the regulatory trade-offs: a local entity usually improves PSP onboarding and compliance alignment, while cross-border models offer speed but introduce constraints. The decision should be informed by licensing needs, settlement behaviour, FX controls and long-term commercial strategy rather than speed alone.

Key Takeaway

- Legal structure determines how regulators, PSPs and banks will treat your market entry

- Local entities unlock the broadest payment options but increase operational oversight

- Branch or cross-border models may accelerate launch but reduce PSP flexibility

Step 5: Building a “Regulatory Readiness Pack” for PSPs & Acquirers

By 2026, PSPs and acquirers expect merchants to demonstrate compliance readiness before they agree to support a new market launch. This shift is driven by tighter prudential rules, heightened AML expectations and growing regulatory scrutiny of cross-border payment flows. A well-constructed readiness pack gives PSPs the confidence that the merchant has mapped the regulatory environment, structured the right entity footprint and established controls appropriate for the destination market.

The readiness pack is not a marketing document it is effectively a due-diligence dossier. PSPs use it to assess whether your business model fits within their risk tolerance and whether the proposed flows comply with local licensing, FX control and data governance rules. It also reduces onboarding delays by answering many of the questions PSPs would otherwise raise during risk assessment.

Core Components of a PSP Readiness Pack

Although the content varies by region and PSP, most readiness packs include a set of foundational materials. These are not decorative; each one addresses a specific regulatory or operational concern.

- Governance & ownership documentation: Group structure charts, key persons, accountability roles

- Licensing and market-entry analysis: Evidence of PI/EMI alignment or local licensing obligations

- AML and KYC controls: Customer risk scoring, enhanced due diligence triggers, monitoring workflows

- Data-handling documentation: Cross-border transfer rules, storage locations, and retention logic

- Operational resilience mapping: Incident response, business continuity and safeguarding controls

- Settlement and FX plan: How funds flow, which currencies are held locally, and where liquidity is maintained

These elements closely mirror the direction of PSD3 and the evolving PSR supervisory framework in the EU, both of which emphasise ex-ante risk assessment and stronger oversight of outsourced payment functions. PSPs must be able to demonstrate to regulators that their merchant portfolio is compliant, which is why the burden of preparation increasingly falls on merchants at the onboarding stage.

How PSD3, PSR and Global AML Reforms Raise the Threshold for Market Entry

Under PSD3 and the upcoming PSR reforms, payment institutions are expected to monitor not just transaction behaviour but also settlement profiles, liquidity risks and cross-border customer journeys. Merchants entering new markets must therefore show:

- How local rules influence their payment flows

- How AML/KYC controls adapt to regional expectations

- How data is stored, transferred and accessed

- How operational risks are managed across borders

At the same time, global AML reforms driven by FATF evaluations and regional enforcement actions mean PSPs may reject applications if the merchant cannot demonstrate market-specific AML alignment.

Clear documentation shortens risk reviews, reduces back-and-forth queries and increases the likelihood of securing acquiring or payout support.

Practical Templates: Market Entry Compliance Checklist

Expansion teams often struggle not with understanding regulations, but with organising the information in a way that PSPs, acquirers and internal stakeholders can actually use. A market-entry compliance checklist helps standardise this process by capturing the critical regulatory and operational variables in a single view. In 2026, this type of structured intake sheet has become an expectation not an optional exercise because PSPs increasingly require merchants to evidence that they have completed foundational due diligence.

The goal is not to produce a long document; it is to produce one that is complete, accurate and easy for regulators or PSP risk teams to digest. Most high-performing expansion teams maintain a one-page template per market that can be updated as rules evolve or PSP requirements shift.

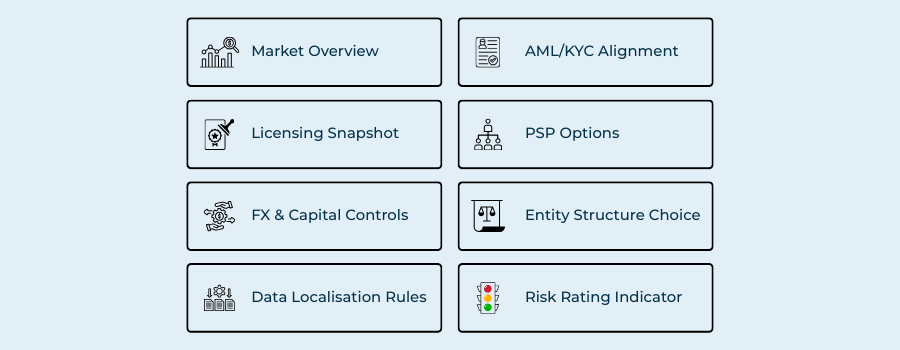

One-Page Intake Sheet (High-Level Template)

Market Name:

Target country, region classification, notes on regulatory openness

Licensing Requirements:

Local licence needed? PI/EMI equivalent? Foreign operator licence? Cross-border allowed?

FX & Capital Controls Summary:

Any inbound/outbound restrictions, conversion rules, repatriation limits, central bank approvals

Data Localisation Requirements:

Storage mandates, approved cloud regions, restrictions on offshore access, cross-border transfer conditions

AML/KYC Alignment:

Local verification requirements, enhanced due diligence triggers, FATF classification relevance

Entity Structure Chosen:

Cross-border, branch, or local entity plus reasoning behind selection

PSP Dependencies:

Which PSPs support the market, onboarding prerequisites, required documentation

Timeline & Dependencies:

Expected activation timeline, internal owners, legal dependencies, PSP sequencing

Risk Rating (Internal):

Clear, concise classification that guides launch order and resource allocation

How Expansion Teams Use the Template

The intake sheet becomes the anchor document for market-entry planning. Legal teams use it to validate licensing implications; treasury teams use it to assess FX and settlement constraints; data teams review localisation rules; compliance teams verify AML posture; and PSP partners rely on it during onboarding reviews.

Because PSPs increasingly face their own supervisory expectations particularly under frameworks influenced by the European Commission’s PSD3/PSR reforms they expect merchants to provide structured, market-specific information rather than general assurances of compliance.

Conclusion

By 2026, entering a new market is no longer defined by product readiness or customer demand alone. The determining factor often the make-or-break variable is whether a merchant can evidence compliance alignment before a single transaction is processed. Licensing rules, FX controls, data localisation requirements and AML expectations now form the practical boundaries of where and how a business can operate.

Merchants that approach compliance reactively tend to discover constraints late, face PSP onboarding delays or encounter settlement issues that undermine customer trust. Those that prepare early, document clearly and structure their entity footprint with intent move faster, negotiate better PSP terms and maintain resilient payment operations across regions. In today’s environment, compliance is not a barrier to expansion; it is the architecture that makes expansion possible.

FAQs

1. How early should compliance mapping begin when entering a new market?

Compliance mapping should start before any commercial or product planning because it defines what is legally possible in a new jurisdiction. PSPs increasingly expect merchants to show full awareness of licensing, FX and data rules at the very beginning of onboarding. Starting early helps avoid late-stage delays, costly restructuring or a situation where the planned payment flows simply cannot operate in that market.

2. Do all markets require merchants to obtain a local payments licence?

No, some markets allow cross-border services from a foreign PI/EMI, while others require a formal local entity or operating licence before accepting payments domestically. A few markets fall between these extremes, permitting limited cross-border services if customer touchpoints or settlement arrangements remain offshore. This variation is why early regulatory mapping is essential.

3. How do FX controls affect refund workflows?

FX restrictions often determine the currency in which refunds must be issued and whether merchants must hold funds locally to process reversals. In markets with stringent capital controls, refunds cannot be issued from an offshore account, even if the original payment cleared internationally. This affects liquidity planning, PSP selection and customer experience, especially where refunds must settle in local currency.

4. Can UK-standard KYC processes be reused in every market?

Not always. Although UK KYC standards are strong, some jurisdictions require additional verification attributes such as local ID types, address verification through domestic databases or enhanced due diligence for certain customer groups. If these gaps are not addressed, PSPs may refuse onboarding or require substantial remediation before launch.

5. How does FATF’s high-risk list influence market entry?

Markets appearing on the FATF high-risk or grey lists trigger heightened scrutiny from PSPs and banks. Transactions from or to these jurisdictions may require enhanced due diligence, stricter monitoring or controlled payout flows. PSPs may also take longer to complete onboarding or reduce the range of supported payment methods in these markets.

6. Is a local entity always better than operating cross-border?

A local entity can unlock domestic acquiring, support faster settlement and improve regulatory acceptance, but it comes with governance, staffing and cost obligations. Cross-border models are quicker to launch but may limit PSP choice and reduce access to local payment methods. The right structure depends on regulatory rules, commercial goals and how deeply the merchant needs to integrate with local payment rails.

7. Why do PSPs require a “regulatory readiness pack”?

PSPs must demonstrate to regulators that their merchant portfolio is low risk and compliant with local laws. A readiness pack gives PSPs confidence that the merchant understands the regulatory landscape and will not expose them to licensing or AML breaches. It also streamlines onboarding, as many PSP questions are answered upfront through structured documentation.

8. What role does PSD3 play in market entry planning?

PSD3 increases expectations around operational resilience, cross-border oversight and governance of outsourced payment functions. PSPs will be required to evidence stronger supervision of merchants, especially when launching in new markets. As a result, merchants must show how their AML, data and operational controls adapt to each jurisdiction rather than relying on a single UK-only framework.

9. How does data localisation impact PSP selection?

Data localisation laws can dictate where transaction data is stored, how it is accessed and whether offshore processing is allowed. If a market requires data to remain in-country, merchants must choose PSPs with local hosting or government-approved cloud arrangements. PSPs unable to meet localisation rules may refuse onboarding altogether, even if the licensing requirements are straightforward.

10. What internal teams should own the market-entry compliance process?

A successful market-entry programme involves collaboration across legal, compliance, finance, data governance and product teams. Each function owns a different segment of the regulatory map from licensing to FX controls to internal controls. Aligning these teams under a single intake sheet ensures consistency and reduces the risk of overlooking a critical requirement before activating payments.