For years, cross-border commerce challenges centred on authorisation rates, local payment method coverage, and the quality of payment routing. But as these layers have improved, settlement has quietly become the new point of friction for UK merchants expanding internationally. Settlement timelines that once followed predictable T+ cycles now fluctuate widely across regions, with some emerging markets extending into multi-day or even multi-week delays. These inconsistencies directly affect cashflow planning, treasury operations, and the ability to fund downstream payouts.

A second pressure point is liquidity fragmentation. UK merchants operating across Europe, APAC, the Middle East and North America increasingly hold value in multiple jurisdictions, under different regulatory regimes, and across intermediaries that do not settle at compatible intervals. The operational burden of reconciling incoming funds, monitoring payable balances, and ensuring sufficient liquidity for real-time payouts is now substantial.

This is why settlement orchestration is emerging as a distinct layer separate from payment orchestration. Payment orchestration focuses on authorisation optimisation and transaction routing. In contrast, settlement orchestration addresses the post-transaction lifecycle: when funds arrive, how they move, where they are allocated, and how quickly merchants can reuse them. For UK businesses scaling globally, the ability to manage settlement predictably is becoming as important as the ability to accept payments efficiently.

- The Evolution of Settlement Architecture (2023-2026)

- What Is a Settlement Orchestration Layer?

- Technical Components of a Settlement Orchestration Layer

- Merchant Use Cases

- 6. Compliance Alignment (PSD3, AMLD6, FATF)

- 2026 Trends Reshaping Settlement Infrastructure

- Merchant Implementation Checklist

- Conclusion

- FAQs

The Evolution of Settlement Architecture (2023-2026)

Between 2023 and 2026, the settlement landscape underwent more structural change than in the previous decade. The shift was driven by merchants pushing for faster access to funds, regulators demanding deeper visibility over payout flows, and PSPs expanding beyond traditional acquiring into treasury and liquidity support. These forces collectively reshaped how settlement infrastructure is designed and operated.

The first major development was the rise of multi-rail settlement routes. Instead of relying solely on card scheme settlement cycles, PSPs began integrating additional rails such as domestic instant payment networks, account-to-account corridors, and specialised payout partners. This allowed merchants to blend settlement paths dynamically prioritising cost, speed, or regulatory clarity depending on the corridor.

A second evolution occurred as PSPs moved into treasury and payout management. Many platforms began offering virtual accounts, multi-currency wallets, automated FX conversion, and early-access features, effectively turning PSPs into hybrid settlement partners. These services were introduced because the traditional acquirer-controlled settlement model could not keep pace with merchants operating across dozens of markets with uneven settlement cycles.

The third and most significant shift was the transition towards orchestration-led settlement. By 2026, UK merchants will increasingly required infrastructure that could standardise settlement across PSPs, banks, schemes, and payout partners. Instead of managing fragmented settlements through multiple dashboards or reconciliation files, orchestration layers consolidated all post-payment operations into a single view. These systems enabled consistent routing rules, unified ledgering, and automated reconciliation, something the legacy acquirer-led model was never built to support.

This period effectively marked the move from settlement being treated as a back-office function to becoming a strategic capability. For merchants operating internationally, settlement architecture became as important as payment acceptance architecture.

What Is a Settlement Orchestration Layer?

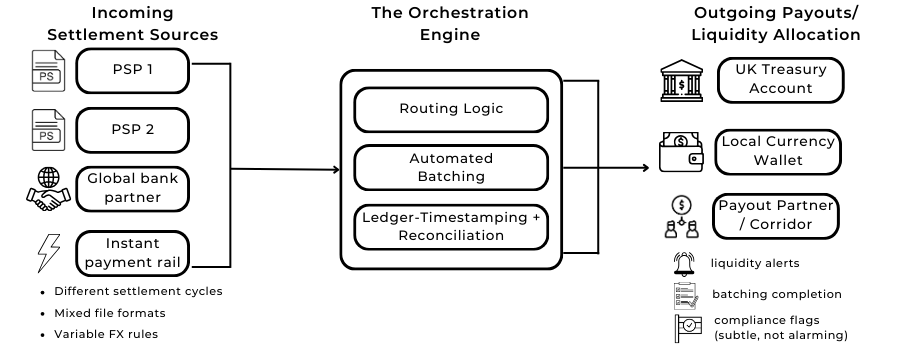

A settlement orchestration layer is a unifying infrastructure that coordinates the movement of funds after a transaction has been authorised. Instead of relying on fragmented PSP dashboards, inconsistent settlement files, and manual reconciliation, the orchestration layer provides a single framework that determines how, when, and through which rail merchants receive and deploy funds. For UK businesses dealing with multiple acquirers, currencies, or regions, it becomes the control centre for their entire post-payment lifecycle.

How It Differs from Payment Orchestration

Although the two concepts are often grouped together, they address different problems:

- Settlement orchestration manages the post-transaction journey settlement timing, liquidity allocation, batching, reconciliation, and payout preparation.

Payment orchestration improves acceptance.Settlement orchestration improves access to funds.

Why the Layer Matters in 2026

By 2026, settlement has become too fragmented for merchants to manage manually. Different PSPs settle at different intervals; regional payout partners operate under different regulatory expectations; and FX conversion windows increasingly affect cashflow planning. A dedicated orchestration layer addresses these gaps by delivering three merchant-critical capabilities:

1. Predictability: Settlement cycles are normalised across providers and corridors, reducing the uncertainty caused by variable T+ timelines.

2. Visibility: The layer creates a consolidated ledger capturing every settlement event, timestamp, FX conversion, and reconciliation result. Treasury teams gain real-time oversight of where value sits globally.

3. Control: Merchants can define rules for allocating funds, selecting settlement rails, batching payouts, or sequencing liquidity based on cost, speed, or compliance considerations.

Technical Components of a Settlement Orchestration Layer

Settlement orchestration only becomes effective when its underlying components work together to create a unified post-payment environment. By 2026, the most advanced layers operate as real-time decision engines, data processors, and treasury coordination tools rather than simple routing utilities. The core components below represent the functions that enable this shift.

Real-Time Payout Routing

Modern payout infrastructures now support multiple settlement rails: card schemes, instant payment networks, cross-border bank partners, and specialist payout providers. The orchestration layer evaluates these options continuously, selecting the optimal rail based on cost, speed, available liquidity, and regulatory constraints attached to the corridor. For UK merchants handling high volumes of international payouts, this routing intelligence reduces delays and avoids reliance on a single PSP’s settlement cycle.

Automated Settlement Batching

One of the most significant pain points for merchants is the inconsistency of settlement files. Providers may batch at different intervals or use different cutoff times, which creates reconciliation gaps. The orchestration layer introduces automated batching rules that standardise how transactions are grouped, timestamped, and forwarded for settlement. This ensures that treasury teams receive predictable, harmonised settlement data regardless of the originating PSP.

Ledger-Based Timestamping

As settlement processes become more multi-rail and multi-partner, maintaining an authoritative source of truth becomes essential. Ledger-based timestamping provides this foundation. Every settlement event whether a partial payout, a reversal, or a delayed release is recorded with immutable timing and value data. This improves FX accuracy, strengthens compliance reporting, and gives merchants visibility into settlement drift across jurisdictions.

Multi-Bank Reconciliation

Most UK merchants operating internationally maintain relationships with several banks or virtual account providers. Each produces different reconciliation formats, and many still rely on manual or semi-automated processes. A settlement orchestration layer ingests all formats and reconciles them against expected settlement flows, identifying discrepancies early. It also supports multi-bank treasury views, enabling merchants to understand their liquidity position globally rather than per-provider.

Merchant Use Cases

Settlement orchestration has gained traction because its benefits are immediately visible in sectors where payout timing, liquidity control, and reconciliation accuracy directly affect customer experience and regulatory obligations. By 2026, several merchant categories in the UK stand out as early adopters.

Travel Refunds

Travel operators handle thousands of reversals and refunds, often across multiple currencies and PSPs. Traditional settlement flows struggle with the mismatch between incoming customer payments and outgoing refunds, especially during peak events such as flight disruptions. An orchestration layer smooths this volatility by aligning settlement inflows with refund schedules, automating batching, and ensuring that liquidity is available in the correct currency and jurisdiction at the moment refunds need to be issued. This reduces operational pressure and improves refund timelines, a critical factor for customer satisfaction and regulatory scrutiny in the travel sector.

iGaming Payouts

iGaming merchants face some of the most complex settlement patterns in the UK market. Payouts must be fast, traceable, and fully compliant with AML requirements. Settlement orchestration allows merchants to route payouts through the most appropriate corridor based on the player’s region, while simultaneously maintaining a transparent record of fund movements for audit purposes. This level of orchestration supports instant-win payouts, multi-provider settlement flows, and the high transaction volumes common in gaming environments, without compromising risk controls.

Forex Withdrawals

Forex platforms handle constant inflows and outflows, often in short timeframes and across multiple liquidity providers. Traditional settlement cycles are too slow to support customer expectations for rapid withdrawals. Orchestration improves both liquidity access and withdrawal predictability by consolidating all settlement data, identifying available balances in real time, and directing withdrawal flows through the fastest possible rail. This reduces operational bottlenecks and helps firms comply with increasingly strict reporting expectations around cross-border FX movements.

Subscription Billing Settlements

Subscription businesses frequently manage recurring payments across different PSPs and regions. Settlement fragmentation becomes particularly visible when billing cycles diverge from settlement cycles. An orchestration layer standardises settlement timing, improves cashflow forecasting, and automatically reconciles partial or offset settlements. For UK merchants scaling SaaS or digital services globally, this creates a more stable financial foundation for predictable revenue operations.

6. Compliance Alignment (PSD3, AMLD6, FATF)

As settlement flows become more complex, compliance expectations are moving upstream. Regulators no longer focus solely on payment initiation; they increasingly want visibility into how funds are settled, where they sit before payout, and whether the merchant maintains adequate oversight of cross-border liquidity.

Settlement orchestration layers are emerging partly because these regulatory shifts have made legacy settlement models too opaque for modern supervision.

Under PSD3, the emphasis on transaction transparency and safeguarding pushes PSPs and merchants to maintain clearer audit trails over settlement cycles. This includes timestamping of settlement events, tracking the movement of funds across intermediaries, and demonstrating that payout timings do not expose customers to undue risk. The FCA’s existing safeguarding framework for payment institutions provides a useful reference point for UK merchants, particularly where settlement flows intersect with customer balances or pre-funded accounts. See FCA safeguarding guidance

AMLD6 extends this by strengthening the requirement for firms to evidence purpose-based fund movement. Where multiple corridors or payout partners are involved, regulators expect organisations to prove that each settlement route is appropriate for the underlying transaction type and risk profile. Without unified ledgering or orchestration, producing this level of traceability becomes difficult even where the merchant has strong AML policies at the transactional layer.

FATF meanwhile continues to stress the importance of end-to-end visibility over cross-border payout chains. In practical terms, this means UK merchants must be able to explain not only how a payment was authorised but also how it was settled, when liquidity moved, and which counterparties handled the funds. An orchestration layer assists by creating a single audit surface: every settlement movement is logged, timestamped, reconciled, and available for reporting without reliance on disparate PSP data structures.

In 2026, compliance has effectively become a settlement issue. Real-time ledgering, unified reconciliation, and structured settlement routing are no longer operational enhancements; they are regulatory necessities. For many merchants, this is one of the strongest motivations to adopt a more formalised orchestration layer rather than relying on the default settlement behaviour of acquiring partners.

2026 Trends Reshaping Settlement Infrastructure

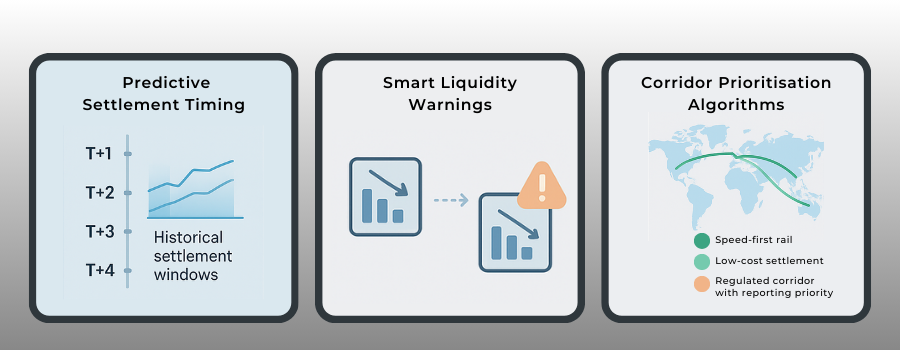

By 2026, the settlement environment is no longer defined simply by how quickly funds move; it is shaped by intelligence, prediction, and the ability to operate across multiple rails with minimal friction. As merchants scale, they need settlement layers that intervene before delays occur, anticipate liquidity shortfalls, and make routing choices that reflect regulatory and operational realities. Several developments are now redefining what “advanced” settlement infrastructure looks like.

One of the most impactful is the rise of predictive settlement timing. Rather than waiting for PSPs or banks to release funds at variable intervals, orchestration systems analyse historical settlement patterns, provider performance, corridor-specific delays, and local banking behaviour to forecast when value will land. This gives UK treasury teams a more stable basis for planning payouts, covering refunds, or managing currency exposure. In high-volume verticals—travel, gaming, digital marketplaces the difference between reactive and predictive settlement management is significant.

Another trend gaining momentum is the emergence of smart liquidity warning systems. Merchants operating across multiple accounts and jurisdictions often discover liquidity shortages only when payouts fail or refunds queue unexpectedly. Orchestration layers now aggregate available balances from banks, virtual IBAN providers, and PSP accounts, then flag upcoming liquidity gaps based on expected settlements and scheduled payouts. These alerts reduce operational failures and allow treasury teams to rebalance funds proactively.

A third development reflects the globalisation of payout routes: corridor prioritisation algorithms. As multi-rail infrastructure expands, merchants can increasingly choose between local bank networks, instant payment schemes, specialist payout partners, or traditional card-scheme settlement cycles. Orchestration layers evaluate the corridor not simply on speed and cost but also on regulatory exposure, FX availability, and reliability. This creates a more strategic settlement flow, where the system:

- Favours corridors with historically stable settlement timing

- Deprioritises partners showing increased delays

- Reallocates payouts dynamically when risk indicators change

Together, these trends turn settlement orchestration from a back-office coordination tool into an intelligent decision engine. UK merchants that previously absorbed settlement inconsistency as an unavoidable operating cost now have the ability to anticipate, plan, and optimise at scale.

Merchant Implementation Checklist

Implementing a settlement orchestration layer is less about adding another tool and more about restructuring how a merchant manages the post-payment lifecycle. UK businesses that adopt these systems typically do so in phases, ensuring treasury, finance, compliance, and engineering teams each gain the visibility they need before orchestration becomes central to day-to-day operations.

The first consideration is API integration. Most orchestration layers operate as data-rich services that ingest settlement reports, ledger entries, and bank reconciliation files from multiple providers. Merchants should ensure that their engineering teams can map existing PSP and banking integrations into a unified feed. This does not need to happen all at once; many start with a single PSP or payout partner before expanding across the full stack.

Next is the configuration of treasury workflows. Orchestration works best when merchants define the rules that govern how funds should be allocated, which corridors to prioritise, and when liquidity warnings should trigger rebalancing actions. The most effective implementations establish shared ownership between finance and product teams, ensuring that routing and batching logic reflects real-world operational needs. Typical workflows include:

- Defining rails for high-priority payouts

- Determining batching windows for specific regions

- Mapping currency conversion preferences to settlement timing

Once these workflows are live, merchants should embed them into their internal dashboards or reporting cycles, ensuring they are reviewed alongside daily settlement activity.

Finally, a KPI framework is essential for measuring whether orchestration delivers tangible value. UK merchants often track settlement drift (the difference between expected and actual settlement time), reconciliation accuracy, the number of unresolved exceptions, and the liquidity required to maintain payout continuity.

As orchestration layers increasingly incorporate predictive models, KPIs are shifting from purely operational metrics to those that reflect treasury efficiency and customer experience.

A well-implemented orchestration layer becomes the connective tissue between payments, payouts, treasury, and compliance. Merchants that devote time to planning integrations, defining workflows, and monitoring outcomes typically realise value within weeks rather than months.

Conclusion

By 2026, settlement is no longer a passive stage in the payment cycle; it is an active infrastructure challenge that affects liquidity, compliance, customer experience, and the ability of UK merchants to expand into new markets. The rise of settlement orchestration reflects this shift. As multi-rail payout routes, fragmented liquidity pools, and stricter regulatory expectations reshape cross-border operations, merchants require a framework that brings coherence to an increasingly decentralised environment.

The most successful UK businesses are adopting orchestration layers not simply to accelerate settlement but to gain structure predictive timing, unified ledgering, intelligent routing, and clear audit trails. These capabilities allow treasury teams to move from reactive problem-solving to strategic liquidity planning, while compliance teams benefit from consistent visibility across every settlement event. For merchants aiming to scale internationally with confidence, settlement orchestration is becoming a foundational component of the operational stack rather than an optional upgrade.

The next phase of innovation will centre on how merchants use these layers to negotiate with providers, optimise cash positions, and prepare for a regulatory landscape that places equal emphasis on authorisation transparency and settlement accountability. Those who modernise now will be markedly better positioned to support higher volumes, enter new corridors, and maintain the level of control they need in a rapidly evolving global payments ecosystem.

FAQs

1. How do settlement orchestration layers help UK merchants manage multiple PSP relationships?

They consolidate settlement files, timestamps, and reconciliation data from every PSP into a single ledger. This removes the inconsistency that typically appears when different providers settle at different intervals or use different reporting formats.

2. What problem does orchestration solve that PSP dashboards cannot?

PSP dashboards provide a provider-specific view. Orchestration delivers a cross-provider view of liquidity, settlement timing, and reconciliation, which is essential when funds move across multiple rails and jurisdictions.

3. When should a merchant introduce orchestration—before or after scaling internationally?

Most merchants introduce it as they expand into two or more regions. Once settlement patterns become inconsistent, or multiple currencies need coordinated liquidity, orchestration becomes more cost-effective than manual workflows.

4. Does orchestration speed up settlements automatically?

Not directly. It improves predictability and routing, which reduces avoidable delays. However, the actual speed still depends on the underlying rail, banking partner, and regional cut-off windows.

5. How does an orchestration layer support AML requirements?

It provides a complete audit trail of settlement movements, FX conversions, and payout routing decisions. This helps firms demonstrate compliance with PSD3, AMLD6, and FATF expectations around transparent fund movement.

6. Can small UK merchants benefit from settlement orchestration?

Yes, particularly those using several PSPs or selling into high-variance corridors. Even modest volumes can create reconciliation issues that orchestration resolves with automated batching and unified ledgering.

7. How does predictive settlement timing work in practice?

The orchestration layer analyses historical settlement behaviour, corridor performance, and provider reliability. It then forecasts expected settlement windows so treasury teams can plan payouts and cover refund obligations more accurately.

8. What internal teams typically use the orchestration dashboard?

Treasury teams use it for liquidity management, finance teams for reconciliation, compliance teams for audit preparation, and operations teams for monitoring payout continuity. It becomes a cross-functional tool rather than a finance-only system.

9. Is orchestration expensive to implement?

Costs vary, but the operational savings—reduced reconciliation time, fewer exceptions, improved liquidity planning—usually outweigh integration costs. Many UK merchants start with one PSP or one corridor to limit initial expenditure.

10. How does orchestration support long-term international expansion?

It gives merchants the ability to onboard new PSPs, banks, and payout partners without overhauling internal processes. As new corridors open, the orchestration layer absorbs the complexity and maintains a single settlement framework.