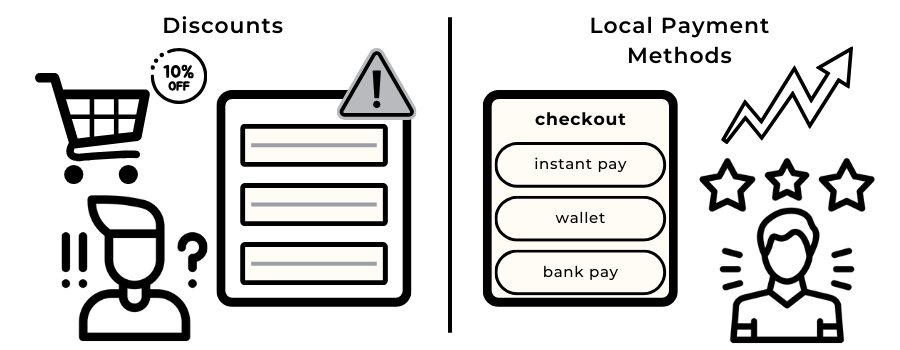

For years, merchants have relied on discounts to boost conversion rates. A percentage off, a seasonal promotion, a limited-time offer all familiar tactics designed to persuade hesitant customers to complete a purchase. But in 2026, global conversion data points in a different direction. What truly shifts consumer behaviour is not price; it is localisation specifically, offering the payment methods that people in each region already know and trust.

As markets become more fragmented and payment ecosystems diversify, user expectations have changed. A customer in São Paulo buying a digital subscription may prefer PIX over an international card. A shopper in Germany may prefer direct bank payments over wallets. A buyer in Singapore expects PayNow to appear instantly at checkout. In each case, conversion depends less on incentives and far more on whether the merchant understands and supports these regional norms.

Localisation is no longer a design choice or a marketing enhancement. It has become a structural driver of payment performance. Local rails reduce issuer friction, lower decline rates, and improve authorisation behaviour in ways discounts never can. Merchants operating internationally, especially in high-risk sectors, now face a simple truth: conversion follows familiarity. When customers recognise a payment option, they proceed with confidence and when they do not, even a generous discount often fails to overcome hesitation.

This blog explores why regional payment options matter more than discounts in 2026, how consumer trust shapes payment decisions, and what merchants can do to build a localisation strategy that improves authorisation rates, reduces operational friction, and delivers a better user experience across every market they serve.

- The Real Meaning of Localisation in Payments

- Why Discounts Don’t Fix Checkout Friction

- Regional Payment Behaviour: How Preferences Differ Worldwide

- The Trust Factor: Why Users Convert More When They Recognise Payment Options

- Local Acquiring vs Cross-Border Processing: Conversion Impact

- Compliance & Settlement Factors in Localised Payments

- How Local Payment Methods Reduce Technical Declines

- Payment Orchestration and Localisation: The 2026 Advantage

- Merchant Playbook: How to Localise Without Overcomplicating Checkout

- PSP Integration Checklist for Multi-Currency Local Payments

- KPIs That Prove Localisation Works

- Conclusion

- FAQs

The Real Meaning of Localisation in Payments

Most merchants think of localisation as language, currency display, or adapting content for a new market. While these elements matter, payment localisation is something far more specific and far more influential on conversion. It means aligning the checkout experience with how people in that region actually prefer to pay. In 2026, customers’ trust in a payment method has become as important as the product they’re buying.

In markets like LATAM, Asia, the EU and Africa, payment behaviour is shaped by decades of domestic habits, bank-level investment and cultural familiarity. A Brazilian consumer expects PIX as the default; an Indian buyer trusts UPI over any card option; a German consumer may look for an A2A solution before reaching for a wallet; and in the Middle East, card tokenisation and cash alternatives still dominate many verticals.

Recognising the difference between “global checkout” and “local checkout”

A global checkout shows the same options everywhere. It is simple to build but delivers uneven conversion results across regions.

A local checkout reshapes itself for each market by:

- Offering region-specific payment methods

- Using local acquirers where possible

- Matching settlement expectations

- Supporting domestic identifiers

The difference in performance is unmistakable. Localisation is not about complexity; it is about confidence. When a user recognises their preferred payment method, the path to purchase feels familiar and safe and this recognition consistently drives higher completion rates than discounts or promotional tactics.

Why Discounts Don’t Fix Checkout Friction

Many merchants still rely on discounting to boost sales during slow periods or high cart abandonment. While price incentives can influence purchasing decisions, they cannot solve the deeper issue that causes most drop-offs: checkout friction. When a user encounters a payment method they do not trust, or one that regularly fails for their region, no discount is strong enough to compensate.

Checkout abandonment rarely happens because the price is slightly too high. It more often occurs because the customer hesitates at the moment of payment, they are unsure whether the payment will go through, whether the method is familiar, or whether their bank will approve the transaction. If the options on the screen do not reflect what they normally use, the risk of failure feels greater than the value of any discount.

This is particularly true in regions where domestic payment rails have transformed consumer habits. PIX in Brazil, UPI in India, and PayNow in Singapore represent such deeply integrated parts of daily life that offering anything else can create friction, even when the merchant is offering a lower price. The user sees a mismatch between expectation and reality, and the buying journey stops.

Discounts work when a customer is already comfortable with the process. Localisation works when it isn’t. By removing uncertainty and aligning with natural payment behaviour, local methods overcome the trust gap that discounts cannot bridge, leading to a more reliable uplift in conversion across every vertical.

Regional Payment Behaviour: How Preferences Differ Worldwide

Understanding how people pay across different regions is essential for improving conversion. Each market has built its own ecosystem of preferred methods, shaped by regulation, banking maturity, fraud patterns, and consumer trust. In 2026, these differences are more pronounced than ever and merchants who ignore them risk losing customers at the final step of the checkout process.

Europe: The Rise of Open Banking

Cards remain widely used, but open banking has matured into a mainstream payment option across the EU and UK. Many consumers appreciate the speed, reduced friction, and strong authentication built directly into bank flows. Wallets like Apple Pay and Google Pay also remain central, particularly for mobile-first purchases.

LATAM: PIX and Domestic Schemes Dominate

Brazil’s PIX continues to reshape payment behaviour, offering instant, low-cost transfers that feel safer and more reliable than international card rails. In Mexico, SPEI plays a similar role, while in other LATAM markets, local cards and cash-based APMs remain common. Cross-border card declines are notably higher here, making localisation essential.

APAC: Wallet Ecosystems Lead

In Asia, digital wallets have become everyday financial tools. GCash in the Philippines, GrabPay in Southeast Asia, and Paytm in India carry strong brand trust and integrate seamlessly into the local retail journey. India’s UPI stands out as one of the world’s most successful real-time systems, driving enormous volumes across online commerce.

MENA: A Mixed Ecosystem Driven by Trust

In the Gulf, cards and tokenised wallet payments are viewed as secure, while parts of North Africa still rely heavily on cash alternatives and local APMs. Regulatory reforms are encouraging broader digital adoption, but consumers still gravitate toward methods that feel familiar and institutionally backed.

Across all regions, the pattern is consistent: local payment methods succeed because they reflect established behaviour, not because they offer lower prices or incentives. The closer a merchant aligns with these habits, the smoother the path to conversion.

The Trust Factor: Why Users Convert More When They Recognise Payment Options

Trust is one of the most influential drivers of conversion, yet it often receives less attention than price or product quality. When a customer reaches the payment step, they make a rapid judgment about whether the method in front of them feels safe, familiar, and reliable. If it does, they proceed almost automatically. If it doesn’t, even strong intent can turn into hesitation or abandonment.

This trust is built through everyday use. A shopper in India sees UPI logos daily, uses it for bills and transfers, and experiences near-instant confirmation. A consumer in the EU increasingly encounters bank payment options during checkout, supported by strong authentication and consistent messaging. In Brazil, PIX has become synonymous with speed and certainty. These routines shape expectations: customers want to pay online the same way they pay offline.

Trust reduces psychological and technical friction

When a trusted payment option appears on-screen, the customer assumes fewer risks:

- They trust the authentication process

- They trust their bank or wallet to process the payment quickly

- They trust that refunds or disputes will follow local norms

This confidence directly boosts conversion. Recognised local methods eliminate uncertainty, remove the sense of “trying something new,” and reassure the user that the transaction aligns with their usual behaviour.

Discounts cannot replicate this effect. They may influence purchasing intent, but they do not resolve the moment of hesitation that unfamiliar payment methods create. Localisation, on the other hand, replaces doubt with recognition and consistently leads to better outcomes for merchants.

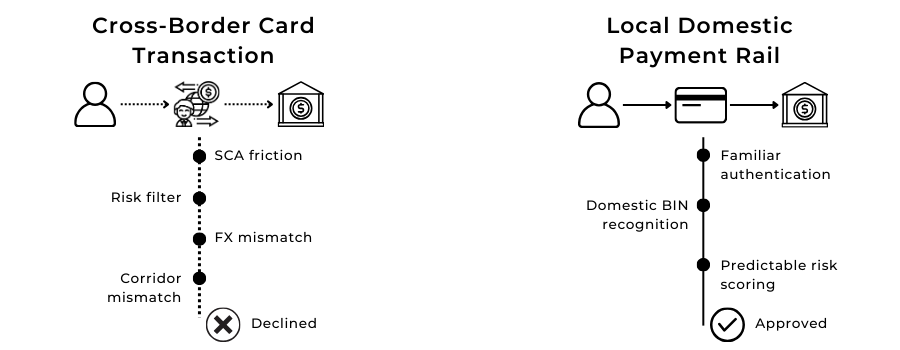

Local Acquiring vs Cross-Border Processing: Conversion Impact

One of the clearest drivers of payment performance in international commerce is the distinction between local acquiring and cross-border processing. While both can technically complete a transaction, issuers do not treat them equally. In 2026, this difference in treatment has become one of the biggest hidden factors behind approval rates, especially for high-risk verticals and merchants operating far from the customer’s domestic market.

Why issuers favour local acquiring

When a transaction is routed through a local acquirer, the issuing bank sees a familiar corridor, a domestic BIN range, and a risk profile aligned with normal consumer behaviour. This reduces issuer suspicion and improves the likelihood that the transaction will pass through internal risk filters. Cross-border transactions, by comparison, often appear unfamiliar or inconsistent with the cardholder’s typical spending, which leads to higher declines even when the user has strong intent and available balance.

Local acquiring also aligns with domestic regulations, settlement cycles and authentication flows. In the EU, for example, strong customer authentication (SCA) operates more reliably when transactions remain within the region. In LATAM, domestic rails avoid the frequent cross-border friction that affects international card traffic. And in APAC, local acquirers often integrate more closely with wallets and bank-transfer solutions, offering a smoother overall flow.

The outcome is simple: local acquiring increases approval rates and reduces friction, while cross-border processing introduces additional layers of risk, scrutiny and potential failure. For merchants expanding internationally, the ability to route transactions through local acquirers either directly or via orchestration platforms is becoming essential to sustaining stable conversion across regions.

Compliance & Settlement Factors in Localised Payments

Local payment methods are popular because they align with regional habits but from a merchant perspective, they also come with specific compliance and settlement considerations. Understanding these differences helps avoid operational issues and ensures that localisation actually improves conversion rather than creating new challenges behind the scenes.

Regulatory obligations differ by region

Every region manages its domestic payment rails with unique regulatory frameworks.

- In the EU, PSD2 and upcoming PSD3 reforms focus on authentication, consumer protection and data portability, influencing how open banking payments must be handled.

- In LATAM, central banks often regulate domestic schemes directly, with Brazil’s central bank overseeing PIX’s rules and dispute processes.

- Across APAC, frameworks such as Singapore’s Payment Services Act and India’s oversight of UPI set strict requirements for reporting, fraud controls and settlement practices.

Merchants integrating local methods must ensure PSP partners meet these standards, as non-compliance can affect their ability to process payments in the region.

Settlement timelines shape cash flow

Local payment methods often offer faster settlement than card schemes.

- PIX and UPI are near-instant.

- EU open banking payments typically settle within the same day or the next day.

- Some MENA and African APMs still operate on T+1 to T+3 timelines.

Understanding these differences helps merchants manage liquidity, refunds and reconciliation more accurately.

FX handling and onshore vs offshore settlement

When funds settle domestically, FX exposure drops. Cross-border settlement, however, may introduce spreads, conversion fees or routing limitations that influence net revenue. Local acquiring and domestic APMs reduce these issues, offering predictable settlement in local currency.

Compliance and settlement are therefore central to localisation. They ensure that payment methods not only increase conversion but also operate smoothly within the legal, financial and operational framework of each market.

How Local Payment Methods Reduce Technical Declines

Technical declines are one of the most common and most frustrating reasons customers fail to complete a purchase. These declines are rarely linked to the customer’s intent or balance. Instead, they stem from risk filters, authentication failures, or corridor mismatches inside banks and card networks. Local payment methods help bypass these issues because they operate within the customer’s domestic ecosystem, connecting more naturally with issuer expectations.

In regions with strong domestic payment rails, issuers maintain detailed behavioural models that recognise and trust local patterns. A PIX transaction in Brazil, for example, travels through a familiar route with predictable authentication, so the bank is far less likely to suspect fraud. The same is true for UPI in India or open banking in the EU, where the flow aligns with established regulatory frameworks such as strong customer authentication. These systems were built for local use, and banks have optimised their rules around them.

Cross-border card payments, by contrast, trigger more automated checks. The issuer may interpret a foreign acquirer or unusual metadata as a risk signal. Even when the customer genuinely wants to purchase, the transaction can fail simply because it appears outside their normal behaviour profile. A discount cannot fix this, but localisation can.

Local payment methods also reduce 3DS failure points. Domestic authentication tends to be smoother, with fewer redirects and more predictable pass rates. The fewer interruptions a customer experiences, the more likely they are to complete the checkout without hesitation.

By removing unnecessary friction and aligning with how banks expect customers to behave, local methods cut down technical declines dramatically. This improvement flows directly into higher conversion, not through incentives, but through a payment experience that feels seamless, trusted and familiar.

Payment Orchestration and Localisation: The 2026 Advantage

As merchants expand across regions, managing multiple PSPs, local payment methods and acquiring partners can quickly become complex. This is where payment orchestration has become a defining advantage in 2026. Rather than relying on a single gateway logic, orchestration allows merchants to automate which payment methods appear, how transactions are routed and which acquirers handle specific markets all without adding extra friction for the customer.

At its core, orchestration creates a flexible layer between the merchant and the payment ecosystem. Instead of building individual integrations or manually determining which rails to support, merchants can use orchestration to detect the user’s region, surface the most relevant payment options and route payments through the channels most likely to achieve approval. This adaptability is crucial in markets where domestic methods like PIX, UPI and open banking outperform international card rails.

Localisation powered by intelligent routing

What sets orchestration apart is the intelligence behind its routing decisions. It does not simply show a list of options it prioritises them based on real-world behaviour such as approval rates, authentication reliability and issuer preference. A user in Brazil might automatically see PIX first, while a customer in Germany is guided toward open banking. Each region receives a checkout experience aligned with its norms, without the merchant needing to build individual configurations.

This also supports operational efficiency. Orchestration platforms can monitor corridor-level performance, switch acquirers when a region shows increased declines and maintain a seamless experience even during outages. For high-growth merchants, this reduces the risk of bottlenecks and ensures that localisation is not only offered it is optimised.

In 2026, localisation and orchestration have become inseparable. Together, they create a payments engine that adapts in real time, aligns with regional expectations and strengthens conversion by reducing friction at the most critical moment in the customer journey.

Merchant Playbook: How to Localise Without Overcomplicating Checkout

Localising payments does not mean adding dozens of new buttons or cluttering the checkout page. The real objective is to introduce familiar, trusted options in a structured way that feels natural to users in each region. This playbook outlines how merchants can scale localisation without losing clarity or control.

Identify the payment methods that actually matter

Not every market needs ten options. Most regions have two or three preferred methods that dominate consumer behaviour PIX in Brazil, UPI in India, PayNow in Singapore, and open banking in parts of Europe. Merchants should concentrate on these rather than trying to support every available APM. This keeps integration simple and ensures the familiarity that boosts conversion.

Use orchestration to automate regional logic

Rather than manually adjusting checkout flows for each market, orchestration platforms allow merchants to set rules based on geography, device type or network conditions. This ensures customers only see the relevant payment methods, reducing clutter while still offering localisation. It also helps route transactions through the acquirer most likely to approve them, improving performance without complicating the merchant’s operational setup.

Keep the checkout flow clean and predictable

Regardless of the region, customers expect a smooth and intuitive experience. A cluttered checkout increases hesitation, even if the right payment methods are available. Merchants should limit the number of visible options, maintain consistent button styles and ensure that authentication flows are predictable. When localisation is done well, the checkout does not look more complex it simply feels more familiar.

Localisation is therefore less about adding choices and more about presenting the right choices in the right markets. By focusing on relevance, automation and clarity, merchants can improve conversion without overwhelming their users or their own operational teams.

PSP Integration Checklist for Multi-Currency Local Payments

When merchants expand internationally, integrating local payment methods is only half of the equation. The other half is ensuring that PSPs can support multi-currency acceptance, settlement and reconciliation without introducing new operational risks. This section offers a practical checklist framed in a narrative style to help merchants evaluate whether their PSP setup is ready for localisation at scale.

The first step is confirming that the PSP supports true multi-currency processing rather than simple currency display. Some PSPs allow checkout in local currency but still settle in a foreign one, leading to unexpected FX costs, reconciliation discrepancies and customer confusion. Merchants should verify that settlement can occur in the domestic currency of each market, especially when working with rails such as PIX, UPI or local EU bank transfers.

Another important factor is understanding how the PSP handles FX routing and conversion logic. A strong provider will offer transparent conversion rates, explain when and where FX occurs, and avoid hidden spreads that affect net revenue. In markets where domestic settlement is preferred or mandated, the PSP should support onshore banking relationships to minimise friction.

Reconciliation capability is also essential. Local payment methods often generate different data fields than card transactions, so the PSP must provide structured reporting that aligns with each rail’s standard. Without this, finance teams may face delays in matching payments, refunds or disputes particularly in high-volume environments.

Finally, merchants should confirm that their PSP can integrate these capabilities into a single orchestration layer, ensuring clean regional logic and uniform reporting across payment types.

A fragmented setup might support local methods, but it will not scale efficiently or deliver the performance benefits localisation is meant to achieve.

With this checklist, merchants can approach multi-currency integration in a way that strengthens both conversion and operational reliability the foundation of an effective localisation strategy in 2026.

KPIs That Prove Localisation Works

Localisation is not just a conversion theory it is measurable. When merchants introduce region-specific payment methods, the impact shows up quickly across several operational and performance metrics. Tracking these KPIs helps confirm that the localisation strategy is working and highlights areas where further refinement is needed.

Approval rate stability

Local payment methods often generate higher and more consistent approval rates, particularly in regions where domestic schemes dominate. When approvals improve immediately after enabling a local rail whether that’s PIX, UPI or open banking the effect is a strong indicator that the checkout now aligns better with user expectations and issuer preferences.

Checkout completion and abandonment

A key sign of effective localisation is a reduction in cart abandonment at the payment stage. Customers are less likely to hesitate when they see a familiar method, and they complete the process more confidently. Merchants should track abandonment before and after localisation changes to understand how much friction has been removed.

SCA and authentication success

In the EU, authentication performance is a major contributor to conversion. Local methods generally offer smoother authentication journeys with fewer interruptions and higher pass rates. Improvements in SCA success after introducing domestic A2A options or wallet flows demonstrate that the merchant is reducing avoidable friction.

Refund and dispute behaviour

Local rails often provide more predictable settlement and clearer rules around disputes, leading to faster refund cycles and fewer misunderstandings between merchants and customers. Monitoring refund timelines and dispute frequency helps evaluate whether the payment mix is improving post-payment operations.

Payment method usage share

A rise in the adoption of local methods is a positive signal. When customers naturally migrate toward these options, it reflects trust and convenience which ultimately reinforces the conversion benefits merchants seek to achieve.

Together, these KPIs create a practical framework for assessing the real impact localisation has on performance. The more aligned the checkout becomes with regional behaviour, the more these metrics trend in the right direction.

Conclusion

Localisation has become one of the most reliable ways to improve conversion in 2026, especially for merchants operating across multiple regions. Discounts may influence interest, but they do not address the core reason many checkouts fail: customers simply do not trust or recognise the payment methods presented to them. By aligning with regional preferences whether that means PIX in Brazil, open banking in Europe, wallets across Asia or domestic APMs in the Middle East merchants create a checkout that feels intuitive and familiar.

The benefits extend beyond the customer experience. Local rails reduce technical declines, improve authentication success, streamline settlement and support more predictable financial operations. Combined with orchestration and multi-PSP setups, localisation becomes a strategic advantage rather than a technical challenge.

Ultimately, conversion follows trust. When merchants offer the payment options users already rely on, the entire journey becomes smoother and the path from intention to completion becomes significantly stronger.

FAQs

1. Why does localisation improve conversion more than discounts?

Localisation removes friction at the exact moment customers decide whether to complete a purchase. When users see familiar payment options such as PIX, UPI or open banking, they feel confident the transaction will be fast, secure and recognised by their bank. Discounts may influence intent but do not remove uncertainty during checkout. Local methods reduce technical declines, smooth authentication and align with everyday payment behaviour, which leads to higher and more stable conversion than price reductions alone.

2. How do regional payment preferences differ around the world?

Preferences vary significantly. In Europe, open banking and wallets are growing quickly. In Brazil, PIX is used for everything from retail to bill payments. India relies heavily on UPI, while Southeast Asia leans toward super-app wallets such as GrabPay and GCash. In the Middle East, cards remain dominant in many sectors, supported by tokenisation. Tailoring checkout options to these established behaviours allows merchants to meet customers where they are most comfortable.

3. Does adding too many payment methods reduce conversion?

Yes, it can. Overloading checkout with too many options creates confusion and slows decision-making. Most regions have two or three dominant payment methods that cover the majority of user behaviour. A localisation strategy should prioritise these, using orchestration logic to show only the most relevant options for each market. Clean, predictable choices outperform a cluttered checkout every time.

4. How does local acquiring increase approval rates?

Local acquiring routes the payment through a domestic corridor, which issuers treat as familiar and lower risk. This reduces unnecessary declines caused by foreign routing or unusual issuer patterns. It also ensures smoother authentication and clearer regulatory alignment. As a result, domestic transactions are approved more consistently than cross-border card traffic, especially in high-risk sectors.

5. Are local payment methods safer than international ones?

Safety depends on the method and region, but many domestic rails offer strong protection. PIX and UPI, for instance, rely on bank-level authentication and strict regulatory standards. EU open banking flows require strong customer authentication. Wallet ecosystems often integrate device binding for added protection. These familiar, regulated processes give users a sense of security that supports higher conversion.

6. What role does payment orchestration play in localisation?

Orchestration simplifies the entire localisation journey. It automatically identifies the customer’s region, surfaces the right payment options and routes transactions through the best-performing acquirer. This removes the need for merchants to manage multiple PSP configurations manually and helps achieve higher approval rates. Orchestration also provides insight into corridor performance, making it easier to refine the localisation strategy over time.

7. Do local payment rails reduce fraud?

They can. Because domestic rails operate within the country’s regulatory system and connect directly to the user’s bank or wallet, they often include strong identity checks by default. Issuers also understand normal behavioural patterns within domestic systems, making it easier to distinguish legitimate transactions from suspicious ones. This can reduce false declines without increasing risk exposure.

8. How can merchants test whether localisation is improving performance?

The clearest indicators are approval rate changes, checkout abandonment metrics, SCA success rates and the distribution of payment method usage. Merchants should compare these KPIs before and after enabling local rails. Even small changes in abandonment or SCA pass rates can have a significant impact on overall revenue, especially at scale.

9. Is localisation expensive to implement?

It doesn’t have to be. With modern orchestration platforms and PSPs offering multi-region support, merchants can implement major local methods without building one-off integrations. The investment is typically outweighed by reduced declines, higher conversion and lower operational friction. For most global merchants, the long-term financial gains make localisation one of the highest-return improvements available.

10. Should merchants localise immediately when entering a new market?

Yes, or as early as possible. Entering a market without supporting local payment behaviour creates an avoidable performance gap. Adoption of domestic methods from day one improves conversion, builds trust with users and prevents early decline-related reputational issues. Localisation should be a core part of the market-entry strategy, not an afterthought.